|

It will be backed by precious metals. The launch of the new cryptomoney is scheduled for the next week.

No details of quantities offered for sale are available at this point.

The first public

offering, the 'Pre-sale' of 38.4 million of the oil-backed "Petro"

on 20 February, has raised US$ 735 million equivalent which is

considered a great success.

By a raw material that the entire world needs, not gold - which has hardly any productive use, but whose value is mostly speculative - not hot air like the US dollar.

Not

fiat money like the

US-dollar and the Euro largely made by private banks without any

economic substance whatsoever, and which are coercive. But a

currency based on the very source for economic output - energy.

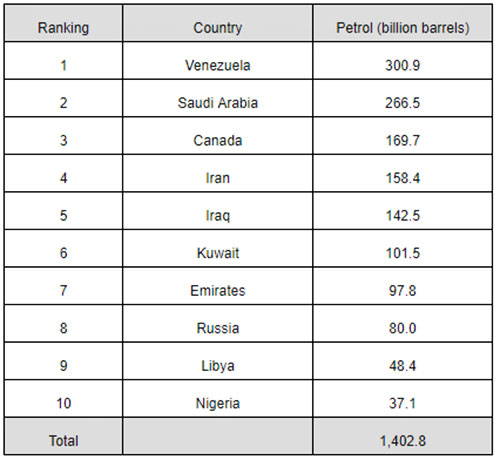

The Petro's value will fluctuate with the market price of petrol, currently around US$61 per barrel of crude.

The Petro was essentially created to avoid and circumvent illegal US sanctions, dollar blockades, confiscations of assets abroad, as well as to escape illegal manipulations from Florida of the Bolivarian Republic's local currency, the Bolívar, via the black-market dollars flooding Venezuela; and, not least, to trade internationally in a non-US-dollar linked currency.

The Petro is a largely

government controlled blockchain currency, totally outside the reach

of the US Federal Reserve (FED) and Wall Street - and it is based on

the value of the world's key energy, hydrocarbons, of which

Venezuela has the globe's largest proven reserves.

Of the 100 million, 82.4% will be offered to the market in two stages, an initial private Pre-Sale of 38.4% of so-called non-minable 'tokens', followed by a public offering of 44% of the cryptomoney.

The remaining 17.6

million are reserved for the government, i.e. the Venezuelan

Authority for Cryptomoney and Related Activities,

SUPCACVEN.

President Maduro has

later affirmed that his country has already entered contracts with

important trading partners and the world's major blockchain

currencies.

It sets a new paradigm for international trade, for safe payment systems that cannot be tampered with by,

It will allow economic development outside illegal 'sanctions'.

The Petro is a shining

light for new found freedom from a hegemonic dollar oppression.

Imagine, other countries

following Venezuela's example, other energy producers, many if not

most of whom would be happy to get out from under the Yankee's boots

of blood dollars inundating the world thanks to uncountable wars and

conflicts they finance - and millions of innocent people they help

kill.

Of the 2,300 to 3,400 tons of gold mined every year around the globe, it is estimated that about a quarter to a third is illegally begotten, so called 'blood' gold, extracted under the most horrendous conditions of,

...and more.

That's the legacy of

gold,

the MSM ("main stream media"), of

course, doesn't talk about.

In desperation,

Washington might want to apply another gold-based international norm

to salvage the faltering dollar. Of course, a norm designed to favor

the US, with the rest of the western and developing world destined

to absorb the astronomical US debt...

Eventually this illegal

gold is purchased by major gold mining or refining corporations

mixed with 'legal' gold, so that the illegal portion is no longer

traceable.

But the world wouldn't go for it. No more. There are healthier and more transparent physical assets to back up international currencies, i.e. the Petro, backed by energy.

Though not free from

socio-environmental damage, petrol-energy may gradually convert into

alternative sources of energy, like solar, wind and aquatic power or

a combination of all of them.

Today it's the other way around:

Thus, economies in our western world are prone to be manipulated by the rulers and their institutions:

...that support the debt/interest-based monetary rules - they are purposefully maneuvered into booms and busts.

With every bust, more

capital is transferred from the bottom to the top, from the poor to

an ever-smaller elite. The energy-based Petro is a first step away

from this sham.

The world would need Petros, as it used to need US dollars to buy hydrocarbon energy. But Petros are blockchain-safe, less vulnerable for manipulation.

They are not coercive,

they are not made for blackmailing 'unwilling' nations into

submission; they are not tools for violence. They are instruments of

equitable production and trade. They are also instruments of

protection from the fiat money abuses.

Not bad to start a worldwide cryptocurrency, based on energy, controlled by energy and by all those who will use energy - that might become a world reserve currency, at par with the Chinese economy - and gold-backed Yuan, but much safer than the fiat currencies of,

The move away from the US-dollar hegemony might result in an implosion of the western monetary structure as we know it.

It may stop the predator empire of the United States in its tracks, by simply decimating her economy of fraud, built on military might, exploitation and colonization of the world, on racism, and on a bulldozing scruple-less killing machine.

The Petro, a secured cryptocurrency based on energy that everybody needs, might become the precursor for an international payment and trading scheme towards a more balanced and equitable approach to worldwide socio-economy development.

$1 Billion in Just Two Days

from

GlobalResearch Website

Venezuelan President Maduro said almost one million people have visited the Petro website since the currency's launch

two days ago.

Each day that passes,

The Venezuelan government

issued the digital currency in response to the financial sanctions

applied by the United States and European Union, which prevent its

citizens from acquiring new debt from the oil nation and limited the

movements of Caracas' money in global banking.

The cryptocurrency has generated interest in several countries, such as,

...after the Venezuelan government launched a private presale of 38.4 million Petros of the total 100 million released, which will extend until March 19.

The launch of the Petro was announced in December.

It is regulated by the

Superintendence of Cryptocurrencies and Related Activities, as

well as the

Blockchain Observatory.

However, the U.S.

Security and Exchanges Commission has been increasingly tracking

digital currencies, classifying some tokens as securities, thus

making them subject to oversight.

|