|

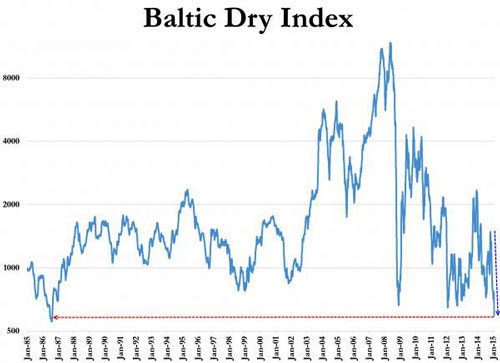

The Baltic Dry Index (BDI) is used by economists and stock traders alike as a leading economic indicator because it predicts future economic activity.

The index tracks in US dollars and measures global supply and demand for commodity shipments among bulk carriers including raw materials like lumber, coal, metallic ores, and grains.

What makes this particular measurement so distinct from others, according to economic Howard Simmons, is that the BDI,

When cargo is moving the price to move that cargo rises.

During the boom-times of the mid 2000's the Baltic Dry Index hit historical record highs of over $8000 for charter higher rates. It promptly collapsed under $1000 into mid-2008, just ahead of the stock market crash.

What you're about to see may shock you if you're of the opinion that an economic recovery has taken hold.

Not only has the index lost 90% of its value in the last several months, but according to Zero Hedge it is just a day or two away from its all-time record lows. Where is the global economy headed in the next few months?

If The Baltic Dry Index is any guide, it's about to implode.

It should be obvious, despite the machinations from governments and central banks the world over, that the economy is coming to a standstill. The collapse in the oil price has certainly pushed it along, but the problems go much deeper.

According to many contrarian analysts we're so far gone that at this point nothing will stop it:

Going forward we will see continued volatility with wild price swings for all asset classes, including gold and oil.

It is a sign of a system on its last legs and for those who have failed to prepare a backup plan things are going to be very difficult.

|