|

by Ian Allison

August 25, 2016

from

IBTimes Website

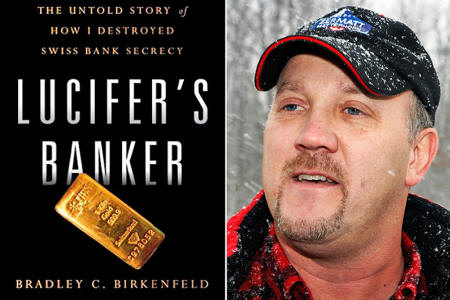

Lucifer's

Banker by Bradley Birkenfeld

covers Birkenfeld's

time at UBS bank.

Reuters

Birkenfeld's book about the

UBS Swiss banking

investigation,

Lucifer's Banker,

is published in October.

UBS, the world's largest wealth manager, is facing embarrassment

over fresh revelations going back to the tax investigation that led

to the collapse of Swiss banking secrecy.

Two significant events are

looming before UBS.

-

The first is the possibility of a public trial

in France, featuring UBS whistleblower Bradley Birkenfeld,

concerning historic tax evasion allegedly orchestrated by the bank.

That could happen this year.

-

The other is the publication this October of Birkenfeld's scathing

new book,

Lucifer's Banker, which covers his

time at UBS.

The tax evasion controversy, which was first highlighted in 2005,

subsequently involved the US Department of Justice, the State

Department and Internal Revenue Service.

It was prompted by

disclosures made by Birkenfeld that UBS had helped wealthy US

citizens evade taxes using offshore financial vehicles and

Swiss-numbered accounts.

In 2009, UBS paid $780m (£588m, €693m) to US authorities to avoid

prosecution.

Birkenfeld served 31 months in prison for one count of conspiracy to

abet tax evasion by one of his clients. After he was released he was

paid a record $104m by the IRS for helping recover unpaid taxes.

However, Birkenfeld has since said that he was systematically

prevented from giving testimony in open court - but this may be

about to change thanks to the French authorities.

Bradley Birkenfeld

Handout

In February 2015, under the request of a French federal subpoena,

Birkenfeld was allowed to travel to Paris where he spent 10 hours

with magistrates giving sworn testimony and submitting multiple UBS

documents in his possession.

"Why is it that I had to travel 3,000 miles across the pond to go

help a foreign government?" asks Birkenfeld.

"My own government

covered it up. Well now the French case is coming forward - and

unlike the US they are actually holding a trial. And not only

France; Germany has also contacted me to help them against UBS, as

well as various other foreign governments. I have not heard from the

UK, surprisingly," he said.

IBTimes UK asked

HMRC if it had considered contacting Birkenfeld.

It

issued this statement:

"HMRC doesn't discuss identifiable

individuals. We are getting tougher on offshore tax evasion,

securing more than £2.5bn since 2010.

"We welcome any information on potential tax fraud, and receive data

from a wide range of sources, gathering hundreds of millions of

items last year alone.

We then analyze the data using some of the

world's most sophisticated systems to identify tax dodgers."

Birkenfeld points out that there is €1.1bn in escrow as bail to

cover a potential penalty for UBS in the French case.

He adds:

"UBS

offered €200m but said they won't plead guilty and the French

refused to accept such a pathetic offer, so UBS pulled the €200m off

the table and then the French kicked it up to €1.1bn.

"The French have a moral standard and they firmly stand up on issues

that are important to them. There is a moral DNA within the society

of the French people."

UBS declined to comment on either a possible trial in France or the

release of Birkenfeld's book.

'James Bond'

bankers

The standard defence among UBS top brass in wealth management was

that they didn't know what their large teams of bankers were getting

up to.

It certainly was a secretive business, which made use of

untraceable SIM cards and encrypted laptops.

Private bankers would

be sent to the US on a quarterly basis to court high net-worth

clients at events such as Art Basel in Miami and other soirees, most

of them sponsored by UBS.

"We would work with US UBS offices to see what VIP events they can

get you into, and who they could actually refer from the bank.

That

was covered by something we called the 'referral program' and

involved a complex and sophisticated system of remuneration for both

sides," said Birkenfeld.

"If you sent a client to me and they put bankable assets you would

get 50% of the revenue generated. So they incentivized you and

that's against the law because you are aiding and abetting clients

to evade their tax obligations."

Politically exposed

persons

Birkenfeld claims the UBS cover-up stretches to the highest levels

of the US establishment, where an additional layer of secrecy

covered the accounts of bank's politically exposed persons (PEPs).

He promises four big names will be exposed in his book.

He said:

"A lot of PEPs were kept under secret, secret status. Swiss

banking was secret, but then PEPs were even more secret. This was

just too sensitive.

They had a desk in Zurich dedicated to PEPs out

of Washington, DC.

"It could be politicians, or it could be someone who was very close

to political circles or doing some dodgy work maybe in Nigeria or

somewhere else in the world.

UBS and Obama

Birkenfeld claims there was a glaring conflict of interest involving

then Senator

Barack Obama, which essentially placed him on the UBS

payroll.

He said UBS was an enthusiastic fundraiser for Obama for

his 2008 election campaign and senior executives at the bank bundled

campaign contributions. Bundlers are expected to raise in excess of

$500,000 each for the US president's re-election effort.

UBS also

advised the president on investments and strategy for the country. Birkenfeld states that when he gave testimony about UBS to the

Senate Committee in late 2007, Senator Obama was conspicuously

absent.

Birkenfeld said:

"When I went to give this information to the US

Senate Committee they provided me a subpoena to testify, as the DOJ

refused to do this. At this time Senator Obama was an active member

of that committee and he never showed up for any of those hearings.

Not one.

"But at the same time he was taking millions of dollars from UBS in

campaign contributions. That's the ultimate conflict of interest

because he should have been there helping to investigate UBS on

behalf of the American taxpayers, but instead he was taking money

from UBS.

I call it political prostitution. He is taking millions of

dollars from a criminally corrupt bank in direct violation to his

oath of office."

"Why wasn't I allowed to testify in public? They stopped it. Why

wasn't I allowed to testify at Raoul Weil's trial? They stopped it.

I had to fight to go find the French magistrate to help them.

"We are dealing here with the corruption of US government and people

like Barack Obama and the corruption of big banks like UBS.

These

are people that have really betrayed their country."

Bradley Birkenfeld's book

Lucifer's Banker - The Untold Story of How

I Destroyed Swiss Bank Secrecy is published by Greenleaf on 18

October 2016.

|