Public announcement GEAB N°28

October 16, 2008

from Leap2020 Website

In this 28th edition of the GEAB (GlobalEurope

Anticipation Bulletin), LEAP/E2020 has decided to launch a new global

systemic crisis alert. Indeed our researchers anticipate that, before next

summer 2009, the US government will default and be prevented to pay back its

creditors (holders of US Treasury Bonds, of Fanny May and Freddy Mac shares,

etc.).

Of course such a bankruptcy will provoke some

very negative outcome for all USD-denominated asset holders.

According to our team, the period that will then

begin should be conducive to the setting up of a «new Dollar» to remedy the

problem of default and of induced massive capital drain from the US.

The process will result from the following five

factors studied in detail further in this GEAB:

-

The recent upward trend of the US Dollar

is a direct and temporary consequence of the collapse of stock

markets

-

Thanks to its recent «political

baptism», the Euro becomes a credible «safe haven» value and

therefore provides a «crisis» alternative to the US dollar

-

The US public debt is now swelling

uncontrollably

-

The ongoing collapse of US real economy

prevents from finding an alternative solution to the country's

defaulting

-

«Strong inflation or hyper-inflation in

the US in 2009?», that is the only question.

Studying the case of Iceland can give an idea of

the upcoming stages of the crisis. That is what our team has been doing ever

since the beginning of 2006. This country indeed provides a good

illustration of what the US and the UK should be expecting.

It can be considered – and that is what most

Icelandic people do today – that the collapse of Iceland's financial system

came from the fact that it was disproportionate to the size of the country's

economy.

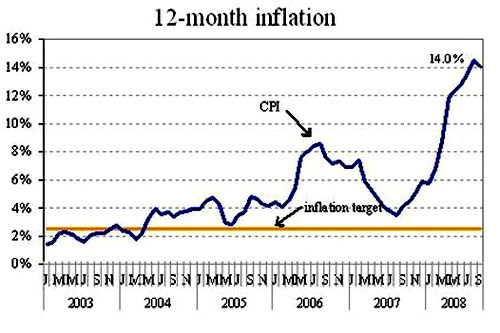

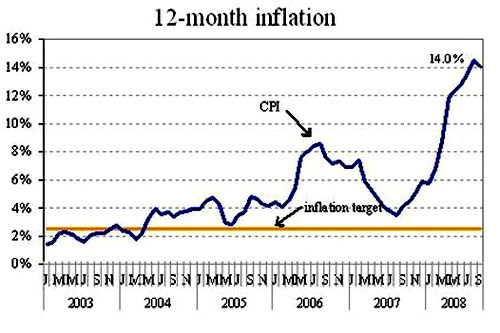

Inflation in Iceland -

2003-2008

Source Central Bank of

Iceland

Financially speaking, Iceland thought of itself

as UK (1), in the same way as, financially speaking, UK thought

of itself as the US and the US thought of themselves as the entire world. It

is therefore quite useful to study the case of Iceland (2) in

order to understand the course of events that London and Washington will

follow in the next 12 months (3).

What we see today is a double historical phenomenon:

-

on the one hand, since September 2008

(as anticipated in the February 2008 edition of the GEAB - N°22),

the whole planet has become aware that a global systemic crisis is

unfolding, characterized by the collapse of the US financial system

and its contagion to the rest of the world.

-

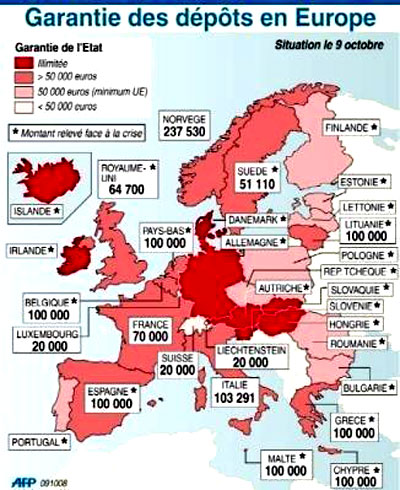

on the other hand, a growing number of

global players are beginning to act on their own, in reaction to the

ineffectiveness of the measures advocated or implemented by the US

though they are the centre of this global financial system. What

happened with this first Euroland (or

Eurozone) summit which took

place on Sunday, October 12, 2008, and whose decisions, by their

scope (close to 1,700-billion EUR) and their nature (4),

resulted in a regain of confidence on financial markets from all

over the world, is typical of the «post-September 2008 world».

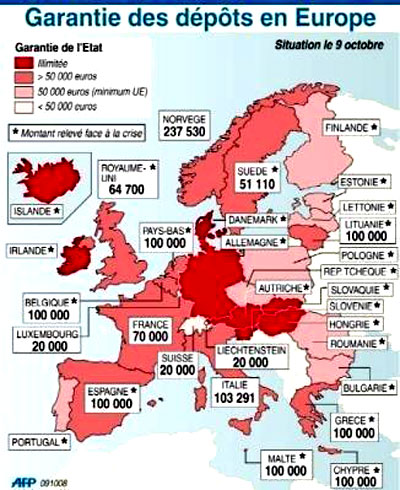

Map of deposit insurances in

the EU

Source AFP - 10/09/2008

Indeed there is such a thing as a «post-September 2008 world». According to

our team, it is now clear that this past month will remain in the history

books of the whole planet as the month when the global systemic crisis

started; even if what is really at play is its decanting phase, the last of

a series of four phases of the crisis described by LEAP/E2020 as early as

June 2006 (5).

As always when it comes to large human groups,

the perception of change among the general public only occurs when change is

already far on its way.

As a matter of fact, September 2008 is the month when the «financial

detonator» of the global systemic crisis exploded.

According to LEAP/E2020 indeed, this second

semester 2008 is the time when «the world dives into the heart of the impact

phase of the global systemic crisis» (6); which means for our

researchers that, at the end of this semester, the world enters the

«decanting phase» of the crisis, i.e. a phase when the outcome of the shock

settles down.

This phase is the longest (from 3 to 10 years,

according to the country) and the one affecting the largest number of people

and countries. It is also the phase when the components of new global

equilibriums will start to appear, two of them being already described by

LEAP/E2020 in this 28th edition of the GEAB in the graphic illustrations

below (7).

Therefore, as we repeated it on and on since 2006, this crisis is far more

important, in terms of impact and outcome, than the 1929 crisis.

Historically, we are the very first players, witnesses and/or victims of a

crisis affecting the whole planet, in a situation of unprecedented

interdependence of countries (resulting from twenty years of globalization)

and people (the level of urbanization - and related dependence for all the

basic needs - water, food, energy… - is also unprecedented).

However, the 1929 experience and all its

dreadful outcome, is still vivid enough in our collective memories to hope,

if citizens are vigilant and leaders clear-sighted, that we will be spared

from a «remake» leading to major conflagration(s).

Europe, Russia, China, Japan,... are certainly the collective players who

can make sure that the unfolding implosion of today’s world power, i.e. the

United States, does not drive the planet into a disaster. Indeed, except for

Gorbachev’s USSR, empires have a tendency to strive in vain to reverse the

course of History when they realize their might is escaping them.

It then belongs to partner-powers to channel the

process peacefully, as well as it belongs to the citizens and rulers of the

concerned country to be clear-sighted and face the difficult times they are

about to cross.

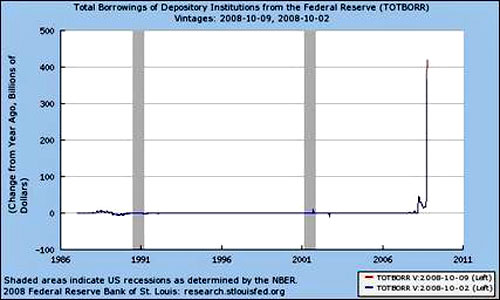

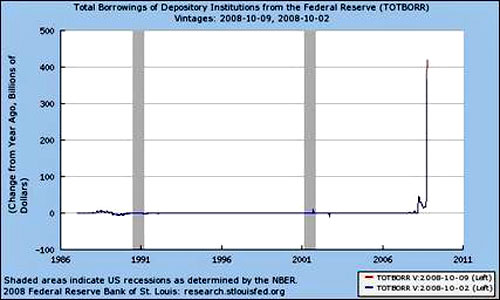

Total borrowings of US

Depository Institutions from the US Federal Reserve (01/08/1986 –

10/09/2008)

Source Federal Reserve Bank

of St Louis

The «emergency repair» of international

financial channels, achieved by the countries of the Eurozone at the

beginning of this month of October 2008 (8), should not hide

three fundamental facts:

-

The “repair” was necessary to curb the

panic that threatened to squander the entire global financial system

in just a few weeks, but what it heals temporarily is merely a

symptom. It has just bought a bit of time, two to three months

maximum, as the global recession and the collapse of the US economy

(the table above shows the staggering increase of US banks’

borrowings from the Fed) will speed up and create new tensions in

the economic, social and political fields, that must be anticipated

and coped with as soon as next month (as soon as the “financial

packages” have been implemented)

-

The huge financial means allocated

worldwide for «emergency rescues» of the global financial system,

though they were necessary to put back in order the system of

credit, are lost for the real economy when it is on the verge of

facing a global recession

-

The «emergency repair» results in

further marginalization, and therefore weakening, for the United

States, because it sets up processes that are contrary to those

advocated by Washington for the allocation of the Hank Paulson’s and

Ben Bernanke’s 700-billion USD

TARP: bank recapitalization by

governments (a decision Hank Paulson has now come to follow) and

interbank loan guarantees (in fact Euroland governments substitute

to credit insurers, a mostly American industry at the centre of

global finance since decades).

These trends turn more and more

decision-making relays and financial flows away from the

United-States when because of the explosion of their public (9)

and private debt they need them more than ever; not to mention

pensions going up in smoke (10).

The last aspect shows how, in the coming months,

solutions to the crisis and to its various sequences (financial, economic,

social and political) will increasingly diverge: what is good for the rest

of the world will not be good for the United States (11), and

now, Euroland in the first place, the rest of the world seems determined to

make its own choices.

The sudden shock that will result from the US defaulting in summer 2009 is

partly due to this decoupling of decision-making processes of the world’s

largest economies with regard to the US.

It is predictable and can be dampened if global

players start to anticipate it.

As a matter of fact, it is one of the topics

developed in this 28th edition of the GEAB: LEAP/E2020 hopes that the

September shock has “educated” the world’s political, economic and financial

policy-makers and made them understand that it is easier to act by

anticipation than in a panic.

It would be a pity if Euroland, Asia and

oil-producing countries, as well as US citizens of course, discover one

morning of summer 2009 that, after a long-week-end or bank-holiday in the

US, their US T-Bonds and Dollars are only worth 10 percent of their value

because a «new Dollar» has just been imposed (12).

Notes

(1) Iceland adopted 10 years ago all the

principles of economic deregulation and «financieration» advocated and

implemented in the US and UK. Reykjavik thus became some sort of a

financial «Mini-Me» of London and Washington, in reference to the very

Americano-British movie character Austin Powers. The three countries

undertook to play the financial game of «the frog that wished to be as

big as the ox», in reference to a fable by Jean de la Fontaine with a

very unhappy end for the frog.

(2) Icelandic stocks collapsed 76 percent after a few days suspension

designed to «avoid» a panic! Source:

MarketWatch, 10/14/2008

(3) On this subject, let's spend a few lines on the amount of the

“financial package” announced by London, i.e. 640-billion EUR including

64-billion EUR to recapitalize banks and a further 320-billion EUR pay

back those same banks’ debt (source:

Financial Times, 10/09/2008). With

an economy in freefall to the image of the real-estate market, with a

soaring inflation, with capital-based pensions going up in smoke and a

currency at the lowest,… apart from increasing the public debt and

weakening even more the Sterling pound, it is difficult to imagine how

the plan can «rescue» British banks. Contrary to Eurozone banks, the

British financial system, exactly like its US counterpart, is at the

centre of the crisis, not a collateral victim. Gordon Brown may well

compare himself to Churchill and Roosevelt together (Source:

Telegraph,

10/14/2008), in his ignorance of History, he seems to forget that

neither Churchill nor Roosevelt had already spent 10 years in their

country's governments when each of them had to cope with their «big

crisis» (that goes for the US and the Bush administration - Paulson and

Bernanke included - who all come from the problem and are certainly not

part of the solution). Not to mention the fact that Churchill and

Roosevelt organized summits such as Yalta or Tehran leaving the French

and the Germans waiting at the door, while today it is him who waits at

the door of the Euroland summit.

(4) Source:

L'Express, 10/13/2008

(5) Source:

GEAB N°5, May 15, 2006

(6) Source:

GEAB N°26, June 15, 2008

(7) LEAP/E2020 made a synthesis of its anticipations on the decanting

phase of the crisis by means of a world map of the impact of the crisis

based on the identification of 6 large groups of countries; and of an

anticipatory schedule of the 4 financial, economic, social and political

sequences over 2008-2013 for each of these regions.

(8) It is indeed the Eurozone which curbed the spiral of global panic.

For weeks, the US and British initiatives followed one another without

any effect. The eruption of a new collective player, the «Euroland

summit», and the wide-ranging decisions it made, are a new and soothing

phenomenon. It is for this very reason that Washington and London have

systematically prevented such a summit from taking place ever since the

Euro was launched, 6 years ago. A complete set of diplomatic

gesticulation was required (preliminary meeting, pre-summit group

photo,…) to make the British Prime Minister believe he was not set aside

the process, when in fact there is no reason why he should take part in

a Euroland Summit. In this edition of the GEAB, LEAP/E202020 comes back

on the phenomenon and the long-term systemic consequences of this 1st

Euroland Summit.

(9) The US financial rescue plan has already increased by 17,000 USD the

debt owned by each US citizen. Source:

CommodityOnline, 10/06/2008

(10) It is indeed 2,000-billion USD of capital-based pensions which

evaporated in the past few weeks in the US. Source:

USAToday, 10/08/2008

(11) At least in the short-term. Indeed our team is convinced that it is

not bad at all for the American people in the medium- and long-term if

the system currently prevailing in Washington and New-York is

fundamentally reappraised. This system has thrust the country into

dramatic problems among which dozens of millions of US citizens now

struggle, as illustrated in this article by the

New York Times dated

10/11/2008.

(12) Even if it will be a minor-scale measure compared to the prospect

of a US bankruptcy, those who think that it is time to invest again on

financial markets may find useful to learn that the New York Stock

Exchange has recently reviewed all its circuit-breaker thresholds as a

result of ratings collapse. Source:

NYSE/Euronext, 09/30/2008