by WashingtonsBlog

January 21, 2013

from

WashingtonsBlog Website

Why Is Germany Demanding

...300 Tons of

Gold from the U.S. and 374 Tons from France?

The German’s are demanding that the U.S. return

all of the 374 tons of gold held by the Bank of France, and 300 tons of the

1500 tons of bullion held by the New York Federal Reserve.

Some say that Germany is only demanding

repatriation of its gold due to internal political pressures, and that no

other countries will do so.

But Pimco co-CEO El Erian

says:

In the first instance, it could translate

into pressures on other countries to also repatriate part of their gold

holdings.

After all, if you can safely store your gold

at home - a big if for some countries - no government would wish to be

seen as one of the last to outsource all of this activity to foreign

central banks.

As we

noted last November:

Romania has

demanded for many years that Russia return its gold.

Last year, Venezuela

demanded the return of 90 tons of gold from the Bank of England.

***

As Zero Hedge

notes (quoting Bloomberg):

Ecuador’s government wants the nation’s banks to repatriate about

one third of their foreign holdings to support national growth, the

head of the country’s tax agency said.

Carlos Carrasco, director of the tax

agency known as the SRI, said today that Ecuador’s

lenders could repatriate about $1.7 billion and still fulfill

obligations to international clients.

Carrasco spoke at a

congressional hearing in Quito on a government proposal to raise

taxes on banks to finance cash subsidies to the South American

nation’s poor.

Four members of the Swiss Parliament

want Switzerland to reclaim its gold.

Some people in the Netherlands

want their gold back as well.

(Forbes

notes that Iran and Libya have recently repatriated their gold as well).

The Telegraph’s lead economics writer -

Ambrose Evans Pritchard - argues that the German repatriation demand

shows that we’re switching to a

de facto gold standard:

Central banks around the world bought more

bullion last year in terms of tonnage than at any time in almost half a

century.

They added a net 536 tonnes in 2012 as they

diversified fresh reserves away from the four fiat suspects: dollar,

euro, sterling, and yen.

The Washington Accord, where Britain, Spain,

Holland, South Africa, Switzerland, and others sold a chunk of their

gold each year, already seems another era - the Gordon Brown era, you

might call it.

That was the illusionary period when

investors thought the euro would take its place as the twin pillar of a

new G2 condominium alongside the dollar. That hope has faded. Central

bank holdings of euro bonds have fallen back to 26pc, where they were

almost a decade ago.

Neither the euro nor the dollar can inspire

full confidence, although for different reasons. EMU is a dysfunctional

construct, covering two incompatible economies, prone to lurching from

crisis to crisis, without a unified treasury to back it up. The dollar

stands on a pyramid of debt.

We all know that this debt will be inflated

away over time - for better or worse. The only real disagreement is over

the speed.

***

My guess is that any new Gold Standard will

be sui generis, and better for it.

Let gold will take its place as a

third reserve currency, one that cannot be devalued, and one that holds

the others to account, but not so dominant that it hitches our

collective destinies to the inflationary ups (yes, gold was highly

inflationary after the Conquista) and the deflationary downs of global

mine supply.

***

A third reserve currency is just what

America needs.

As Prof Micheal Pettis from Beijing University has

argued, holding the world’s reserve currency is an “exorbitant burden”

that the US could do without.

The Triffin Dilemma - advanced by the

Belgian economist Robert Triffin in the 1960s - suggests that the holder

of the paramount currency faces an inherent contradiction. It must run a

structural trade deficit over time to keep the system afloat, but this

will undermine its own economy. The system self-destructs.

A partial Gold Standard - created by the

global market, and beholden to nobody - is the best of all worlds. It

offers a store of value (though no yield). It acts a balancing force. It

is not dominant enough to smother the system.

Let us have three world currencies, a tripod

with a golden leg. It might even be stable.

How Much Gold Is There?

It’s not confidence-inspiring that CNBC’s senior

editor John Carney argues that

it doesn’t matter whether or not the U.S. has the physical gold it

claims to hold.

In fact, many allege that

the gold is gone:

Cheviot Asset Management’s Ned

Naylor-Leyland says that the FED and Bank of England will

never return gold to its foreign owners.

Jim Willie

says that the gold is gone.

***

Others allege that the gold has not been

sold outright, but has been leased or encumbered, so that the U.S. does

not own it outright.

$10 billion dollar fund manager Eric Sprott

writes - in an article entitled “Do

Western Central Banks Have Any Gold Left???“:

If the Western central banks are indeed

leasing out their physical reserves, they would not actually have to

disclose the specific amounts of gold that leave their respective

vaults.

According to a document on the European

Central Bank’s (ECB) website regarding the statistical treatment of

the Eurosystem’s International Reserves, current reporting

guidelines do not require central banks to differentiate between

gold owned outright versus gold lent out or swapped with another

party.

The document states that, “reversible

transactions in gold do not have any effect on the level of monetary

gold regardless of the type of transaction (i.e. gold

swaps, repos, deposits

or loans), in line with the recommendations contained in the IMF

guidelines.”

6

Under current reporting guidelines,

therefore, central banks are permitted to continue carrying the

entry of physical gold on their balance sheet even if they’ve

swapped it or lent it out entirely. You can see this in the way

Western central banks refer to their gold reserves.

Indeed, it is now well-documented that

the FED has leased out a large chunk of its gold reserves, and that big

banks

borrow gold from central banks and then to multiple parties.

As such, it might not entirely surprising that

the

FED needs 7 years to give Germany back its 300 tons of gold… even

though the FED claims to

hold 6,720 tons at the New York Federal Reserve Bank alone:

Even Pimco co-CEO Bill Gross

says:

When the FED now writes $85 billion of checks to buy Treasuries and mortgages every month, they really have

nothing in the “bank” to back them.

Supposedly they own a few billion dollars of “gold certificates” that

represent a fairy-tale claim on Ft. Knox’s secret stash, but there’s

essentially nothing there but trust...

When a primary dealer such as J.P.

Morgan or Bank of America sells its Treasuries to the FED, it gets a

“credit” in its account with the FED, known as “reserves.” It can spend

those reserves for something else, but then another bank gets a credit

for its reserves and so on and so on.

The FED has told its member banks

“Trust me, we will always honor your reserves,” and so the banks do, and

corporations and ordinary citizens trust the banks, and “the beat goes

on,” as Sonny and Cher sang.

$54 trillion of credit in the U.S. financial system based

upon trusting a central bank with nothing in the vault to back it up.

Amazing!

And given that gold-plated tungsten has turned

up all over the world, and that a top German gold expert found fake gold

bars imprinted with official U.S. markings, Germans may have lost confidence

in the trustworthiness of the FED. See

this,

this,

this and

this.

This may especially be true since the FED

refused to allow Germans to inspect their own gold stored at the FED.

Currency War?

The gold repatriation is - without doubt-

related to currency.

As Forbes

notes:

Officials at the Bundesbank… acknowledged

the move is “preemptive” in case a “currency crisis” hits the European

Monetary Union.

***

“No, we have no intention to sell gold,” a

Bundesbank spokesman said on the phone Wednesday, “[the relocation] is

in case of a currency crisis.”

Reggie Middleton thinks that

Germany’s demand for its gold is part of a currency war.

Jim Rickards has previously

said that the FED had plans to grab Germany gold:

Jim Rickards has outlined possible plans by

the Federal Reserve to commandeer Germany’s and all foreign depositors

of sovereign gold at the New York Federal Reserve in the event of a

dollar and monetary crisis leading to intensified “currency wars” and

the ‘nuclear option’ of a drastic upward revision of the price of gold

and a return to a quasi gold standard is contemplated by embattled

central banks to prevent debt deflation.

Is that one reason that Germany is demanding its

gold back now?

China is quietly becoming a

gold superpower, and China has long been rumored to be

converting the Yuan to a gold-backed currency.

The Telegraph’s James Delingpole

points out:

Back in the mid-1920s, the head of the

German Central Bank, Herr Hjalmar Schacht, went to New York to see

Germany’s gold. However the NY FED officials were unable to find the

palette of Germany’s gold bullion.

The Chairman of the Federal Reserve,

Benjamin Strong was mortified, but to put him at ease Herr Schacht

turned to him and said ‘Never mind, I believe you when you say the gold is there. Even if it weren’t you are good for its

replacement.’

(H/T

The Real Asset Company)

But that was then and this is now. In the

eyes of the Germans - and who can blame them? - America has lost its

mojo to such a degree that it can no longer be trusted honor its debts,

even in the unlikely event that it were financially capable of doing so.

Which is why, following in the footsteps of

Venezuela’s Hugo Chavez (who may be an idiot but is definitely no fool),

Germany is repatriatriating its gold from the US federal reserve. It

will now be stored in Frankfurt.

***

[Things] may look calm on the surface, but

this latest move by the Bundesbank gives us a pretty good indication

that beneath the surface that serene-seeming swan is paddling for dear

life.

If you want a full analysis I recommend

this excellent summary by Jan Skoyles.

The scary part is this bit:

Every few months there is a discussion

regarding what China are planning on doing with the gold they both

mine and import every year, with many believing they are hoarding

the metal as an insurance against the billions of US Treasury bonds,

notes and bills they hold.

Many believe they will issue some kind

of gold-backed currency in the short-term and dump its one trillion

dollars’ worth of US Treasury securities.

Whilst, at the moment the

US seem to take their monopoly currency for granted, should the

Chinese or anyone else behave in such a manner, the US will need to

respond - most likely with gold, which on its own it does not have

enough of.

Anyone who thinks this isn’t going to happen

eventually should read Peter Schiff’s parable

How An Economy Grows And Why It Crashes. If something can’t go on

forever, it won’t.

In other words, Rickards and Skoyles appear to

argue that Germany may be repatriating gold in the first round of musical

chairs in which China is preparing to roll out a gold-backed Yuan.

Under this theory, the rest of the world’s

currencies will sink unless their nations’ can scramble to get their hands

on enough gold to lend credibility to their paper.

Postscript

Michael Rivero

thinks that the war in Mali is connected:

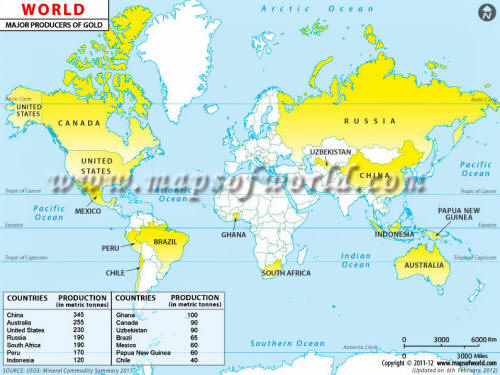

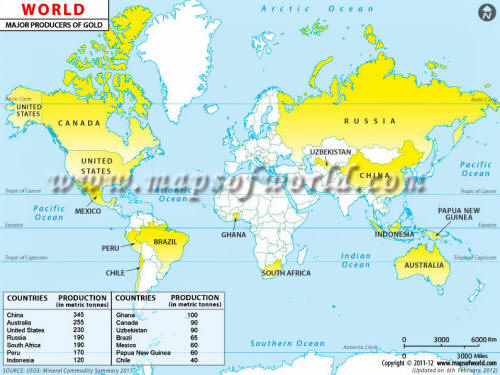

Mali is one of the world’s largest gold

producers. Together with neighboring Ghana they account for 7-8% of

world gold output. That makes them a rich prize for nations desperate

for real physical gold.

So, even as Germany started demanding their

gold back from the Bank of France and the New York Federal Reserve,

France (aided by the US) decided to invade Mali to fight “Islamists”

working for “Al Qaeda.”

Of course, “Islamists” has become the

catch-all label for people that need to be killed to get them out of the

way of the path to riches, and the people being bombed by France (aided

by the US) are not “Al Qaeda” but Tawariqs, who have been fighting for

their independence for 150 years, long before the CIA created “Al

Qaeda”.

Left to themselves, the Tawariqs could sell

gold to whoever they want for whatever they want, and right now China

can outbid the US and France.