|

One by one, the Brexit dominoes are falling.

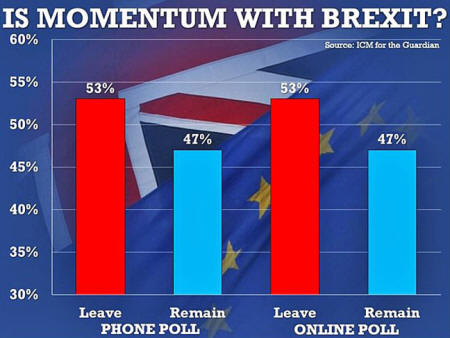

First it was the surprise ORB poll last Friday showing those in favor of Britain's departure from the EU a whopping 10 points in the lead.

Then it was two new polls this week confirming that the "Leave" camp has taken a convincing lead with just 10 days left to go before the vote. Then it was Murdoch's Sun urging its readers in its typical low key and understated fashion to "BeLEAVE in Britain!"

Now even serious journalists like The Telegraphs's Ambrose Evans-Pritchard are encouraging Britons to vote for separation from the EU in next week's referendum:

I couldn't have said it better myself.

Well, actually I could, but fewer people would listen...

So the bookmakers may still be giving the winning odds to the "Stay" camp (for the compulsive gamblers out there, it's 4-7 for stay vs. 7-4 for leave), but there is significant movement behind the push to extricate the UK from its 43-year entanglement with the EUreaucracy.

So of course the banksters are doing what they always do when things are not going their way:

Accordingly, the bankster mouthpiece media has been breathlessly reporting for months now on the number of economists who have lined up to warn that the sky will fall and dogs will start marrying cats (economically speaking) if Britain asserts control of its own territory:

Bah, there's no time to check the facts, just trust the experts. It's time to be afraid!

And they're not necessarily wrong. After all, the financiers control the central banks, which have been dictating the global equities and bond bubble we've been living through since Lehman, so if and when they decide to pop it they just have to start calling in their debts and sucking the air out of the economy.

And so we get a series of catastrophic headlines: And, just in case you didn't get the message:

This should surprise precisely no one. Remember when public outcry against the $700 billion bankster bailout of 2008 was so loud that Congress overwhelmingly rejected the bill?

Remember what Brad Sherman later admitted on the floor of Congress?

Remember when the banksters showed they were willing to follow through on their warnings, with $1.2 trillion of wealth being wiped out of the stock market the day that Congress voted to reject the bill?

Remember how Congress caved and passed the bill after a second vote a few days later?

Well, why would we expect anything different this time around? The banksters want Britain in the EU and they're not afraid to hold a gun to the head of the global economy in order to get their way.

There are a couple of points to take away from this. Firstly, should voters allow the inevitable backlash from the powers-that-shouldn't-be to stop them from doing what they feel is right come referendum day?

And secondly, isn't it instructive that the only response the banksters really have is to take their ball and go home when things don't go their way?

I mean, sure, the "ball" is the global debt-based finance capital economy they've constructed in their image and that keeps the wheels of commerce as we know it today greased (and thus is more or less directly responsible for the gainful employment of almost everyone), but still… all they can do is try to take that away from us.

So, once again, doesn't it all come down to an even more fundamental question:

Sadly, we don't live in a world where those practices are mainstream (yet), so on June 23rd the Brits need to ask themselves one simple question:

|