by Tyler Durden

June 10, 2013

from

ZeroHedge Website

The short but profitable tale of how 483,000

private individual have "top secret" access to the nation's most non-public

information begins in 2001.

"After 9/11, intelligence budgets were

increased, new people needed to be hired, it was a lot easier to go to

the private sector and get people off the shelf," and sure enough

firms like Booz Allen Hamilton - still

two-thirds owned by the deeply-tied-to-international-governments

investment firm The Carlyle Group - took full advantage of Congress'

desire to shrink federal agencies and their budgets by enabling outside

consultants (already primed with their $4,000 cost

'security clearances') to fulfill the needs of an

ever-more-encroaching-on-privacy administration.

Booz Allen (and other security consultant

providing firms) trade publicly with a cloak of admitted opacity due to the

secrecy of their government contracts ("you may not have important

information concerning our business, which will limit your insight into a

substantial portion of our business") but the actions of Diane Feinstein

who

promptly denounced "treasonous" Edward Snowden, "have

muddied the waters," for the stunning 1.1

million (or 21% of the total) private consultants with access to

"confidential and secret" government information.

Perhaps the situation of gross government

over-spend and under-oversight is summed up best,

"it's very difficult to know what

contractors are doing and what they are billing for the work - or even

whether they should be performing the work at all."

First, Diane Feinstein's take on it all...

“I

don't look at this as being a whistleblower. I think it's an act of

treason,” the chairwoman of the Senate

Intelligence Committee told reporters. The California lawmaker went on

to say that Snowden had violated his oath to defend the Constitution.

“He violated the

oath, he violated the law. It's treason.”

So how did all this get started?... (via

AP)

The

reliance on contractors for intelligence work ballooned after the 9/11

attacks. The government scrambled to

improve and expand its ability to monitor the communication and movement

of people who might threaten another attack.

"After 9/11, intelligence budgets were

increased, new people needed to be hired," Augustyn said.

"It was a lot easier to

go to the private sector and get people off the shelf."

The

reliance on the private sector has grown since then, in part because of

Congress' efforts to limit the size of federal agencies and

shrink the budget.

Which has led to what appears to be major

problems.

But critics say

reliance on contractors hasn't reduced

the amount the government spends on defense, intelligence or other

programs.

Rather, they say it's just shifted work to

private employers and reduced

transparency. It becomes harder to track the work of those

employees and determine whether they should all have access to

government secrets.

"It's very

difficult to know what contractors are doing and what they are billing

for the work - or even whether they should be performing the work at

all,"

...and to

the current PRISMgate whistleblowing

situation:

Of the 4.9 million people with clearance to

access "confidential and secret" government information,

1.1 million, or 21 percent, work for

outside contractors, according to a report from Clapper's

office.

Of the 1.4

million who have the higher "top secret" access, 483,000, or 34 percent,

work for contractors.

...

Because clearances can take months or even

years to acquire, government

contractors often recruit workers who already have them.

Why not - it's lucrative!!

Snowden says he accessed and downloaded the

last of the documents that detailed

the NSA surveillance program while

working in an NSA office in Hawaii for Booz Allen, where he says he was

earning $200,000 a year.

Analysts caution that

any of the 1.4 million people with access

to the nation's top secrets could have leaked information about the program

- whether they worked for a contractor or the government.

For individuals and firms alike.

Booz Allen

has long navigated those waters well.

The firm was founded in 1914 and began

serving the U.S. government in 1940, helping the Navy prepare for World

War II. In 2008, it spun off the part of the firm that worked with

private companies and abroad.

That firm, called Booz & Co., is held

privately.

Booz

Allen was then acquired by

the Carlyle Group, an investment firm with

its own deep ties to the government. In

November 2010, Booz Allen went public.

The Carlyle Group still

owns two-thirds of the company's shares.

Or, a full-majority stake.

Curiously once public, The Booz Allens of

the world still operate like a pseudo-private company, with extensive

confidential cloaks preventing the full disclosure of financial data.

But

don't worry - we should just trust them...

Via Bloomberg's Jonathan Weil.

Psst, here's a stock tip for you.

There's a company near Washington with

strong ties to the U.S. intelligence community that has been around for

almost a century and has secret ways of

making money - so secret that the company can't tell you what they are.

Investors who buy just need to have faith.

To

skeptics, this might seem like a pitch for an investment scam.

But as anyone who has been paying attention to the news might have

guessed, the company is Booz Allen Hamilton Holding Corp.

...

"Because we are limited in our ability

to provide information about these contracts and services," the

company said in its latest annual report,

"you may not have important

information concerning our business, which will limit your insight

into a substantial portion of our business, and therefore

may be less able to fully evaluate the risks related to that portion

of our business."

This seems like it would be a

dream arrangement for some corporations:

Not only is Booz Allen allowed to keep investors uninformed, it's

required to. I suppose we should give the company credit for being

transparent about how opaque it is.

And while the media and popular attention is

currently focused on who, if anyone else, may be the next Snowden struck by

a sudden pang of conscience, perhaps a

better question is what PE behemoth Carlyle, with a gargantuan $170 billion

in

AUM, knows, and why it rushed to purchase Booz Allen in the

months after the Bear Stearns collapse, just when everyone else was batting

down the hatches ahead of

the biggest financial crash in modern history.

From

Bloomberg, May 2008:

Carlyle Group, the private-equity firm run

by David Rubenstein, agreed to acquire

Booz Allen Hamilton Inc.'s U.S. government-consulting business for $2.54

billion, its biggest buyout since the credit markets collapsed in July.

The purchase would be Carlyle's biggest

since it agreed to buy nursing-home operator Manor Care Inc. last July

for $6.3 billion. Deal-making may be rebounding from a 68 percent

decline in the first quarter as investment banks begin writing new

commitments for private-equity transactions.

Buyouts ground to a halt last year because

of a global credit freeze triggered by record U.S. subprime-mortgage

defaults.

The Booz

Allen government-consulting unit has more than 18,000 employees and

annual sales of more than $2.7 billion. Its clients include branches of

the U.S. military, the Department of Homeland Security and the World

Bank.

Carlyle, based in Washington, manages $81.1

billion in assets [ZH: that was 5

years ago - the firm now boasts $170 billion in AUM].

Rubenstein founded the firm in 1987 with William Conway and Daniel

D'Aniello. The trio initially focused on deals tied to government and

defense.

Carlyle and closely held Booz Allen

have attracted high-level officials from the government.

Carlyle's senior

advisers have included former President George H.W. Bush, former British

Prime Minister John Major, and Arthur Levitt, the ex-chairman of the

U.S. Securities and Exchange Commission.

R. James

Woolsey, who led the U.S. Central Intelligence Agency from 1993 to 1995,

is a Booz Allen executive. Mike McConnell, the U.S. director of national

intelligence, is a former senior vice president with the company.

...

Carlyle last year sold a minority interest

in itself to Mubadala Development Co., an investment fund affiliated

with the government of Abu Dhabi, capital of the United Arab Emirates.

And in addition to the UAE, who can possibly

forget Carlyle's Saudi connection.

From the

WSJ circa 2001:

If the U.S.

boosts defense spending in its quest to stop Osama bin Laden's alleged

terrorist activities, there may be one unexpected beneficiary: Mr. bin

Laden's family.

Among its far-flung business

interests, the

well-heeled Saudi Arabian clan - which says it is estranged from Osama - is an investor in a fund established by Carlyle Group, a

well-connected Washington merchant bank specializing in buyouts of

defense and aerospace companies.

Through this investment and its ties to

Saudi royalty, the bin Laden family has become acquainted with some of

the biggest names in the Republican Party.

In recent

years, former President

Bush,

ex-Secretary of State James Baker

and ex-Secretary of Defense Frank Carlucci

have made the pilgrimage to the bin Laden family's headquarters in

Jeddah, Saudi Arabia.

Mr. Bush makes speeches on behalf of Carlyle

Group and is senior adviser to its Asian Partners fund, while Mr. Baker

is its senior counselor. Mr. Carlucci is the group's chairman.

Osama is one of more than 50 children of

Mohammed bin Laden, who built the

family's $5 billion business, Saudi Binladin Group, largely

with construction contracts from the Saudi government. Osama worked

briefly in the business and is believed to have inherited as much as $50

million from his father in cash and stock, although he doesn't have

access to the shares, a family spokesman says.

Because his Saudi citizenship was revoked in

1994, Mr. bin Laden is ineligible to own assets in the kingdom, the

spokesman added.

...

People familiar with the family's finances

say the bin Ladens do much of their banking with National Commercial

Bank in Saudi Arabia and with the London branch of Deutsche Bank AG.

They also use Citigroup Inc. and ABN Amro,

the people said.

"If there were ever any company closely connected to the U.S. and

its presence in Saudi Arabia, it's the Saudi Binladin Group,"

says Charles Freeman, president of the

Middle East Policy Council, a Washington nonprofit concern that

receives tens of thousands of dollars a year from the bin Laden

family.

"They're the establishment that Osama's

trying to overthrow."

...

A Carlyle executive said the bin Laden

family committed $2 million through a London investment arm in 1995 in

Carlyle Partners II Fund, which raised $1.3 billion overall.

The fund has purchased several

aerospace companies among 29 deals. So far, the family has received $1.3

million back in completed investments and should ultimately realize a

40% annualized rate of return, the Carlyle executive said.

But a foreign financier with ties to

the bin Laden family says

the family's overall investment with Carlyle is

considerably larger.

He

called the $2 million merely an initial contribution.

"It's like plowing a field," this person said. "You seed it once.

You plow it, and then you reseed it again."

The Carlyle executive added that he

would think twice before accepting any future investments by the bin

Ladens.

"The situation's changed now," he

said. "I

don't want to spend my life talking to reporters."

We can clearly see why.

We can also clearly see why nobody has mentioned

Carlyle so far into the Booz Allen fiasco.

A

U.S. inquiry into bin Laden family business dealings could brush against

some big names associated with the U.S. government.

Former President Bush said through his chief of staff, Jean Becker, that

he recalled only one meeting with the bin Laden family, which took place

in November1998.

Ms. Becker confirmed that there was a second

meeting in January 2000, after being read the ex-president's subsequent

thank-you note.

"President Bush does not have a

relationship with the bin Laden family," says Ms. Becker. "He's

met them twice."

Mr. Baker visited the bin Laden family

in both 1998 and 1999, according to people close to the family.

In the second trip, he traveled on a

family plane. Mr. Baker declined comment, as did Mr. Carlucci, a past

chairman of

Nortel Networks Corp., which has partnered with Saudi Binladin Group on

telecommunications ventures.

As one can imagine the rabbit hole just gets

deeper and deeper the more one digs. For now, we will let readers do their

own diligence. We promise the results are fascinating.

Going back to the topic at hand, we will however

ask just how much and what kind of confidential, classified, and or Top

Secret information is shared "behind Chinese walls" between a Carlyle still

majority-owned company and the private equity behemoth's employees and

advisors, among which are some of the most prominent political and business

luminaries currently alive.

The following is a list of both current and

former employees and advisors.

We have used

Wiki but anyone

wishing to comb through the firm's full blown roster of over 1,000 employees

and advisors, is welcome to do so at

the firm's website.

Business

-

G. Allen Andreas -

Chairman of the

Archer Daniels Midland Company, Carlyle European

Advisory Board

-

Daniel Akerson -

CEO of General Motors, Board member at 7 companies,

Managing director at Carlyle

-

Joaquin Avila - former

managing director at Lehman

Brothers, Managing director at Carlyle

-

Laurent Beaudoin -

CEO of

Bombardier (1979-), former member of Carlyle’s Canadian

Advisory board

-

Peter Cornelius -

Managing Director of Nielsen

Australia.

-

Paul Desmarais -

Chairman of the

Power Corporation of Canada, former member of Carlyle’s

Canadian Advisory board

-

David M. Moffett -

CEO of Freddie Mac, Former

Senior advisor to the Carlyle

-

Karl Otto Pöhl -

former President of the

Bundesbank, Former Senior advisor to the Carlyle Group

-

Olivier Sarkozy (half-brother

of

Nicolas Sarkozy, former President of France) - co-head

and managing director of its recently launched global financial

services division, since March 2008.

Political figures

-

North America

-

James Baker III, former

United States Secretary of State under George H. W. Bush,

Staff member under

Ronald Reagan and George W. Bush, Carlyle Senior Counselor,

served in this capacity from 1993 to 2005

-

George H. W. Bush,

former U.S. President, Senior Advisor to the Carlyle Asia

Advisory Board from April 1998 to October 2003

-

Frank C. Carlucci,

former

United States Secretary of Defense from 1987 to 1989;

Carlyle Chairman and Chairman Emeritus from 1989 to 2005

-

Richard G. Darman,

Director of the

Office of Management and Budget in the

Bush Administration; Managing director from 1993, later

Senior Advisor

-

William E. Kennard,

chairman of the

Federal Communications Commission from 1997-2001 and

United States Ambassador to the European Union; Carlyle

managing director from 2001-2009

-

Arthur Levitt, Chairman

of the U.S.

Securities and Exchange Commission (SEC) under President

Bill Clinton, Carlyle Senior Advisor from 2001 to the present

-

Luis Téllez Kuenzler,

Mexican economist, former Secretary of Communications and

Transportation under the

Felipe Calderón administration and former Secretary of

Energy under the

Zedillo administration

-

Frank McKenna, former

Premier of New Brunswick,

Canadian Ambassador to the United States between 2005 and

2006 and current Deputy Chairman of

Toronto-Dominion Bank; served on Carlyle's Canadian advisory

board

-

Mack McLarty, Carlyle

Group Senior Advisor (from 2003), White House Chief of Staff to

President Bill Clinton from 1993 to 1994

-

Randal K. Quarles,

former Under Secretary of the U.S. Treasury under President

George W. Bush, now a Carlyle managing director

-

Europe

-

Asia

-

Anand Panyarachun,

former Prime Minister of

Thailand (twice), former member of the Carlyle Asia Advisory

Board until the board was disbanded in 2004

-

Fidel V. Ramos, former

president of the

Philippines, Carlyle Asia Advisor Board Member until the

board was disbanded in 2004

-

Peter Chung, former associate

at Carlyle Group Korea, who resigned in 2001 after 2 weeks on

the job after an inappropriate e-mail to friends was circulated

around the world

-

Thaksin Shinawatra,

former Prime Minister of Thailand (twice), former member of the

Carlyle Asia Advisory Board until 2001 when he resigned upon

being elected Prime Minister

Media

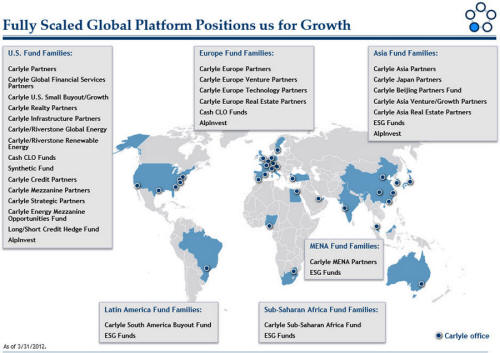

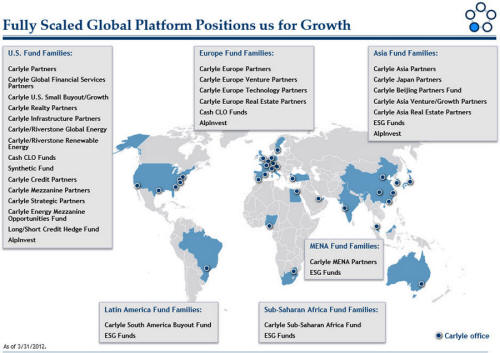

Here is Carlyle, straight from the horse's

recently IPOed mouth, courtesy of its

most recent public presentation:

Perhaps Bloomberg's Jonathan Weil sums it up

best:

There's no easy solution here, aside from

the obvious point that the government keeps way too many secrets.

So what happens when one corporation, owned and

controlled by the same government's former (and in some cases current) top

power brokers, potentially has access to all of the same

government's secrets?