by Mark Sircus

Director

17 July 2011

from

IMVA

Website

...And Everyone Else

The Economist

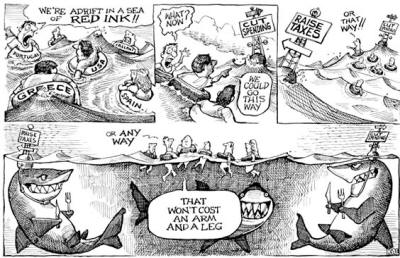

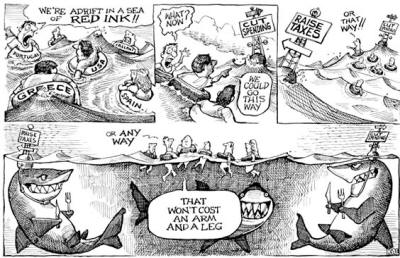

The end of the banker’s reign is near and that

is a really good thing.

Up to this point, bankers have managed to turn

humanity into pile of debt slaves. Since the advent of paper money, bankers

have tended to form an unholy alliance with elected governments to expand

debt and both parties have prospered until now; the time has come when debt

can no longer be repaid.

Darryl Robert Schoon

writes,

“The global economic collapse is perhaps

humanity’s greatest hope for escaping the debt slavery the world’s

financiers and bankers have planned for the world. However, to escape

slavery one must first know he is a slave.”

Debt is the slavery of the free.

Publius Syrus, 50 BC

“Now everybody understands that Greece needs

to be helped to exit recession as soon as possible. The relevant

negotiations are making progress, and I hope they are completed as soon

as possible,” Greece’s Prime Minister George Papandreou said.

Some people are very serious about their

delusions and want us to believe in them too.

How is an economic backwater

country like Greece going to be helped out of a recession when the rest of the world is on the verge of financial and economic calamity? And how is any

person or country in debt helped by taking on more debt?

Don’t tell anyone

but a massacre is going to occur in the banking industry, for haircuts are

not what are in the offering but instead full-field scalping as countries

default on their debts. It’s only a matter of time.

Sheldon Filger

says,

“policymakers have no real solutions, and

have just about run out of gimmicks and short-term fixes.

The global

economic crisis that began with the

financial collapse of 2008, far from

being resolved or a clear path to recovery being underway, is entering a

more dangerous phase, in which sovereign debt reaches the level of unsustainability.

The result could very well be paralyzing insolvency

among the advanced economies, which could destroy the economic future of

an entire generation.”

Monty Pelerin

writes,

“The circus surrounding the debt ceiling

makes interesting theater but all the babble is irrelevant. How the debt

ceiling is eventually resolved only changes the timing and extent of the

economic collapse.”

The baby boomer generation,

“Will be remembered most for the incredible

bounty and freedom it received from its parents and the incredible debt

burden and constraints it left on its kids,”

writes Thomas Friedman for

the New York Times, telling us that both European and American dreams

are on the line.

Everywhere the sense of wrongness is leaking

into the mainstream except perhaps with

freshman Republicans who are more

interested in doing what is right than in getting reelected.

“E3 is not a solution. It is currency

destruction that leads to eventual hyperinflation that wipes out fixed

incomes and most savings. It is nothing more than a temporary political

escape from reality. It ensures the ultimate political and economic

collapse of the country.

The only solution is to pare back government to

where it is no longer destructive to the productive sector. It must be

defanged and caged. Immediate cuts of 50% in spending would be my

starting point. Additional cuts would follow,” concludes Pelerin.

We know that American politicians will not even

dream of such dramatic cuts of their power or of the budget so I am

convinced that nearly everything about today’s world is going to change over

the comings months or short period of the next year.

The ride down in terms

of evaporating financials, housing values, loan values, expanding

unemployment, and contracting world economy will be hard. No soft landings

ahead. It’s going to be much worse than most people expect.

It is tough for people and governments all over the world.

David Galland

writes,

“Japan is essentially offline. Reports from

friends in Japan - including one who was initially skeptical about the

scale of the problems at Fukushima - have now changed in tone by 180

degrees.

You can almost feel the growing sense of desperation as the

already massively indebted nation begins to slide toward an abyss. There

is little standing in the way of the world’s third-largest economy’s

slide.”

Greece, Ireland and Portugal are not far behind

in terms of desperation though they worry not over increasing radiation

levels, not yet at least.

Italy and Spain now seem ready to fall onto their fat bellies threatening to

bring down German and French banks with them and then perhaps the entire

central banking system in the process. Nothing sane can be said of the

United States so we can only expect the worst from her. As the world spirals

downward we can only expect America to make conditions down here on earth

more dangerous, especially now to its own citizens.

At this point it will

probably be safer outside the United States. In a serious crisis, most of

the criminals out to steal your property and do harm to you will come with

official government sanction and not from traditional criminal elements.

America is like Humpty Dumpy sitting high on the wall about to take a great

shattering fall.

The Eurozone is growing increasingly desperate and everyone

is watching for and wondering who the markets are going to punish next. The

U.S. debt situation is far worse than anyone in Washington is willing to

admit so nothing will be done about it. China’s bubble is big and dangerous.

The Middle East is in flames and different countries, states, cities, towns

and businesses are going bankrupt with so many of them being just too big to

fail.

The Daily Bell

asks,

“Is that a great Depression knocking? Leave

the door shut. Guard yourself and your loved ones. You are being lied

to; it is a conscious campaign, a Dreamtime, lulling you. Lift the

blinds and look outside. Trust your own vision, not what you’re being

told.”

John Rubino

said that,

“The idea that there were pain-free

solutions to the mountain of debt the world has taken on was always a

delusion. But it was one that the leaders of the U.S. and Europe in

particular have clung to ferociously. Until now.

In just the past few

days it seems they’ve all been forced to recognize the futility of their

situation, and they have simply given up.”

We might not be taking what Rubino is saying

seriously but that is not the case with governmental officials from the

treasury department.

July 16, 2011 – WASHINGTON

Federal officials have reached out

to banks and investors to discuss the government’s plans for its

paying obligations after August 2 in the event the debt ceiling

isn’t raised, the Washington Post reports.

Among the options

being considered to raise revenues while borrowing is prohibited

are the suspension of non-critical payments and the sale of

federally-owned student loans, mortgages, and even gold

reserves. The government is facing a $159 billion deficit in

August, according to the Bipartisan Policy Center.

The Post is

reporting that financial firms and investors were skeptical of

the plans when briefed by Treasury Department officials, arguing

there would be chaos in the markets due to speculators quick to

scoop up valuable assets at low prices from a cash-starved

government.

Rating agencies have said any partial default on its

obligations, or steps to pay only some of the nation’s bills,

could be met by a downgrade of federal debt - which would cause

further economic turmoil.

Business Insider

“This was inevitable because ‘extend and pretend’ is by definition a

temporary strategy. It works for a while but only for a while. And now

it’s ending everywhere, all at once.

We’ve entered a new phase of the

global financial collapse that began in 2000.

Any one of these

capitulations - a Greek default, followed inevitably by either more PIIGS [Portugal, Italy, Ireland, Greece and Spain] defaults or EU

bailouts of surreal size, the admission that the U.S. government will

run trillion dollar deficits essentially forever, and a massive new Fed

stimulus plan - would by itself be enough to destabilize the global

economy.

Toss them all into the mix at once and you get chaos,"

continued Rubino.

Bob Chapman

writes,

“What America is seeing today is a

flat-lining economy. The U.S. economy is doing a slow-motion swan dive

and the corporatists do not care because they believe they’ll become

part of this new World Order.

The big question is why haven’t government

and the Fed tried to solve the economic situation? The answer is they

have no intention of doing so, because they want the public on their

knees economically and financially so they can impose World Government.”

The cold, hard reality of the matter is that

economic decline and economic despair are spreading rapidly and they will

come to almost all of us soon enough.

Don’t make the mistake that you can

escape the crisis that is building up like a standing wave ready to sweep

away old structures and institutions reshaping the basic social and economic

environment that we now take for granted.

Silver Shield

slams most of us in the face saying,

“The last place I would want to be is in a

multicultural, densely packed, urban area with huge wealth disparities

when the dollar collapses. When the dollar collapses, food and fuel will

become scarce and people will become desperate.

We have seen riots in

the past, but let me assure you that you have not seen anything yet. I

remember the Rodney King riots and this collapse will make that look

like child’s play. Those riots were over some verdicts on a few men; the

dollar collapse is a verdict on all of us.”

“The shock of abject poverty and sudden desperation will bring out the

worst in people. The police will be overwhelmed at a time when their

paychecks stop or don’t buy anything and their pensions wiped clean.

Those officers will not risk their lives out on the street trying to

save some failed system. They will be at home defending their families

or simply getting out of dodge.

Leaving all of those left behind to fend

for themselves.”

Those that are wise, will be far away

from danger, instead of tempting fate.

Silver Shield

If you have not seen part two of Gerald Celente’s recent video with

Max Kestler I would recommend a listen.

No one

alive talks as much street sense as Celente and it’s no coincidence that

Gerald, a martial arts specialist when he is not doing financial

forecasting, talks about guns and escape plans. Ignoring people who are

shouting out warnings now can become very costly in the near term of life.

Even for me, someone who depends on spiritual protection from the harm

people do to others, the harsh realities are difficult to fathom and accept

as I attempt to sort through the choices I must make when balancing the

above with my family responsibilities.

“Those areas that are most dependent on the

dollar paradigm will be the worst places when the dollar collapses. Most

people have only a few days of food to exist on, and if the water gets

shut, less than that for water.

What is also not very well known, and

very dangerous, is that we have 1/10th of the population on

anti-depressants.

If people don’t get their pills and come off too fast,

they will suffer psychological breaks at a time when their real world is

falling apart. It seems every school shooting or mother drowning her

kids are from people who stopped taking their meds. I would be willing

to bet that the use of these kinds of drugs are significantly higher in

urban areas than rural areas.

This fact is only going to compound the

problem in a world already gone mad,” concludes Shield.

Chris Hedges, a Pulitzer Prize-winning author

writes,

“Adequate food, clean water and basic security are now beyond the

reach of half the world’s population. Food riots and political protests will

be frequent, as will malnutrition and starvation.

Desperate people employ

desperate measures to survive.

And

the elites will use the surveillance and

security state to attempt to crush all forms of popular dissent. The aim of

the corporate state is not to feed, clothe or house the masses but to shift

all economic, social and political power and wealth into the hands of the

tiny corporate elite.

“Do not expect them to take care of us when

it starts to unravel. We will have to take care of ourselves. We will

have to rapidly create small, monastic communities where we can sustain

and feed ourselves. It will be up to us to keep alive the intellectual,

moral and cultural values the corporate state has attempted to snuff

out.

It is either that or become drones and serfs in a global

corporate.”