|

from ElliottWave Website

Every time a new wave of the financial crisis

thunders over us, it restarts the debate about which of the world currencies

is "the safest." Right now is no exception. So far the Swiss franc has emerged as a clear leader, after making new all-time highs against both the Euro and U.S. Dollar. Even so, the Euro and the buck have locked horns as rivals for a while, and thus far neither one is giving up its turf.

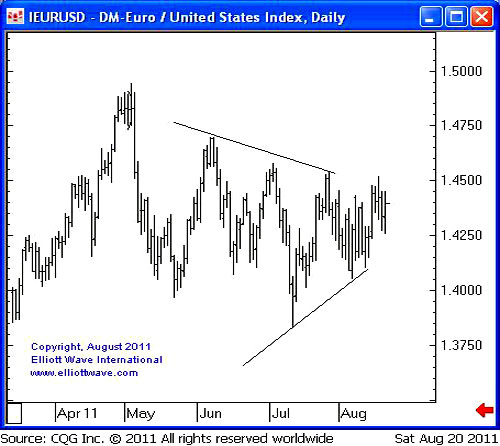

This is what a daily EUR/USD chart looks like today:

As you can see, since early summer, the EUR/USD has gone nowhere but sideways.

In the media, the explanations you read boil

down to this: Yes, Europe is in a sovereign debt crisis, but America has a

debt problem of its own. But to an Elliottician, that's not what jumps out

from this chart.

Put differently, it says:

The only question is, which direction will the "bang" take now - up or down?

|