|

by Charles Hugh Smith

Due to their grip on the levers of financial and political power, whatever lays waste to the bottom 90% of the populace is either,

History offers an abundance of examples.

But there are counter-examples as well.

I visited the impressive Pei residence, which is now a government-owned property open to the public.

The Pei family was wealthy enough to be comfortably in the top tier of Chinese society.

Life was good for China's elite, right up to 1949.

So the super-wealthy don't always skate through tumultuous times, emerging richer than ever.

We all understand how vast wealth inequality influences the political and social responses to crises.

What is less well understood is the role of fairness in the social and political realms:

The porousness of the border between the wealthy and the poor matters greatly in assessing fairness.

If the financial-social membrane between the two

classes is relatively porous, enabling the most ambitious and

brightest of the poor to enter the ranks of the wealthy (or the

ranks of the the top 10% who serve them...),

then the society maintains a minimum level of fairness that

alleviates the pressure to overthrow the regime.

If the government acts decisively to raise estate

taxes, taxes on unearned (i.e. rentier) income and on the higher

reaches of earned income, and devotes some minimal attention to the

basic needs of the bottom 90%, these policies also alleviate the

pressure to overthrow the regime.

If the response is PR artifice, i.e. the rich

keep getting richer as the suffering of the bottom 90% increases,

regime change starts looking like the only solution available.

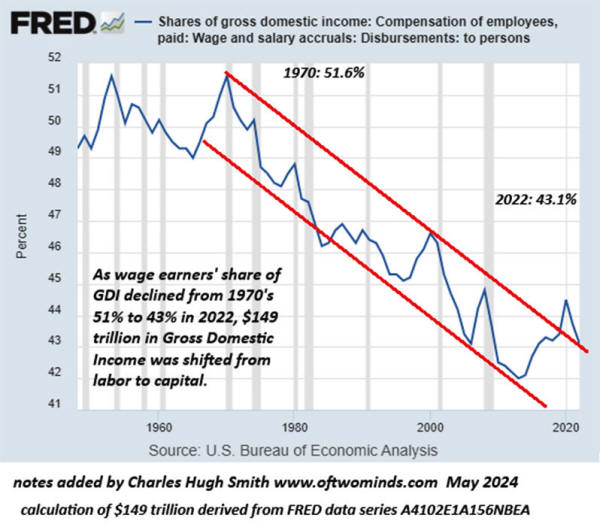

Over the past 45 years, the value of earnings has

declined $149 trillion to the benefit of unearned gains reaped by

the already-wealthy:

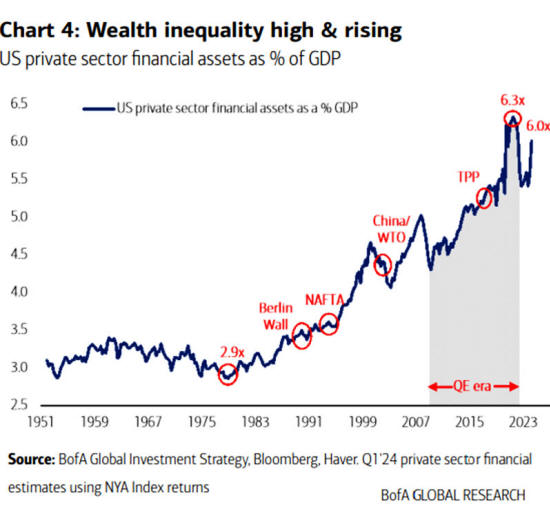

This chart shows how wealth inequality has risen

from the late 1970s, and how it was rocket-boosted by the Federal

Reserve's "wealth effect" policies of quantitative easing (QE):

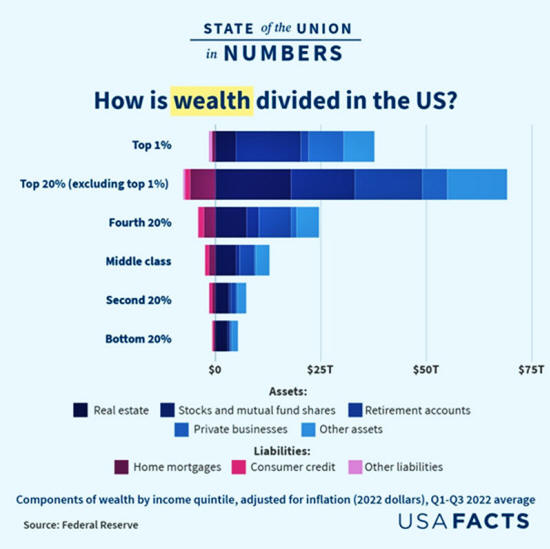

The bottom 80% own a mere fraction of the wealth

owned by the top 1% and top 10%:

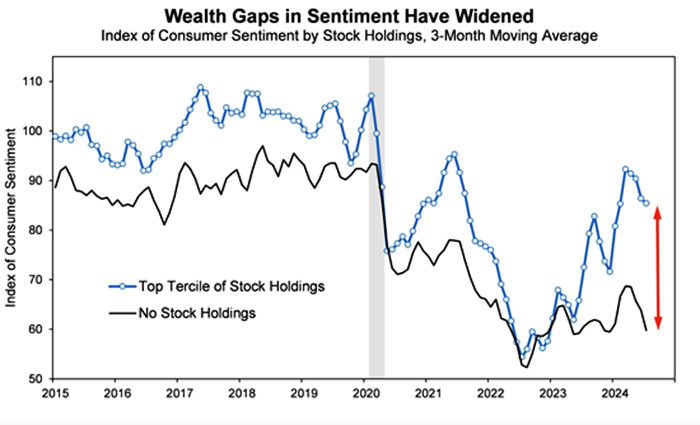

While the wealthy cling to the self-serving

narcissistic view that since we're doing fine, everyone's doing

fine, the reality is the bottom 80% are awakening to the reality

that they're not doing fine, a divide that will only widen as

recession tightens its grip on the throats of the bottom 80%:

This is the vision of the "our wealth is rightly all ours" camp of the super-wealthy: the rest of us will own nothing and we'll be gloriously happy...

Uh, sure... Since we're so happy, why don't we

switch places?

The less self-congratulatory camp of the super-wealthy understand the pressure cooker of inequality and unfairness is going to blow unless they relinquish some of their unearned gains generated by FED policies.

While they naturally intend on keeping the vast

majority of their gains, they realize the dividends of limitless

greed might just be the overthrow of the regime they control to

serve their own interests.

|