by David Chu

November 2010

from

Rense

Website

|

David Chu is a professional

engineer who has worked throughout the United States for over 19

years.

In 2008, he wrote the book, NO

FORECLOSURES!, to help Americans fight the banksters by delaying and

stopping foreclosures.

For more information on his

book, please go to www.no2foreclosures.info or you may email him at

david@no2foreclosures.info |

Three monks were walking back from a Dharma teaching with their

Master. As they arrived back at their village they noticed a flag on

a post, fluttering in the wind.

The first student looks up says, "I see

a flag flapping." The next student looks up and, trying to out-do

the first, says, "No, I see the wind flapping." The third student

even more sure of his superior understanding, glances up and says,

"I see the mind flapping."

Then their Master looks up and says, "And I see mouths flapping!"

[1]

Upon hearing such a Buddhic pronouncement, the 3

monks, who were leisurely strolling on their way to economic and financial

nirvana, stopped in their tracks and quietly closed their mouths and started

staring every which way they could to avoid the penetrating gaze of their

Master.

The picture of Henry "Hank"

Paulson, Jr. (left), Benjamin Shalom Bernanke, and

Timothy Franz Geithner speaks volumes, doesn't it?

No, this article is NOT about to name-call these

fine gentlemen, “The Three Stooges.” That would be paying them too fine a

compliment, not worthy of the three real Stooges: Curly Howard, Larry Fine,

and Moe Howard.

At least with Curly, Larry, and Moe, they had

you in comedic stitches, laughing and crying and backslapping.

With Hank, Ben, and Timmy, we'd be lucky if YOU

did not go postal over what they have committed, once you had figured out

what they've done that is.

Now that the much awaited suspense of what the

Federal Reserve is going to

do or not going to do to save the U.S. economy and the entire universe from

"Great Depression 2" (GD2) is finally lifted by the Fed's pronouncement on

November 3, we can all go back to our collected amnesia and wallow in our

People-magazine pop culture for the ladies and in who's going to win the

Super Bowl next February for the guys.

There's nothing to see here, move along.

But before we move along any further, I want to unequivocally state for the

record that I am not a PRINCETON/HARVARD/YALE/BULLETS/BOMBS/BANKS economist

or financial expert. [2]

Heck, I don't even consider myself as a plain

old economist or financial anything. But I do pride myself on being an

AMATEUR student in economic and financial matters of life-and-death

circumstances. [3]

In this day and age, if you are not an amateur

economist and an amateur financial expert, you are gambling with your

precious life because the odds of becoming a road kill on the Fed-brick road

are very high.

But luckily everyone who shops at Walmart and

everyone else who don't are amateur economists and financial experts, even

if they don't know it, because they are making economic decisions based on

their financial situations on a daily basis.

The Fed's QE2

Pronouncement

According to Bloomberg News,

“The Federal Reserve will buy an additional

$600 billion of Treasuries through June [2011], expanding record

stimulus and risking its credibility in a bid to reduce unemployment and

avert deflation.” [4]

This act of monetary inflation by the Fed is

euphemistically known as QE2 or “Quantitative Easing Part 2.”

With what is the Fed, helmed by the monk in the middle of the picture above,

actually going to buy the additional $600 billion of U.S. Treasuries,

Bloomberg News is purposefully vague. Short story shorter, Ben is going to

print $600 billion of digital dollars in cyberspace and email it over to the

U.S. Treasury, managed by the monk on the right, in exchange for $600

billion of Treasuries or government bonds that will be physically printed

out and handed over to the Fed.

We could only hope.

Furthermore, Bloomberg News explains,

“While Bernanke's near-zero rates and $1.7

trillion in asset purchases helped end the recession [yeah, right!], the

Fed said progress has been ʻdisappointingly slow' in bringing down

joblessness close to a 26-year high.”

If the stated purpose of the Fed's action is,

-

to reduce unemployment

-

to avert deflation

-

to end the recession,

...as the Fed and their pals in the

lame-stream

media would lead us to believe, then it has already done a hell of an

abysmal job.

Isn't the very definition of insanity this:

“Doing the same thing over and over again,

and expecting a difference result?”

After quantitative easing some $1.7 trillion

into existence from 2008 through 2009 (known as QE1), the Fed then purchased

or helped to alleviate hundreds of billions, maybe trillions, of toxic,

worth-LESS financial assets from their Wall Street gangsters and banksters,

exemplified by the monk on the left who was the CEO and Chairman of Goldman

Sachs before he exchanged his illustrious titles for that of the

U.S. Treasury Secretary under Bush II to help implement TARP ($700 billion

Troubled Asset Relief Program) and QE1. The result of TARP and QE1 is that

the U.S. economy is still sinking in the proverbial bidet.

Official unemployment, according to a recent 60 Minutes report done by Scott Pelley, is approximately 9.5% nationally.

Mr. Pelley goes on to state some very

interesting facts:

“It [the U.S. government's official

unemployment figure of 9.5%] doesn't count the people who have seen

their hours cut to part-time. It doesn't count the people who have quit

looking for work. If you add all of that together, the unemployed and

the under-employed, it's not nine and half percent. It's 17%. And here

in California, it's 22%.” [5]

What about that other ugly monster called

“deflation” that the Fed is so worried about?

If there are any doubts that

what the U.S. is currently experiencing is NOT deflation, but inflation,

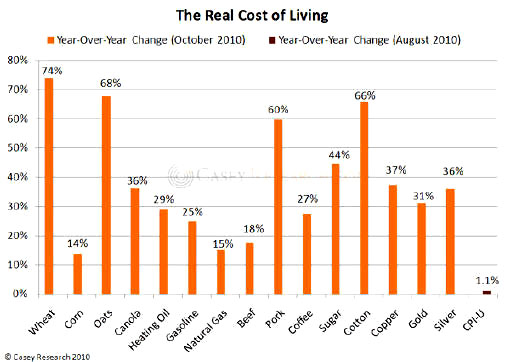

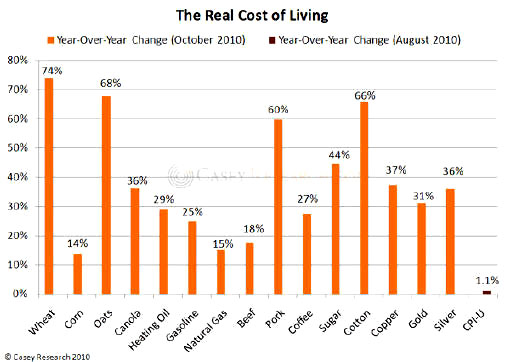

here's a chart of goodies to consider: [6]

I don't know about real economists and financial

gurus, but to me real people consume things like wheat, corn, oats, canola

oil, beef, pork, coffee, and sugar.

The above chart shows that the cost of these

food items rose between 14% and 74%, comparing their wholesale prices in

October 2010 to October 2009. The average year-to-year increase of these 8

items is about 43%.

Real people also use natural resources like

heating oil, gasoline, and natural gas. Their average year-to-year increase

is 23%. So, if the wholesale prices of things real Americans consume rose

about 43% annually and the wholesale prices of resources that real Americans

use increased 23% annually, why is the official inflation index, CPI-U (the

Consumer Price Index for All Urban Consumers), indicating only a 1.1% annual

increase?

Something is very fishy here. [7]

More importantly, we note that the United States

is (or will be very shortly) experiencing inflation, not deflation, and huge

inflation at that.

The third monster that the Fed is purportedly trying to slay is the

“recession.” I don't have to tell anyone reading this article, especially

those 17% of Americans or the 22% of Californians who are unemployed and

underemployed, that the green shoots promised by Hank, Ben, and Timmy have

all withered and died, and that the U.S. will be lucky to avoid not only a

double dip recession but GD2.

So, what is the real purpose of QE2? I am so

glad you asked.

Further into the rabbit hole we go.

The Currency Hole

But before we get to the real reasons for QE2, we need to take a slight and

calculated detour and ask the following question.

Why are these 3 presidential-looking gentlemen

laughing and having such a great time?

What do they know that we don't know?

In a seminal article published in February 2008

titled, “Inflation: America's Greatest Export,” Peter Schiff wrote the

following economic words of wisdom: [8]

A significant by-product of the current

global economic system, wherein Americans spend money they do not earn

to buy foreign products that they do not make, is that trillions of

dollars are now parked in foreign banks just looking for somewhere to

go.

In a healthy trade relationship, a nation pays for its imports with

equal exports that result from real productivity that pumps up demand.

In contrast, the current U.S. import boom has been created by the

artificial demand of inflation, in which increased money supply has put

more dollars in the hands of U.S. consumers...

IN SHORT, WE HAVE EXPORTED OUR INFLATION

ABROAD.

What Mr. Schiff is saying is basically what I

have said previously and the real reason why our 3 U.S. Presidents are

laughing so hard:

The joke around the world is that America

exports its monopoly money (electronically created out of thin air and

backed by nothing) in exchange for real goods and services provided by

the sweat and hard labor from the rest of the world. But the rest of the

world is finally waking up to this not-so-funny situation.

Countries like China, which still pegs its currency very closely to the

U.S. Dollar [USD] for export purposes, will be forced to allow their

currency to appreciate when the USD continues to fall.

This is because

China cannot continue to absorb the high cost of the resultant inflation

that is created there.

Mr. Schiff explains further the real problems

that this American trade “practice” is causing in export-driven countries

like China (comments in brackets and bolded emphasis in all capitalizations

are mine):

Our foreign creditors basically have two

choices as how to dispose of their excess dollars.

They can use them to

buy U.S. financial assets [priced in USD], such as bonds, stocks or real

estate, or they can exchange them for other currencies or commodities

[purposefully also priced in USD], such as gold or oil.

If they choose the former, foreign central

banks are off the hook, as those dollars find their way back to the U.S.

economy without any additional money creation [in their countries].

However, as foreigners are increasingly choosing the latter, foreign

central banks have been “forced” to print money like it's going out of

style.

In years past, foreign investors were happy to hold strong U.S. dollars,

which they either saved as a store of value, or used to purchase mighty

Wall Street stocks and bonds.

However, when the dollar began its epic swan

dive, and U.S. investments began to grossly underperform non-U.S.

alternatives, private investors dumped their dollars en masse by

exchanging them for local currencies. The unwanted dollars then became

the property and problem of foreign central banks.

If central banks did not buy these dollars, [their] citizens would have

been forced to sell their surplus dollars on the open market [if they

are able to do so]. To prevent this from happening these [central] banks

have become the buyers of first and last resort.

HOWEVER, TO SOP UP ALL OF THE EXCESS SUPPLY,

CENTRAL BANKS MUST CREATE MORE OF THEIR OWN [MONEY], RESULTING IN

RAPIDLY EXPANDING MONEY SUPPLIES [IN THEIR OWN COUNTRIES].

As much as Wall Street and government

economists pretend otherwise, the expansion of money supply is the

essential definition of inflation.

THE REAL REASON THAT PRICES ARE RISING IN

CHINA IS THAT SO MANY YUAN ARE BEING PRINTED TO BUY UP ALL THESE SURPLUS

DOLLARS.

To further illustrate what Mr. Schiff has just

said, especially his last paragraph:

China has currently $2.65 trillion worth of

foreign exchange reserves, the accumulation of U.S. dollars, European

Union's euros, British pounds, and Japanese Yen, from its massive trade

surpluses over the years.

This gargantuan amount of money is a big

headache for China's currency,

the Yuan.

Like most export-driven nations such as Russia, Brazil, and Argentina,

China's Yuan is what is called a non-convertible currency. What this means

is that the Yuan is not traded openly in international currency markets such

as in New York or London. In contrast, the U.S. dollar, the British pound,

the European Union's Euro, etc. are convertible currencies and are traded in

international foreign exchange markets.

China's Yuan is only traded within China and is

basically worthless outside of the country for individuals.

When there is an excessive amount of USD swishing around inside the Chinese

market, this condition causes the USD to depreciate or devaluate or decrease

against the Yuan. In other words, the Yuan becomes more valuable

than the USD.

This situation is abhorred greatly by China because any

significant increase in the Yuan against the USD could mean a potential loss

of Chinese export markets to other export-driven nations whose currency

remain more competitive than the Yuan.

As the Chinese Premier Wen Jiabao recently exclaimed,

“The 20-40 percent appreciation of the Yuan

demanded by U.S. lawmakers would cause many bankruptcies in the Chinese

state-owned enterprises, and cut jobs for urban workers and migrant

workers, and eventually bring in fierce social turbulence.” [9]

So what the Chinese government is doing to

prevent such Yuan appreciation is that its central bank buys up the excess

USD with Yuan.

How does China do that? Does China have hundreds

of billions of Yuan just sitting around inside the vaults of its central

bank? No, of course not! China, like everyone else, prints billions of Yuan

out of thin air! Instead of billions of USD floating in the Chinese market,

now there are even MORE billions of newly minted Yuan floating in China

(remember, it takes approximately $6.5 Yuan to buy $1 USD currently).

The net effect of this action conducted by

China's central bank is that the price of things in China gets heated up

figuratively.

If the rate of increase in goods and services produced in China for the

Chinese people does not go up as fast as the rate of increase in new Yuan

circulating in the Chinese market, then this new money will cause inflation

inside China. Price inflation is the appearance of rising prices when in

reality it is caused by too much local currency chasing the same amount of

local goods and services (i.e., real estate, stocks, foods, etc.)

Is there any evidence of such price inflation in

China?

Here is an anecdotal example of the huge inflation in China's real estate

market, specifically, in Shanghai. One of my relatives has an apartment in

Shanghai that was purchased in 2005 for $88,000 USD. Today, that apartment

is worth around $300,000 USD. This is an appreciation of almost 50% PER YEAR!

Not even during the recent housing bubble in the

San Francisco area have we witnessed such an unbelievable appreciation rate

in real estate prices.

My Argentina

Experience

For a better and more concrete example of how the United States is causing

monetary and price inflation in other countries, we visit Argentina where I

had lived for 2 years.

Argentina is also an export-driven country.

Genetically modified soybeans is one of its main exports. The Argentina peso

is also non-convertible. Argentina must also maintain the competitive edge

of its peso for the export market.

When I landed in Argentina in August 2008, the peso was trading at

approximately 3 to 1 against the USD, meaning that it took $3 pesos to buy

$1 USD. When I left in July 2010, the peso was and still is trading at

approximately 4 to 1. This translates into a depreciation or devaluation or

decrease of the Argentina peso of 24% against the USD over the past 2 years.

[10]

How did the Argentineans accomplish this feat,

especially against an ever falling USD?

Their central bank printed out

billions of pesos from thin air and then bought the excess USD inside their

country due to its accumulated trade surpluses, that's how. In fact, there

is so much monetary inflation in Argentina that they have to import

Argentina pesos from Brazil! [11]

Is there any correlation between monetary inflation and price inflation in

Argentina?

The Argentina government states that the official inflation rate in

Argentina was 8% in 2009. The International Monetary Fund (IMF) has it

pegged at 6.3%. Word on the streets is that the real inflation rate in

Argentina was 15 to 18% in 2009 (or 16.5% on average).

What about for 2010?

Official government inflation rate for 2010 is projected at 11%, while the IMF is guessing 10.6%. Barclays Capital, the giant international

investment banking firm based out of London, England, is quietly telling its

key investors to expect inflation in Argentina to be around 16.5% for 2010.

[12]

We all know that governments lie, Argentina's is

no exception.

The IMF, really an arm of the Anglo-American establishment, is

not any better.

It's really fascinating to make the following observation. The Argentina

peso depreciated from 3 to 1 in late 2008 to 4 to 1 two years later. If we

treat the USD as an iPod, it took $3 pesos to buy one iPod in August 2008

and it costs $4 pesos to buy that same iPod in 2010. So, the price of an

iPod in Argentina has gone up by 33% over 2 years. Or the inflation rate of

our iPod (or USD) is 16.7% per year. [13]

Is it just a coincidence that the inflation rate experienced by people on

the streets of Argentina (16.5% in 2009) and discussed in the private board

rooms of investment banking houses (16.5% for 2010) matches almost exactly

our theoretically derived calculation of 16.7% per year?

It would seem that the price inflation rate in

Argentina, at least, matches its monetary inflation rate for the past 2

years.

Currency Wars

It is very important for people to

understand that the United States of America and no country around the

world can devalue its way to prosperity, to [be] competitive... It is

not a viable, feasible strategy and we will not engage in it.

The U.S. Treasury Secretary, Timothy Geithner,

uttered those words on October 18, 2010. [14]

Almost everyone reading his statement assumes

what he said is that no country including the United States can devalue its

currency as the means to prosperity.

Didn't he promise that the United

States won't engage in it?

Wrong!

Please stop now and re-read what he actually said.

What Mr. Geithner actually said is the exact opposite!

He is making two

statements (1, 2 below) and trying to get away with his first statement by

covering up with his last sentence (3).

-

"It is very important for people to

understand that the United States of America can devalue its way to

prosperity, to [be] competitive..."

-

"It is very important for people to

understand that no country around the world can devalue its way to

prosperity, to [be] competitive..."

-

"It is not a viable, feasible strategy

and we will not engage in it."

How is that for double-speak?

Forget double-speak, the monetary actions of the United States through the

Fed and the Treasury speak louder than any words, as the following chart

shows the depreciation of the USD against the Euro over a 10-year period.

One USD went from buying 1.20 euros in November

2000 to just 0.70 euros in November 2010.

To help explain why we are having currency wars, let's look at the Chinese

Yuan.

The Yuan is valued in comparison to another currency, like the USD for

example.

For the Yuan to go up in value or to appreciate against the USD,

-

it could go up in value against a static

USD, or

-

it can remain static against a falling

USD, or

-

it could be one of many permutations

thereof.

The U.S. has been devaluating or debasing or

decreasing the worth of its USD through monetary inflation as the above

chart demonstrates, i.e., printing money from thin air and exporting most of

it to other countries, making their currencies like the Euro and Yuan more

valuable.

The Chinese, like other export-driven countries, can't allow that to happen

because it would result in losing their export market shares to these other

countries. So, they engage in devaluating or debasing or decreasing the

worth of their currency in order to keep up with the ever falling USD.

The

euphemistic term is “quantitative easing.”

The other export-driven countries, such as Japan, Brazil, India, etc., are

all engaging in the same quantitative easing scheme to keep up with China,

and, more significantly, with the crashing USD.

And so this potentially vicious circle of debasement of currencies goes on

and on.

What is the real solution to the currency wars?

UNITED STATES OF AMERICA: CEASE AND DESIST

FROM DEBASING YOUR CURRENCY!

Unfortunately, such a simple solution would

never see the light of day.

Now, let's get back on board the U.S.S. QE2.

The Real Purposes of

QE2

To put it in simplest layman's terms what is happening:

the United States is “pissing” on its

currency, the USD, by hyper-inflating it through QE1 and

QE2 and, soon

to be, QE3, i.e., it is debasing or devaluing its currency by printing

trillion of dollars out of thin air. [15]

The United States government doesn't give a damn

to what its citizens and the world think because the USD is currently the

reserve currency of the world:

-

it has the only license in the world to

freely print its currency from nothing, and the rest of the world

will gladly accept the newly minted USD

-

because it doesn't plan on paying off

its debts to countries such as China. [16]

However, the rest of the world, including China,

is catching on to this greatest

Ponzi Scheme in history.

Countries like China and Japan are slowing down

their purchase and accumulation of U.S. Treasuries due to the indisputable

fact that their holdings of U.S. government debts are losing value as the

USD continues to drop.

What is the United States going to do when other countries are not willing

to keep buying its Treasuries when it needs to finance the projected $721

billion for its Department of War (oops, I meant the Department of Defense)

in 2011, among other deficit spending expenditures?

That's where the Fed comes in and why QE2 was implemented. And,

subsequently, QE3 and QE4...

The Fed is literally forced to print trillions of USD to buy up all of the

unwanted U.S. debts in the coming months and years, as other nations stop

buying U.S. Treasuries and start selling them back to the U.S. ever so

gently and quietly.

The secondary purpose of QE2, of course, is to bail out the Wall Street banksters by providing them with liquidity at an almost zero interest rate.

The banksters, in turn, might take some of that $600 billion and use it to

shore up their bottom line or they might re-invest it in the stock market or

in other higher yield investments.

Contrary to all the pundits who are blaming the Fed for making a big mistake

for implementing QE2, the Fed is doing exactly what it was created to do.

As

an anonymous commentator on Gonzalo Lira's popular blog succinctly puts it:

[17]

Now, for the assertion that the Fed made a

mistake. Wrong!

They did exactly the best thing... FOR THE

FED!

The Fed is a

privately held [consortium] of banks. Their actions

are not necessarily intended to save us or the economy; their actions

are intended to save the banks, to drive up asset valuations so the

smart money can get out before the collapse.

Ben Bernanke was a boy wonder, child prodigy and a genius academician.

He still is. He is only doing the bidding of his betters in this, saving

the asses of the asses who drove the economy into the ground.

To hell with the best interest of the US.

Conclusions?

What conclusions can we make from all of this?

-

For one thing, massive price inflation

is coming very soon to the United States in terms of everyday retail

prices such as in food and fuel. This will probably be felt by the

average American within the next 6 to 9 months.

-

Secondly, the currency wars among the

export-driven nations will intensify as the USD keeps falling off

the financial cliff.

-

Thirdly, we are headed into Great

Depression 2 just as assuredly as the RMS Titanic headed straight to

the bottom of the Atlantic Ocean.

-

And last but not least,

another major

war, maybe even global in scale, may not be too far off in the

distance, and it will be initiated by the United States or by one of

its proxy allies in a “shock and awe” attempt to bypass and cover up

the greatest economic and financial collapse in history.

You know, maybe we should have let these final

three gentlemen handle the U.S. economy (below - from left to right: Moe Howard,

Curly Howard, and Larry Fine).

They couldn't have done a worse job than Hank,

Ben, and Timmy, or

Obama,

Bush, and

Clinton.

References

[1] http://buddhistsjustwannahavefun.tribe.net/thread/6e18d590-a7a8-4145-bdd4-afe3a791442f

[2] This term is coined by Gerald Celente of the Trends Research

Institute . His original wording, “Princeton, Harvard, Yale, Bullets,

Bombs, and Banks” succinctly describes the real underlying causes of the

economic and financial problems in the United States.

[3] The word “amateur” comes from the Latin words “amator” or “lover,”

and “amare” which means “to love.” To be an amateur in golf, for

example, is to love the sport.

[4] http://www.bloomberg.com/news/2010-11-03/federal-reserve-to-buy-additional-600-billion-of

securities-to-aid-growth.html

[5] http://market-ticker.org/akcs-www?post=170176

[6] http://www.shtfplan.com/headline-news/fed-clicks-print-button-saves-america-again_11032010

[7] Changes in wholesale prices usually take about 6 months to appear in

the retail markets.

[8] http://www.kitco.com/ind/Schiff/feb222008.html

[9] http://english.caijing.com.cn/2010-09-25/110529595.html

[10] The Argentina peso went from $3 pesos buying $1 USD in 2008 to $4

pesos buying $1 USD in 2010. Or another way to express this currency

ratio: from $1 peso buying $0.33 USD to $1 peso buying $0.25 USD. So,

what the peso buys in terms of the USD has gone down from $0.33 to$0.25.

This decrease can be expressed as a percentage which is equal to

(0.33-0.25)/0.33 or 0.24or 24%. The peso has depreciated by 24% over 2

years or 12% per year.

[11]

http://momento24.com/en/2010/11/03/inflation-and-growth-increase-the-printing-bills-of-100-pesos/

[12] http://en.mercopress.com/2010/01/05/argentinas-inflation-third-highest-in-the-world-say-private

consultants

[13] The price of our iPod example went from $3 to $4 pesos, or the iPod

went up in price by an amount equal to (4-3)/4 or 0.33 or 33%. Remember

this is over a 2 year period. So, our iPod increased by16.7% per year.

We can call this “monetary inflation,” as the iPod is used in place of

the USD.

[14] http://news.yahoo.com/s/nm/20101019/bs_nm/us_usa_dollar_geithner

[15] http://www.theglobeandmail.com/report-on-business/commentary/jeff-rubins-smaller-world/

quantitative-easing-is-just-devaluation/article1782626/

[16] http://dailybail.com/home/peter-schiff-of-course-were-not-going-to-pay-back-the-chines.html

[17]

http://gonzalolira.blogspot.com/2010/11/two-more-nails-in-dollars-coffinthe.html

Videos