by James Hall

June 27, 2012

from

BART Website

The shadow-banking component that adds to the

risk of non-regulatory oversight just deepens the mystery behind the most

powerful banking institution that runs roughshod over global finance.

In order to gain an insight into the complexity

of deception, examine

the function of the BIS. The granddaddy of all central

banks, the Bank for International Settlement, latest

BIS Annual Report

2011/2012, foretells future financial consolidation.

Banker to the World's Bank - Time to Deleverage

video interview on CNBC

From

Chapter V. Restoring fiscal sustainability, in this report concludes:

"Sovereigns have been losing their risk-free

status at an alarming rate. Fiscal positions were already unsustainable

in many advanced economies before the financial crisis, which in turn

led to significant further weakening.

The deterioration of public finances has

undermined financial stability, lowered the credibility of fiscal and

monetary policy, impaired the functioning of financial markets, and

increased private sector borrowing costs.

Restoring sustainable fiscal positions will

require implementing effective fiscal consolidation, promoting long-term

growth, and breaking the adverse feedback loop between bank and

sovereign risk."

The section called,

Box VI.A: Shadow banking,

states:

"While definitions differ, the term "shadow

banking" broadly refers to financial activities carried out by non-bank

financial institutions that create leverage and/or engage in maturity

and liquidity transformation.

Thus, even though they are subject to

different regulatory frameworks, shadow and traditional banks operate

alongside each other.

Shadow banking exists because historical and institutional factors, the

rapid pace of financial innovation and specialization have all increased

the attractiveness of performing certain types of financial

intermediation outside traditional banking. In normal times, shadow

banking enhances the resilience of the broader financial system by

offering unique financial products and a range of vehicles for managing

credit, liquidity and maturity risks.

But shadow banking also creates risks that

can undermine financial stability in the absence of prudential

safeguards."

The bombshell news that raises alarm is the

admission that "Too Big To Fail" is still the operative principle that

drives the banking system into an unsustainable servicing of debt

obligations.

The cloak of the shadow banking practice,

intended to circumvent usual regulatory standards, creeps along the soft

underbelly of respectable central banking. When a collapse catches up with

the racket of excessive leverage, the ensuing scandal is directed to some

esoteric phantom operation that is expendable.

The analysis in

Big Banks Take Risks Expecting

Taxpayers To Cover Losses identifies who ultimately bears the risk of the

world fiat, debt created, financial system.

"The report also emphasized the need to

increase the safety of the banking system by pushing banks to be

responsible for their losses, add to their financial buffers and avoid

risky practices. It added that big banks still have an interest in using

high-risk debt - so-called "leveraging" - to magnify any trading gains

because they can expect taxpayers to step in and cover their losses if

things go bad.

"Big banks continue to have an interest in driving up their leverage

without enough regard for the consequences of failure: because of their

systemic weight, they expect the public sector to cover the downside, "

said BIS.

"Another worrying sign is that trading, after a brief

crisis-induced squeeze, has again become a major source of income for

large banks."

Protecting the fractional reserve scheme, at all

cost, is the true purpose of the BIS. Sovereign holdings, with their ensuing

national debt owed to the banksters pays homage to the real owners of

underlying collateral assets.

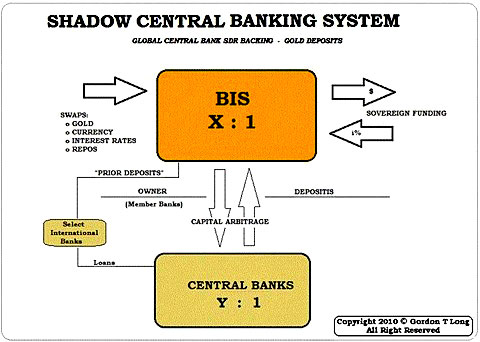

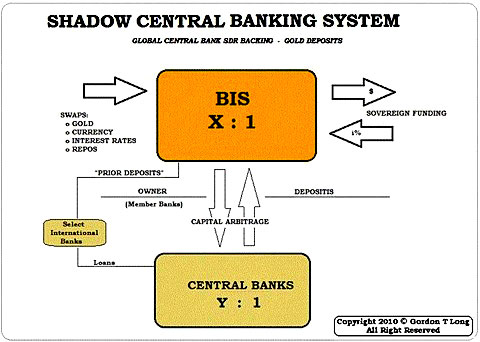

From a source in the essay,

Revolution against Central Banks, explains a

scheme of global magnitude for financial control.

"The BIS is taking national currency

deposits from the 55 member/owner central banks and converting them to

SDR's on its own balance sheet.

The SDR's are 'claims on the freely usable

currencies of IMF members,' therefore, the deposits of the central banks

become claims on those currencies - the deposits of the fiat central

banks who can deposit as much as they feel at the BIS in whatever

currency the chose - including the SDR's allotted to their 'nation,' as

the central banks are the sole depositories for the national

wealth/sellers of the national debt.

The BIS is then paying out dividends to

these same member CB's in the form of SDR's, which again can be used to

claim currencies. By August 2009, they had just made up out of thin air

almost twelve times the supposed global supply of SDR’s.

They are truly acting like the "central bank

of the world," complete with printing!"

By any objective standard of decency and

accountability, the BIS is the ultimate clearinghouse of worldwide debt for

the New World Order. Need proof, just reflect on the diversion used by a

captain from one of the most powerful "Godfather" family of investment

banking.

Finally in,

Time to Stop Expecting So Much From the Fed?, Goldman Sachs

strategist Jim O’Neill told CNBC:

Even the central bank for central banks, the

Bank for International Settlements, is playing down the power of the Fed

and other central banks.

"It would be a mistake to think that central bankers can use their

balance sheets to solve every economic and financial problem," the BIS

said in its annual report.

"In fact, near-zero policy rates, combined with abundant and nearly

unconditional liquidity support, weaken incentives for the private

sector to repair balance sheets and for fiscal authorities to limit

their borrowing requirements," the report said.

World consumers are being pick-pocketed in the

graveyard of financial ruin.

Strip away the skin of a decayed corpse and

what remains is the stark skeleton of a dead paper monitory system. The life-support methods used to keep the

interest payments accruing, only forestall the day of reckoning.

The End Game for the central bankers is

foreclosure on pledged guarantees. Currency swaps will become a recall of

national fiat species and a replacement with a float of a new world coinage.

National governments are mere public diversions from the real power behind

the thrones.