|

March 26, 2012 from ZeroHedge Website

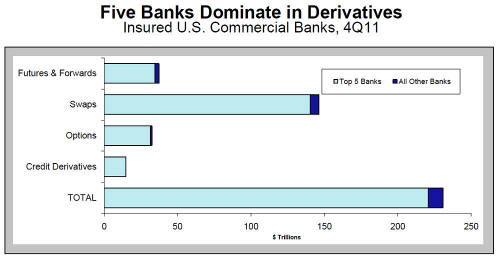

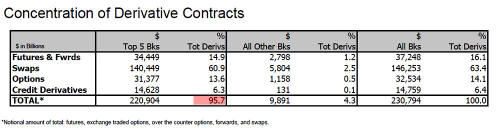

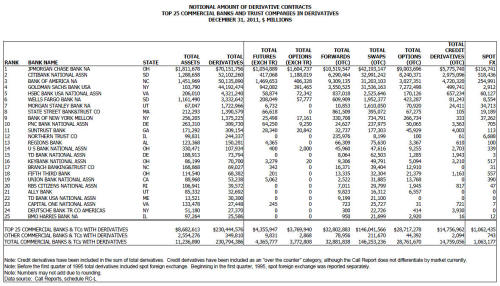

To wit: in Q4 2011, of the total $230.8 trillion in US outstanding derivatives, the Top 5 banks, ...accounted for 95.7% of all Derivatives.

In some respects this is good news:

Unfortunately it is also bad news, because $220 trillion is more than enough for the world to collapse in a daisy chained failure of bilateral netting (which not even all the central banks in the world can offset).

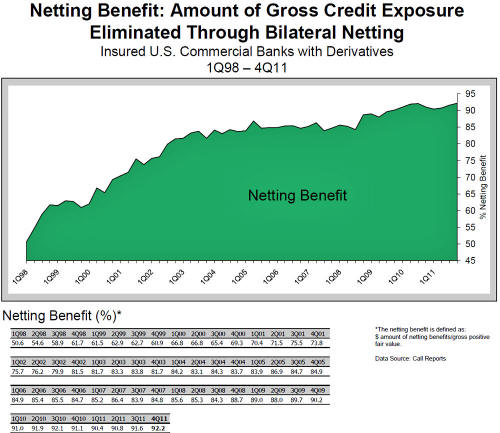

What is the worst news, is that the just released report indicates that in addition to everything else, we have now hit peak delusion, as banks now report to the OCC that a record high 92.2% of gross credit exposure is "bilaterally netted."

While we won't spend much time on this issue now, it is safe to say that bilateral netting is the biggest lie in modern finance (read How US Banks Are Lying About Their European Exposure; Or How Bilateral Netting Ends With A Bang, Not A Whimper for an explanation of this fraud which was exposed completely in the AIG collapse).

And just to put this in global perspective, according to the BIS in the first half of 2011, global derivative gross exposure increased by $107 trillion to a record $707 trillion.

It will be quite interesting to get the full year report to see if this acceleration in gross exposure has increased.

Because if it has, we will now know that in 2011 European banks were forced up to load up on several hundred trillion in mostly interest rate swap exposure. Which can only mean one thing: when and if central banks lose control of government bond curves, an rates start moving wider again, the global margin call will be unprecedented.

Until then we can just delude ourselves that

central planners have everything under control, have everything under

control, have everything under control...

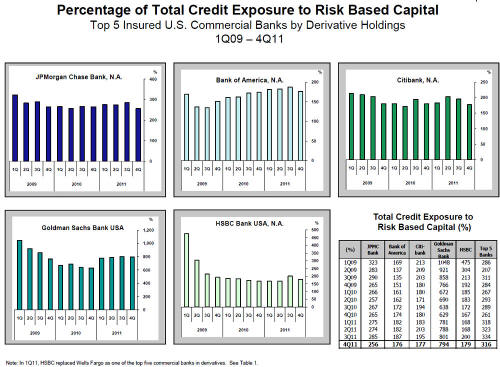

Exposure by bank:

And the delusion that everyone is somehow hedged.

To the tune of $230 trillion!

Source:

OCC

|