by Mark Sircus

07 January 2011

from

IMVA

Website

This below video powerfully presents the ideas in this essay.

My first spiritual

teacher, who also doubled as a martial arts instructor, taught that people

learn from repetition and impact. The video definitely delivers on the

impact and I hope my presentation of the words of many delivers on the

necessary repetition.

It is understandable when people without resources and

intelligence ignore all the warning signs but there is no excuse when

intellectually capable people stick their collective heads in the sand.

Egon von Greyerz

writes,

“We now live in a world where governments

print worthless pieces of paper to buy other worthless pieces of paper

that, combined with worthless derivatives, finance assets whose values

are totally dependent on all these worthless debt instruments.

Thus most

of these assets are also worthless.

So the world financial system is a

house of cards where each instrument’s false value is artificially

supported by another instrument’s false value. The fuse of the world

financial market time bomb has been lit. There is no longer a question

of IF it will happen but only WHEN and HOW.

The world lives in blissful

ignorance of this.”

Ben Bernanke, Timothy Geithner, Barack Obama,

the Wall

Street banks, and the corporate mainstream media are playing a giant

confidence game. It is a desperate gamble. The plan has been to

convince the population of the US that the economy is in full recovery mode.

The Burning Platform

“First, the global economy is in dire

straits and riding the wave of a convoluted ‘recovery’ built on fiat and

fantasy. So to get to the point (as if it is not painfully obvious);

there is no recovery!

I don’t care how often CNBC, MSNBC, FOX, or CNN,

pull skewed data and automaton analysts from their ghastly dungeon of

disinformation, the fundamental dysfunctions of the American economy

remain unchanged.

The key here is the dollar and its inevitable demise,

which the establishment is trying desperately to hide until the last

possible moment. Over the next year we are likely to be buried in a

deluge of excuses, half-truths, and lies, all meant to divert attention

away from the word ‘inflation’ as the masses begin to question just what

the hell is going on,”

writes 'Giordano Bruno.'

The mainstream financial press as usual will be

used as a tool to mislead the public even as the storm hits them broadside.

The United States financial system, as it

exists, is making

war on its own citizens, and on the citizens of other countries,

by foisting the decrepit system on the rest of the world.

James West

After

the Federal Reserve went on its latest

rampage of printing money, Peter Schiff of Euro Pacific Capital said,

“If bond prices failed to rise given such a

Herculean effort to lift them up, there can be only one direction for

them to go: down.”

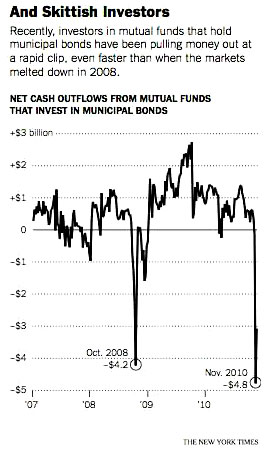

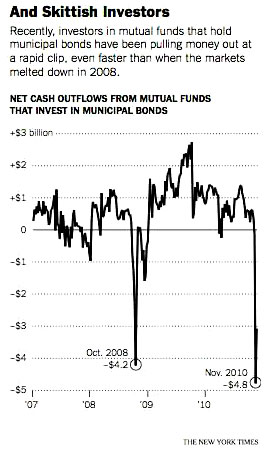

So as the winter opened her cold doors, the

bells of doom are ringing in the huge bond market meaning that a lot of

trouble is brewing on the horizon.

“The big money realizes that the Fed is

fueling a trend of global inflation. And only a fool would want to be

stuck holding bonds when interest rates rise,” writes Robert Prechter.

One can hear a storm like this approaching. It

sounds like a hundred freight trains converging on you.

The above video is

like this but reality is always so much worse than any presentation of it.

Storms like this are real and they do destroy property and kill people. What

is happening in the financial sphere though is so much worse for its going

to be like a storm of this destructive power touching down on all points of

the earth simultaneously.

Everyone everywhere will feel its destructive

capacity to destroy lives and wealth though obviously the wealthy that have

their wits about them have prepared more than others.

James Howard Kunstler, in a master document of the world’s fate for 2011

says,

“As is the case now, first in the unraveling

of global financial arrangements – a terrifying matrix of irresolvable

mutual obligations that are destined to be repudiated in an ugly way.

Everybody owes too much money to everybody else.

A worldwide game of

financial musical chairs is currently eliminating various nation-players

too weak to plant their asses in the diminishing chair-space. Iceland

dropped out first, then Greece, then Ireland, and so it goes.

Entering

2011, the trouble is that the world is out of runt countries to shove to

the sidelines. There are Portugal and Belgium to go, and from these on

all you’ve got are nations too big to fail and too broke to keep going,

the most conspicuous being Spain.”

It is uncommon to conceptualize the world and

human history as an ongoing clash between the filthy rich and almost

everyone else, between the extractors of economic renters and the sellers of

debt, the oppressors and the oppressed.

Today we stand on the brink where

large swaths of unproductive private and public debt will not be repaid, and

sovereign countries will default on their obligations. International

monetary, political or strategic unions that rely on economic stability,

mutual trust and confidence will not be preserved in any meaningful form and

it’s going to be one hell of a ride down from here.

Governments will do anything to keep funds flowing.

Daniel R. Amerman

writes,

“Something really interesting (and

terrifying) happens when you combine monetary inflation with asset

deflation in real terms (meaning the purchasing power of assets is

plummeting).

As the dollar price of the assets in ever-more-worthless

dollars climbs higher and higher, the purchasing power of those assets

drops lower and lower. This generates very high taxable profits that are

then taken by an increasingly desperate federal government.”

Amerman continues,

“Many people, looking at what has just been

presented, would see this as being a major reason to keep that deficit

spending right up there and maybe even get more aggressive about it.

This is indeed the position of many politicians and pundits, as well as

a number of mainstream economists. Unfortunately, there is a double

problem with this approach: there’s no indication that it’s working

other than as a short term band-aid, and the cost of the “band-aid”

risks wiping out the value of money, savings and investment on a

nationwide basis.”

“Unfortunately it appears quite likely that there will be a crash in the

value of money itself. This is likely to be accompanied by a crash in

the purchasing power of financial assets. The stock market may collapse

in a way we haven’t seen since the last time we saw this level of

depression, that being the 1930s.

We are likely to see a tremendous bond

market crash as US government monetary creation and manipulation is

eventually overwhelmed by reality.”

The Western public debt crisis is growing very

rapidly.

The absence of economic recovery in the United States, the

accelerated structural weakening of the United States in monetary, financial

as well as diplomatic affairs, and the global drying up of sources of cheap

finance are all leading to a storm of unprecedented proportions.

Ron Robins

writes,

“Banks and the financial system will probably soon experience a new

round of massive real-estate-related losses and subsequent financial

institutions’ bankruptcies. Thus, a new major financial crisis will likely

soon engulf America, greatly impairing its lending facilities and creating a

severe scarcity of debt.”

The biggest macro-economic

story of 2010 was

Europe:

It’s falling apart, and there doesn’t seem

to be anything that’s going to stop this collapse.

Jim Willie

writes,

“Remember in mid-2008 the

nation was told that the $1.4 trillion deficit would be reduced to below $1

trillion easily in 2009. It was not, and repeated the $1.4 trillion.

Remember in mid-2009 the nation was told that the previous two $1.4 trillion

deficits would be reduced to below $1 trillion easily in 2010.

It was not,

and repeated the $1.4 trillion. Finally, the US Govt deficits in current

projections are estimated to be well above $1 trillion, as reality has

struck. The $1T deficits are a permanent fixture. Thus the Quantitative

Easing #2 is in place, since the US Treasury does not want the shame from

failed auctions to reflect badly on the US Dollar or the other galaxy of

US$-based paper assets. They masquerade as containing value, when they are

largely trash items.

They can no longer compete against gold. If truth be

known, Wall Street executives are trashing their corporations and buying

gold in private accounts as counter-parties. They will someday dump their

corporate losses on the US Govt and ride into the sunset zillionaires.

Then

comes the US Treasury default.”

Practical Economics

Enough of this high finance stuff. Let’s look at how the common man is

fairing in all of this.

Public Workers Facing Outrage as Budget Crises Grow

reads

the headline in the New York Times.

“Across the nation, a rising

irritation with public employee unions is palpable, as a wounded economy has

blown gaping holes in state, city, and town budgets, and revealed that some

public pension funds dangle perilously close to bankruptcy.”

Everyone either on a pension or soon to deserve one might not get one or

will definitely lose ground as the money to pay them dries up.

It will

almost be like class warfare with people close to or in retirement being the

first in line to lose the basic structure of their lives. Equally, the salt

of society, its teachers, librarians, police, firemen, and just about

everyone else in local, city, and state governments are facing an apocalypse

in terms of their promised benefits and even their daily wages.

The young also are not having a good time with things these days either.

Europe’s Young Grow Agitated Over Future

Prospects is

the headline, also published in the Times. Many of the young

are getting fed up with how surreal and ultimately sad it is to be young in

the first world today.

The outrage of the young has erupted, sometimes

violently, on the streets of Greece and Italy in recent weeks, as the young

protest austerity measures and a rising reality and feeling of being

increasingly shut out of their own futures.

The young are facing a terrible job market.

“Giuliano Amato, an economist and former

Italian prime minister, was even more blunt.

“By now, only a few people

refuse to understand that youth protests aren’t a protest against the

university reform, but against a general situation in which the older

generations have eaten the future of the younger ones,” he

recently told Corriere della Sera, Italy’s largest newspaper.”

“As a result, a deep malaise has set in among young people.

Some take to

the streets in protest; others emigrate to Northern Europe or beyond in

an epic brain drain of college graduate. But many more suffer in

silence, living in their childhood bedrooms well into adulthood because

they cannot afford to move out.”

http://www.nytimes.com/2011/01/02/world/europe/02youth.html

Conclusion:

“Sooner or later all this dishonesty will

terminate in collapsing living standards, loss of public services,

growing civil disorder, and political crisis. You can get there via

deflation (no money) or via inflation (plenty of worthless money) but

the destination is the same.

I don’t see how America fails to begin

arriving at that destination before Halloween 2011. Europe may get there

by springtime, anyway, dragging the rest of the developed world into a

vortex,”

writes James Howard Kunstler.