|

by Herman K. Trabish

September 15, 2011

from

GreenTechMedia Website

In the poker game being played for the

future of the wind turbine’s drivetrain, VC

NEA just told VC

CMEA

Capital they would see the $15.1 million round B on permanent magnet

generator (PMG) specialist Danotek and raise with a $35 million bet

on PMG innovator Boulder Wind Power.

As just reported by Greentech Media, PMG technology’s emerging

inevitability as a replacement for the traditional gearbox in the

turbine drive-train was affirmed when CMEA Capital and three other

heavyweight Danotek backers (GE Energy Financial Services, Khosla

Ventures, and Statoil Hydro) re-upped funding to advance development

of the company’s PMG converter system.

NEA, which had already invested $11 million in first round backing

for Boulder Wind Power (BWP), joined with first-time investor and

international rare earth metals powerhouse Molycorp in a second

round of funding.

This is a unique synchronicity because a PMG’s

magnets require rare earth metals.

The

Danotek high-speed PMG system’s attractiveness to investors is

based on a uniquely efficient stator-rotor configuration, as well as

its existing relationships with wind industry manufacturers and

developers such as Clipper Windpower and DeWind.

The

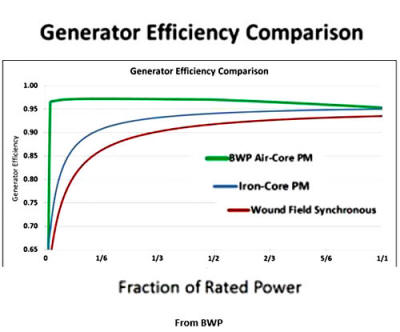

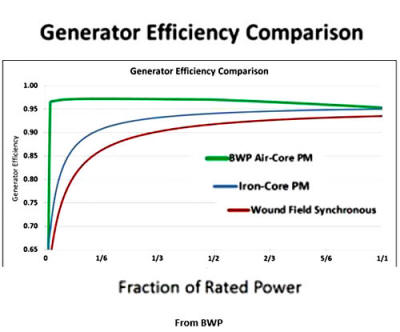

BWP low-speed PMG system’s attractiveness is based on an

innovative PMG concept that gets away from expensive rare earth

metals and creates efficiencies that BWP says can make wind power

competitive with traditional sources of electricity generation

without the need for incentives.

Based on the three key factors in the

cost of wind - the capital

cost of the turbine; the production of energy; and the cost of

operations and maintenance - the BWP direct drive with its PMG can

be expected, according to rigorous modeling, to keep the cost of

wind generated electricity down in the four cents per kilowatt-hour

range,

according to Sandy Butterfield, the company’s CEO.

At that price, said Butterfield, formerly the Wind Technology Center

Chief Engineer at the U.S. Department of Energy’s National Renewable

Energy Laboratory (NREL), wind would be would be - on an

unsubsidized basis - a more cost-effective source of electricity

than coal.

The BWP direct drive system will be,

“lighter and cheaper than a

gear-driven system,” Butterfield said, “but the big bang is in

reliability. With a direct drive generator, you have basically

one big moving part to replace [instead of] a bunch of very high

precision, high quality steel moving parts in a gear box.”

Turbine gearboxes, no matter how

precisely designed and assembled, wear out long before the turbine’s

20-year life span is over, requiring a very costly replacement

process involving replacement of the complicated lubrication system,

as well.

“A direct drive system eliminates

all of those opportunities for early failure,” said Butterfield,

who, as head of the Gearbox Reliability Collaborative during his

time at NREL, is one of the foremost U.S. authorities on the

subject.

One of the most distinguishing

characteristics of the BWP PMG design is that its magnets are part

of an axial flux air core machine which operates at relatively low

temperatures and are made with a rare earth metal called

neodymium.

More commonly, PMG magnets are part of

iron core radial flux machines like Danotek’s, operate at relatively

high temperatures and require a rare earth metal called

dysprosium.

In very round numbers, Butterfield said, dysprosium sells - in

today’s very constrained market dominated by China’s hoarding of its

unique rare earth metal supply - for around $1,000 to $2,000 per

kilo; neodymium sells for about $100 per kilo and is relatively more

common.

More significantly, BWP has secured a portion of its newest funding

from first-time investor

Molycorp, the only rare earth oxide

producer in the Western hemisphere and the largest outside of China.

Molycorp will take a place on Boulder Wind Power’s board and be the

"preferred provider" of neodymium from its flagship rare earth mine

and processing facility, currently ramping up to full production, at

Mountain Pass, California.

Rare earth metal processing techniques used in China, Butterfield

said,

“are pretty environmentally

detrimental."

But,

he said,

“Molycorp has developed a closed loop

system that is both efficient and environmentally friendly.

Nothing comes out of it and their yield is much better.”

This assures BWP a secure domestic

supply of neodymium while other PMG system makers must continue to

pursue supplies of dysprosium, which, Butterfield said,

“drives the price of high

temperature magnets.”

The $35 million “will get us to

commercialization,” Butterfield said.

Next, he wants “to secure commercial

partners.” He is currently in talks “and very far along” with

multiple turbine manufacturers, for whom he will design the direct

drive PMG system to their turbines’ specifications.

He expects to have operational

prototypes within 18 months.

“We would be working with the design

teams. We don’t expect the rotor to change. We don’t expect the

tower to change,” Butterfield said.

“The nacelle - everything between

the tower and the rotor - will have significant changes. But

it’s all

mechanical engineering. We’re not inventing new

science. And in many ways, this is an easier machine to handle.”

Commercial deployment will come at the

end of that two-year process:

“That is when we start selling

machines.”

|