You won't find a better, more incisive

discussion of the question than the

one by U.S. District Judge Jed Rakoff of New York in

the

current issue of the New York Review of Books.

Rakoff, 70, is the right person to raise the

issue. He's a former federal prosecutor in Manhattan, where he handled

business and securities fraud. A Clinton appointee, he's been on the

bench for more than 17 years.

It's unsurprising to find Rakoff emerging as

a critic of the government's hands-off treatment of Wall Street and

banking big shots in the aftermath of

the financial crisis:

He's never

shown much patience for the settlements in which the Department of

Justice and the

Securities and Exchange Commission allow corporations and executives

to wriggle out of cases by paying nominal penalties and promising not to

be bad in the future.

These are known as "consent decrees."

In 2009, he tossed a $33-million

SEC

settlement of a white-collar case with

Bank of America, calling it,

"a contrivance designed to provide the

S.E.C. with the facade of enforcement and the management of the Bank

with a quick resolution of an embarrassing inquiry."

The parties later agreed to a higher fine

and stricter terms. And in 2011 he rejected a $285-million consent

decree

Citigroup entered with the SEC. That rejection is still being

pondered by a federal appeals court.

In his new essay, Rakoff takes particular

aim at the government's habit of prosecuting corporations, but not their

executives - a trend

we railed against earlier this year.

"Companies do not commit crimes," Rakoff

observes; "only their agents do... So why not prosecute the agent who

actually committed the crime?"

He's witheringly skeptical of prosecutions

of corporations, which usually yield some nominal fines and an agreement

that the company set up an internal "compliance" department.

"The future deterrent value of

successfully prosecuting individuals far outweighs the prophylactic

benefits of imposing internal compliance measures that are often

little more than window-dressing."

Rakoff's at his best when analyzing why the

government has stopped pursuing individuals and taken the easy route of

settling with corporations.

He notes that this is a recent trend: In the

1980s, the government convicted more than 800 individuals, including top

executives, in the savings-and-loan scandal, and a decade later

successfully prosecuted the top executives of Enron and

WorldCom.

He dismisses the Department of Justice

rationale that proving "intent" to defraud in the financial crisis cases

is difficult: There's plenty of evidence in the public record that

banking executives knew the mortgage securities they were hawking as AAA

were junk.

He doesn't buy the excuse that criminal

prosecutions involving major financial firms might have damaged the

economy - no one has ever contended that a big firm would collapse just

because its high-level executives were prosecuted. And he notes that the

government doesn't dispute that some of these executives may be guilty -

it just comes up with excuses for not prosecuting.

Why? Rakoff posits that there are several

reasons for the lack of prosecutions.

One is that the

FBI and SEC are both understaffed because of budget cuts, and in the

FBI's case with the diversion of much of its workforce to anti-terrorism

efforts

after 9/11. And he speculates that the

government may feel abashed at its own complicity in the crisis, arising

from the easing of financial and mortgage regulations over the years.

Rakoff's piece has elicited some predictable

push-back from the Department of Justice, where a spokesman scoffed that

he,

"does not identify a single case where a

financial executive should have been charged, but wasn't."

This is a cynical defense at best, since the

DOJ knows well that for Rakoff to have prejudged a case by naming

names would have been a flagrant breach of judicial ethics.

Indeed, Rakoff takes pains to disavow any

opinion about whether criminal fraud was committed "in any given

instance."

But he does point out that evidence of

fraudulent behavior is not hard to find - the

final

report of the Financial Crisis Inquiry Commission headed by former

California Treasurer Phil Angelides brims with documented

examples.

What's been lacking, Rakoff finds, is the

political will and government resources to bring individuals before the

bar of justice.

Although millions of Americans are still

suffering the financial consequences of the crisis, Rakoff suggests that

the failure of the justice system may do even more lasting damage to the

fabric of American society.

His warning should be heeded, before it's

too late.

The Financial Crisis

-

Why Have No High-Level Executives Been Prosecuted?

-

by Jed S. Rakoff

The New York Review of Books

January 9, 2014 Issue

from

NYBooks Website

Five years have passed since the onset of what is sometimes called the

Great Recession.

While the economy has slowly improved, there

are still millions of Americans leading lives of quiet desperation:

without jobs, without resources, without hope.

-

Who was to blame?

-

Was it simply a result of

negligence, of the kind of inordinate risk-taking commonly

called a "bubble," of an imprudent but innocent failure to

maintain adequate reserves for a rainy day?

-

Or was it the result, at least in

part, of fraudulent practices, of dubious mortgages portrayed as

sound risks and packaged into ever more esoteric financial

instruments, the fundamental weaknesses of which were

intentionally obscured?

If it was the former - if the recession was

due, at worst, to a lack of caution - then the criminal law has no role

to play in the aftermath.

For in all but a few circumstances (not here

relevant), the fierce and fiery weapon called criminal prosecution is

directed at intentional misconduct, and nothing less.

If the Great Recession was in no part the

handiwork of intentionally fraudulent practices by high-level

executives, then to prosecute such executives criminally would be "scapegoating"

of the most shallow and despicable kind.

But if, by contrast, the Great Recession was in material part the

product of intentional fraud, the failure to prosecute those responsible

must be judged one of the more egregious failures of the criminal

justice system in many years.

Indeed, it would stand in striking contrast

to the increased success that federal prosecutors have had over the past

fifty years or so in bringing to justice even the highest-level figures

who orchestrated mammoth frauds.

Thus, in the 1970s, in the aftermath of the

"junk bond" bubble that, in many ways, was a precursor of the more

recent bubble in mortgage-backed securities, the progenitors of the

fraud were all successfully prosecuted, right up to Michael Milken.

Again, in the 1980s, the so-called savings-and-loan crisis, which again

had some eerie parallels to more recent events, resulted in the

successful criminal prosecution of more than eight hundred individuals,

right up to Charles Keating.

And again, the widespread accounting frauds

of the 1990s, most vividly represented by Enron and WorldCom, led

directly to the successful prosecution of such previously respected CEOs

as Jeffrey Skilling and Bernie Ebbers.

In striking contrast with these past prosecutions, not a single

high-level executive has been successfully prosecuted in connection with

the recent financial crisis, and given the fact that most of the

relevant criminal provisions are governed by a five-year statute of

limitations, it appears likely that none will be. It may not be too

soon, therefore, to ask why.

One possibility, already mentioned, is that no fraud was committed. This

possibility should not be discounted. Every case is different, and I,

for one, have no opinion about whether criminal fraud was committed in

any given instance.

But the stated opinion of those government entities asked to examine the

financial crisis overall is not that no fraud was committed. Quite the

contrary.

For example, the Financial Crisis Inquiry

Commission (FCIC),

in its final report, uses variants of the word "fraud" no fewer than 157

times in describing what led to the crisis, concluding that there was a

"systemic breakdown," not just in accountability, but also in ethical

behavior.

As the commission found, the signs of fraud were everywhere to be seen,

with the number of reports of suspected mortgage fraud rising

twenty-fold between 1996 and 2005 and then doubling again in the next

four years.

As early as 2004, FBI Assistant Director

Chris Swecker was publicly warning of the "pervasive problem" of

mortgage fraud, driven by the voracious demand for mortgage-backed

securities.

Similar warnings, many from within the

financial community, were disregarded, not because they were viewed as

inaccurate, but because, as one high-level banker put it,

"A decision was made that 'We're going

to have to hold our nose and start buying the stated product if we

want to stay in business.'"

Without giving further examples, the point

is that, in the aftermath of the financial crisis, the prevailing view

of many government officials (as well as others) was that the crisis was

in material respects the product of intentional fraud. In a nutshell,

the fraud, they argued, was a simple one.

Subprime mortgages, i.e., mortgages of

dubious creditworthiness, increasingly provided the chief collateral for

highly leveraged securities that were marketed as AAA, i.e., securities

of very low risk.

How could this transformation of a sow's ear

into a silk purse be accomplished unless someone dissembled along the

way?

While officials of the Department of Justice have been more circumspect

in describing the roots of the financial crisis than have the various

commissions of inquiry and other government agencies, I have seen

nothing to indicate their disagreement with the widespread conclusion

that fraud at every level permeated the bubble in mortgage-backed

securities.

Rather, their position has been to excuse

their failure to prosecute high-level individuals for fraud in

connection with the financial crisis on one or more of three grounds:

- First,

they have argued that proving fraudulent intent on the part of the

high-level management of the banks and companies involved has been

difficult.

It is undoubtedly true that the ranks of

top management were several levels removed from those who were

putting together the collateralized debt obligations and other

securities offerings that were based on dubious mortgages; and the

people generating the mortgages themselves were often at other

companies and thus even further removed.

And I want to stress again that I have

no opinion whether any given top executive had knowledge of the

dubious nature of the underlying mortgages, let alone fraudulent

intent.

But what I do find surprising is that the Department of Justice

should view the proving of intent as so difficult in this case. Who,

for example, was generating the so-called "suspicious activity

reports" of mortgage fraud that, as mentioned, increased so hugely

in the years leading up to the crisis? Why, the banks themselves.

A top-level banker, one might argue,

confronted with growing evidence from his own and other banks that

mortgage fraud was increasing, might have inquired why his bank's

mortgage-based securities continued to receive AAA ratings.

And if, despite these and other reports

of suspicious activity, the executive failed to make such inquiries,

might it be because he did not want to know what such inquiries

would reveal?

This, of course, is what is known in the law as "willful blindness"

or "conscious disregard."

It is a well-established basis on which

federal prosecutors have asked juries to infer intent, including in

cases involving complexities, such as accounting rules, at least as

esoteric as those involved in the events leading up to the financial

crisis. And while some federal courts have occasionally expressed

qualifications about the use of the willful blindness approach to

prove intent, the Supreme Court has consistently approved it.

As that Court stated most recently in

Global-Tech Appliances, Inc. v. SEB S.A. (2011):

The doctrine of willful blindness is

well established in criminal law. Many criminal statutes require

proof that a defendant acted knowingly or willfully, and courts

applying the doctrine of willful blindness hold that defendants

cannot escape the reach of these statutes by deliberately

shielding themselves from clear evidence of critical facts that

are strongly suggested by the circumstances.

Thus, the department's claim that

proving intent in the financial crisis is particularly difficult may

strike some as doubtful.

- Second,

and even weaker, the Department of Justice has sometimes argued

that, because the institutions to whom mortgage-backed securities

were sold were themselves sophisticated investors, it might be

difficult to prove reliance.

Thus, in defending the failure to

prosecute high-level executives for frauds arising from the sale of

mortgage-backed securities, Lanny Breuer, the then head of

the Department of Justice's Criminal Division, told PBS:

In a criminal case… I have to prove

not only that you made a false statement but that you intended

to commit a crime, and also that the other side of the

transaction relied on what you were saying.

And frankly, in many of the

securitizations and the kinds of transactions we're talking

about, in reality you had very sophisticated counterparties on

both sides.

And so even though one side may have

said something was dark blue when really we can say it was sky

blue, the other side of the transaction, the other sophisticated

party, wasn't relying at all on the description of the color.

Actually, given the fact that these

securities were bought and sold at lightning speed, it is by no

means obvious that even a sophisticated counterparty would have

detected the problems with the arcane, convoluted mortgage-backed

derivatives they were being asked to purchase.

But there is a more fundamental problem

with the above-quoted statement from the former head of the Criminal

Division, which is that it totally misstates the law. In actuality,

in a criminal fraud case the government is never required to prove -

ever - that one party to a transaction relied on the word of

another.

The reason, of course, is that that

would give a crooked seller a license to lie whenever he was dealing

with a sophisticated buyer.

The law, however, says that society is

harmed when a seller purposely lies about a material fact, even if

the immediate purchaser does not rely on that particular fact,

because such misrepresentations create problems for the market as a

whole. And surely there never was a situation in which the sale of

dubious mortgage-backed securities created more of a problem for the

marketplace, and society as a whole, than in the recent financial

crisis.

- The third

reason the department has sometimes given for not bringing these

prosecutions is that to do so would itself harm the economy.

Thus, Attorney General Eric Holder

himself told Congress:

It does become difficult for us to

prosecute them when we are hit with indications that if you do

prosecute - if you do bring a criminal charge - it will have a

negative impact on the national economy, perhaps even the world

economy.

To a federal judge, who takes an oath to

apply the law equally to rich and to poor, this excuse - sometimes

labeled the "too big to jail" excuse - is disturbing, frankly, in

what it says about the department's apparent disregard for equality

under the law.

In fairness, however, Holder (who later claimed his comment was

misconstrued) was referring to the prosecution of financial

institutions, rather than their CEOs.

Moreover, he might have also been

influenced, as his department unquestionably was, by the adverse

reaction to the Arthur Anderson case, where that accounting firm was

forced out of business by a prosecution that was ultimately reversed

on appeal.

But if we are talking about prosecuting

individuals, the excuse becomes entirely irrelevant; for no one that

I know of has ever contended that a big financial institution would

collapse if one or more of its high-level executives were

prosecuted, as opposed to the institution itself.

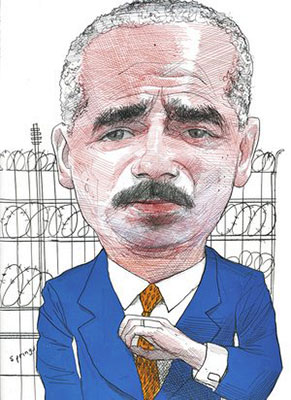

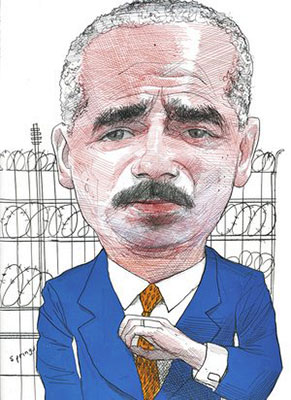

Eric Holder

drawing by John Springs

Without multiplying examples further, my point is that the Department of

Justice has never taken the position that all the top executives

involved in the events leading up to the financial crisis were innocent;

rather it has offered one or another excuse for not criminally

prosecuting them - excuses that, on inspection, appear unconvincing.

So, you might ask, what's really going on

here?

I don't claim to have any inside information

about the real reasons why no such prosecutions have been brought, but I

take the liberty of offering some speculations.

At the outset, however, let me say that I completely discount the

argument sometimes made that no such prosecutions have been brought

because the top prosecutors were often people who previously represented

the financial institutions in question and/or were people who expected

to be representing such institutions in the future: the so-called

"revolving door."

In my experience, most federal prosecutors,

at every level, are seeking to make a name for themselves, and the best

way to do that is by prosecuting some high-level person.

While companies that are indicted almost

always settle, individual defendants whose careers are at stake will

often go to trial. And if the government wins such a trial, as it

usually does, the prosecutor's reputation is made.

My point is that whatever small influence

the "revolving door" may have in discouraging certain white-collar

prosecutions is more than offset, at least in the case of prosecuting

high-level individuals, by the career-making benefits such prosecutions

confer on the successful prosecutor.

So, one asks again, why haven't we seen such prosecutions growing out of

the financial crisis?

I offer, by way of speculation, three

influences that I think, along with others, have had the effect of

limiting such prosecutions.

- First,

the prosecutors had other priorities. Some of these were completely

understandable.

For example, before 2001, the FBI had

more than one thousand agents assigned to investigating financial

frauds, but after September 11 many of these agents were shifted to

antiterrorism work.

Who can argue with that? Yet the result

was that, by 2007 or so, there were only 120 agents reviewing the

more than 50,000 reports of mortgage fraud filed by the banks.

It is true that after the collapse of

Lehman Brothers in 2008, new agents were hired for some of the

vacated spots in offices concerned with fraud detection; but this is

not a form of detection easily learned, and recent budget

limitations have only exacerbated the problem.

Of course, while the FBI has substantial responsibility for

investigating mortgage fraud, the FBI is not the primary

investigator of fraud in the sale of mortgage-backed securities;

that responsibility lies mostly with the SEC.

But at the very time the financial

crisis was breaking, the SEC was trying to deflect criticism from

its failure to detect the

Madoff

fraud, and this led it to concentrate on other Ponzi-like

schemes that emerged in the wake of the financial crisis, along with

cases involving misallocation of assets (such as stealing funds from

a customer), which are among the easiest cases to prove.

Indeed, as Professor John Coffee

of Columbia Law School has repeatedly documented, Ponzi schemes and

misallocation-of-asset cases have been the primary focus of the SEC

since 2009, while cases involving fraud in the sale of

mortgage-backed securities have been much less frequent.

More recently, moreover, the SEC has

been hard hit by budget limitations, and this has not only made it

more difficult to assign the kind of manpower the kinds of frauds we

are talking about require, but also has led the SEC enforcement

staff to focus on the smaller, easily resolved cases that will beef

up their statistics when they go to Congress begging for money.

As for the Department of Justice proper, a decision was made in 2009

to spread the investigation of financial fraud cases among numerous

US Attorney's Offices, many of which had little or no previous

experience in investigating and prosecuting sophisticated financial

frauds. This was in connection with the president's creation of a

special task force to investigate the crisis, from which remarkably

little has been heard in the intervening four-plus years.

At the same time, the US Attorney's

Office with the greatest expertise in these kinds of cases, the

Southern District of New York, was just embarking on its prosecution

of insider-trading cases arising from the Raj Rajaratnam tapes,

which soon proved a gold mine of prosecutable cases that absorbed a

huge amount of the attention of the securities fraud unit of that

office.

While I want to stress again that I have no inside information, as a

former chief of that unit I would venture to guess that the cases

involving the financial crisis were parceled out to assistant US

attorneys who were also responsible for insider-trading cases.

Which do you think an assistant would

devote most of her attention to: an insider-trading case that was

already nearly ready to go to indictment and that might lead to a

high-visibility trial, or a financial crisis case that was just

getting started, would take years to complete, and had no guarantee

of even leading to an indictment?

Of course, she would put her energy into

the insider-trading case, and if she was lucky, it would go to

trial, she would win, and, in some cases, she would then take a job

with a large law firm.

And in the process, the financial fraud

case would get lost in the shuffle.

In short, a focus on quite different priorities is, I submit, one of

the reasons the financial fraud cases have not been brought,

especially cases against high-level individuals that would take many

years, many investigators, and a great deal of expertise to

investigate.

- But a

second, and less salutary,

reason for not bringing such cases is the government's own

involvement in the underlying circumstances that led to the

financial crisis.

On the one hand, the government, writ large, had a part in creating

the conditions that encouraged the approval of dubious mortgages.

Even before the start of the housing

boom, it was the government, in the form of Congress, that repealed

the

Glass-Steagall Act, thus allowing

certain banks that had previously viewed mortgages as a source of

interest income to become instead deeply involved in securitizing

pools of mortgages in order to obtain the much greater profits

available from trading.

It was the government, in the form of

both the executive and the legislature, that encouraged

deregulation, thus weakening the power and oversight not only of the

SEC but also of such diverse banking overseers as the Office of

Thrift Supervision and the Office of the Comptroller of the

Currency, both in the Treasury Department.

It was the government, in the form of

the Federal Reserve, that kept

interest rates low, in part to encourage mortgages. It was the

government, in the form of the executive, that strongly encouraged

banks to make loans to individuals with low incomes who might have

previously been regarded as too risky to warrant a mortgage.

Thus, in the year 2000, HUD Secretary Andrew Cuomo increased

to 50 percent the percentage of low-income mortgages that the

government-sponsored entities known as Fannie Mae and Freddie Mac

were required to purchase, helping to create the conditions that

resulted in over half of all mortgages being subprime at the time

the housing market began to collapse in 2007.

It was the government, pretty much across the board, that acquiesced

in the ever-greater tendency not to require meaningful documentation

as a condition of obtaining a mortgage, often preempting in this

regard state regulations designed to assure greater mortgage quality

and a borrower's ability to repay.

Indeed, in the year 2000, the Office

of Thrift Supervision (OTS),

having just finished a successful campaign to preempt state

regulation of thrift underwriting, terminated its own underwriting

regulations entirely.

The result of all this was the mortgages

that later became known as "liars' loans."

They were increasingly risky; but what

did the banks care, since they were making their money from the

securitizations. And what did the government care, since it was

helping to create a boom in the economy and helping voters to

realize their dream of owning a home?

Moreover, the government was also deeply enmeshed in the aftermath

of the financial crisis.

It was the government that proposed the

shotgun marriages of, among others,

If, in the process, mistakes were made

and liabilities not disclosed, was it not partly the government's

fault?

One does not necessarily have to adopt

the view of Neil Barofsky, former special inspector general

in charge of oversight of TARP, that regulators made almost no

effort to hold accountable the financial institutions they were

bailing out, to wonder whether the government, having helped create

the conditions that led to the seeming widespread fraud in the

mortgage-backed securities market, was all too ready to forgive its

alleged perpetrators.

Please do not misunderstand me. I am not suggesting that the

government knowingly participated in any of the fraudulent practices

alleged by the Financial Inquiry Crisis Commission and others.

But what I am suggesting is that the

government was deeply involved, from beginning to end,

in helping create the conditions that could lead to such fraud,

and that this would give a prudent prosecutor pause in deciding

whether to indict a CEO who might, with some justice, claim that he

was only doing what he fairly believed the government wanted him to

do.

- The final (third)

factor I would mention is both the most subtle and the most systemic

of the three, and arguably the most important.

It is the shift that has occurred, over

the past thirty years or more, from focusing on prosecuting

high-level individuals to focusing on prosecuting companies and

other institutions. It is true that prosecutors have brought

criminal charges against companies for well over a hundred years,

but until relatively recently, such prosecutions were the exception,

and prosecutions of companies without simultaneous prosecutions of

their managerial agents were even rarer.

The reasons were obvious.

Companies do not commit crimes; only

their agents do. And while a company might get the benefit of some

such crimes, prosecuting the company would inevitably punish,

directly or indirectly, the many employees and shareholders who were

totally innocent.

Moreover, under the law of most US

jurisdictions, a company cannot be criminally liable unless at least

one managerial agent has committed the crime in question; so why not

prosecute the agent who actually committed the crime?

In recent decades, however, prosecutors have been increasingly

attracted to prosecuting companies, often even without indicting a

single person.

This shift has often been rationalized

as part of an attempt to transform "corporate cultures," so as to

prevent future such crimes; and as a result, government policy has

taken the form of "deferred prosecution agreements" or even

"non-prosecution agreements," in which the company, under threat of

criminal prosecution, agrees to take various prophylactic measures

to prevent future wrongdoing.

Such agreements have become, in the

words of Lanny Breuer, the former head of the Department of

Justice's Criminal Division,

"a mainstay of white-collar criminal

law enforcement," with the department entering into 233 such

agreements over the last decade.

But in practice, I suggest, this

approach has led to some lax and dubious behavior on the part of

prosecutors, with deleterious results.

If you are a prosecutor attempting to discover the individuals

responsible for an apparent financial fraud, you go about your business

in much the same way you go after mobsters or drug kingpins:

you start at the bottom and, over many

months or years, slowly work your way up.

Specifically, you start by "flipping" some

lower- or mid-level participant in the fraud who you can show was

directly responsible for making one or more false material

misrepresentations but who is willing to cooperate, and maybe even "wear

a wire" - i.e., secretly record his colleagues - in order to reduce his

sentence.

With his help, and aided by the substantial

prison penalties now available in white-collar cases, you go up the

ladder.

But if your priority is prosecuting the company, a different scenario

takes place. Early in the investigation, you invite in counsel to the

company and explain to him or her why you suspect fraud. He or she

responds by assuring you that the company wants to cooperate and do the

right thing, and to that end the company has hired a former assistant US

attorney, now a partner at a respected law firm, to do an internal

investigation.

The company's counsel asks you to defer your

investigation until the company's own internal investigation is

completed, on the condition that the company will share its results with

you. In order to save time and resources, you agree.

Six months later the company's counsel returns, with a detailed report

showing that mistakes were made but that the company is now intent on

correcting them. You and the company then agree that the company will

enter into a deferred prosecution agreement that couples some immediate

fines with the imposition of expensive but internal prophylactic

measures.

For all practical purposes the case is now

over. You are happy because you believe that you have helped prevent

future crimes; the company is happy because it has avoided a devastating

indictment; and perhaps the happiest of all are the executives, or

former executives, who actually committed the underlying misconduct, for

they are left untouched.

I suggest that this is not the best way to proceed.

Although it is supposedly justified because

it prevents future crimes, I suggest that the future deterrent value of

successfully prosecuting individuals far outweighs the prophylactic

benefits of imposing internal compliance measures that are often little

more than window-dressing. Just going after the company is also both

technically and morally suspect.

It is technically suspect because, under the

law, you should not indict or threaten to indict a company unless you

can prove beyond a reasonable doubt that some managerial agent of the

company committed the alleged crime; and if you can prove that, why not

indict the manager?

And from a moral standpoint, punishing a

company and its many innocent employees and shareholders for the crimes

committed by some unprosecuted individuals seems contrary to elementary

notions of moral responsibility.

These criticisms take on special relevance, however, in the instance of

investigations growing out of the financial crisis, because, as noted,

the Department of Justice's position, until at least recently, is that

going after the suspect institutions poses too great a risk to the

nation's economic recovery.

So you don't go after the companies, at

least not criminally, because they are too big to jail; and you don't go

after the individuals, because that would involve the kind of years-long

investigations that you no longer have the experience or the resources

to pursue.

In conclusion, I want to stress again that I do not claim that the

financial crisis that is still causing so many of us so much pain and

despondency was the product, in whole or in part, of fraudulent

misconduct.

But if it was - as various governmental

authorities have asserted it was - then the failure of the government to

bring to justice those responsible for such colossal fraud bespeaks

weaknesses in our prosecutorial system that need to be addressed.