by Mark Sircus

Director

25 July 2011

from

IMVA

Website

Treasury Secretary Timothy Geithner says

it’s “unthinkable” that there would be a time when the U.S. couldn’t pay its

bills.

That’s why he says he’s confident of a deal to

raise the government’s borrowing limit before an August 2 default deadline.

He says the U.S. has a top credit rating and that despite all the rhetoric,

there are signs that both sides are coming closer to an agreement.

But he says the legislative process needs to get

started by Monday night.

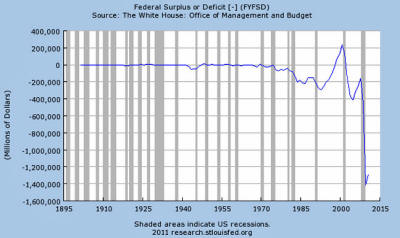

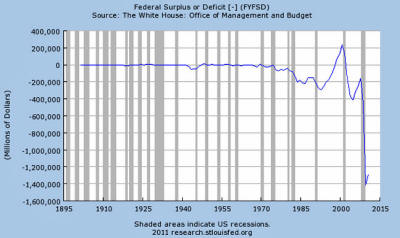

We are going to talk a lot about insanity in this essay and these

declarations by Geithner are a good place to start. Look at this above chart from

the Office of Management and Budget. That’s a graphic image of the United

States government’s swan dive into oblivion. That’s a straight line into

fiscal hell. That’s the visual proof that the only reasons that Geithner is

not taken away in a straight jacket is that he knows how to dress well.

Look at that chart again and let your imagination drop with that line that

marks off the descent in two-hundred-billion-dollar amounts. That’s a lot of

money!

More accurately said, it was a lot of money but

today $100 billion does not buy governments much since so much of it has to

go to paying interest on debts and the insanity of war instigated by mad men

who should not be allowed to walk freely on our planet.

Argentina’s President Cristina Fernandez, whose

own country

defaulted on about $100 billion in debt a decade ago, asked

last week: "When did the American dream become a nightmare?"

The current reality, represented very clearly by

the above chart, is that the American government cannot pay its bills, not

with real money at least, only with the fabricated stuff, the kind of money

that can be created out of thin air.

Its funny money and it is taking the whole world

down to a place where it will probably take many decades from which to

recover.

Congressman Ron Paul said,

“It isn’t too late to return to fiscal

sanity. We could start by canceling out the debt held by

the Federal

Reserve, which would clear $1.6 trillion under the debt ceiling. Or we

could cut trillions of dollars in spending by bringing our troops home

from overseas, making gradual reforms to Social Security and Medicare,

and bringing the federal government back within the limits envisioned by

the Constitution.

Yet no one is willing to step up to the

plate and make the hard decisions that are necessary. Everyone wants to

kick the can down the road and believe that deficit spending can

continue unabated.”

“Eventually the American taxpayer will get

so fed up with this bunch of morons in Washington - Republican and

Democrat - they are going to demand we take real action with real

numbers; cut through the crap and start dealing with this debt and we

can do it.

Why did we say in U.S., ‘the bondholders

can’t be hurt?’ What the hell was that about? It was all mad!” said

Howard Davidowitz.

It certainly is too late to return to fiscal

sanity for it is insanity that rules the world, insanity that drives the

United States government and insanity that runs deep in the psyche of the

human race.

We are a race of madmen though of course some are much madder

than others.

Today we wake up to see the work of a super madman who gunned down 90

innocent boys and girls in Norway. The madmen who have run the pharmaceutical

industry kill hundreds of thousands of men, women and children each year so

it’s really hard to decide who is the most insane.

In the United States

alone over 100,000 die each year from properly prescribed medicine.

“President Obama and his allies in Congress

believe they know better than you do what is in your own best interest,”

writes attorney Jonathan Emord, which means “we have a bunch of morons

in Washington” running roughshod over our future lives.

As Emord tells us, they even want to control the

food we eat so you really know that those running the show behind the scenes

are truly mad.

Monsanto, with their genetically modified foods, are in all

likelihood creating a food Armageddon.

In short, that company should be dissolved and

its executives locked up for their violence against humanity.

Apparently whether the “little people” like

something

or not doesn’t matter now in this “new” world.

Daily Bell

There is little desire or regard for the middle

class from the people at the top of the human heap because a big portion of

their wealth is derived from robbing the lower classes.

The

Federal Reserve acts at the top of the line

as the greatest robber of them all, raping the entire system to serve the

people at the top.

“The

first top-to-bottom audit of the

Federal Reserve uncovered eye-popping new details about how the U.S.

provided a whopping $16 trillion in secret loans to bail out American

and foreign banks and businesses during the worst economic crisis since

the Great Depression.

An amendment by Sen. Bernie Sanders to the

Wall Street reform law passed one year ago this week directed the

Government Accountability Office to conduct the study.

“As a result of this audit, we now know that

the Federal Reserve provided more than $16 trillion in total financial

assistance to some of the largest financial institutions and

corporations in the United States and throughout the world,” said

Sanders.

“This is a clear case of socialism for the

rich and rugged, you’re-on-your-own individualism for everyone else.”

Financial Poison

Contemporary civilization has already committed financial suicide and we are

now just waiting for the poison to take full effect but many millions are

already feeling the poison flooding through their veins.

The only answer the governments have been able

to come up with to resolve the situation is to drink much more poison (debt)

and ram it down the throats of their citizens.

The future of the world is at stake and we have

mad politicians at the helm so we do indeed have much to be concerned about.

“The banks of Europe are the new Feudal

Manors and Masters. All Europeans now serve them as debt-serfs in one

way or another.

If we knock down all the flimsy screens of artifice and

obscuring complexity, what we see in Europe is a continent of

debt-serfs, indentured to the banks under the whip of the European Union

and its secular religion, the euro,” wrote Charles Hugh Smith.

The title of his essay was

500 Million

Debt-Serfs: The European Union Is a Neo-Feudal Kleptocracy.

We are closing in on an event that will,

“set fire to the heart of the global

financial system. The insolvency of the global financial system, and of

the Western financial system in the first place, returns again to the

front of the stage after just over a year of political cosmetics aimed

at burying this fundamental problem under truckloads of cash,”

writes GEAB.

The elites that stand behind the EU are trying

to

build a

one-world order, and they will stop at

nothing to get it. The same thing is going on in

the U.S. with the debt crisis. An orchestrated

agenda. The Americans will eventually get

European-style austerity. They simply

don’t

understand the ramifications yet.

Daily Bell

There is a shock coming soon, probably in the

autumn of 2011 where the collective experience will literally be the ground

giving way beneath our feet as the underpinnings of our global financial

system come apart.

As we head into the black hole of debt that cannot be repaid we will see the

word default come up again and again.

Jean-Claude Trichet had the

word “default” stuffed down his throat last week and in the United States

politicians are now, like tug boats, maneuvering the United States of

America closer to defaulting on a mountain range of debt and liabilities

that should never have been incurred by a sane society and government.

Karl Denninger

writes,

“When investors get nervous about stocks,

they usually flow to bonds. Today, they’re not. They’re buying gold

instead which is up just under 1%, or silver, which is up 3.2%…”

During the next few weeks or short months even

the blind will begin to see which way events are going to take us. Every

tick upward of interest rates will ring the bells of doom since servicing

trillions upon trillions of debt becomes that much more impossible.

Bloomberg

published,

“That consumers are increasingly 'using

credit cards to pay for basic necessities as income gains fail to keep

pace with rising food and fuel prices'.”

Silvio Tavares, senior vice president of

the largest credit card processor said,

“Consumers, particularly in the lower-income

end, are being forced to use their credit cards for everyday spending

because there’s been no other positive catalyst, like an increase in

wages, to offset higher prices. It’s a cash-flow problem.”

It is not only governments that are in serious

trouble but an entire generation or even two generations that are drowning

in debt and fiscal insanity.

The people of Brazil and Chile also have a cash-flow problem. Their banks

were loose and easy with money they lent out because in some cases they have

been collecting over 200 percent interest on peoples’ debts. There are

perhaps a billion debt slaves in the world and we can count most countries

within those numbers.

Perhaps my numbers are way too conservative;

there is no way to count but the situation is dire.

To make matters much worse for the near future of the American economy we

and preview at end of the year seeing 3.7 million Americans stop receiving

jobless benefits. This financial Armageddon for these 3.7 million families

will be cruel enough for them but it will spill over to the wider economy -

acting as a hit man to consumption in the first quarter of 2012.

That’s a lot of people to drop out of the bottom of society all at once.

It’s the safety net tearing, allowing perhaps as many as 10 million men,

woman and children to fall to total destitution.

Now imagine what could

happen if the United States government goes down and cannot pay for the food

for its 40 million Americans on food stamps?

Are you getting an idea yet of the bad endings

that are possible for the American dream?

Down the Slippery

Slope

In

a recent Elliott Wave Theorist, Robert Prechter focuses on

a different metaphor from sailing to explain what’s happening in the

economy. He references the granite slope of Stone Mountain, pictured below

for those of you who have never visited Atlanta.

Investments

“Near Atlanta is a mound of granite called

Stone Mountain.

Over the years, people have fallen to their

deaths because they allowed the mountain to fool them. There is no sharp

cliff of which to beware. The slope is rounded. So, people sometimes

sneak past the protective fence and edge their way down the

mountainside, thinking that they have sufficient traction to remain

stable.

But when they pass the point at which they

can hold on, the slope only increases, and they fall to their doom.

“This seems to me somewhat analogous to the

economic depression that has been developing since the year 2000.

It started out slowly, so that people didn’t

even realize it was beginning. As the economy deteriorated, they didn’t

worry much, because they thought it had plenty of traction.

Periods of moderate stability increased

their confidence.

The quick slide of 2008 wasn’t fatal, because there

was a convenient ledge to stop the fall. Today, it seems that 29,900

economists out of the approximately 30,000 in the world are breathing

easier, thinking the mountain is safe.

But just a few more steps downward in the

economy and the slope will be too steep to keep it from going into a

death slide.

Excerpted from the June 2011 Elliott

Wave Theorist