|

Common wisdom has China as the future model for the Globalist economy.

Also, conventional thinking has the Western financial debt created money system as the backbone of the New World Order.

The big question is,

When "China Has Announced Plans For A 'World Currency'," the world is put on notice that a fundamental shift is about to take place.

Before the celebration begins that the game is up for the Federal Reserve mastery from the days of the Bretton Woods Conference, look a little closer.

While gold and its fixed price were instrumental to that monitory standard, the freeing from fixed rates has generated the madness of floating currency speculation that now dominates the financial markets.

The cunning and patient Chinese built their export economy on cheap priced goods into their importing customer economies. Saving is a noble objective in the East, while going into debt is the hallmark of Western practices.

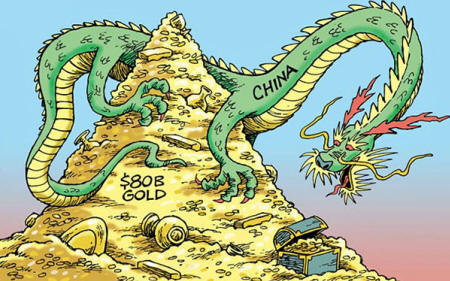

The Chinese have applied their huge balance of trade surpluses to buying up commodities. Most notable is gold.

The article, "Could China actually have 30,000 tonnes of gold in reserves?," makes the strongest argument that China is poised to become the new superior currency is based upon the potential of establishing a convertible relationship between the Renminbi and bullion.

Before the rush to the door to dump your U.S. Dollars for whatever store of wealth one believes will maintain its purchasing value, consider what the voice of the global financial establishment, the IMF says.

Stating the outlook from the central Bankster's perspective in, "Will the Renminbi Rule?," the message is that paper money, burdened by debt, is still firmly in place.

The IMF concludes:

Now for anyone even remotely schooled in the manners and maturations of the financial elites, turning the other cheek to a pretender, is not in the lesson book.

Investment manager, Richard Harris offers in a report, "Time to create new Chinese-Hong Kong dollar," an interesting possibility.

Keeping paper money in place as the international medium of exchange is fundamental to the New World Order.

While China may never implement an actual redemption of gold for their Renminbi, there is a real possibility that some gold weighted backing for Chinese paper instruments could be introduced.

The U.S. Dollar maintains illusionary worth, only because the central bankers are all in with their dollar dominated derivatives.

Moreover, the Chinese are very much dependent upon their exports to keep their economy going. Settlement in Federal Reserve notes is crucial for the American system to keep buying from overseas.

Just the mere threat of payment in the Renminbi for all the Chinese goods that Walmart imports could be devastating. Allowing for a gradual transition into a semi-reserve Renminbi status keeps the Bankster's game going.

The prudent analysis suggests that the NWO created China's emergence into an economic power through off-shoring domestic industries in their subject countries. Nonetheless, the international cabal is not about to starve their interest paying indebted nations by letting the Chinese accumulate even greater cash reserves.

Expect a downturn in China's prospects, as soon as any ascendency for their currency begins gaining a reserve acceptance.

|