by Matthias Chang

September 20, 2010

from

GlobalResearch Website

The Global Too Big To Fail Banks are so precarious that literally anything

can trigger a collapse in the coming months.

I have read recent commentaries on

Basel III posted to various renowned

websites and financial publication, but they missed (or deliberately misled)

the underlying message of the proposals, the implementation of which will be

delayed till 2017 and some till 2019.

Basel III is pure spin and its timing was to

assuage the deep-seated fears that there are no solutions in sight to save

the fiat money system and fractional reserve banking.

THE PROBLEM

The major global banks are all under-capitalized and this was all too

apparent when Lehman Bros. collapsed.

Banks were borrowing so much and so recklessly

to play at the global casino that when the bets went sour, they were staring

at a black-hole in the $trillions. In fact the banks are all insolvent.

The problem was compounded when the central bankers (all are corrupt without

exception) and regulators turned a blind eye to how bankers defined what

constituted “capital” so as to circumvent the need to maintain the capital

ratio.

THE BASEL III SOLUTION

At its 12 September 2010 meeting, the Group of Governors and Heads of

Supervision, the oversight body of the

Basel Committee on Banking

Supervision, announced a substantial strengthening of existing capital

requirements and fully endorsed the agreements it reached on 26 July 2010.

These capital reforms, together with the introduction of a global liquidity

standard, deliver on the core of the global financial reform agenda and will

be presented to the Seoul G20 Leaders summit in November.

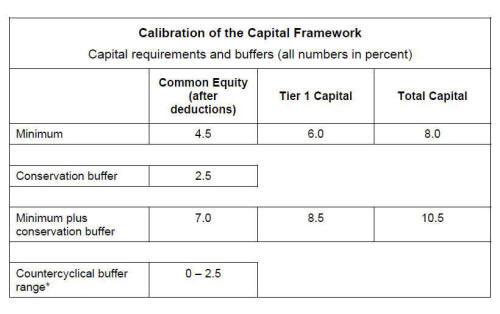

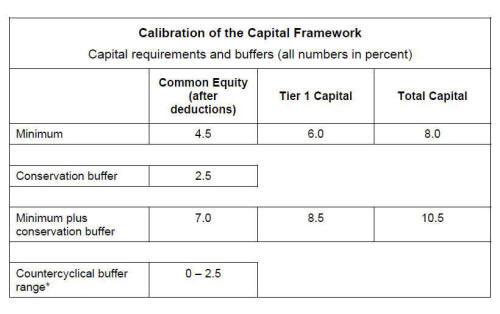

The Committee’s package of reforms will increase the minimum common equity

requirement from 2% to 4.5%.

In addition, banks will be required to hold a capital conservation buffer of

2.5% to withstand future periods of stress bringing the total common equity

requirements to 7%.

This reinforces the stronger definition of capital agreed by Governors and

Heads of Supervision in July and the higher capital requirements for

trading, derivative and securitization activities to be introduced at the

end of 2011.

Increased capital requirements

Under the agreements reached, the minimum requirement for common equity, the

highest form of loss absorbing capital, will be raised from the current 2%

level, before the application of regulatory adjustments, to 4.5% after the

application of stricter adjustments.

This will be phased in by 1 January 2015.

The Tier 1 capital requirement, which includes common equity and other

qualifying financial instruments based on stricter criteria, will increase

from 4% to 6% over the same period.

The Group of Governors and Heads of Supervision also agreed that the capital

conservation buffer above the regulatory minimum requirement be calibrated

at 2.5% and be met with common equity, after the application of deductions.

The purpose of the conservation buffer is to ensure that banks maintain a

buffer of capital that can be used to absorb losses during periods of

financial and economic stress.

While banks are allowed to draw on the buffer during such periods of stress,

the closer their regulatory capital ratios approach the minimum requirement,

the greater the constraints on earnings distributions.

This framework will reinforce the objective of sound supervision and bank

governance and address the collective action problem that has prevented some

banks from curtailing distributions such as discretionary bonuses and high

dividends, even in the face of deteriorating capital positions.

A countercyclical buffer within a range of 0% - 2.5% of common equity or

other fully loss absorbing capital will be implemented according to national

circumstances.

The purpose of the countercyclical buffer is to achieve the broader

macroprudential goal of protecting the banking sector from periods of excess

aggregate credit growth.

-

For any given country, this buffer will only be in effect when there is

excess credit growth that is resulting in a system wide build up of risk.

-

The countercyclical buffer, when in effect, would be introduced as an

extension of the conservation buffer range.

-

These capital requirements are supplemented by a non-risk-based leverage

ratio that will serve as a backstop to the risk-based measures described

above.

In July, Governors and Heads of Supervision agreed to test a minimum Tier 1

leverage ratio of 3% during the parallel run period.

Based on the results of the parallel run period, any final adjustments would

be carried out in the first half of 2017 with a view to migrating to a

Pillar 1 treatment on 1 January 2018 based on appropriate review and

calibration.

Systemically important banks should have loss absorbing capacity beyond the

standards announced today and work continues on this issue in the Financial

Stability Board and relevant Basel Committee work streams. [1]

THE LOOPHOLE &

ADMISSION OF INSOLVENCY

Since the onset of the crisis, banks have already undertaken substantial

efforts to raise their capital levels.

However, preliminary results of the Committee’s comprehensive quantitative

impact study show that as of the end of 2009, large banks will need, in the

aggregate, a significant amount of additional capital to meet these new

requirements.

Smaller banks, which are particularly important for lending to the

SME

sector, for the most part already meet these higher standards.

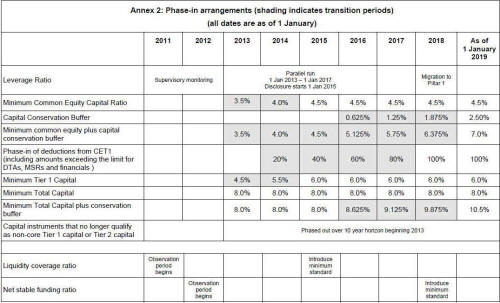

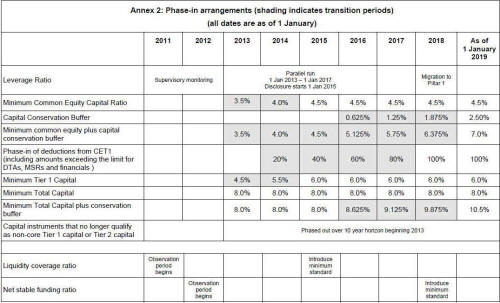

The Governors and Heads of Supervision also agreed on transitional

arrangements for implementing the new standards.

These will help ensure that the banking sector can meet the higher capital

standards through reasonable earnings retention and capital raising, while

still supporting lending to the economy.

THE IRON CLAD

CONFIRMATION THAT BANKS ARE IN DEEP SHITS

Please read all the passages which I have highlighted in bold in the above

paragraphs.

If the banks were at all material times

adequately capitalized and the central bankers in collusion with these

banksters and fraudsters were prevented from manipulations, there would not

be any need for Basel III regulations.

In saying this, I am not in anyway conceding that even with these new

requirements, the banks will be adequately capitalized.

The simple truth is that as long as the derivative casino is still running

and banks are allowed to continue their off balance sheet activities,

nothing will be resolved.

The 2 tables below tell the whole story:

Source: Basel iii Compliance

Professionals Association (B iii CPA)

How can the ultimate capital requirement of 8

percent be adequate when leverage under Basel III is still allowed at the

astronomical rate of 33:1?

In the second table, and it is a no brainer to conclude that the

'banking'

crisis (if we are lucky) may be “resolved” by 2015 but it is most likely

that it can be only resolved by 2017/2018 .

This is an express admission that all banks would require such a long

transition period to comply with the new requirements!

The stark reality is that the Too Big To Fail Banks do not have the ability

and or the means to raise capital at this critical juncture.

To use an analogy, the banking patient will be in Intensive Care until 2017,

which is rather optimistic for the projection implies that the patient may

be able to recover.

It is my view that Basel III is pure spin and is intended to convey the

impression that the central bankers and regulators have things under

control. This is a big lie!

I have said in my earlier article that the FED through QEI purchased toxic

assets from the banks and part of the monies were used to shore up the

reserves and part to purchase treasuries (to give an illusion of better

quality assets in banks’ balance sheet).

There are so much more, $trillions more of toxic waste that no amount of QE

(quantitative easing) can remove them. This situation does not even take

into consideration the toxic waste in SPVs - the off balance sheet mumbo

jumbos.

The FED and Accounting Bodies have suspended

accounting and regulatory rules that have enabled the banks to hide such

toxic waste in SPVs and not having to account for them in the banks’ balance

sheet.

LIFE SUPPORT

QEI has merely enable the Too Big To Fail Banks to continue some form of

banking activities thus deceiving the public that they are solvent and

prevent a bank run.

But the central bankers cannot have the cake and eat it as well. In trying

to shore up public confidence in banks with the introduction of Basel III,

they have inadvertently let the cat out of the bag and as the above two

tables show, the banks are all insolvent.

Additionally, whatever reserves that have been accumulated are insufficient

to stimulate further lending, because the banks have reached their limits

under the fractional reserve system. This is the reason for the contraction

of credit and not as one commentator has postulated that Basel III would

“contract credit”.

Two burdens are weighing down on the banks:

-

inadequate capital to meet liabilities

(borrowings)

-

inadequate reserves under fractional

reserve banking

This is a big mess!

THE CONFIDENCE GAME

At this moment, I cannot give a precise time-line as to how long the FED and

the global central banks can prolong the confidence game, hoodwinking the

public and sovereign creditors that all is well.

When confidence in banks evaporates for whatever reasons, the consequences

will be ugly and there will be massive social upheavals across the globe.

The first indication that the game is up is when US treasuries are

increasingly purchased by the FED to make up for the shortfalls by foreign

creditors and to finance the ballooning US deficits.

All of a sudden, some entities may start to get real nervous and unload the

treasuries, and the FED steps in to shore up treasuries. Then, the tipping

point is reached and Hell breaks loose!

China is also part of this confidence game.

But, contrary to IMF and other renowned economists who are betting on

China’s and Asia’s so-called economic strengths, I take the view that when

US treasuries collapse, faith in all fiat monies will likewise evaporate and

there will be massive capital flight to commodities, especially gold, silver

and oil.

Asian stock markets will be devastated and there will be volatile gyrations

in currency values.

Therefore, it is utter lunacy and recklessness for the Malaysian central

bank (Bank Negara) and the government to even consider allowing the ringgit

to be traded.

When confidence in dollar assets vaporizes, China will be caught right in

the middle. The third and final phase of the Global Financial Tsunami will

devastate Asian economies and with it, the greatest depression in history

will ensue.

Time Line? Between now and anytime in 2011. At the latest,

2012.

God help us.