by Common Dreams

March 6, 2012

from

CommonDreams Website

In the wake of

the financial crisis of 2008 and

the recession that followed, huge numbers of US workers lost their jobs,

homes were lost to foreclosure, and most found themselves in the most

precarious economic shape of their lives.

Now, in a new report, evidence shows that as an

economic recovery (slight as it was) appeared on the scene, nearly all of it

went, not to those struggling, but to the very wealthiest of Americans, many

of whom helped lead the economy off the cliff in the first place.

According to a new report, nearly 93% of the economic gains made from 2009

to 2010 went to the wealthiest 1% of Americans.

"Top 1% incomes grew by 11.6% while bottom

99% incomes grew only by 0.2%. Hence, the top 1% captured 93% of the

income gains in the first year of recovery," reads the report by

Emmanuel Saez titled

Striking It Richer - The Evolution of Top Incomes

in the United States.

"Such an uneven recovery," writes Saez in

the report, "can possibly explain the recent public demonstrations

against inequality."

And continues by detailing some of the

historical context of wealth disparity in the United States, from early part

of the 20th century to the present:

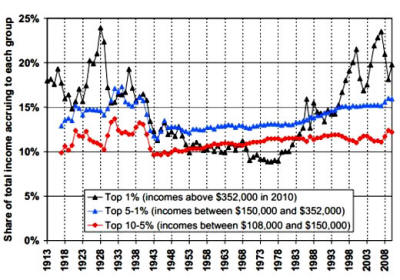

The top percentile share declined during

WWI, recovered during the 1920s boom, and declined again during the

great depression and WWII.

This very specific timing, together with the

fact that very high incomes account for a disproportionate share of the

total decline in inequality, strongly suggests that the shocks incurred

by capital owners during 1914 to 1945 (depression and wars) played a key

role.

Indeed, from 1913 and up to the 1970s, very top incomes were

mostly composed of capital income (mostly dividend income) and to a

smaller extent business income, the wage income share being very modest.

Therefore, the large decline of top incomes

observed during the 1914-1960 period is predominantly a capital income

phenomenon.

Interestingly, the income composition pattern at the very top has

changed considerably over the century. The share of wage and salary

income has increased sharply from the 1920s to the present, and

especially since the 1970s.

Therefore, a significant fraction of the

surge in top incomes since 1970 is due to an explosion of top wages and

salaries.

Indeed, estimates based purely on wages and salaries show that

the share of total wages and salaries earned by the top 1 percent wage

income earners has jumped from 5.1 percent in 1970 to 12.4 percent in

2007.

A telling chart:

Alexander Eichler, writing at Huffington Post,

observes:

Saez's findings suggest that even though the

recession

dealt a blow to the 1 percent, it did little to push the U.S.

off the path it's been on for decades - that of a

vast and growing

disparity between the richest and poorest citizens.

Income for most workers has barely risen in the last 30 years, but the

top 1 percent of earners have seen their income almost triple in the

same amount of time.

Economists and other experts say that could be the

result of any number of factors, including the

decline of labor unions,

the explosion in capital gains during the middle part of the aughts, and

tax policies put in place in recent years that favor the wealthy.

In his State of the Union address this past January, President Obama

called economic fairness "the defining issue of our time," perhaps

mindful of the growing number of voters who say they can't even afford

basic necessities like

food.

The wealth gap has been cited as a major concern for the

nationwide

Occupy movement, and research has suggested that income inequality might

be associated with the kind of underwhelming economic growth the country

has experienced for the past two years.