|

Dollar-Less Iranians Discover...

Virtual Currency

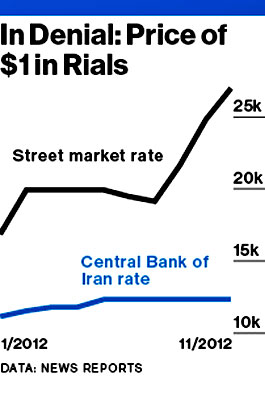

The Rial fell from 20,160 against the greenback on the street market in August to 36,500 Rials to the dollar in October. It’s settled, for now, around 27,000. The central bank’s fixed official rate is 12,260.

Yet there’s one currency in Iran that has kept its value and can be used to purchase goods from abroad:

Created in 2009 by a mysterious programmer named Satoshi Nakamoto, Bitcoins behave a lot like any currency.

Their value is determined by demand, and they can be used to buy stuff.

Bitcoin transactions are encrypted and handled by a decentralized global network of tens of thousands of personal computers. Merchants around the world accept the currency, from a bakery in San Francisco to a dentist in Finland.

Individuals who own Bitcoins and wish to exchange them for physical currencies like Euros or dollars can use exchange sites such as localbitcoins.com, a Finland-based site founded by Jeremias Kangas.

The advantage for Iranians is that Bitcoins can be swapped for dollars that can then be kept outside the country.

Another plus: Regulators can’t easily track the

transactions, since Bitcoins aren’t issued from a central server. Bitcoin

users can conduct business on virtual private networks, which hide

customers’ identities.

That doesn’t bother Rafigh, who’s studying computer engineering as well as playing music.

Rafigh has translated some Bitcoin software into Farsi for his friends.

Iranian-American Bitcoin consultant Farzad Hashemi recently traveled to Tehran and talked up Bitcoin to his friends.

Iranians working or living abroad can send Bitcoins to their families, who can use one of the online currency matchmaking services to find someone willing to exchange Bitcoins for Euros, Rials, or dollars.

Bitcoins are useful to Iranians wishing to move

their money abroad, either to children studying in Europe or America or

simply to stash cash in a safe place.

The uncertainty has led some Iranian software developers to ask clients to pay them in Bitcoins.

The exchange rate in Iran is 332,910 Rials per

Bitcoin. It isn’t known how many Iranians use Bitcoins to skirt sanctions.

According to local-bitcoins’ Kangas, 32 people in Iran have contacted each

other through his site.

The report was leaked to Wired and Betabeat.

For now, Iranians are using Bitcoins to maintain a fragile connection to the outside world.

The bottom line:

|