|

from GlobalPost Website

(Fabrice Coffrini/AFP/Getty

Images)

Analysis: Heard about income inequality lately?

Here's one way the rich keep

getting richer.

Hollywood tells us they're top-secret safety deposit boxes for the world's elite - places where drug kingpins and bankers and politicians and heirs hide their fortunes from government investigations and taxation.

They're how the super rich do banking.

We know how banks have helped drug traffickers, arms dealers, and terrorists to launder money and create financial infrastructures that have made them less like criminal gangs operating in dirty cash and more like global criminal enterprises earning interest, making investments, and sending wire transfers.

And we know more about how corrupt

governments, government officials, and political leaders have

embezzled money and robbed the people they're meant to serve.

French newspaper Le Monde got a hold of the information in 2014 and set up a collaboration with the the Washington DC-based International Consortium of Investigative Journalists (ICIJ).

The new partners recruited a team of investigative journalists from over 45 countries to mine the data, which relates to over 100,000 banking clients in 200 countries, and find the stories.

On Feb. 8, the ICIJ launched its interactive report: "Swiss Leaks."

(Simran Khosla/ GlobalPost)

"Swiss Leaks" has three main sections: Countries, People, and Stories. Each does something different, and each is deeply troubling in its own way.

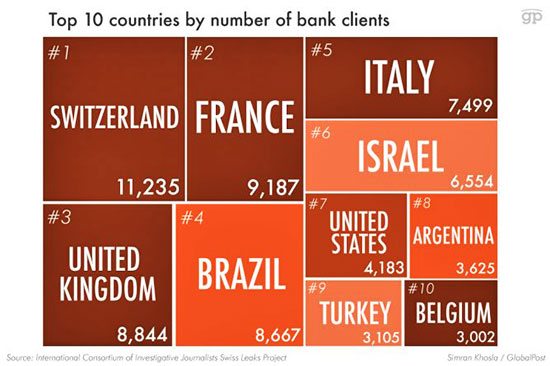

Countries

"Countries" gives you the meta-level picture of where the money was coming from - how much money from each country and how many banking clients per country.

(You can see that information in graphic form throughout this article.)

Money in Swiss Bank accounts by country

But Swiss Leaks is about much more than just the numbers.

It's about the stories behind them...

People

The "People" section of the report includes profiles of 65 public figures connected to HSBC Swiss accounts. (It's a sample of the larger data. In its written report, ICIJ discusses many other people.)

You'll learn, for example, that Mexican billionaire Carlos Hank Rohn was the beneficial owner of 10 bank accounts listed to "Hmex Pte. Ltd" that held a total of around $158 million in 2006/2007.

You'll also learn that King of Jordan, Abdullah II ibn al-Hussein, was connected to an account opened in the name of a person ICIJ identifies as a "senior palace official." It held $41.8 billion in 2006/2007.

And there's plenty more info on,

...a pretty diverse crew of people who share one thing in common.

They are super rich...

(Simran Khosla/ GlobalPost)

Read "People" carefully, though.

Not every person with an HSBC Swiss account is evading taxes and laundering money, as ICIJ notes. Several people responded to ICIJ's request for comment with compelling explanations.

Take British musician Phil Collins. He's listed. Bad look, right?

Not when you ask Collins' manager, who explained to ICIJ that the singer actually lives in Switzerland and that,

Another example:

Tax dodger? Maybe not.

One lesson from Swiss Leaks is that each HSBC account is a story worth investigating.

Swiss Bank clients by country

Stories

ICIJ's international team of journalists is telling those stories, and "Stories" is where you can read them.

There are (at least) two things you'll take away from "Stories."

The "Swiss Leaks" story and the stories it's revealed are developing, so follow along.

The Swiss government has just opened a criminal investigation against the Geneva-based HSBC for "aggravated money laundering."

|