|

by Kasasa

June 15,

2020

from

Kasaca Website

What

separates Generation Y from X,

and is

Generation Z a thing?

How old is each

generation?

Are they really

that different?

It’s easy to see why

there is so much confusion about generational cohorts.

If you’ve ever felt muddled by this "alphabet soup" of names…you’re

not alone. The real frustration hits when you realize that Gen Y

consumers will earn 46% of income in the U.S. by 2025.

And unless you understand

who they are and what they want, you won’t capture a dollar of their

money.

Furthermore, as one

generation’s spending power decreases (i.e. Boomers) another is

increasing.

People Grow

Older, Birthdays Stay the Same

A common source of confusion when labeling generations is their age.

Generational cohorts are defined (loosely) by birth year, not

current age.

The reason is simple,

generations get older in groups. If you think of all Millennials as

college kids (18 - 22), then you are thinking of a stage in

life and not a generation.

Millennials are out of

college and that life stage is now dominated by Gen Z.

Another example, a member of Generation X who turned 18 in 1998

would now be nearly 40. In that time, he or she cares about vastly

different issues and is receptive to a new set of marketing

messages. Regardless of your age, you will always belong to the

generation you were born into.

As of 2020, the breakdown by age looks like this:

-

Baby Boomers:

Baby boomers were born between 1944 and 1964. They're

current between 56-76 years old (76 million in U.S.)

-

Gen X: Gen

X was born between 1965 - 1979 and are currently between

41-55 years old (82 million people in U.S.)

-

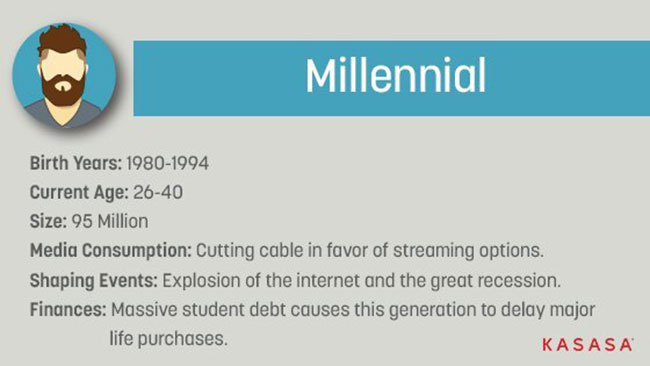

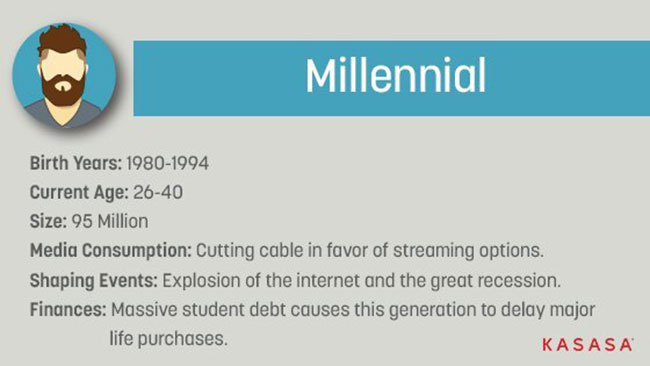

Gen Y: Gen

Y, or Millennials, were born between 1980 and 1994. They are

currently between 26-40 years old.

-

Gen Z: Gen

Z is the newest generation to be named and were born between

1995 and 2015. They are currently between 5-25 years old

(nearly 74 million in U.S.)

The term "Millennial" has

become the popular way to reference both segments of Gen Y (more on

Y.1 and Y.2 below).

Realistically, the name

Generation Z is a place-holder for

the youngest people on the planet. It is likely to morph as they

leave childhood and mature into their adolescent and adult

identities.

Why are

generations named after letters?

It started with Generation X, people born between 1965-1979.

The preceding generation

was the Baby Boomers, born 1944-1964. Post World War II, Americans

were enjoying new-found prosperity, which resulted in a "baby boom."

The children born as a

result were dubbed the Baby Boomers.

But the generation that followed the Boomers didn’t have a blatant

cultural identifier. In fact, that’s the anecdotal origin of the

term Gen X — illustrating the undetermined characteristics they

would come to be known by.

Depending on whom you

ask, it was either sociologists, a novelist, or Billy Idol who

cemented this phrase in our vocabulary.

From there on it was all down-alphabet. The generation following Gen

X naturally became Gen Y, born 1980-1994 (give or take a few years

on either end). The term "Millennial" is widely credited to

Neil Howe, along with

William Strauss.

The pair coined the term

in 1989 when the impending turn of the millennium began to feature

heavily in the cultural consciousness.

Generation Z refers to babies born from the mid-2000s through today,

although the term isn’t yet widely used. This may signal the end of

‘alphabet soup’ (it does coincide with the literal end of the

alphabet, after all).

A flurry of potential

labels has appeared, including Gen Tech, post-Millennials,

iGeneration, and Gen Y-Fi.

Splitting Up

Gen Y

Javelin Research noticed that

not all Millennials are currently in the same stage of life.

While all millennials

were born around the turn of the century, some of them are still in

early adulthood, wrestling with new careers and settling down, while

the older millennials have a home and are building a family.

You can imagine how

having a child might change your interested and priorities, so for

marketing purposes, it's useful to split this generation into Gen

Y.1 and Gen Y.2.

Not only are the two groups culturally different, but they’re in

vastly different phases of their financial life. The younger group

are financial fledglings, just flexing their buying power.

The latter group has a

credit history, may have their first mortgage and are raising

toddlers. The contrast in priorities and needs is vast.

The same logic can be applied to any generation that is in this

stage of life or younger. As we get older, we tend to homogenize and

face similar life issues. The younger we are, the more dramatic each

stage of life is.

Consider the difference

between someone in elementary school and high school. While they

might be the same generation, they have very different views and

needs.

Marketing to young generations as a single cohort will not be nearly

as effective as segmenting your strategy and messaging.

Why are

generation cohort names important?

Each generation label serves as a short-hand to reference nearly 20

years of attitude, motivations, and historic events.

Few individuals

self-identify as Gen X, Millennial, or any other name.

They’re useful terms for marketers and have a tendency to trickle

down into common usage. Again, it’s important to emphasize that

referring to a cohort simply by the age range gets complicated

quickly.

10 years from now, the

priorities of Millennials will have changed - and marketing tactics

must adjust instep. Whatever terminology you use, the goal is to

reach people with marketing messages that are relevant to their

phase of life.

In short, no matter how

many letters get added to the alphabet soup, the most important

thing you can do is seek to understand the soup du jour for the type

of consumer you want to attract.

What makes

each generation different?

Before we dive into each generation, remember that the exact years

born are often disputed, but this should give you a general range to

help identify what generation you belong in.

The other fact to remember is that new technology is typically first

adopted by the youngest generation and then is gradually adopted by

the older generations.

As an example,

96% of Americans have a smartphone,

but Gen Z (the youngest generation) is the highest user.

The Baby

Boomer Generation

-

Boomer Birth

Years: 1944 to 1964

-

Current Age:

56 to 76

-

Generation

Size: 76 Million

-

Media

Consumption:

Baby boomers

are the biggest consumers of traditional media like

television, radio, magazines, and newspaper. Despite

being so traditional 90% of baby boomers have a Facebook

account. This generation has begun to adopt more

technology in order to stay in touch with family members

and reconnect with old friends.

-

Banking

Habits:

Boomers

prefer to go into a branch to perform transactions. This

generational cohort still prefers to use cash,

especially for purchases under $5.

-

Shaping

Events:

Post-WWII

optimism, the cold war, and the hippie movement.

-

What's next

on their financial horizon:

This

generation is experiencing the highest growth in student

loan debt. While this might seem counterintuitive, it

can be explained by the fact that this generation has

the most wealth and is looking to help their children

with their student debt. They have a belief that you

should take care of your children enough to set them on

the right course and don't plan on leaving any

inheritance. With more Americans outliving their

retirement fund, declining pensions, and social security

in jeopardy, ensuring you can successfully fund

retirement is a major concern for Boomers.

Generation X

-

Gen X Birth

Years: 1965 to 1979

-

Current Age:

41 to 55

-

Other

Nicknames: "Latchkey" generation, MTV generation

-

Generation

Size: 82 Million

-

Media

Consumption:

Gen X still

reads newspapers, magazines, listens to the radio, and

watches TV (about 165 hours worth of TV a month).

However, they are also digitally savvy and spend roughly

7 hours a week on Facebook (the highest of any

generational cohort).

-

Banking

Habits:

Since they

are digitally savvy, Gen X will do some research and

financial management online, but still prefer to do

transactions in person. They believe banking is a

person-to-person business and demonstrate brand loyalty.

-

Shaping

Events:

End of the

cold war, the rise of personal computing, and feeling

lost between the two huge generations.

-

What's next

on Gen X's financial horizon:

Gen X is

trying to raise a family, pay off student debt, and take

care of aging parents. These demands put a high strain

on their resources. The average Gen Xer carries $142,000

in debt, though most of this is in their mortgage. They

are looking to reduce their debt while building a stable

saving plan for the future.

Millennials

(Gen Y)

-

Millennial

Birth Years: 1980 to 1994

-

Current Age:

26 to 40

-

Other

Nicknames: Gen Y, Gen Me, Gen We, Echo Boomers

-

Generation

Size: 95 Million

-

Media

Consumption:

95% still

watch TV, but Netflix edges out traditional cable as the

preferred provider. Cord-cutting in favor of streaming

services is the popular choice. This generation is

extremely comfortable with mobile devices but 32% will

still use a computer for purchases. They typically have

multiple social media accounts.

-

Banking

Habits:

Millennials

have less brand loyalty than previous generations. They

prefer to shop product and features first and have

little patience for inefficient or poor service. Because

of this, Millennials place their trust in brands with

superior product history such as Apple and Google. They

seek digital tools to help manage their debt and see

their banks as transactional as opposed to relational.

-

Shaping

Events:

The Great

Recession, the technological explosion of the internet

and social media, and 9/11

-

What's next

on their financial horizon:

Millennials

are entering the workforce with high amounts of student

debt. This is delaying major purchases like weddings and

homes. Because of this financial instability,

Millennials prefer access over ownership which can be

seen through their preference for on-demand services.

They want partners that will help guide them to their

big purchases.

Gen Z

-

Gen Z Birth

Years: 1995 to 2019

-

Currently

Aged: 5 to 25

-

Other

Nicknames: iGeneration, Post-millennials, Homeland

Generation

-

Generation

Size: Roughly 25% of the population

-

Media

Consumption:

The average

Gen Zer received their first mobile phone at age 10.3

years. Many of them grew up playing with their parents'

mobile phones or tablets. They have grown up in a

hyper-connected world and the smartphone is their

preferred method of communication. On average, they

spend 3 hours a day on their mobile device.

-

Banking

Habits:

This

generation has seen the struggle of Millennials and has

adopted a more fiscally conservative approach. They want

to avoid debt and appreciate accounts or services that

aid in that endeavor. Debit cards top their priority

list followed by mobile banking. Over 50% have not

entered a bank branch in at least 3 months.

-

Shaping

Events:

Smartphones,

social media, never knowing a country not at war, and

seeing the financial struggles of their parents (Gen X).

-

What's next

on Gen Z's financial horizon:

Learning

about personal finance. They have a strong appetite for

financial education and are opening savings accounts at

younger ages than prior generations.

If you want to know more

about Gen Z, check out

this deep dive into their media

consumption and banking habits.

Do Generations

Use Technology Differently?

Younger generations have

often led older Americans in their adoption and use of technology,

and this largely holds true today.

Although Baby Boomers may trail Gen X and Millennials on native

technology usage, the rate at which Boomers expand their use of

technology is accelerated.

In fact, Boomers are now far more likely to own a smartphone than

they were in 2011 (68%

now vs. 25% then).

Do Generations

Bank Differently?

Absolutely, and for

several reasons.

-

Each generation

has been in the workforce for different lengths of time and

accumulated varying degrees of wealth.

-

Baby

Boomers have an average net worth of $1,066,000 and

a median net worth of $224,000.

-

GenXers

average net worth is around $288,700, but the median

is $59,800.

-

Millennials have an average net worth around

$76,200, but their median net worth is only $11,100

-

Gen Z's

average net worth is difficult to report on since so

much of the generation has no net worth or career.

-

Each generation

is preparing and saving for different life stages; be that

retirement, children's college tuition, or buying a first

car.

-

Each generation

grew up in evolving technological worlds and has unique

preferences in regard to managing financial relationships.

-

Each generation

grew up in different financial climates, which has informed

their financial attitudes and opinions of institutions.

|