|

by Chris Martenson

August 17,

2018

from

PeakProsperity Website

And how do things

usually work out for the rat?

There are ample warning signs that another serious financial

crisis is on the way.

These warning signs are being soundly ignored by the majority,

though. Perhaps understandably so.

After 10 years of near-constant central bank interventions

to prop up markets and make stocks, bonds and real estate rise in

price - while also simultaneously hammering commodities to mask the

inflationary impact of their money printing from the masses -

it's difficult to imagine that "they" will allow markets to ever

fall again.

This is known as the "central bank put":

whenever the markets

begin to teeter, the central banks will step in to

prop/nudge/cajole the markets back towards the "correct"

direction, which is always: Up...!

It's easy in retrospect

to see how the central banks have become caught in this trap of

their own making, where they're now responsible for supporting all

the markets all the time.

The 2008 crisis really spooked

them. Hence their massive money printing spree to "rescue" the

system.

But instead of admitting that Great Financial Crisis (GFC)

was the logical result of flawed policies implemented after the 2000

Dot-Com crash (which, in turn, was the result of flawed policies

pursued in the 1990's), the central banks decided after 2008 to

double down on their bets - implementing even worse policies.

The

Largest-Ever Monetary Experiment In Human History

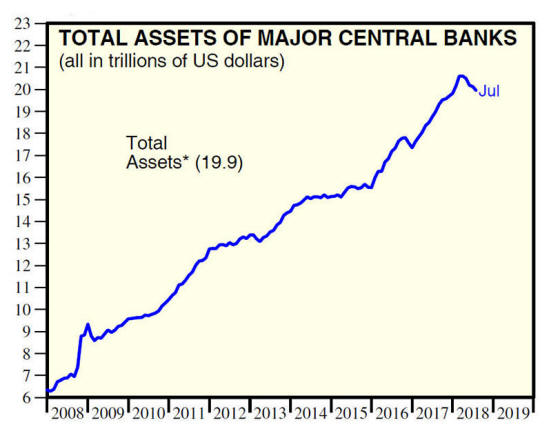

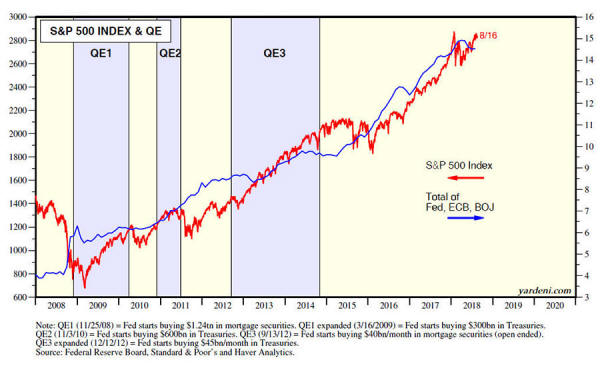

It's not hyperbole to say that the monetary experiment conducted

over the past ten years by the world's leading central banks (and

its resulting social and political ramifications) is the

largest-ever in human history:

Source

This global flood of freshly-printed 'thin air' money has no

parallel in the historical records.

All around the world,

each of us is part of a grand experiment being conducted without the

benefits of either prior experience or controls. Its outcome will be

binary: either super-great or spectacularly awful.

If the former, then no worries. We'll just continue to borrow and

spend in ever-greater amounts - forever. Perpetual prosperity for

everyone!

But if things hit a breaking point, then you had better be prepared

for some truly bad times.

Excessive money printing leads to the destruction of currency.

Fiat money like,

...is a social contract

and has an associated set of related agreements.

When that contract and

those agreements are broken by reckless expansion of the currency

base, things fall apart fast. We need look no further than

current-day Venezuela to understand

that.

It's important to remember that money - whether physical cash or in

digital form, stocks, or bonds - is just a claim on real wealth.

Real wealth is: land,

clothes, food, oil… you know, 'real' things...

We expect that our cash

will be able to buy us the real things we want when we want them.

We trust that our stocks

give us an ownership stake in a real company producing real things

for real profits. We rely on our bonds being re-paid in the future

along with interest; but if not, we expect that our bond becomes a

claim on valuable collateral.

Ideally, the money supply and the amount of real wealth should exist

in balance. As money is a claim on "stuff", as economic output (i.e.

"stuff") increases, then so should the claims. And vice-versa during

periods of economic contraction.

But what happens when the claims start to far outweigh the 'real'

"stuff"? That's when things get precarious...

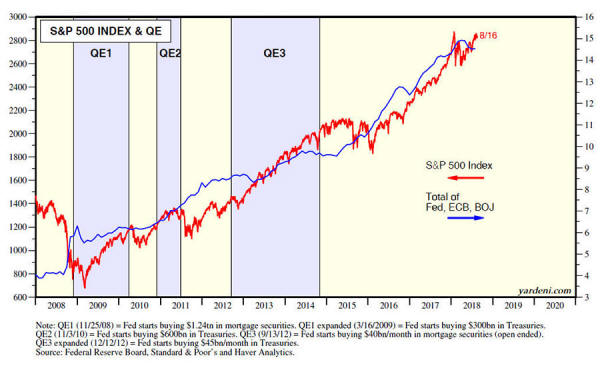

Note how dramatically the claims represented by just the

S&P 500 index alone have quadrupled

since the start of 2009, driven by the central banks' quantitative

easing programs:

Source

The flood of money unleashed by

QE didn't result in vast amounts of

new actual wealth being created (i.e. greater productive output per

capita).

But it did result in

grotesquely-inflated financial asset prices that have helped to

create the most profound wealth and income inequality seen in our

lifetime (perhaps ever).

The Many Sins

of the Central Banks

The list of central bank-induced injustices is long.

It reads like the rap

sheet of a virulent psychopath:

-

$trillions looted

from savers and handed to the big banks and leveraged

speculators

-

ruined pensions

-

shattered

retirement dreams for millions

-

record amounts of

debt in every corner of the global economy

-

an increasingly

unaffordable cost of living for everyone but the elite 1%...

"But we had

to save the system!" cry the central bankers in their

defense.

Even if that were the

case (and I dispute whether the world is really better off for

having saved Citibank et al.), that rescue should have ended back in

mid-2009, at the latest.

But instead, the central banks ramped up their wanton ways in the

years since the GFC.

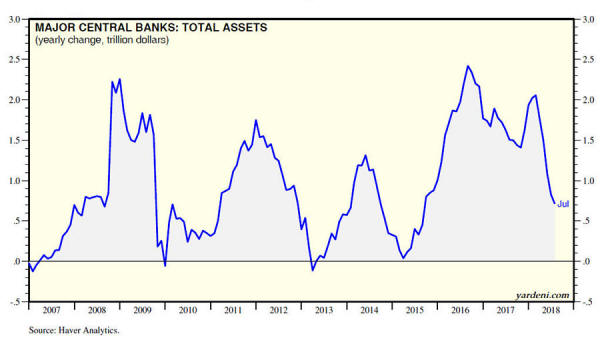

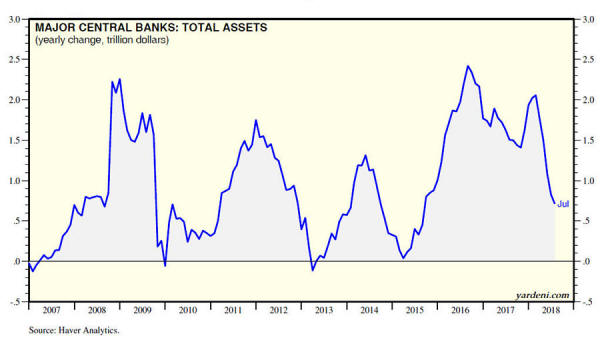

Did you know that their

largest-ever printing spree happened over the past two years? (2016

to 2017):

Source

The bigger the printing spree the bigger the fundamental

distortions.

In such a world, up

becomes down, black becomes white, and right becomes wrong. All of

which means that fundamental analysis, has been all but useless as a

predictor of prices.

All that has mattered is

the answer to the question:

"How much will the

central banks print next...?"

In such an environment,

there's no room for investors.

It forces all of us to

become speculators, trying to predict what a small cabal of bankers

are thinking.

But among their very worst offenses has been the manipulation of

sentiment. The prices of financial assets and commodities have

become political and propaganda tools, which means that nothing can

be left to chance.

All prices have to send

the "right" signals at all times, in the same way that certain news

outlets pump a point of view endlessly. Repetition creates its own

reality.

Because of the increasingly frequent (probably daily), interventions

by central banks and their proxies, the financial markets have

become ""markets"". They no longer provide us with any useful

signals about the future or about the current health of the economy.

Instead, they only tell us what the authorities want us to hear.

To them, all that matters is strength and stability.

As long as those conditions continue to be met for stocks, bonds and

real estate prices, most people are content to let things ride and

not probe too deeply.

But when this scam comes to its inevitable end:

the crash will be

spectacular when it arrives.

This reckoning is already

way overdue.

At this point, we find

ourselves in the odd position of rooting for it to happen soon, as

the potential energy in the system builds with every passing day.

Our worry is that if the

crash is delayed for much longer, its resulting carnage will be so

large that it will be unsurvivable.

And while we mean that in the figurative sense for people's

portfolios, it's possible that the crash could become literally

unsurvivable if the political "solution" to deflect blame away from

the the central banks and their DC partners-in-crime is a kinetic

war.

When viewed in that light, America's histrionic attempts to

demonize Russia over the past

few years begin to make frighteningly more sense...

It's Time to

'Talk Turkey'

We've been vocal of late about the numerous signs that another great

financial crisis is building.

The gut-punch Turkey

hit global markets with this week is just one example.

Yes, it will be painful

to crash from here.

But once the needed

correction is underway, we'll have the opportunity to make the best

of it. We can pick up the pieces and begin building towards a future

we can all believe in.

Yes, there's no avoiding the pain of taking our lumps for the the

past mistakes we've made. But we don't have to compound our misery

by continuing to do more of exactly what got us into this mess in

the first place. We simply need the courage to face the

psychological burden of admitting to our prior failings.

That's doable...

It all starts with being honest with ourselves.

Look, we all know the world is finite:

Infinite economic growth on a

finite planet is an impossibility...

We have all the data we need to

make that conclusion. Every passing day where we pretend that's

somehow untrue or avoidable makes the eventual adjustment that much

more wrenching.

It's an intellectually simple exercise to conduct. But an

emotionally impossible task for those whose internal belief systems

would be hopelessly compromised by allowing that logic to penetrate

their world view.

And so the future will be represented by two sorts of people:

I sincerely hope that

you're not among those deterred from preparing by the last gleaming

of today's glittering stock prices.

We're going to need as

many prepared people as possible in the coming future. And we may

need them soon. The severe recent deterioration in the Emerging

Markets threatens a contagion that could well start the next crisis.

Turkey is currently in a major currency crisis threatening to

metastasize into a full-blown sovereign debt crisis.

Defaults there will spill

over into Europe's banking system (which has made loads of shaky

loans to Turkey), and from there cause domino effects throughout the

rest of the world.

But Turkey isn't the weakest or the most worrying country faltering:

Italy is stumbling,

as is Brazil, and even China...

But Asia ex-China is the

real powderkeg:

their unserviceable

debts dwarf everybody else.

|