|

by Peter Koenig

September

21, 2017

from

GlobalResearch Website

|

Peter Koenig is an economist

and geopolitical analyst.

He is also a former World Bank staff and worked

extensively around the world in the fields of

environment and water resources. He lectures at

universities in the US, Europe and South America.

He

writes regularly for Global Research, ICH, RT, Sputnik,

PressTV, The 4th Media (China), TeleSUR, The Vineyard of

The Saker Blog,

and other internet sites.

He is the

author of Implosion - An Economic Thriller about War,

Environmental Destruction and Corporate Greed - fiction

based on facts and on 30 years of World Bank experience

around the globe.

He is also a co-author of The World

Order and Revolution! - Essays from the Resistance.

|

Based on an interview with

Tashreeq Truebody, Radio 786,

South Africa

1. Global

Economy and BRICS

Peter Koenig:

Let's put

the BRICS in perspective:

The BRICS are of

course Brazil, Russia, India, China and South Africa.

Together they make up

for almost 50% of the world population and close to one third of

the world's economic output, or GDP.

This alone would make them fully independent from the western

economy, from the western, what I call, fraudulent dollar-based

monetary system.

And it will happen - it will happen sooner than

the world believes.

However, with the

current political structure of the BRICS, the relative lack of

political and economic coherence, safe for Russia and China,

this for the moment is just theory.

If you allow me, let's backtrack a bit in history, to where the

term BRIC came from, and who coined it.

At the beginning,

South Africa was not yet member of the association.

In 2001,

shortly after the 9/11, in 2001, the chief economist of Goldman

Sachs,

Jim O'Neill, invented the term

'BRIC' - as he was

forecasting that these emerging economies, spread throughout the

world, Brazil, Russia, India and China - would overtake the

so-called western economy by 2041.

The forecast was

later revised several times, all the way to 2032 - and now,

there is, I believe no formal forecast, but it could easily

happen by 2025, or earlier, especially with the new Oil-for-yuan

and gold exchange market soon to be opened in Shanghai.

Many

predict this to be the end of the petro-dollar, and the end of

the dollar hegemony.

Then strangely and formidably the four BRIC countries realized

their potential and took things in their own hands. That's how

dynamics work - often totally unpredictably.

For sure, Goldman

Sachs and their Chief economist had no clue that this would

create the western monetary and economic system's most daunting

adversary.

The first BRIC summit was held in Russia in June 2009. That was

the formal conference to create the BRICS.

By 2011, the five countries, Brazil, Russia, India and China -

plus South Africa were the five fastest growing emerging

markets, and in April 2013, South Africa was added to the BRIC

group - to make it formally the BRICS.

This just as a little historic introduction - to show that the

impetus for the BRIC(S) came actually form a most unlikely

western source - Goldman Sachs.

In the meantime, the BRICS are struggling with another reality.

For the BRICS to be

an effective alternative to the western economy, or the western

monetary system, they need a unified political vision, as well

as a coherent and unified economic development approach, one

that distances itself from the western dollar-euro based system.

Unfortunately, today this is not so. But that doesn't mean it

will not happen. Personally, I believe

it will. It may just take longer than the majority of the world

may have liked.

Both Brazil and India are totally in the hands of Wall Street,

the World Bank and the IMF.

In the case of India,

you will recall last fall's deadly monetary fiasco, when PM

Narendra Modi decided to cancel more than 80% of the

countries circulating cash currency, and as an interim step to

replace it with other bills and eventually

digitalize the Indian

economy.

It is not known how many poor Indians perished, those with no

access to bank accounts, those who have no alternative means to

pay for food.

Uncountable small businesses failed - an important

impact on the Indian economy. More, much more inhuman was the

impact on the poor average Indians.

But, Modi followed

the dictate of the west, of Wall Street and the IMF, with a

program to test digitalization in a large emerging economy,

implemented by USAID.

How much trust does India under Modi as

a BRICS member deserve?

And Brazil under neoliberal Temer, who is under

accusation of corruption; he has literally handed his country's

economy to the sharks of Wall Street, the IMF and the WB.

So, when Temer and

Modi stood there holding hands with the other three BRICS

members in Xiamen, China on 4th and 5th September, it looked to

me like a club that was united only by name.

Yet, the theme of this 9th BRICS Conference was "BRICS

- Stronger

Partnership for a Brighter Future" - I truly hope this

objective will be achieved. And it very well may - over time...

It is important to

approach such an event in a positive and forward-looking spirit.

Perhaps it was along the same philosophy, that ahead of the

September summit in Xiamen, President Putin said

something crucial, but highly political and highly diplomatic:

"It is important

that our group's activities are based on the principles of

equality, respect for one another's opinions and consensus.

Within BRICS, nothing is ever forced on anyone. When the

approaches of its members do not coincide, we work patiently

and carefully to coordinate them.

This open and trust-based

atmosphere is conducive to the successful implementation of

our tasks."

2.

Understanding Industrialization/development and the Brics Bank

PK: Let's

start with the BRICS development bank, now called New

Development Bank (NDB).

It emerged as an idea

from the Durban BRICS summit in March 2013 and was formally

created in 2014, and signed as a Treaty in July 2015.

Source: ndt.int

Under the Agreement the BRICS Development Bank, as it was first

called - now the NDB - they set up a "reserve currency pool" of

US$ 100 billion.

Each of the

five-member countries was to allocate an equal share of the US$

50 billion start-up capital, to be expanded later to the US$ 100

billion.

Contributions per country were, Brazil, $18 billion, Russia $18

billion, India $18 billion, China $41 billion and South Africa

$5 billion.

The problem is that the initial capital and the

Contingency Reserve Arrangement (CRA) of US$ 100 billion was set

up in US dollars.

How can they break loose from the western dollar-based monetary

system, if their contribution is dollar based?

Also, South Africa and Brazil are heavily indebted - in US

dollars. South Africa's current debt is today above 50% (US$ 153

billion) of GDP which stands just below 300 billion.

To comply with their contribution to the dollar-denominated CRA,

Brazil and SA may have to borrow from where? Wall Street, or

the IMF, as the CRA is a dollar reserve fund.

This puts these

countries even more into a dollar bondage, in the hands of

the

FED and the

Bretton Woods Organizations - instead of freeing

them from this predicament.

As a parenthesis, South Africa's interest on foreign debt of

$153 billion was about US$ 5 billion (2016). Foreign debt is

almost 52% of SA's GDP of close to US$ 300 billion.

The US$ 5 billion

debt payments are higher than the country's spending on tertiary

education (about R60 billion/US$ 4.6 billion equivalent).

This is also a good

reason to detach from a debt-based monetary system - and, as

originally was planned by the BRICS - migrate towards a BRICS

own monetary and international payment system - similar to the

one already introduced to the world by China - the Chinese

International Payment System (CIPS).

On Industrialization - the NDB will certainly help boost

industrialization within each of the BRICS countries, but also

among the BRICS countries - and even outside the BRICS nations,

as trade will increase.

At present the NDB has approved seven investment projects in the

BRICS countries, worth around $1.5 billion. This year, the NDB

is to approve a second package of investment projects worth $2.5

to $3 billion in total.

Although it is not clear what precisely these projects entail,

the original idea for the NDB was to support infrastructure and

energy projects within the BRICS countries.

There is a big need

for infrastructure and independent energy production.

Of course,

infrastructure and energy development, means also

industrialization and trade.

3. Economic

diversification

PK: A solid

BRICS cooperation, as well as an own development bank, will most

likely attract - and through the NDB leverage - new investments.

This was one of the

goals discussed during the Xiamen summit. The amount of which

is difficult to predict, but Indian PM Modi has talked about an

expected 40% increase over the next few years.

But even if India

or any BRICS country receives foreign investments, it will be

difficult to discern which investments are directly related to

the new BRICS strength, as so fervently expressed in Xiamen.

More important is the diversification of investments, as well as

the related trade. There are currently several countries on a -

what shall I call it, "waiting list" - to become members of the BRICS.

For example, South

Korea and Mexico (both are OECD members), Indonesia, Turkey,

Argentina, have been mentioned.

Trade between emerging and developing markets has already been

increasing more rapidly than "globalized average trade" for

which WTO imposes the rules.

I could imagine that

trade - and, thus, diversification - between BRICS countries, or

better even, an enlarged BRICS block, could really boom.

It would be a sort of

'globalization' with most trade barriers removed, of a

peace-oriented economy, one that strives for the well-being of

the people, rather than

an elite - and of course, an economy

that does not work for the war industry, as does the western

dollar-based economy.

For that reason, it will be important that the BRICS detach

themselves from the western dollar-based economy and eventually

have their own currency. At the Xiamen summit, this was

discussed in some ways.

The five members have agreed to,

"promote and

develop BRICS Local Currency Bond Markets and jointly

establish a BRICS Local Currency Bond Fund, as a means of

contribution to the capital sustainability of financing in

BRICS countries, boosting the development of BRICS domestic

and regional bond markets."

This comes pretty

close to what the Euro was before it became Fiat money, i.e. it

was the European Currency Unit (ECU) that then converted into

the virtual Euro, before in January 2002, the Euro became paper

and dollar like Fiat money.

By now we know that the US drove this European currency effort -

establishing the euro as the foster child of the US dollar -

totally unsustainable as a unitary currency of a group of

countries that have no common political interests and goals,

that have no common Constitution.

Their only common

denominator is NATO, their permanent drive for war. It was clear

from the beginning that such a project will be doomed to fail.

Hopefully - and I trust - the BRICS will learn a lesson from this

failed exercise, and only with a strong bond that includes

political, economic and defense long-term goals, a common

currency can flourish.

In Xiamen, the BRICS also established the Strategy for,

"BRICS Economic

Partnership and initiatives related to its priority areas

such as trade and investment, manufacturing and minerals

processing, infrastructure connectivity, financial

integration, science, technology and innovation, and

Information and Communication Technology (ICT) cooperation,

among others."

All this for

sustainable, balanced and inclusive global growth.

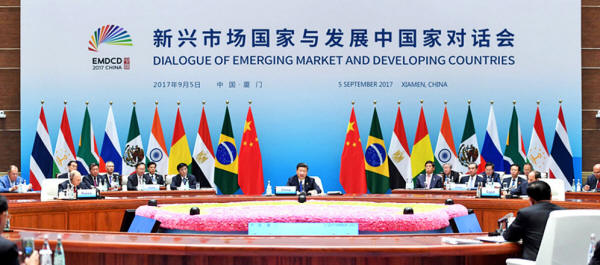

Xi

addresses Dialogue of

Emerging Market and Developing Countries

(Source: BRICS 2017)

This Strategy already is indicative for a different development

and monetary approach than was the one that laid the cornerstone

for the European Union.

4. Trade

between BRICS and the dollar

PK: This will

be interesting to see emerging.

In the medium term, I

see a full integration between the countries of the Shanghai

Cooperation Organization (SCO) and the BRICS.

Several countries

are already today members of both associations; for example,

Russia and China, recently also India joined the SCO.

The SCO also

comprises most of central Asia, the former Soviet Republics, and

also new Iran and Pakistan. The SCO has already a common

long-term objective, in economic development, political vision,

as well as defense strategy.

During the recent Eastern Economic Forum (EEF) in Vladivostok,

President Putin and President Xi announced cementing of the

fusion between the Eurasian Economic Union (EAEU) and the new

'Silk Road', also called "One Belt One Road" (OBOR), or for

short "OBI" - the One Belt Initiative.

Since OBI is largely driven by SCO, i.e. by China, this also

means that the countries of the Eurasian Economic Union are part

of SCO. Imagine, the economic power of the entire group SCO,

EAEU and BRICS… Western supremacy will be a thing of the past.

This means worldwide trading, but without the dollar hegemony,

without an economic and monetary systems that allows Washington

to impose "sanctions" - outrageous and illegal punishments on

countries that refuse to follow their dictate.

Its high time that

this high crime stops. And that we reinstate international law -

which today is completely 'bought' by Washington.

Today it is clear to most progressive and forward-looking

economists that the future is the east; the west has practically

committed suicide with its constant wars for greed and dominance

and disrespect for the very peoples that foot the western

empire's war bills.

5. BRICS

Development Bank and World Bank

PK: Yes, the

original idea was - and I hope still is - that the BRICS New

Development Bank (NDB) will be able to compete with the WB and the

IMF.

In other words, by

applying non-neoliberal economic policies and with loans that do

not impose austerity - which, as we know, is devastating for

economic development - but will promote peoples' based

development - aiming at a more just income and wealth

distribution.

This is not yet the case.

As mentioned before, the problem is that the BRICS bank's

initial capital and the Contingency Reserve Arrangement (CRA) of

US$ 100 billion was set up in US dollars.

Also, as said before, South Africa and Brazil are heavily

indebted in US dollars, an existing bondage that is difficult

to break. But not impossible!

The same is true for the Chinese Asian Infrastructure and

Investment Bank (AIIB), whose capital of currently also US$ 100

billion is also dollar denominated, and of which about US$ 18

billion is paid in.

It is very likely that the NDB and the AIIB will work together

in the future - and jointly break the stranglehold of the WB and

the IMF.

In order to do so, they both need to totally break loose from

the dollar economy - which is about to happen, perhaps soon,

with the enactment of the Chinese Petrol exchange in Shanghai,

where trading will NOT be in US dollars but in gold-convertible

Yuan.

A possible solution is an SCO-BRICS currency basket, similar to

the IMFs Special Drawing Rights (SDR) basket which currently

consist of 5 currencies:

This may start out as

a virtual currency for external trade, while each country

preserves her own monetary system.

It looks like a brighter future is ahead...

|