|

by Business Insider Intelligence

August 26,

2016

from

BusinessInsider Website

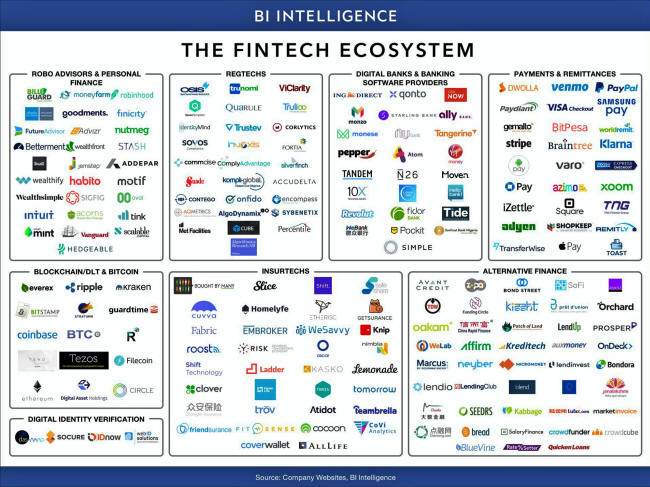

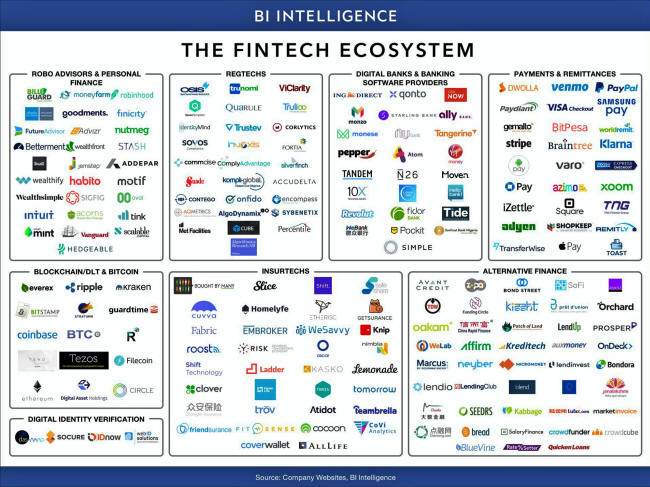

Fintech is the emerging financial system for

Sustainable Development, and will permeate every

phase and level of the financial world.

Further, all nations of the world are embracing

Fintech, from China to Europe to the entire Islamic

world.

Source

Fintech broke onto the scene as a

disruptive force following

the 2008 crisis, but the industry's

influence on the broader financial services system is changing.

The fintech industry no longer stands clearly apart from financial

services proper, and is increasingly growing embedded in mainstream

finance.

We're now seeing the

initial stages of this transformation.

For instance, funding is growing more internationally distributed,

and startups are making necessary adjustments to prove

sustainability and secure a seat at the table.

Most fintech segments in

the ascendant a year ago have continued to rise and grow more

valuable to the broader financial system.

Meanwhile, several

fintech categories have had to make adjustments to stay on top.

New subsegments are also appearing on the scene - such as

digital identity verification fintechs - as new opportunities for

innovation are discovered.

Significantly, incumbents are responding more proactively to the

rising influence of fintech by making updates to their

consumer-facing channels, back-end systems, and overall business

operations.

Most are realizing that

the best way to adapt is to work alongside the fintechs that are

transforming the financial services environment, either by

partnering with them or acquiring the startups entirely.

As fintech's power grows,

incumbents will have no choice but to change in order to stay

relevant and competitive.

All around, fintech is

becoming embedded in mainstream finance.

Business Insider Intelligence, has written the definitive

Fintech Ecosystem Report that,

-

looks at the

shifts in the broader environment that fintechs operate in,

including funding patterns and regulatory trends

-

examines the

adaptations that some of fintech's biggest subsegments have

had to make to secure a foothold in the financial services

system

-

discusses how the

continued rise of the fintech industry is pressuring

incumbents to make fundamental changes to their business

models and roles.

It ends by assessing what

a global economy increasingly influenced by innovative fintechs will

look like.

Here are some key takeaways from the report:

-

The fintech

industry is far more than a group of digitally native,

consumer-centric startups, although they are, in many ways,

becoming the new face of financial services.

It's increasingly

clear that fintech no longer stands apart from financial

services proper, and is morphing into an integral part of

the financial system.

-

To secure their

position in the mainstream economy, some of the main fintech

subsegments have had to adjust their business models. These

include neobanks, robo-advisors, and alt lenders.

Other fintech

categories, meanwhile, have instead found that current

conditions are well suited to their original models, and are

seeing largely smooth sailing, like regtechs, insurtechs,

and payments fintechs.

Innovation and

dynamism is still alive in fintech too, with new categories

still emerging.

-

The rising

influence of fintechs is having a dramatic effect on

incumbents, from banks to insurers to wealth managers,

pushing them to respond proactively to stay relevant.

Incumbents are

reacting to changes wrought by fintechs on three key fronts:

the front end, the back end, and in their core business

operations.

As such,

incumbents and fintechs are converging on a digital middle

ground.

-

As this happens,

the fintech industry is on the cusp of becoming an integral

component of the broader financial services ecosystem.

But it will

likely first have to go through a complete credit cycle, and

survive an economic downturn like the one that set the stage

for its arrival in 2008, for this to happen.

Companies included in this report:

Neyber, Addepar,

Robinhood, Coinbase, Kreditech, 10x Future Technologies, TDW.cn,

Dianrong, Zhong An, Prosper, Qudian, Lending Club, OnDeck,

Lu.com, One97, SoFi, Greensky, Oscar Health, Credit Karma,

Zenefits, Avant, Tuandaiwang, AvidXchange, Clover Health,

TransferWise, Funding Circle, Kabbage, Rong360, Symphony,

51XinYongka, Suishou Technology, Janalakshmi, Upserve, bread,

Dashu Finance, TNG FinTech Group, Toast blend, Plum, Oval Money,

Monzo, Tink, Atom Bank, Starling Bank, N26, Tandem, Monese.

|