|

by Mac Slavo

August 11, 2015

from

SHTFplan Website

For the last several months there have

been warnings of a coming economic storm, with many

forecasting serious financial calamity

by the Fall of this year.

With stock markets in China having self

destructed, Greece and Europe in another crisis, and corporate

earnings for some of the world's biggest corporations showing

lackluster performance, it should be clear that the situation is

rapidly deteriorating.

But for the last several years America

has appeared to remain fairly insulated from overt crisis.

We were told that a recovery had taken

hold, jobs were returning and consumer confidence had reached new

highs, propaganda which drove millions of investors back into stock

markets and real estate.

No one in the mainstream world, it

seems, believes there's anything to be concerned about. Except there

is...

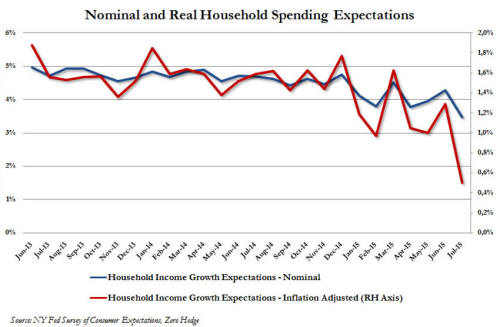

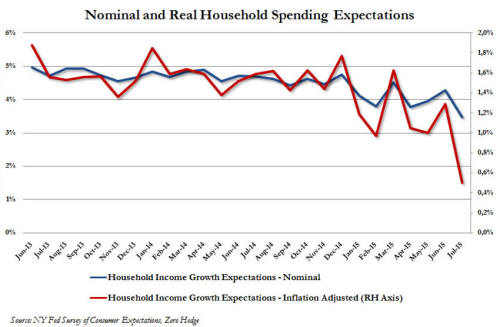

A

report from Zero Hedge highlights

just how hard Americans have been hit with increased energy prices,

inflation and low-wage labor offerings.

This is the hard evidence that proves

once and for all what most Americans will become privy to after the

fact: we are in a recession.

One of the biggest drivers of the

so-called recovery (in addition to the Fed's $4.5 trillion

balance sheet levitating te S&P500 and the offshore bank

accounts of 1% of the US population) has been the US consumer:

that tireless spending horse who

through thick, thin, recession and depression is expected to

take his entire paycheck, and then some tacking on a few

extra dollars of debt, and spend it on worthless trinkets.

Sure enough, for the past 8 years,

said consumer has done just that and with the help of the

endless hopium and Kool-Aid dispensed by the administration (who

can forget Tim Geithner's August 2010 op-ed "Welcome

to the Recovery"), and by the political and financial

propaganda media, spent, spent and then spent some more hoping

that "this time it will be different."

…

The biggest culprit in the collapse

in spending intentions was the middle class (those making

between $50 and $100K) but mostly the wealthy, those with

incomes over $100K.

It was the latter whose spending

expectations dropped to, you guessed it, the lowest in series

history.

Needless to say, this was not

supposed to happen.

Worse,

in an economy

where 70% of the GDP is in the hands of consumer spending, a

collapse in spending intentions to multi-year low levels means

just one thing: recession.

The U.S. economy is driven by one thing:

consumer spending, much of it based on credit.

As the chart above shows, spending has

collapsed. And that can really only mean one thing going forward.

America is not about to enter a recession, we are already in one

right here and now.

But

that's just part of the story. It actually gets worse.

Recent earnings from the world's largest

manufacturer of construction and mining equipment suggests it's

actually a whole lot worse than just another short-term dip.

We are, by the following account

detailing

Caterpillar's global sales, in a

full blown global depression:

Summarizing it all, after an

increasingly shallower series of dead CAT bounces in the past

year, first thanks to Latin America, and then the US, global

retail sales just dropped by 14% - marching the biggest Y/Y

decline since the financial crisis.

And the cherry on top:

there has now been an

unprecedented 31 consecutive months of CAT retail sales declines.

This compares to "only" 19 during the near systemic collapse in

2008.

…

In other words, if global

demand for heavy industrial machinery, as opposed to unemployed

millennials' demands for $0.99 Apple apps, is any indication of

the true underlying economy, forget recession:

the world is now in a second great depression

which is getting worse by the month.

That's right, while the band plays on

and everyone says there's nothing to worry about, the ship is

rapidly sinking.

What follows is anybody's guess, but if

government military exercises and simulations are a guide, we can

fully expect a significant economic event followed by widespread

civil unrest.

You didn't think they were stockpiling

guns, bullets, gas masks and riot gear just for fun, did you?

Somebody in government knows exactly

what is coming, and they will do whatever it takes to maintain

control once the Ponzi scheme has been revealed to the rest of the

public in the form of financial crashes and wealth confiscation.

It has been suggested that the collapse

of the debt bubble could lead to shortages of the most basic

necessities for survival.

Analyst Greg Mannarino

recently warned that because the

growth, including population growth, we've seen over the last two

decades has been

dependent on credit, once that

credit is frozen it will have ramifications that most people can't

even imagine as a possibility:

-

It's created a population boom…

a population boom has risen in tandem with the debt. It's

incredible.

-

So, when the debt bubble bursts

we're going to get a correction in population. It's a

mathematical certainty.

-

Millions upon millions of people

are going to die on a world-wide scale when the debt bubble

bursts. And I'm saying when not if…

The scenario outlined by Mannarino is

certainly an outlier, but what if he's right?

How would most Americans cope?

According to

The Prepper's Blueprint

author Tess Pennington, they won't because they have become

so dependent on the system they simply will not have the tools or

mental ability to adjust:

Collectively speaking, the

contribution from our easy lifestyle and comfort level has

created rampant complacency and a population of dependent,

self-entitled mediocres.

We no longer count on our sound

judgment, capabilities and resources.

The system keeps everything in

working order so we don't have to depend on ourselves, and

furthermore, don't want to. I realize that many of the readers

here do not fall into this collectivism, as you see through the

ideological facade and know that the system is fragile and can

crumble.

Breaking away from the system is the

only way to avoid the destruction of when it comes crumbling

down.

When you don't feed into the

manipulation tactics of the system, or enslave yourself to debt,

and possess the necessary skills to sustain yourself and your

family when large-scale or personal emergencies arise, you will

be far better off than those who were dependent on the system.

Those who lived during the Great

Depression grew up in a time when self-reliance was bred into

them and were able to deal with the blow of an economic

depression much easier.

Which side of this would you want to be on?

Source

|