|

from

InvestmentWatchBlog Website

Billionaires Continue to Dump Stocks, Traders are Betting Against The Economy, Hedge Funds Preparing for Market Sell-Off, and Now They Start Betting Against Currencies as World Plunges Into Recession

Billionaires Dumping Stocks, Economist Knows Why

Despite the 6.5% stock market rally over the last three months, a handful of billionaires are quietly dumping their American stocks... and fast.

Warren Buffett, who has been a cheerleader for U.S. stocks for quite some time, is dumping shares at an alarming rate. He recently complained of “disappointing performance” in dyed-in-the-wool American companies like Johnson & Johnson, Procter & Gamble, and Kraft Foods.

In the latest filing for Buffett’s holding company Berkshire Hathaway, Buffett has been drastically reducing his exposure to stocks that depend on consumer purchasing habits. Berkshire sold roughly 19 million shares of Johnson & Johnson, and reduced his overall stake in “consumer product stocks” by 21%.

Berkshire Hathaway also sold its entire stake in California-based computer parts supplier Intel.

With 70% of the U.S. economy dependent on consumer spending, Buffett’s apparent lack of faith in these companies’ future prospects is worrisome. Unfortunately Buffett isn’t alone.

Fellow billionaire John Paulson, who made a fortune betting on the subprime mortgage meltdown, is clearing out of U.S. stocks too. During the second quarter of the year, Paulson’s hedge fund, Paulson & Co., dumped 14 million shares of JPMorgan Chase.

The fund also dumped its entire position in discount retailer Family Dollar and consumer-goods maker Sara Lee.

So if that’s why,

...are dumping stocks, they have decided to cash out early and leave Main Street investors holding the bag.

Google Inc Executive Chairman Eric Schmidt...is selling roughly 42 percent of his stake in the Internet search

Source

|

|

|

World Plunges Into Recession

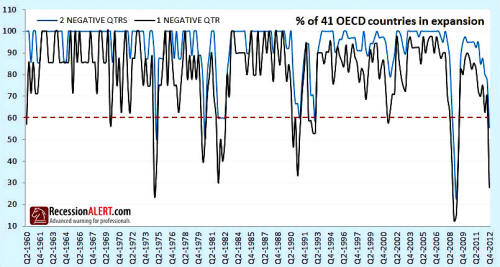

With the disappointing initial GDP releases for 4Q-2012 from Europe out, the “world” as defined by 41 OECD countries across the globe, has plunged into recession.

We define “recession” through two alternative definitions for our comparison, either the presence of a single negative quarter-on-quarter growth or the more traditional two consecutive negative quarterly growths.

Whichever way you look at it, the number of countries in expansion plunged dramatically between 3Q-2013 and 4Q-2012.

Now this is a diffusion index, with each country receiving equal weightings, and so it appears that 60% seems to be a viable threshold for the definition of “global recession” using the single-quarter definition (black) and 70% is probably the appropriate threshold for the 2-quarter definition (blue).