by Michael Snyder

July 18, 2012

from

TheAmericanDream Website

Federal Reserve Chairman Ben Bernanke delivered

his annual address to Congress on Tuesday, and he did very little to give

lawmakers much confidence about where the U.S. economy is heading.

Bernanke told members of Congress that recent

economic data points “suggest further weakness ahead” and that

the Federal

Reserve is projecting that the U.S. unemployment rate will remain at 7

percent or above all the way through the end of 2014.

Now, it is important to keep in mind that

Federal Reserve forecasts are almost always way too optimistic. The actual

numbers almost always end up being much worse than what the Fed says they

will be.

So if Bernanke is saying that the U.S.

unemployment rate will be 7 percent or higher until the end of 2014, then

what will the real numbers end up looking like?

During his testimony, Bernanke seemed unusually

gloomy about the direction of the U.S. economy. He seemed resigned to the

fact that there really isn’t that much more that the Federal Reserve can do

to stimulate the U.S. economy. Yes, the Federal Reserve could try another

round of quantitative easing, but the first two rounds did not really do

that much to help.

The truth is that the United States is

absolutely drowning in debt, and when that debt bubble finally bursts the

Federal Reserve is simply not going to be able to save us from the Great

Depression that will happen as a result.

At this point, Bernanke appears to be in “cya” mode.

For example, the

following is from

Bernanke’s prepared remarks to Congress on Tuesday…

The second important risk to our recovery,

as I mentioned, is the domestic fiscal situation.

As is well known, U.S. fiscal policies are

on an unsustainable path, and the development of a credible medium-term

plan for controlling deficits should be a high priority. At the same

time, fiscal decisions should take into account the fragility of the

recovery. That recovery could be endangered by the confluence of tax

increases and spending reductions that will take effect early next year

if no legislative action is taken.

The Congressional Budget Office has

estimated that, if the full range of tax increases and spending cuts

were allowed to take effect - a scenario widely referred to as the

fiscal cliff - a shallow recession would occur early next year and about

1-1/4 million fewer jobs would be created in 2013.

These estimates do not incorporate the

additional negative effects likely to result from public uncertainty

about how these matters will be resolved.

As you recall, market volatility spiked and

confidence fell last summer, in part as a result of the protracted

debate about the necessary increase in the debt ceiling. Similar effects

could ensue as the debt ceiling and other difficult fiscal issues come

into clearer view toward the end of this year.

The most effective way that the Congress could help to support the

economy right now would be to work to address the nation’s fiscal

challenges in a way that takes into account both the need for long-run

sustainability and the fragility of the recovery.

Doing so earlier rather than later would

help reduce uncertainty and boost household and business confidence.

Did you catch that?

Bernanke says that the federal government is on an “unsustainable path” and

must reduce debt, but he also says that the economy cannot afford tax

increases and spending cuts right now.

In fact, Bernanke is

warning that “a

shallow recession would occur early next year” if something is not done

about the looming “fiscal cliff” that so many people are talking about.

So what does Bernanke want us to do?

-

If we continue on the path that we are

on, our debt will continue to grow by leaps and bounds.

-

But if we seriously cut spending or

raise taxes, that will significantly slow down the economy.

Either path leads to a whole lot of pain.

Bernanke sounds like a politician that is trying to cover all of his bases

without giving us a recommendation about how to fix things.

Of course the truth is that

the Federal Reserve system itself is at the very

heart of our economic problems and has been the engine that has caused our

national debt to explode at an exponential rate, but we all know that

Bernanke will never admit that.

-

Bernanke can see that things are

starting to fall apart, and he wants to shift as much blame to

Congress and to other entities as he can while there is still time.

-

Bernanke knows that the U.S. economy is

not going to produce enough jobs for our population anymore, and he

does not want to be blamed for that.

-

Bernanke knows that the money printing

done by the Fed is going to cause prices to continue to go up and

that this will seriously stretch family budgets all over America,

and he does not want to be blamed for that.

-

Bernanke wants to come out of all this

looking like a good guy. At this point he is probably hoping that

the next

great global financial crisis does not happen until his

term ends.

Unfortunately, he is not going to have that

luxury.

The next wave of the economic collapse is

rapidly approaching, and it is going to hit the U.S. even harder than the

last recession did.

And when the unemployment rate soars well up into the double digits, what do

you think is going to happen?

The truth is that the entire country will soon

resemble cities such as Gary,

Indiana and Flint, Michigan.

To get an idea of what most of our cites will soon look like, just check out

this video.

When people lose hope, they tend to get desperate.

And desperate people do desperate things.

Just

look at the mob robberies that we are seeing all over the country right

now.

In Jacksonville, Florida the other day, hundreds of young people that had

just left a massive house party that police had broken up decided that they

would descend on the local Wal-Mart.

According to police, approximately 300 people stormed into Wal-Mart and

started going crazy. They threw produce at each other, many of them started

putting merchandise into their pockets, they destroyed an anti-shoplifting

security scanner that is worth about $1,500 and there were even reports that

shots were fired outside of the store.

It was absolute chaos. You can see video of this incident

right here.

A

similar mob robbery happened in the Portland, Oregon area on Saturday

night…

A group of teens targeted a Troutdale store

last weekend in a ‘flash rob’ and investigators are trying to identify

the suspects.

Investigators said as many as 40 kids entered the Albertsons store at

25691 SE Stark Street at the same time late Saturday night and started

stealing things.

Security officers chased the thieves out, but no one was captured. They

also left employees pretty shaken up, including one woman who was in

tears after getting terrorized by the robbers.

So will Ben Bernanke and the Federal Reserve be

able to save us from this kind of chaos?

Of course not.

If you have any faith in Bernanke at this point then you are being quite

foolish.

Our economy is on the verge of collapse, and when it does collapse there is

going to be hell to pay on

the streets of America.

These days young people seem to commit absolutely brutal crimes just for the

fun of it. For example, in Chicago the other day two teens beat to death a

62 year old disabled man who was collecting cans for no apparent reason

whatsoever.

The following is

from a report about this incident from the NBC

affiliate in Chicago…

Police said a 16-year-old gang member

punched Delfino Mora, father to 12 children and a grandfather to 23,

last Tuesday in an alley in the 6300 block of North Artesian.

Mora’s

devastated family told NBC Chicago that Mora was on his regular route of

collecting cans that he sells for cash when the teens confronted him.

Nicholas Ayala, 17, of the 6300 block of North Talman and Anthony

Malcolm, 18, of the 5500 block of North Broadway were both charged with

first-degree murder and robbery.

Malik Jones, 16, the Latin Kings member accused of striking Mora, was

charged with first-degree murder and ordered held without bail Sunday by

Judge Adam Bourgeois.

Police said Jones handed his friends his cell phone to start filming

then demanded money from Mora and punched him in the jaw. Ayala and

Malcolm are accused of taking turns filming the video which allegedly

showed Mora’s head smashing into the concrete.

But just because you aren’t in the city does not

mean that you are safe.

For example, just check out what happened to three rural Michigan teens when

they decided that it would be fun to hop on a passing train.

The following

is from a

recent article in the New York Times…

For generations of Midwestern youths who

have grown up hearing the long whistles and deep rumbling of passing

locomotives, hopping a freight train to another city has seemed like a

free ride to adventure.

But for three rural Michigan teen-agers who actually followed this

dream, the results proved disastrous. The two 15-year-old boys and a

14-year-old girl climbed off the train when it stopped last Wednesday

evening in a rough neighborhood here. Within hours, the girl had

suffered multiple sexual assaults and all three had been shot in the

head and left for dead in a park.

One boy, Michael Carter, was killed, while the other, Dustin Kaiser, and

the girl staggered to a road and flagged down a truck driver.

Dustin is

in stable condition at the Hurley Medical Center after two rounds of

surgery, while the girl, who was shot through the cheek, was treated and

released on Friday, said Donna J. Fonger, a hospital administrator.

Our country is degenerating, and the Federal

Reserve is not going to save you.

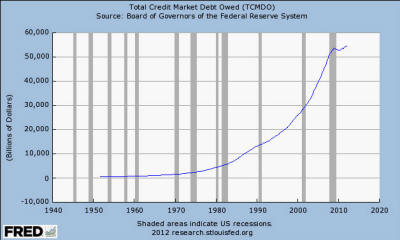

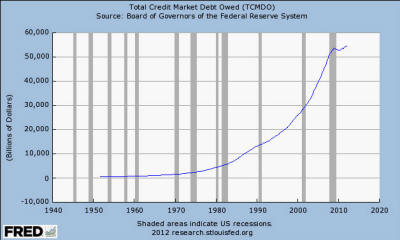

We have been living in the greatest debt bubble in the history of the

planet, and it is going to burst at some point and that is going to cause a

massive economic depression.

Just check out what Richard Duncan, the author of The New Depression,

told

CNBC the other day…

When we broke the link between money and

gold forty years ago, this removed all the constraints on credit

creation. And afterwards credit absolutely exploded. In the U.S. it grew

from $1 trillion to $50 trillion – a fifty-fold increase in forty three

years.

This explosion of credit created the world we live. It created very

rapid economic growth. It ushered in the age of globalization.

But it now seems credit cannot expand any further because the private

sector is incapable of repaying the debt that it has already. And if

credit now begins to contract there is a very real danger that we will

collapse into a new great depression.

In the chart posted below you can see what he is

talking about.

Once upon a time the total amount of debt in the United

States (including government debt, business debt and consumer debt) was

sitting at about a trillion dollars.

Today, it has nearly reached 55 trillion dollars…

We have lived way above our means for decades, and now a day of reckoning is

rapidly approaching.

Ben Bernanke and the Federal Reserve may be able to delay the coming

depression slightly, but they cannot avert it.

You better get ready...