by Jonathan Benson

staff writer

September 30, 2011

from

NaturalNews Website

Since the initial release of the US Department of Agriculture's (USDA)

draft of organic standards in 1997, large industrial food processors have

been gradually acquiring or forming strategic alliances with organic food

brands.

And a series of detailed charts (far

below images) assembled by Philip H. Howard, an assistant professor at Michigan State University

(MSU),

provides a visual glimpse into how the organic industry has changed over the

years.

It was expected that, with the establishment of national organic standards

to replace the loose patchwork of state and local standards that existed

prior, large food producers would want in on the action. And many got what

they wanted, as they quickly gobbled up many of the largest and most viable

organic brands that existed at the time.

Howard explains that most acquisitions of organic brands by industrial food

processors occurred between 1997 and 2002, when USDA organic standards were

fully implemented.

During that time,

Other major acquisitions over the years include,

-

Kraft's takeover of Boca Foods and Back

to Nature

-

General Mills takeover of LaraBar and

Cascadian Farm

-

Pepsi's takeover of Naked Juice

And many other acquisitions have taken place

over the years as well, which you can learn more about at below charts.

Do these buyouts mean that the acquired brands are no longer reputable or of

the same quality as they were before? The answer to this, of course, is

dubious. In many cases, the contents of an acquired brand's products have

remained mostly or completely the same - the parent company simply wanted a

strategic piece of the pie.

But in other cases, the acquired brand's

offerings were altered to cut costs. Perhaps the most widely-known case of

brand tampering occurred with

Dean Foods Silk brand.

As many readers may already know,

Silk quietly stopped using organic soybeans in its soy milk products, but did not tell

customers. Silk even kept the same

barcodes and product packaging, which

resulted in some retailers unknowingly selling the altered product as if it

was organic for months after the change was made.

At the same time, many industrial food processed have developed organic

versions of their existing brands in response to growing consumer demand for

organic food, which has improved the overall quality of many popular brands.

These include for example, the introduction of,

Who Owns What in The Organic Industry

by Philip H. Howard

from

MichiganStateUniversity

Website

Organic Processing Industry Structure

The development of the USDA

National Organic Standard in place of differing

state/regional standards was widely predicted to accelerate trends of

increasing consolidation in this sector.

The first draft of the standard was released in

1997; what changes in ownership and control have since occurred?

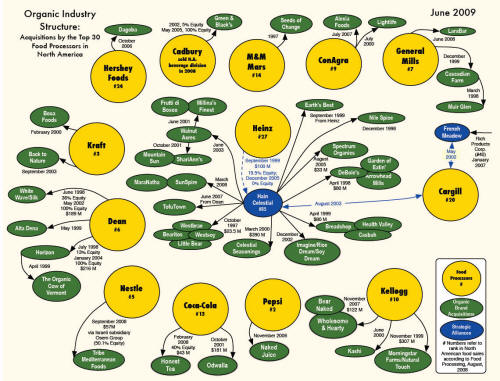

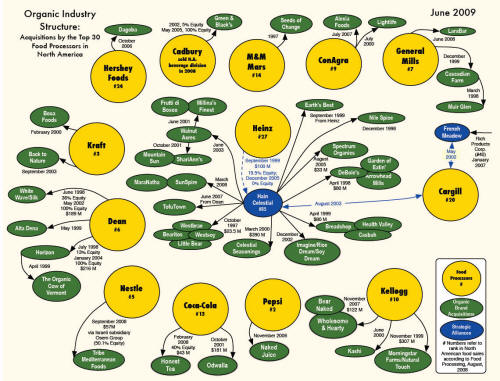

2009 Organic Industry Structure

Top 30 Acquisitions

Changes since June 2009

include,

(1) Coca-Cola fully acquiring Honest Tea in March

2011

(2) Nestlé's acquisition of Sweet Leaf Tea in May,

2011

(3) Sara Lee's acquisition of Aidell's

Sausage for $87 million in May, 2011

Most acquisitions of organic processors occurred between

December, 1997 when the draft USDA standard was released,

and its full implementation in October, 2002. Few companies

identify these ownership ties on product labels.

Cargill's strategic alliances with French Meadow and Hain

Celestial are to develop products with nutritionally

enhanced organic ingredients such as phytosterols, soy

isoflavones, trehalose, inulin, and chondroitin.

Heinz acquired a 19.5%

stake in Hain Celestial in 1999 while also transferring

ownership of their Earth's Best brand, but sold all of its

Hain Celestial stock in 2005.

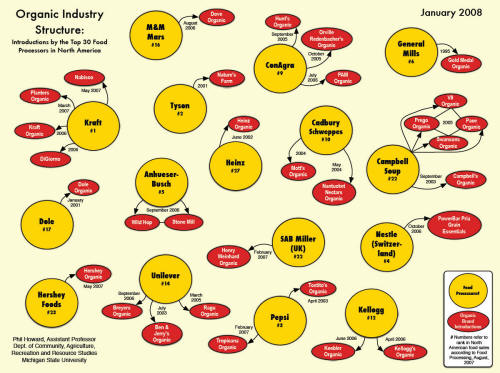

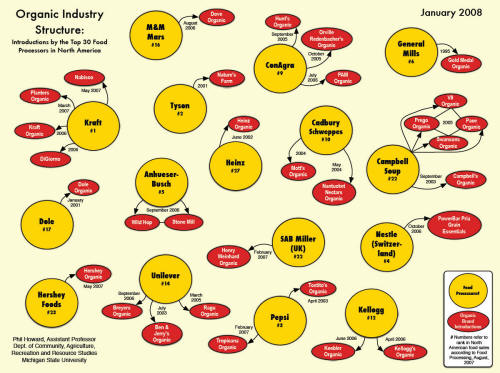

2008 Organic Industry Structure

Top 30 Acquisitions

Most introductions of

organic versions of well-known brands occurred after the

USDA standard was implemented in October, 2002. Some, such

as Dove Organic, have been developed specifically for

Wal-Mart.

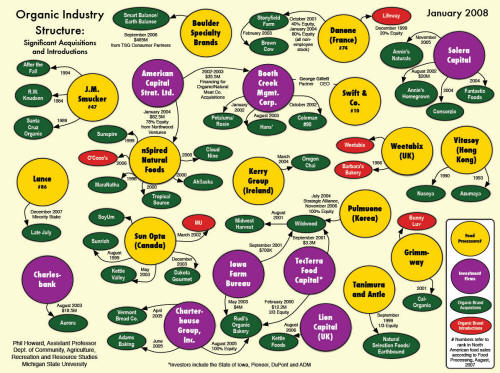

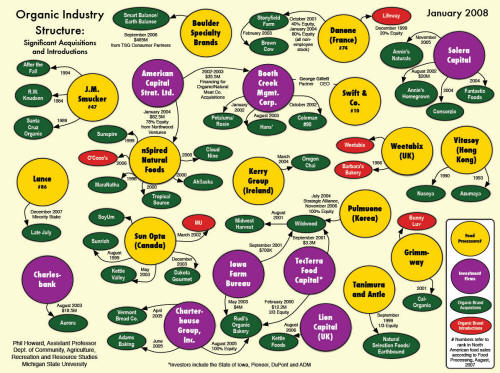

Organic Industry Structure

Significant Acquisitions and

Introductions

Venture capitalists

currently describe organic processing as "fragmented." They

are acquiring brands within the same sector (bread, meat,

etc.) with plans to sell them for significant gain at a

later date.

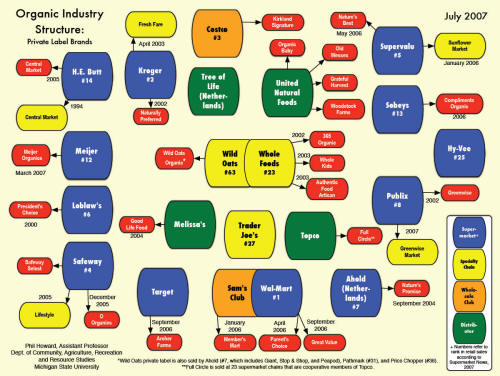

Organic Industry Structure

Major Independents and Their

Subsidiary Brands

Most remaining

independent organic processors have resisted substantial

buyout offers

(typically 2 times

annual sales).

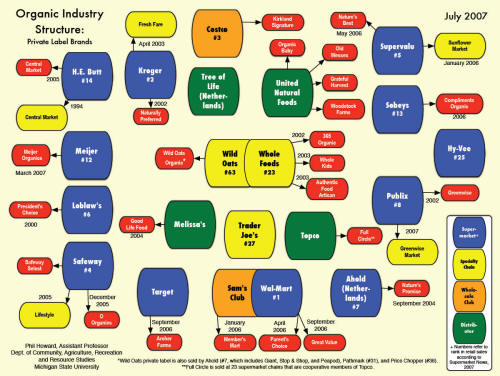

Organic Industry Structure

Private Label Brands

An increasing number of

supermarkets, wholesale clubs and distributors are

introducing organic private label products, in addition to

chains that specialize in organic and natural foods.