|

by Yves Smith July 13, 2017 from NakedCapitalism Website

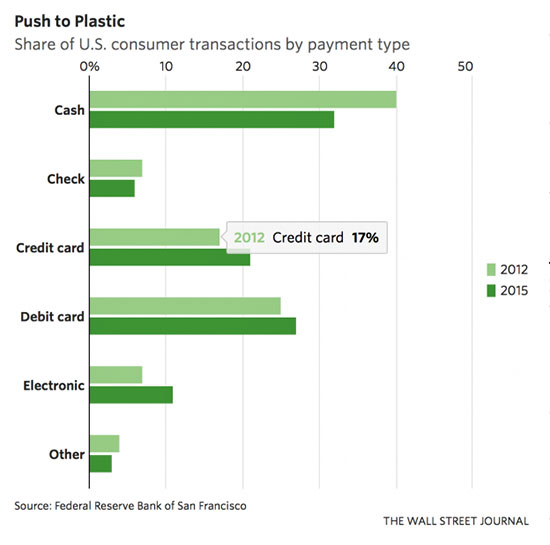

A big driver isn't

central banks who want to be able to inflict negative interest rates

on savers, or Treasuries who see cash transactions as hiding

revenues from their tax collectors, but the payment networks that

want to kill cash (and checks!) as competitors to their oh so

terrific (and fee-gouging) credit and debit cards.

Food vendors, and in particular restaurants, are low margin businesses with fickle customers who have little to no loyalty.

Why risk driving business

away?

Mag cards were often faster than cash, since you swiped and could stuff the card back in your wallet while the transaction was being approved.

Chip cards, by contrast, require you to keep the card in the machine while it is being approved, so one is very much aware of the wait.

And when I've seen people

using phones (often to buy small stuff like coffee, which really

amazes me), I find that they are slower with it that they would

probably be with cash, in that they seem to have to fumble with the

phone to get the right app readied and then the payment doesn't

always go right through either.

By contrast, even if you

use a credit card at a store, Clive informs us that the card network

typically retains only the date of transaction.

I take credit and debit cards through PayPal, and also checks.

And even though I am often slow to deposit checks because I find it hard to get to the bank, I'd still rather have checks despite the somewhat greater hassle because I save the 3% cut the card networks take.

Visa makes the argument that handling cash has costs too, but they are the ones that have ginned up the numbers, and in my case, they don't wash.

As the Journal points out:

Negative impact on employees who get tips

As one of my tax attorney buddies drily remarks,

Restaurant workers who have tips as the major source of their income almost assuredly prefer getting them in cash, rather than facing the delay of having their employer receive them through the payment network which creates delay as well as the not-trivial odds that the boss might cheat them either informally or declare that he's entitled to a processing cut.

And that's before getting

to the fact that restaurant pay levels probably pre-suppose a fair

bit of tax evasion, so the business owner might risk losing his

better employees to competitors who hadn't gone the no-cash route.

How is Visa going to

police establishments that say they aren't going to take cash? Will

Visa have spies? Will Visa have audit rights?

As a surprisingly large number of Wall Street Journal readers pointed out, cash is a legally sanctioned means of payment.

For instance:

The Treasury does support

the position that

private business can refuse to take cash

as payment for goods and services, as opposed to settlement of

debts.

Thus the market segment Visa is targeting for this move (the Wall Street Journal headline says, Visa Takes War on Cash to Restaurants) would seem to be one where Visa is on a particularly weak legal footing.

I can easily see someone with a penchant for mixing things up go to a restaurant, either not have a card or bring a card he knows will be declined (just to look like he didn't intend to stage a stunt) and then video putting down more than enough cash to settle the bill and leave.

The merchant will have no legal out. He's been paid. And at least in any decent-sized city, no way will the cops intervene. They'll regard this as a private dispute not worth their time.

If the restaurant staff

try to restrain the exiting customer, they could wind up with a very

costly suit on their hands.

A savvy New York City

colleague regularly points out how many New York City businesses,

like pizzerias and cheap jewelry stories that never seem busy, or

nail salons that have economics that don't seem to make sense, are

probably partly if not mainly in the money laundering business.

For what it's worth, my landlord (more accurately, his in-house management operation), who has an office building that takes up a full block on Park Avenue in the upper 40s, plus has seven residential buildings, takes only checks for rent.

One factor may be that in NYC, if a landlord accepts a rental payment from a party, that party obtains a legal interest in the lease.

That in turn means the landlord would lose one of his main axes for controlling who lives in the apartment (or worse, a corporation could pay make a rental payment and in theory let anyone it authorized stay in the apartment).

It's easy to see on a check who is making the payment.

On a bank transfer, the

landlord may regard it as too much hassle to verify the source of a

bank auto-debit to be worth any potential labor-savings on other

fronts. I'd be curious to learn from any readers who rent what types

of payments their landlord accepts.

Vocal customers may be

the best way to head off Visa's profiteering.

|