|

by John Galt

December 27, 2011

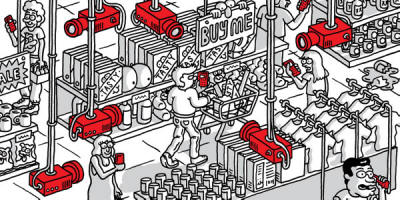

However, many retailers seem undeterred by privacy issues and have fully embraced the concept of going even a step further:

A

recent report by Bloomberg comes to a disturbing conclusion in at least

one case - the greater the tracking, the greater the sales.

A little cheese here, a little shock there -

and, what do you know; look at 'em run.

The result is an eye in the sky looking down

upon the maze of shoppers moving through different areas of stimulating

bait, while groups of gatekeepers encourage a pre-determined pattern of

behavior. The mission is to transform the unpredictable brick-and-mortar

world into the pattern recognition landscape of the Web.

RetailNEXT is a product of BVI Networks, which is at the heart of the new high tech approach to shopper management.

Alexei Agratchev, chief executive officer of consultancy, expressed his distaste for the unknown by saying that "stores have been a black hole"... until now.

According to their website, the company utilizes "best-in-class video analytics, on-shelf sensors and RFID readers along with data from point-of-sale and other business systems" in order to create an information field to fill that black hole.

Agratchev's background is interesting, having

formerly been a senior manager at Cisco systems and a consultant for

Accenture; a company currently at the center of government funding to

implement a

biometric database for illegal immigrants and U.S. citizens

alike, as well as construction of the Smart Grid.

Furthermore, the tech sector continues to be

exposed for having

built in backdoors from the very beginning at the behest

of government agencies like the FBI, calling into question any concern for

the true end user's

digital privacy rights.

As company CEO, Al Shipp, boasts,

The shopping application is an extension of a facial recognition security function that they have been using in Northern California banks where Shipp says,

For a look at the extreme ends of where this

type of security camera/software integration is being developed, have a look

across the pond to Great Britain - which is, incidentally, where the makers

of the Black Friday mall tracking technology are based:

Retailers like JCPenny have been hesitant to sign on, as well as Home Depot.

However, when companies like Montblanc report a 20% sales increase since they began tracking their shoppers, other stores are bound to overlook privacy issues. If people are so concerned, they might reason, then why do they show up?

And this is the lesson we consumers should learn:

To see where all of this is ultimately heading

unless we strongly resist and boycott the companies and locations that

install these technologies, please view the video below for

Recorded Future

- a company whose tag line is "Unlock the Predictive Power of the Web."

by Ashley Lutz and Matt Townsend December 15, 2011 from BloombergBusinessWeek Website

For the most part, they’ve been forced to rely on consumer surveys, says Herb Sorensen, an adviser at market research firm TNS Retail & Shopper (WPPGY) in London.

To get a better understanding of their customers in real time, mall operators are monitoring shoppers’ behavior with devices that track mobile-phone signals, while retailers including,

...are finding new uses for old tools such as in-store security cameras.

The goal is to divine which variables affect a purchase, then act with Web-like nimbleness to deploy more salespeople, alter displays, or put out red blouses instead of blue.

Until recently,

Agratchev says RetailNext was founded in 2007 to change that.

It helps retailers build systems to better understand customer behavior. In most cases, the company relies on the video from a store’s existing security camera system. That feed is run through RetailNext’s software, which analyzes the video and correlates it with sales data. The software can also integrate data from hardware such as radio-frequency identification (RFID) chips and motion sensors to track how often a brand of cereal is picked up or how many customers turn left when they enter a store.

The company now has 40 retailer clients, including American Apparel (APP) and Family Dollar, and another 20 are testing the systems.

RetailNext’s data sometimes refutes conventional

wisdom. For instance, many food manufacturers pay a premium for their

products to be displayed at the end of an aisle. But customers pay greater

attention to products placed in the center of an aisle, according to

RetailNext’s analysis.

Rodrigo Fajardo, Montblanc’s brand manager in Miami, says RetailNext’s analysis helps his team make decisions faster.

He says the software has helped boost sales 20

percent and that Montblanc plans to expand its use to a dozen locations.

He says T-Mobile, in Bellevue, Wash., uses 3VR’s technology in some of its retail stores to track how people move around, how long they stand in front of displays, and which phones they pick up and for how long. T-Mobile declined to comment. Now 3VR is testing facial-recognition software that can identify shoppers’ gender and approximate age.

The software would give retailers a better handle on customer demographics and help them tailor promotions, Shipp says.

Some retailers are installing gear to track shoppers via cell phones.

Path Intelligence, a company in Portsmouth, England, started selling a technology in 2009 that records a phone’s cellular signal and follows its owner through a building. Today it’s used primarily by malls in Europe, and the company says its technology records the paths of more than 1 million customers every day.

Some retailers use the data to figure out where

in a mall to place their stores, says Path Intelligence CEO Sharon Biggar.

Others use it to find out the nationality of their visitors using the

country code at the start of their phone numbers.

David Jacobs, a fellow at the Electronic Privacy Information Center, says it’s “impractical” to suggest shoppers turn off their phones because so many people use them to meet up with friends.

Path Intelligence says it doesn’t record anyone’s identity and alters some of the digits in each phone number before storing it.

Not everyone is reassured.

In November the Short Pump Town Center in Richmond, Va., and the Promenade Temecula mall in California began testing Footpath, the first such trials in the U.S.

The test was suspended after one day following complaints from Senator Charles E. Schumer (D-N.Y.) that the technology could compromise shoppers’ privacy.

J.C. Penney (JCP) tested the technology in one store but has no plans to implement it, says Rebecca Winter, a spokeswoman for the chain.

Mark Rasch, director of cybersecurity and privacy at CSC (CSC), a consulting firm in Falls Church, Va., says that tracking phones or using cameras to glean shopping habits is “no more intrusive than what online retailers do.”

These tools are likely to become more common if other retailers can replicate Montblanc’s success at boosting sales.

The bottom line: Montblanc reports sales increases of 20 percent with shopper-tracking technology that raises privacy concerns.

|