by Tyler Durden

August 01, 2012

from

ZeroHedge Website

Back in March we wrote "Mario Draghi Is Becoming

Germany's Most Hated Man" for one reason:

a few months after the former Goldman

appartchik was sworn in to replace Trichet with promises he would not

"print" Draghi did just that in a covert way via $1.3 trillion in LTROs,

that immediately hit the economy and sent inflation across Europe

soaring.

We said that:

"Slowly but surely the realization is

dawning on Germany that while it was sleeping, perfectly confused by

lies spoken in a soothing Italian accent that the ECB will not print,

not only did Draghi reflate the ECB's balance sheet by an unprecedented

amount in a very short time, in the process not only sending Brent in

Euros to all time highs (wink, wink, inflation, as today's European CPI

confirmed coming in at 2.7% or higher than estimated) but also putting

the BUBA in jeopardy with nearly half a trillion in

Eurosystem "receivables" which it will most likely never collect."

It now appears that the simmering hatred between

the two is about to upshift to a whole new level, with the threat of open

escalation finally arriving.

Because if Sueddeutsche Zeitung is correct, via

Reuters, in precisely 12 hours, Draghi will proceed with a plan that has

neither Germany's nor Buba's blessing, in the process effectively isolating

the only remaining solvent country in Europe, and its de facto paymaster,

and forcing Germany to take a long, hard look at the exit sign (which,

however, as reported earlier, with each passing day that drags Germany's

economy is becoming less of an unthinkable outcome).

To wit:

"Draghi is planning concerted action using

both the ECB and the future euro European Stability Mechanism (ESM) to

purchase sovereign debt from Spain or Italy in order to help push down

borrowing rates for those two countries."

There is one problem:

"highly doubtful that the German government

would agree to Draghi's approach. The Bundesbank also is likely to

reject the idea, the paper added."

In essence what Draghi will do tomorrow is what

Monti did a month ago when together with Rajoy, he presented Germany with

one option, and would not back down else risk disintegrating the Eurozone.

Merkel then took the diplomatic way out and

pretended to agree that the ESM would lose its seniority status, something

which as Finland confirmed today, never actually happened after the Nordic

country said the ESM still and will always have explicit seniority status.

The problem however is that the June summit was political theater.

What happens tomorrow will have all too real

consequences if and when Monti injects another €1 trillion into the economy.

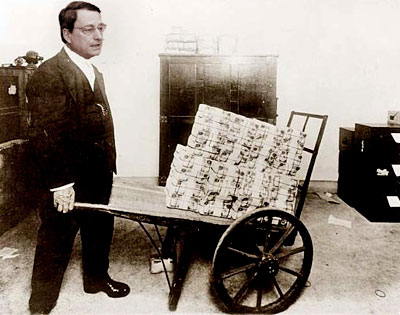

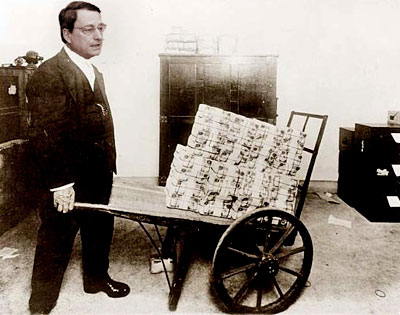

How soon afterward can Germany again expect to

once again pay a record amount for a liter of unleaded. And how quick until

the latest iteration of attempted inflation fizzles and has to be replicated

with a €2 trillion bond monetization episode. Then €4 trillion. Then €8.

Etc.

You get the picture.

More from Reuters:

which doesn't tell us anything really new, but merely

confirms (allegedly) that Draghi will indeed openly go where so few have

gone before - openly against the will of Germany, its Chancellor and banking

head, Herr Weidmann:

The ESM would purchase sovereign debt in

smaller amounts directly from both countries while the central bank

would resume its purchase of debt in the secondary market, the daily

wrote in an advance released on Wednesday evening. The Bundesbank has

opposed further ECB debt purchases.

The ECB Council will meet on Thursday and the Sueddeutsche Zeitung said

it looked like a majority was emerging in favor of the ECB resuming its

purchases of sovereign debt. It added there will most likely not be any

official decision on such a measure.

The ECB's role would be a stopgap until the ESM

is approved by the German constitutional court. Which it very way may never

happen.

There is a greater likelihood that Draghi

will spell out in more concrete terms what he said last week - that the

ECB will do everything within its mandate to support the euro, the paper

said. A final decision is not expected until after Sept. 12, after the

German Constitutional Court rules on the ESM.

The daily said Draghi's plans could lead to the ESM taking part directly

in the auctions of state debt by those countries affected, leading to a

reduced interest rate for the auction.

The ECB's task would to be to work before the auctions to push the

interest rates down to an acceptable level and to keep them fixed at

that lower level for the longer term.

The delusion continues because not only have we

shown that the impact of

each SMP episode is weaker and weaker, but that

absent the ECB officially denouncing its senior status, and thus fears of

bondholder subordination, the ECB will achieve absolutely no incremental

interest in bond purchases by private investors who are convinced both Spain

and Italy will conclude merely as yet another Greece.

Sueddeutsche said it is hoped the plan would

restore private investors' confidence in the bond market. The ESM would

probably only have to allot

relatively small sums of money for this or could bow out of bond

auctions at the last minute if the interest rates had fallen to an

acceptable level.

Finally and most crucially:

The daily said it was at the same time

highly doubtful that the German government would agree to Draghi's

approach. The Bundesbank also is likely to reject the idea, the paper

added.

And with that the open warfare between the ECB

and Germany will begin. The only question remaining is does Draghi, even if

he is truly merely a figurehead for Goldman, really want to launch all out

war against Germany?

Especially with his office located in downtown Frankfurt.

Oh, and don't call him Super Mario any more. The proper prefix now is

HyperTM.

Then again, just like today's violent disappointment by the Fed, all of the

above could be merely well positioned media propaganda, and the reality is

that Draghi will do absolutely nothing.