|

September 13, 2019 from Mises Website

The US dollar continues to enjoy the confidence of markets, governments, and central banks. But faith in the US dollar weakens a little every year.

...and many small countries set new initiatives every year to make themselves independent. And gold, too, plays a major role in this slow departure from the US dollar.

But for the world

financial system, none of their currencies offer a viable,

fully-fledged alternative to the US dollar yet, which is why any

news of the death of the US dollar is definitely exaggerated.

Europe's Small

Uprising

This is not the case. Twenty years after its creation in 1999, the Euro area is larger than ever.

Of course, nothing is perfect in the EU.

Against this backdrop, the celebrations to mark the 20th anniversary of the Euro were not particularly large and pompous.

But there was a lot of talking going on.

In his "State of the Union" speech in September 2018, EU Commission President Jean-Claude Juncker called for a stronger role for the Euro in the international monetary system - and he did bring facts:

The Euro currently accounts for around 20% of global currency reserves.

This amount exceeds the Euro zone's share of global economic output. Around 36% of global payments are already made in the Euro. The US dollar is at 40%. The EU imports oil and gas worth around EUR 300bn annually.

But 80% of these are still invoiced in US dollars today.

In view of the fact that only 2% of energy imports come from the USA, Juncker commented:

Despite all the economic, political and structural problems within the Euro area, this is a statement full of self-confidence.

Iran is, above all, a case study in

what Washington can do to you if you expose yourself to the US

dollar for better or for worse.

SWIFT belongs to an international banking consortium and is even based in Belgium - within the EU. Nevertheless, the USA was able to build up enough pressure to exclude Iran from SWIFT.

That's what the governor of the Oesterreichische Nationalbank (OeNB), Ewald Nowotny, means when he says:

With the Joint Comprehensive Plan of Action (JCPOA) signed this phase was believed to be over.

But Donald Trump withdrew from JCPOA in May 2018. What's more, he has managed to get SWIFT to expel Iran again. That was a shock to the other signers of the deal.

Suddenly the EU took action...

For the first time since the introduction of the Euro, the idea of a separate payment agency was put forward.

The abbreviation stands for "Instrument in Support of Trade Exchanges".

The fact that China and Russia have promised INSTEX support should come as no surprise. 4

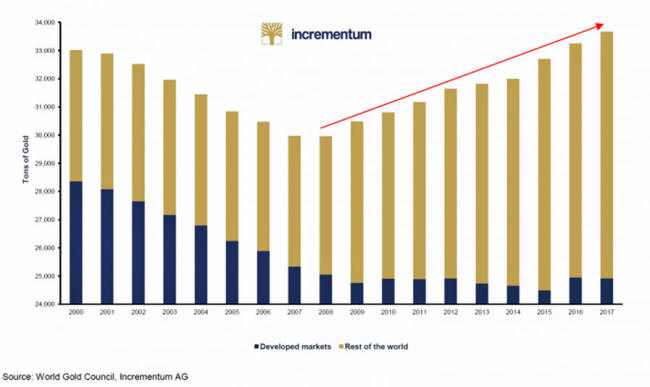

But when it became known at the beginning of this year that the central banks had recently bought more gold in 2018 than they had since 1971, that revelation was worth some headlines.

In 2018 alone they bought 651 tonnes of gold. This figure corresponds to an increase of 74% over the previous year. 5

Analysts of the

World Gold Council expect purchases

of around 750 tonnes again this year.

You also have to ask yourself why the central banks are such hard-working gold buyers...

Gold, which many central banks now include in their balance sheets at market value,6 offers an alternative. It is indeed the only truly neutral asset available to governments and central banks.

Around a third of the world's gold holdings are held in the vaults of central banks.

Nobody describes the banks' rationale better than DNB, the central bank of the Netherlands:

Only the next major crisis will show whether the Euro, the Yuan, or Gold will really be able to do any harm to the leading currency status of the US dollar - or whether the US dollar still has enough life left in it to prevail.

Until then, the creeping loss of confidence in the dominant currency of the past seven decades is likely to continue.

References

|