by Tyler Durden

June 09, 2014

from

ZeroHedge Website

2013 was a good year for Goldman Sachs

investments in Emerging Markets,

most notably Venezuelan bonds (as they bet

on socialism and won).

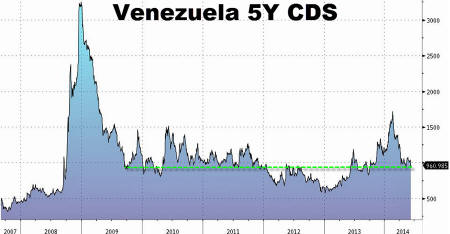

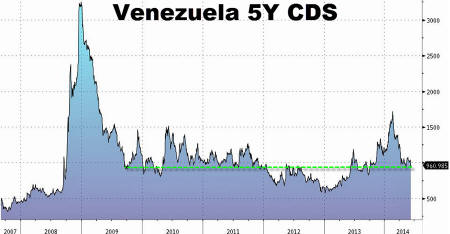

A year later and Goldman's EM debt portfolio is

still loaded with Venezuelan bonds... and the arrears are mounting.

As Bloomberg reports, at a time when

Venezuelaís record $25 billion in arrears to importers has its

citizens waiting hours in line to buy drinking water and crossing borders in

search of medicine, President Nicolas Maduro

is using the nationís dwindling supply of dollars to enrich bondholders.

As Bloomberg

reports,

Venezuela, which imports just about

everything, and its state oil producer have paid $2.8 billion in

interest to overseas creditors this year, according to Barclays Plc.

Including debt principal,

bondholder outlays will balloon to

almost $10 billion by year-end, the London-based firm

estimates.

By

putting off the local companies responsible for supplying everything

from diapers to cancer medications, Maduro can preserve access to debt

markets and protect oil shipments that would be vulnerable to bondholder

seizure, said Alejandro Arreaza, an

analyst at Barclays.

Even if that means fanning the worldís

fastest inflation and inflaming protests over shortages that have left

at least 42 people dead since February.

"The

governmentís priority is to pay the sovereign debt,"

Alejandro Arreaza, an analyst at Barclays Plc, said in a telephone

interview from New York.

Of course, it's not just the government

debt but

state-owned entities that need the USD and are getting priority over the

thirsty population...

State oil company Petroleos de Venezuela SA

is seeking a loan to pay off $3 billion of debt that matures this year

and isnít planning additional dollar bond sales in 2014, a company

official said yesterday.

PDVSA, as the Caracas-based company is

known, is working to refinance an additional $11.9 billion of dollar

debt due through 2017 to bring its annual maturities to no more than $3

billion, said the official, who asked not to be identified because he

isnít authorized to speak publicly.

"Itís

the first time that itís ever reached this critical level,"

he said by telephone. "And itís clear that they canít pay it off at

once."

"There has been a

divergence between what happens to

Venezuelan bonds in the international market and what happens to

businesses that operate inside of Venezuela,"

As one analysts noted... just like everywhere

else in the world...

"The market

is giving Venezuela the benefit of the doubt and hopes that it applies

other economic measures that in one form or another will guarantee its

capacity to repay bondholders."

And so it goes...