|

from ForeignPolicy Website

Going stateless to maximize profits, multinational companies are vying with governments for global power.

Who is winning...?

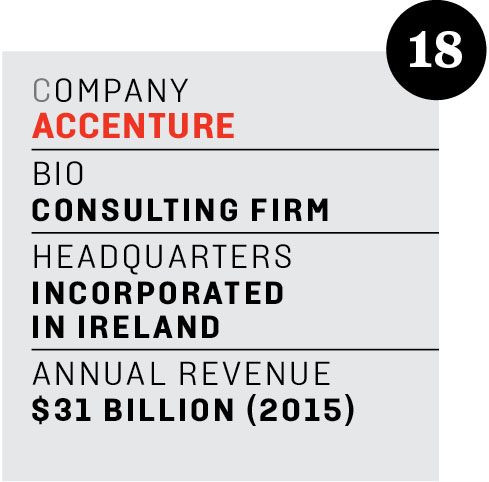

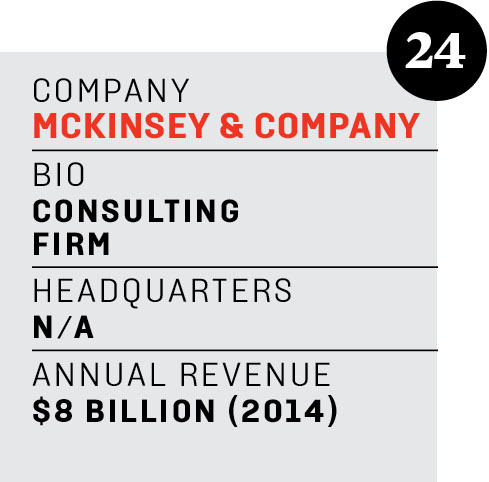

One of the world's biggest consulting companies, which commands tens of billions of dollars in annual revenues, was born in the 1950s as a small division of accounting firm Arthur Andersen.

Its first major project was advising General Electric to install a computer at a Kentucky facility in order to automate payment processing.

Several decades of growth followed, and by 1989, the division was successful enough to become its own organization:

Yet a deeper look at the business shows its ascent veering off the American track.

This wasn't because it opened foreign offices in Mexico, Japan, and other countries; international expansion is pro forma for many U.S. companies. Rather, Andersen Consulting saw benefits - fewer taxes, cheaper labor, less onerous regulations - beyond borders and restructured internally to take advantage of them.

By 2001, when it went public after adopting the name Accenture, it had morphed into a network of franchises loosely coordinated out of a Swiss holding company.

It incorporated in Bermuda and stayed there until 2009, when it redomiciled in Ireland, another low-tax jurisdiction.

Today, Accenture's roughly 373,000 employees are scattered across more than 200 cities in 55 countries. Consultants parachute into locations for commissioned work but often report to offices in regional hubs, such as Prague and Dubai, with lower tax rates.

To avoid pesky residency

status, the human resources department ensures that employees don't

spend too much time at their project sites.

When business and strategy experts Yves Doz, José Santos, and Peter Williamson coined the term in a 2001 book, metanationals were an emerging phenomenon, a divergence from the tradition of corporations taking pride in their national roots.

In the 1950s, General Motors President Charles Wilson famously said,

Today, the severing of state lifelines has become business as usual.

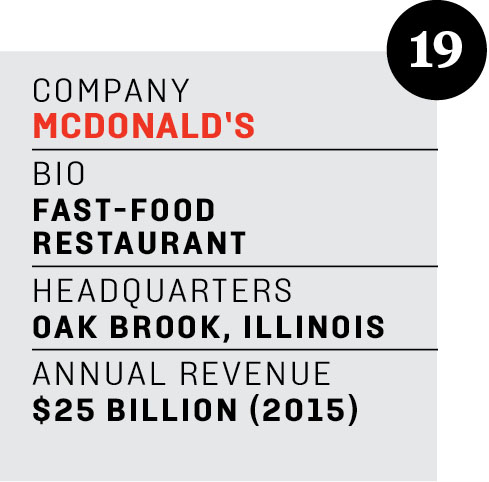

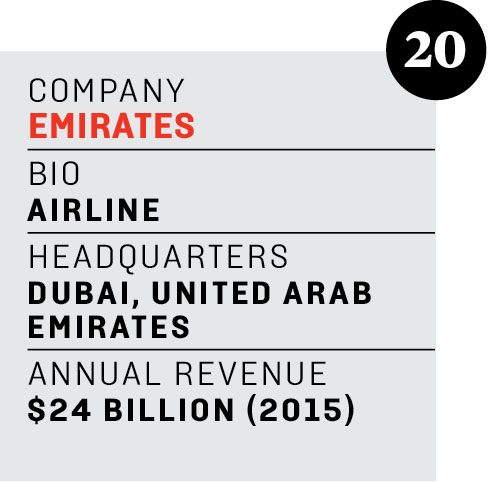

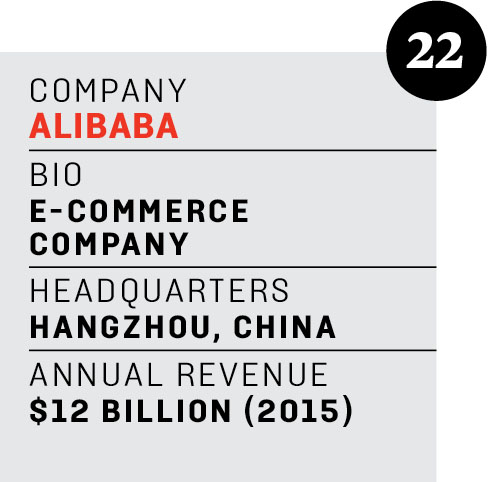

...these companies all choose locations for personnel, factories, executive suites, or bank accounts based on where regulations are friendly, resources abundant, and connectivity seamless.

Clever metanationals often have legal domicile in one country, corporate management in another, financial assets in a third, and administrative staff spread over several more.

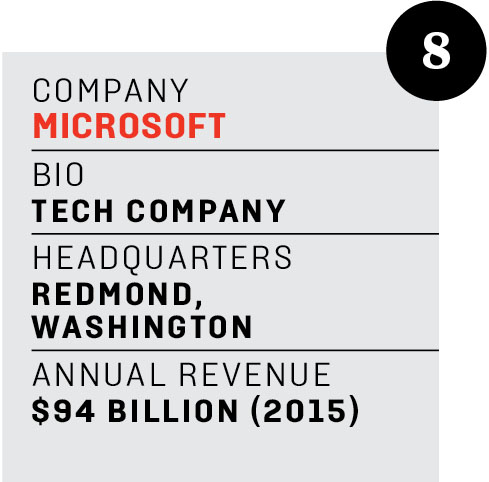

Some of the largest American-born firms - GE, IBM, Microsoft, to name a few - collectively are holding trillions of dollars tax-free offshore by having revenues from overseas markets paid to holding companies incorporated in,

In a nice illustration of

the tension this trend creates with policymakers, some observers

have dubbed the money "stateless income," while U.S. President

Barack Obama has called the

companies hoarding it America's "corporate deserters."

The debate over that term usually focuses on states - that is,

In June 2015, the Pew Research Center surveyed people in 40 countries and found that a median of 48 percent thought China had or would surpass the United States as a superpower, while just 35 percent said it never would.

Pew, however, might have

considered widening its scope of research - for corporations are

likely to overtake all states in terms of clout.

After the 2008 financial crisis, the U.S. Congress passed the Dodd-Frank Act to discourage banks from growing excessively big and catastrophe-prone.

Yet while the law crushed some smaller financial institutions, the largest banks - with operations spread across many countries - actually became even larger, amassing more capital and lending less.

Today, the 10 biggest banks still control almost 50 percent of assets under management worldwide.

Meanwhile, some European Union officials, including Competition Commissioner Margrethe Vestager, are pushing for a common tax-base policy among member states to prevent corporations from taking advantage of preferential rates.

But if that happened (and

it's a very big if), firms would just look beyond the continent for

metanational opportunities.

As scholar Gary Gereffi of Duke University has argued, denationalization now involves companies assembling the capacities of various locations into their global value chains.

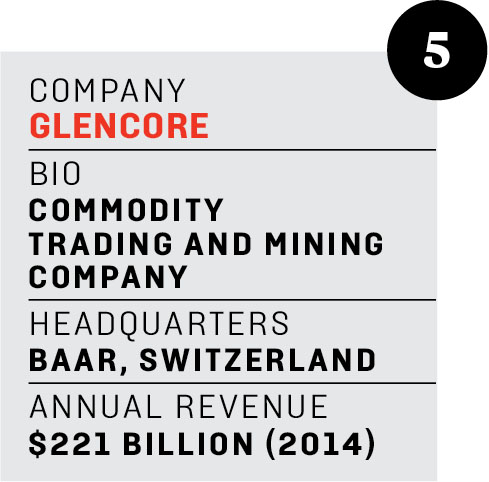

This has birthed success

for companies, such as commodities trader Glencore and

logistics firm Archer Daniels Midland, that don't focus

primarily on manufacturing goods, but are experts at getting the

physical ingredients of what metanationals make wherever they're

needed.

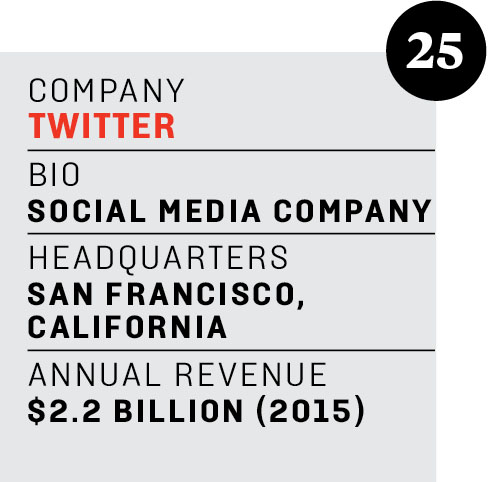

In 2013, Balaji Srinivasan, now a partner at the venture-capital company Andreessen Horowitz, gave a much debated talk in which he claimed Silicon Valley is becoming more powerful than Wall Street and the U.S. government.

He described "Silicon Valley's ultimate exit," or the creation of,

The idea is that because

social communities increasingly exist online, businesses and their

operations might move entirely into the cloud.

Seen in this light, metanationals disassociating from terrestrial restraints and harnessing the power of the cloud is anything but far-fetched.

It may even be

inevitable.

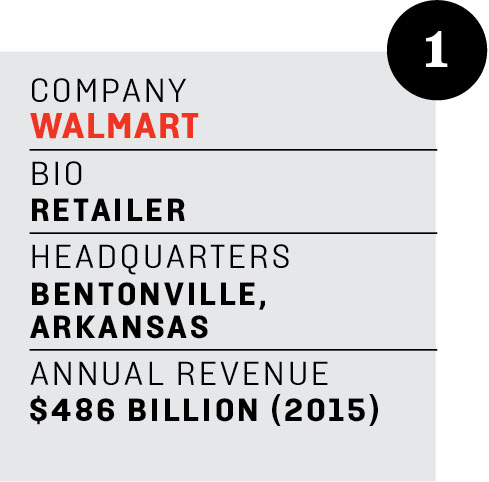

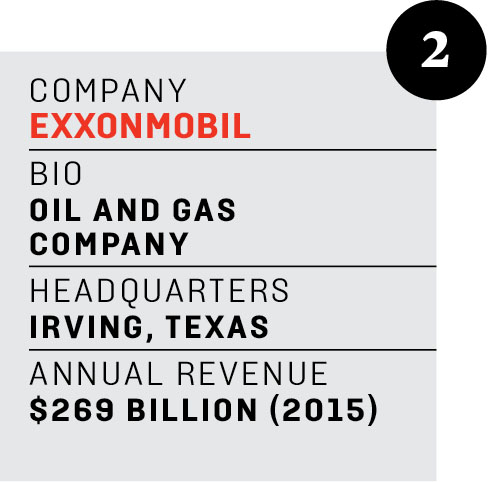

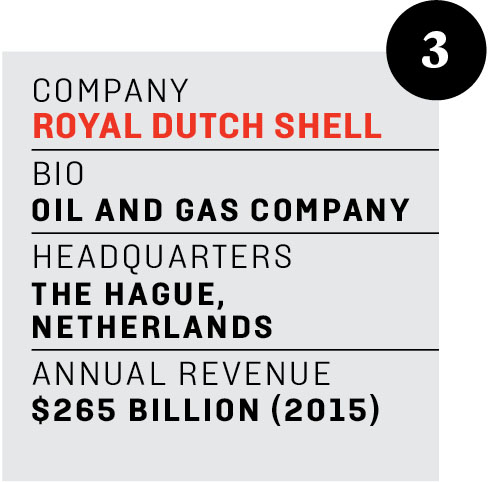

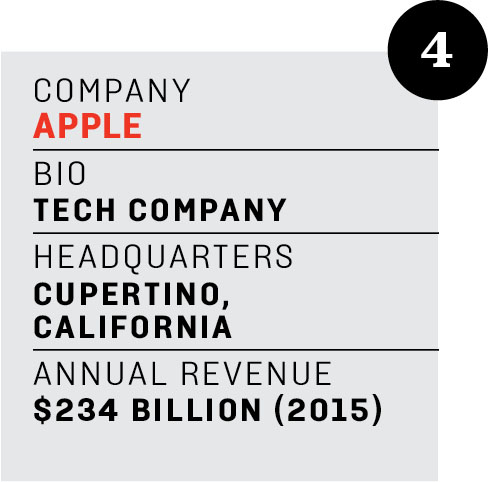

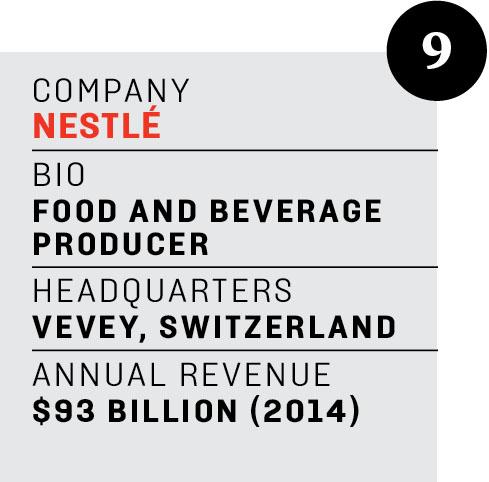

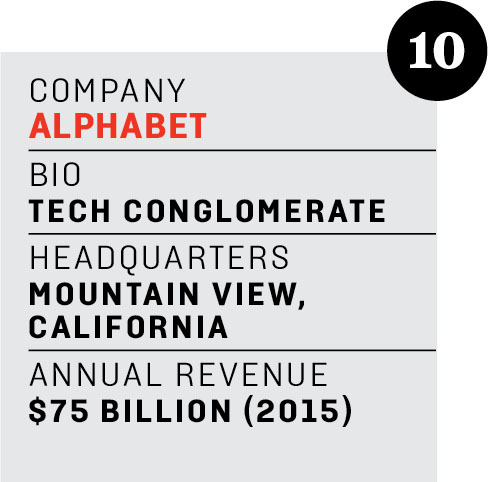

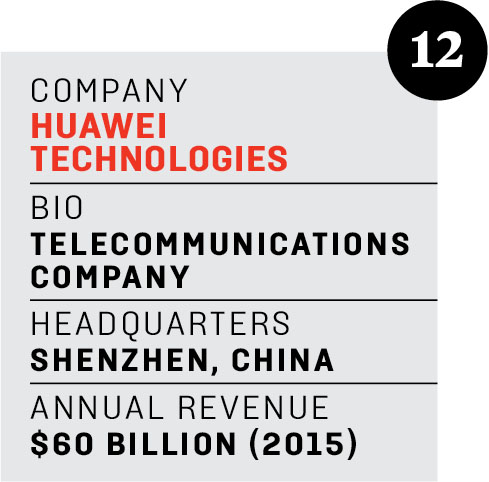

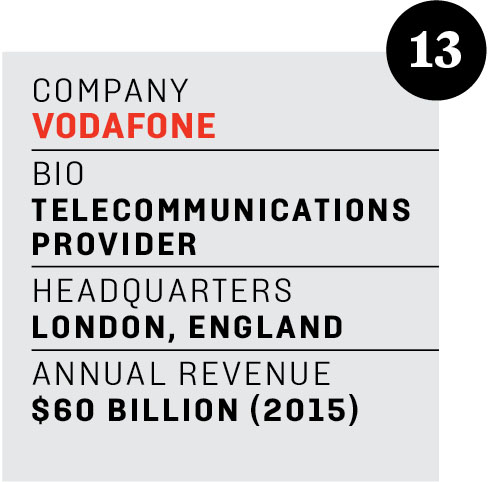

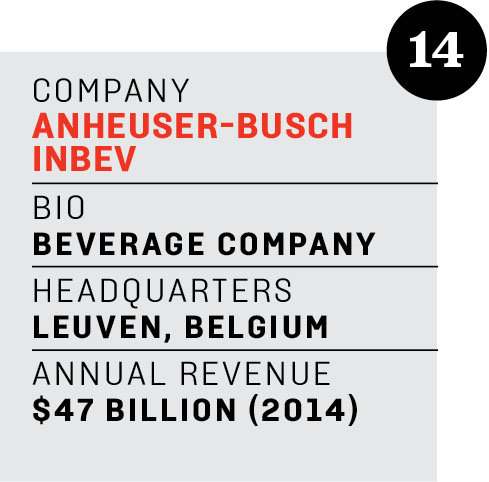

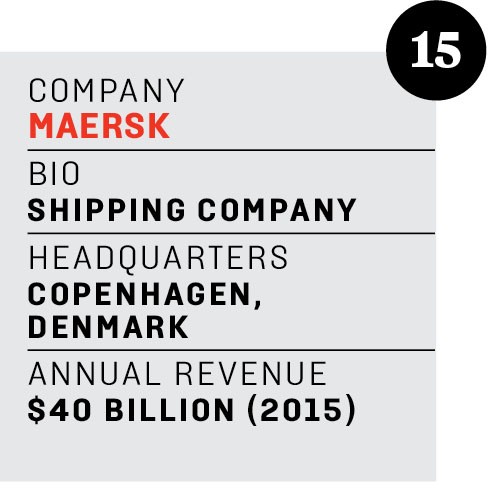

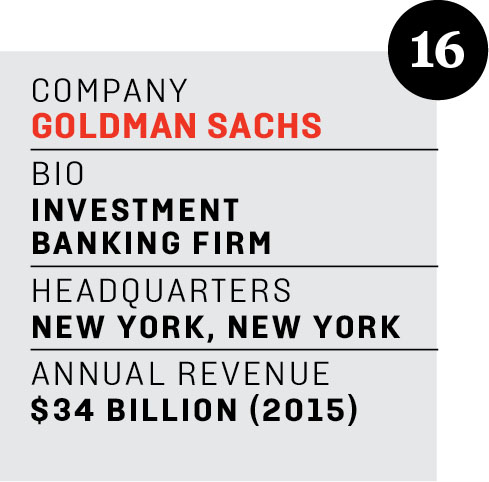

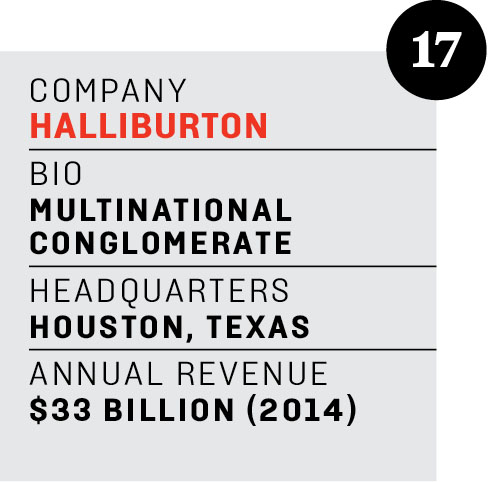

The Top 25 Corporate

Nations

|