|

by Jonathan Leake

February 11, 2025

from

TheTelegraph Website

BP chief Murray Auchincloss

says the restructuring will

'be a new

direction for BP'.

Credit: Amr Alfiky/Reuters

BP vows 'fundamental reset'

as it retreats from

'net zero.'

Oil giant's change in strategy

comes after it was targeted

by US

activist investor...

BP has halted all investments in

renewable energy as part of a

"fundamental reset" of its strategy.

As part of a bid to refocus on fossil fuels, the UK oil giant has

said it will sell off 10 of its US onshore wind farms and hive off

its offshore wind assets into a separate venture with Japan's Jera

Co.

The shift in strategy comes after profits at the company fell from

$13.4bn (£10.9bn) in 2023 to $8.2bn last year, which has led to BP

cutting its performance-related bonuses for its senior leaders to

45%.

"We have completely decapitalized renewables," said chief executive

Murray Auchincloss, who added that BP increased oil and gas

production by 2% last year.

It comes after the company was recently targeted by

Elliott

Management, a US hedge fund with a reputation for taking stakes in

companies and demanding they break themselves up or sell assets.

Mr. Auchincloss has said he will provide further details of BP's

reset at a capital markets day later this month.

He said:

"We have been reshaping our portfolio - sanctioning new

major projects and focusing our low-carbon investment - and have

made strong progress in reducing costs.

"Building on the actions taken in the last 12 months, we now plan to

fundamentally reset our strategy and drive further improvements in

performance, all in service of growing cash flow and returns."

This means the company has

halted investment in around 30

projects that were set to generate uncertain profits, instead

targeting 10 of its most lucrative.

That includes Kaskida in the Gulf of Mexico where BP is drilling

more than 35,000ft into the seabed to access one of the region's

largest new oil fields.

Another is the $7bn Tangguh project in Papua Barat, Indonesia.

Major

investments are also planned in Iraq with the redevelopment of oil

fields around Kirkuk, and in India where BP will help develop the

country's largest offshore oil field.

The shake-up has also led to BP

scaling back its investment in

low-carbon energy and biofuel projects.

It marks an end to the legacy left by

Bernard Looney, the former BP

boss who was forced out in 2023 after failing to disclose

relationships with his colleagues.

Mr. Looney admitted that following his exit, he had not been "fully

transparent" about his past relationships.

Under Mr. Looney, BP shifted aggressively toward

green energy by

ramping up investment in solar and wind, while also pledging to

reduce oil and gas production significantly.

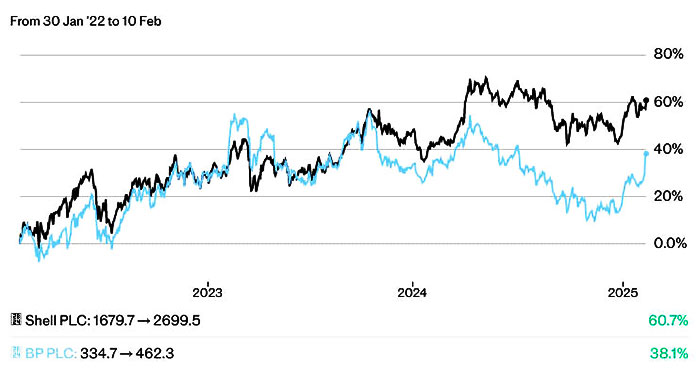

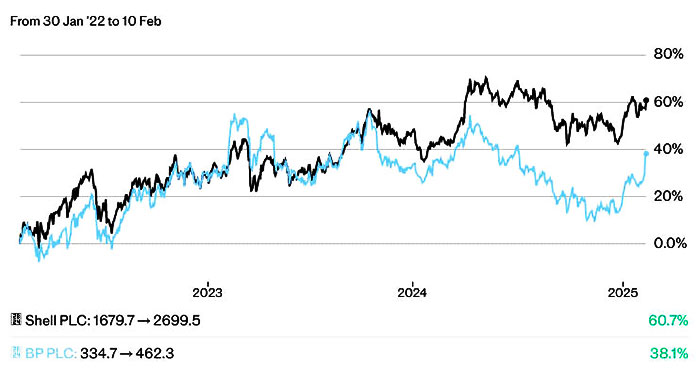

This has led to BP falling out of favor with investors in recent

years, with its share price falling by more than 9% over the past

year.

That is compared to a 6.5% rise for rival Shell.

Mr. Auchincloss said the restructuring would "be a new direction for

BP", although analysts are already predicting how Elliott could seek

to influence strategy.

Neil Shah at Edison Group said:

"The looming shadow of activist

hedge fund Elliott Management now raises the stakes further.

"Speculation is already rife that BP could face demands for a

sharper focus on its core hydrocarbons business, asset spin-offs, or

even a listing relocation to the US to tap deeper capital markets.

"If BP fails to deliver a clear and credible strategy at its capital

markets day on Feb 26, these pressures may become unavoidable.

"The next phase of BP's evolution will hinge on whether it can

convince markets that it can generate meaningful returns on both

sides of the energy spectrum."

Environmental group

Global Witness said BP had invested nearly £9bn

in fossil fuels last year - seven times more than the £1.3bn

invested in renewables and low carbon energy.

It said:

"The figures suggest abandonment of the net zero targets

the company pledged five years ago."

|