|

by Tom Luongo

July 29,

2019

from

TomLuongo Website

Deal or No-Deal, when it comes to

BREXIT, the euro is toast.

Markets, however, believe

the fantasy of its survival. And as we approach the end of July the

euro clings to support at $1.11, mere pips away from a technical

breakdown.

That breakdown will trigger a wave of asset liquidation and another

round of negative headlines emanating from troubled German banks.

With 10 Downing St. now saying No-Deal is acceptable, the

hard line negotiating tactics of

the European Union have hit a rocky

shore. Because it looks like

Boris Johnson is ready to give

as good as he gets.

I've been saying this for a long time.

The EU is not a tough

nut to crack.

They have no leverage

in these BREXIT negotiations.

What they had was a stacked deck of British officials

negotiating with Brussels on Brussels' terms.

It's not a negotiation if both sides agree on terms. It's a

surrender...

The only negotiation that

went on during (Theresa) May's administration was with the

British people on accepting the horrific treaty written by German

Chancellor Angela Merkel's staff and rubber-stamped by May.

Today Britain looks different, at least on the surface.

The market is

punishing them for entertaining No-Deal.

The pound is falling out of bed today below $1.24 because

Johnson looks serious about re-opening negotiations or opting

for No-Deal.

But here's the thing.

The eurozone is

facing a recession.

I've talked about

Germany's freefalling economy

before.

It's not getting any

better. And it won't if a no-deal BREXIT occurs.

So the

Forex markets are offside today.

Way offside...

Johnson came out and

bypassed the Withdrawal Treaty completely saying let's

just move to Stage 2 of BREXIT, the free-trade agreement.

You never would have

heard that under Theresa May.

That's why the pound

is getting crushed today...

At some point, however,

that move will get overdone. The EUR/GBP pair is way overbought and

was looking toppy before Monday's massacre in the pound.

What's clear, however, is that in the short term, the pound will

be allowed to collapse to assist the 'Remain' case.

As the media focuses on

the pound falling it neglects the pound is now more attractive to

U.S. investors. It's making Trump's offer of a free-trade deal more

attractive to wobbly Tory MP's.

The pound has been over-valued for years thanks to being slaved to

the euro-zone. President Trump knows this and this is why he

backs BREXIT as well as both Johnson and Nigel Farage.

It's also why Trump is going after France for its new taxes on U.S.

tech firms.

The wine tariff is

political cover...

Trump is attacking

the French side of the brewing war for control of the EU.

France's President

Emmanuel Macron, while

ignoring the rising potential for domestic revolution via

the Gilet Jaunes, has

positioned himself as the de facto leader of the EU as Angela

Merkel's political power wanes.

And BREXIT is the key to this.

Macron wants to

punish Britain for BREXIT. He'd rather a no-deal than any

concessions. Merkel will countenance a deal rather than lose the

U.K. completely.

Mike Shedlock

is right:

the EU is complacent

now about a No-Deal but panic will soon set in.

No-Deal BREXIT is

very much on the table.

Would Macron allow a

no-deal to hurt rival Germany since Germany's trade deficit with

the U.K. is more important to them than France?

I think so...

Johnson would be happy to sit down with Trump and cut a free-trade

deal yesterday. But being in the EU forbids this. And it's France

that is the biggest obstacle, regardless, just as it was for any

EU/US trade deal.

As Martin Armstrong

points out today:

The restrictions on

trade imposed by Brussels are impossible to manage because all

28 members have a say in any trade deal.

This is why the deal

with the USA took so long to start with and it became

unworkable. Trump offered a free trade deal and France was the

one screaming the loudest.

Germany cannot cut a

deal with the USA because of France and neither could Britain.

A breakdown in the Euro

below $1.11 puts it on the path to its low at $1.034.

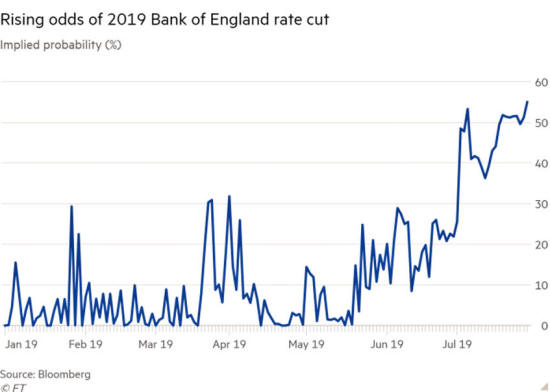

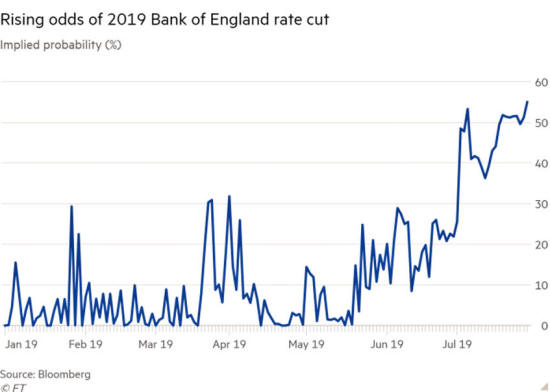

Markets are screaming for

the Bank of England to cut rates alongside the FED on Thursday.

Source:

Financial Times

Why? The markets are against BREXIT...

In essence the market is front-running a rate cut and it means we

could see the pound at $1.20. But euro-traders are still clinging to

hope that

Jay Powell and

the FED won't disappoint on

Thursday.

Europe can't and won't respond to Johnson until the last possible

minute.

Its hardball tactics

on BREXIT are all it has.

Johnson's initial calls with EU leadership, left things exactly

as they are.

It's clear they hate

him. It's also clear the EU still thinks its agents in British

parliament can block Johnson's plans to exit without a deal on

October 31st.

Those people are now the EU's best hope, but they don't have

many if any tools left if Johnson is serious about October 31st.

A pending election won't stop BREXIT.

The government won't

allow a revocation of Article 50... If it were possible Theresa

May would have done it.

All they have is delay and attrition.

The road, however, looks

like a dead end...

Johnson, for his part, is smart in using the Irish backstop

as his wedge issue. He's turning it around on the EU who used it as

a cudgel wielded by Theresa May earlier this year to bludgeon

Tories, including both Johnson and prominent Brexiteer

Jacob Rees-Mogg, into voting

for the deal as the threat to BREXIT looked existential.

Johnson and Rees-Mogg both paid politically for this vote and will

continue to do so.

While the opinion polls

have moved their way in this past

week, the situation between the Tories and the BREXIT Party is still

very fluid.

Johnson knows this.

Brussels knows this.

And if their planned

sabotage of BREXIT fails over the next ninety-plus days, the

markets will finally come to terms with it.

Farage has played this

smartly, as I pointed out last week,

handing Johnson the talking points

he needs to consolidate power after he delivers BREXIT.

If Johnson is serious

about bringing about a 'post-EU golden age for the U.K.',

then he would be taking Farage up on his offer of help to deliver

wins in the Labour-heavy Midlands where BREXIT did so well in the EU

elections in May.

That's the way things look like right now...

Johnson is creating an

environment for a post-BREXIT general election to consolidate

power, destroy the 'Tory Remainers' * and crush the resurgent

Liberal Democrats who have become the single-issue Remain party.

* NOTE:

Remainers

Those in favor of the UK remaining in the EU are sometimes referred

to as "Remainers". The derogatory term "Remoaner" (a blend of "remainer"

and "moan") is sometimes used by Brexiters to describe adherents of

the Remain campaign.

Source

But he can, only with Farage's help, take control of the Midlands,

England's version of "Les Deplorables" for a generation.

That's the thing markets

will have to come to terms with. The EU will then have to stop

distracting itself with trifles and turn back to the reality that it

is a club that fewer and fewer want to be a part of.

Just wait until the

markets figure that out...

|