by WashingtonsBlog

April 15, 2013

from

WashingtonsBlog Website

Why Is Gold Crashing?

Gold has fallen off a cliff. It has fallen

faster than at any time in the last

30 years.

Zero Hedge

notes:

Adding insult to injury, the Shanghai Gold

Exchange overnight announced that following the tumbling precious metal

prices and limit down drop in early trading, it may raise trading

margins for its gold and silver forward contracts.

Raising margin requirements tends to trigger

further selling. (Update: CME has

also raised margin requirements.)

Some Say It Is a Good Time to Buy

While most financial advisers are screaming

“sell!”, there are some well-known contrarians.

For example,

Bill Gross still recommends buying

gold.

Marc Faber

says:

“I love the fact that gold is finally

breaking down because that will offer an excellent buying opportunity”

…. “The bull market in gold is not completed.”

John Hathaway of Tocqueville Funds (with

$10 billion under management)

says that the selloff in gold is “a contrarian’s dream scenario”:

The evidence shows strong macro fundamentals

for gold, investor sentiment at a negative extreme and compelling

valuations in the mining shares. It seems like a contrarian’s dream

scenario to us.

And Zero Hedge notes that - from the perspective

of technical analysis - gold is the

most oversold it has been in 14 years.

The Bearish Explanation

But why has gold crashed?

Bloomberg

blames:

-

“Optimism that a U.S. recovery will curb

the need for stimulus”; and

-

“The prospect that beleaguered members

of the euro zone might be forced to sell gold to raise part of the

funding, and there are much bigger holders in that category than

Cyprus.”

Citigroup

opines:

Gold decline may have been related to some

break in technical levels and the general improvement in global risk

appetite.

CNN

theorizes:

Monday’s broad decline was sparked by

slowing growth in China. The world’s second biggest economy grew by 7.7%

in the first quarter of the year, down from 7.9% in the fourth quarter

of 2012.

The growth number was higher than the

Chinese government’s target for 2013 but much weaker than the 8% most

economists were expecting.

Other China data also raised doubts about

the health of the global economy - industrial production slowed to 8.9%

in March against economists’ forecasts for about 10%.

The weak China data could mean reduced

demand for commodities from the world’s second biggest economy and

subdued inflationary pressures. Gold is often viewed as a safe store of

value when prices are rising.

Larry Edelson

writes:

You have to realize that sometimes gold is

money … and sometimes it’s not.

Right now, gold is not money. Just consider

what’s happening in Japan. The wicked and aggressive devaluation of the

Japanese yen is setting off a massive stampede OUT of gold and into cash

and other assets.

***

Why are the Japanese dumping gold,

especially when their currency is being devalued?

It’s simple. The fall in the Japanese yen

caused the price of gold in yen to spike sharply higher. So Japanese

investors are cashing in their profits.

In addition, Japanese investors want to

either spend their gold proceeds, or move it into other assets. They

need liquidity. And holding on to gold is not a liquid situation.

It’s very easy to understand. This sort of

thing is also happening in Europe, where gold demand is also down.

Why? Because if you have money in a bank,

Cyprus has proven that European leaders will stop at nothing to try to

solve Europe’s crisis, even if it means confiscating your money from

your bank.

Gold’s not going to do you much good in that

situation. If you take your money out of the bank and buy gold, how are

you going to pay for the basic necessities in life?

Moreover, how are you going to move your

gold out of the country, if that’s what you wish to do (which many

Europeans are indeed doing)?

Moving physical gold around isn’t so easy

either. It takes time and money to move your gold. And even then, you

won’t know how safe it is, because in the back of your mind there’s

always that fear that your gold could be confiscated.

The bottom line: While gold is indeed the

ultimate long-term store of value against depreciating currencies and

failing governments, there are times when forces that are seemingly

bullish for gold are actually bearish.

Business Insider

argues:

[Gold's price collapse] vindicates the

economic ideas of the economic elites.

***

To respond to the economic crisis,

economists and mainstream policy makers have favored highly unusual

policy measures (massive Fed balance sheet expansion, massive stimulus,

etc.). These ideas are usually based on years of traditional economic

research (Keynesianism, monetarism, etc.).

All of these ideas have been slammed by

heterodox types like Austrian economists, who have warned of

hyperinflation, and gold going to $10,000.

So the collapse in gold is not about gold,

but about vindication for a large corpus of belief and economic

research, which has largely panned out. It’s great that our economic

elites know what they’re talking about, and have the tools at their

disposal to address crises without creating some new catastrophe.

Things aren’t great in the economy, but the

collapse/hyperinflation fears haven’t panned out, and the decline in

gold is a manifestation of that.

Barry Ritholtz

writes:

History shows Gold trades differently than

equities. Why? It comes back to those fundamentals.

It has are none.

This is not to say gold is not affected by

Macro issues. But that is very different than saying Gld has a

fundamental value, an intrinsic worth. It does not. That led to this

heretical advice:

Gold is not, and can never be, an investment.

It has no true intrinsic value, no cash

flow, no earnings, no coupon. no yield. What people call fundamentals

are nothing more than broad macro analysis (and how have your macro

funds done lately?). Gold is the ultimate

greater fool trade,

with many of its owners part of a collective belief theory rife with

cognitive errors and bias.

I do not want to engage in

Goldenfreude - the delight

in gold bugs’ collective pain - but I am compelled to point out how

basic flaws in their belief system has led them to this place where they

are today.

Gold does trade technically, and is

especially driven by the collective belief system of the crowd. When

that falter, well, you know what happens...

Gold Bug View

Gold bugs, on the other hand, see things quite

differently.

Andrew Maguire says that the crash is

solely in the paper gold market … and that there is actually a shortage of

physical gold. Many other sources make the

same claim.

Egon von Greyerz - founder and managing

partner at Matterhorn Asset Management -

argues:

They shouldn’t be concerned about the

temporary pressure on gold. This decline has nothing to do with the

physical market because enormous demand for gold continues.

The paper market in gold is not a real

market, and at some point in the near future paper gold holders will

wake up and realize they are holding are worthless pieces of paper.

This is when the world will witness one of

the greatest short squeezes in history as investors panic in to physical

and the price of gold explodes to the upside.”

London bullion dealer Sharps Pixley

thinks that the crash was largely

initiated by a single entity:

The gold futures markets opened in New York on Friday 12th April to a

monumental 3.4 million ounces (100 tonnes) of gold selling of the June

futures contract in what proved to be only an opening shot.

The selling took gold to the technically

very important level of $1540 which was not only the low of 2012, it was

also seen by many as the level which confirmed the ongoing bull run

which dates back to 2000. In many traders minds it stood as a formidable

support level… the line in the sand.

Two hours later the initial selling,

rumored to have been routed through

Merrill Lynch’s floor team, by a rather more significant

blast when the floor was hit by a further 10 million ounces of selling

(300 tonnes) over the following 30 minutes of trading.

This was clearly not a case of disappointed

longs leaving the market - it had the hallmarks of a concerted ‘short

sale’, which by driving prices sharply lower in a display of ‘shock &

awe’ - would seek to gain further momentum by prompting others to also

sell as their positions as they hit their maximum acceptable losses or

so-called ‘stopped-out’ in market

parlance - probably hidden the unimpeachable (?) $1540 level.

The

selling was timed

for optimal impact with New York at its most liquid, while key

overseas gold markets including London were open and able feel the

impact.

The estimated 400 tonne of gold futures

selling in total equates to 15% of annual gold mine production - too

much for the market to readily absorb, especially with sentiment weak

following gold’s non performance in the wake of Japanese QE, a nuclear

threat from North Korea and weakening US economic data.

***

By forcing the market lower the Fund sought to prompt a

cascade or avalanche of additional selling, proving the lie;

predictably some newswires were premature in announcing the death of the

gold bull run doing, in effect, the dirty work of the shorters in

driving the market lower still.

Gold Core’s Mark O’Byrne

agrees.

James Rickards

thinks the Fed is manipulating the gold market (and every other market).

Former assistant Treasury Secretary Paul

Craig Roberts

says:

Rapidly rising bullion prices were an

indication of loss of confidence in the dollar and were signaling a drop

in the dollar’s exchange rate. The Fed used naked shorts in the paper

gold market to offset the price effect of a rising demand for bullion

possession.

Short sales that drive down the price

trigger stop-loss orders that automatically lead to individual sales of

bullion holdings once their loss limits are reached.

***

According to Andrew Maguire, on Friday,

April 12, the Fed’s agents hit the market with 500 tons of naked shorts.

Normally, a short is when an investor thinks the price of a stock or

commodity is going to fall.

He wants to sell the item in advance of the

fall, pocket the money, and then buy the item back after it falls in

price, thus making money on the short sale. If he doesn’t have the item,

he borrows it from someone who does, putting up cash collateral equal to

the current market price.

Then he sells the item, waits for it to fall

in price, buys it back at the lower price and returns it to the owner

who returns his collateral. If enough shorts are sold, the result can be

to drive down the market price.

***

Bullion dealer Bill Haynes told

kingworldnews.com that last Friday bullion purchasers among the public

outpaced sellers by 50 to 1, and that the premiums over the spot price

on gold and silver coins are the highest in decades. I myself checked

with Gainesville Coins and was told that far more buyers than sellers

had responded to the price drop.

***

In addition to short selling that is clearly

intended to drive down the gold price, orchestration is also indicated

by the advance announcements this month first from brokerage houses and

then from Goldman Sachs that hedge funds and institutional investors

would be selling their gold positions.

***

I see the orchestrated effort to suppress

the price of gold and silver as a sign that the authorities are

frightened that trouble is brewing that they cannot control unless there

is strong confidence in the dollar.

Roberts also

says:

This is an orchestration (the smash in

gold). It’s been going on now from the beginning of April. Brokerage

houses told their individual clients the word was out that hedge funds

and institutional investors were going to be dumping gold and that they

should get out in advance.

Then, a couple of days ago, Goldman Sachs

announced there would be further departures from gold. So what they are

trying to do is scare the individual investor out of bullion. Clearly

there is something desperate going on….

Indeed, this may tie into

the

Federal Reserve leak of insider information.

Specifically, Roberts

writes:

The Federal Reserve began its April Fool’s

assault on gold by sending the word to brokerage houses, which quickly

went out to clients, that hedge funds and other large investors were

going to unload their gold positions and that clients should get out of

the precious metal market prior to these sales.

As this inside information was the

government’s own strategy, individuals cannot be prosecuted for acting

on it. By this operation, the Federal Reserve, a totally corrupt entity,

was able to combine individual flight with institutional flight. Bullion

prices took a big hit, and bullishness departed from the gold and silver

markets.

The flow of dollars into bullion, which

threatened to become a torrent, was stopped.

As Congressman Grayson

pointed out in a recent letter, right after the Federal Reserve’s Open

Market Committee leaked valuable inside information to big banks, Goldman

told its clients:

We recommend initiating a short COMEX gold

position...

What Happened The Last Time We Saw...

Gold Drop Like This?

by Tyler Durden

April 15, 2013

from

ZeroHedge Website

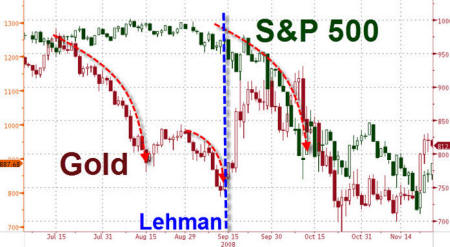

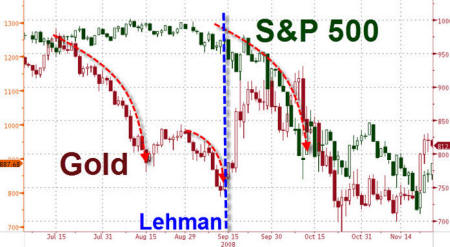

The rapidity of gold's drop is impressive,

concerning, and disorderly.

We have seen two other such instances of

disorderly 'hurried' selling in the last five years. In July 2008, gold

quickly dropped 21% - seemingly pre-empting the Lehman debacle and the

collapse of the western banking system.

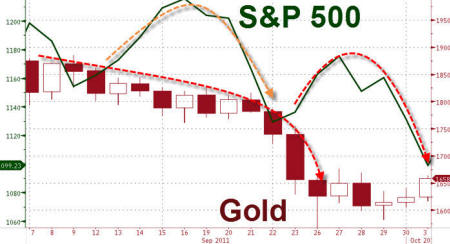

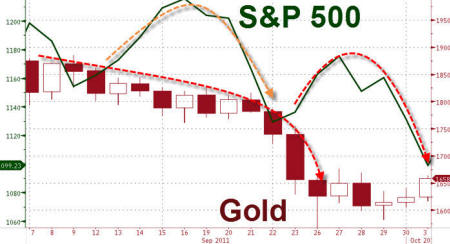

In September 2011, gold fell 20% in a short

period - as Europe's risks exploded and stocks slumped prompting a globally

coordinated central bank intervention the likes of which we have not seen

before.

Given the almost-record-breaking drop in gold in

the last few days, we wonder 'what is

coming'?

Chart: Bloomberg

This is what it looked like in Q3 2008...

Chart: Bloomberg

...and in 2011...

Chart: Bloomberg

...and now...

Chart: Bloomberg

...and it seems safety is bid dramatically

elsewhere as 2Y Swiss rates plunge 4bps to -7bps - their lowest in 4

months...