|

from TheEconomicCollapseBlog Website

This time, the Federal Reserve (FED) has created a truly global problem.

A big chunk of the trillions of dollars that it pumped into the financial system over the past several years has flowed into emerging markets. But now that the FED has decided to begin "the taper", investors see it as a sign to pull the "hot money" out of emerging markets as rapidly as possible.

This is causing currencies to collapse and interest rates to soar all over the planet.

...are just some of the emerging markets that have been hit hard so far.

In fact, last week emerging market currencies experienced the biggest decline that we have seen since the financial crisis of 2008. And all of this chaos in emerging markets is seriously spooking Wall Street as well. The Dow has fallen nearly 500 points over the last two trading sessions alone.

If the Federal Reserve opts to taper even more in the coming days, this currency crisis could rapidly turn into a complete and total currency collapse.

A lot of Americans have always assumed that the U.S. dollar would be the first currency to collapse when the next great financial crisis happens. But actually, right now just the opposite is happening and it is causing chaos all over the planet.

For instance, just check out what is happening in Turkey according to a recent report in The New York Times...

As inflation escalates and interest rates soar in these countries, ordinary citizens are going to feel the squeeze. Just having enough money to purchase the basics is going to become more difficult.

And this is not just limited to a few countries.

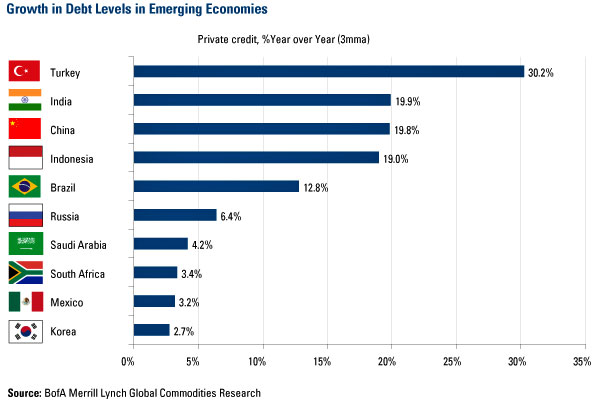

What we are watching right now is truly a global phenomenon...

So why is this happening?

Well, there are a number of factors involved of course. However, as with so many of our other problems, the actions of the Federal Reserve are at the very heart of this crisis.

A recent USA Today article described how the FED helped create this massive bubble in the emerging markets...

What we are potentially facing is the bursting of a financial bubble on a global scale.

Just check out what Egon von Greyerz, the founder of Matterhorn Asset Management in Switzerland, recently had to say...

And many smaller nations are being deeply affected already as well.

For example, most Americans cannot even find Liberia on a map, but right now the actions of our Federal Reserve have pushed the currency of that small nation to the verge of collapse...

Closer to home, the Mexican peso tumbled quite a bit last week and is now beginning to show significant weakness. If Mexico experiences a currency collapse, that would be a huge blow to the U.S. economy.

Like I said, this is something that is happening on a global scale.

If this continues, we will eventually see looting, violence, blackouts, shortages of basic supplies, and runs on the banks in emerging markets all over the planet just like we are already witnessing in Argentina and Venezuela.

Hopefully something can be done to stop this from happening.

But once a bubble starts to burst, it is really difficult to try to hold it together. Meanwhile, I find it to be very "interesting" that last week we witnessed the largest withdrawal from JPMorgan's gold vault ever recorded.

Was someone anticipating something?

Once again, hopefully this crisis will be contained shortly. But if the FED announces that it has decided to taper some more, that is going to be a signal to investors that they should race for the exits and the crisis in the emerging markets will get a whole lot worse.

And if you listen carefully, global officials are telling us that is precisely what we should expect.

For example, consider the following statement from the finance minister of Mexico...

Yes indeed - it is looking like this is going to be a very volatile year.

I hope that you are ready for what is coming next.

|