by Tyler Durden

July 15, 2014

from

ZeroHedge Website

As we

suggested last night, the anti-dollar alliance among the BRICS has

successfully created a so-called "mini-IMF" since the BRICS are clearly

furious with the IMF as it stands currently.

This is what the world's

developing nations just said on this topic,

"We remain disappointed and

seriously concerned with the current non-implementation of the 2010

International Monetary Fund (IMF) reforms, which negatively impacts on the

IMF’s legitimacy, credibility and effectiveness."

As Vladimir Putin explains, this is part of,

"a system of measures that would help

prevent the harassment of countries that do not agree with some foreign

policy decisions made by the United States and their allies."

Initial

capital for the BRICS Bank will be $50 Billion - paid in equal share among

the 5 members (with a contingent reserve up to $100 Billion) and will see

India as the first President.

The BRICS Bank will be based in Shanghai and

chaired by Russia.

Simply put, as Sovereign Man's Simon Black warns,

"when

you see this happen, you’ll know it’s game over for the dollar... I give it

2-3 years."

A quick take on existing monetary policy.

The punch-line, however, is that using bilateral swaps, the BRICS are

effectively disintermediating themselves

from a FED and

other "developed

world" central-bank dominated world and will provide their own funding.

We are pleased to announce the signing of the Treaty for the establishment

of the BRICS Contingent Reserve Arrangement (CRA) with an initial size of

US$ 100 billion.

This arrangement will have a positive precautionary effect,

help countries forestall short-term liquidity pressures, promote further BRICS cooperation, strengthen the global financial safety net and complement

existing international arrangements...

The Agreement is a framework for the

provision of liquidity through currency swaps in response to actual or

potential short-term balance of payments pressures.

Incidentally, the role of the dollar in such a world is, well,

nil.

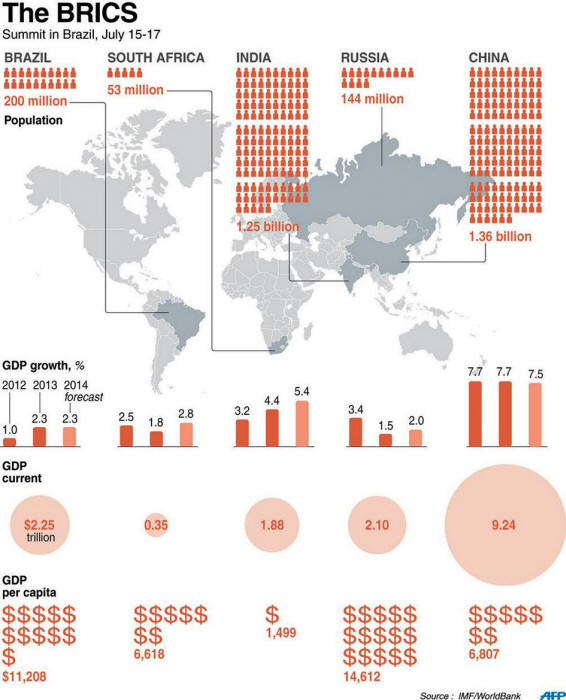

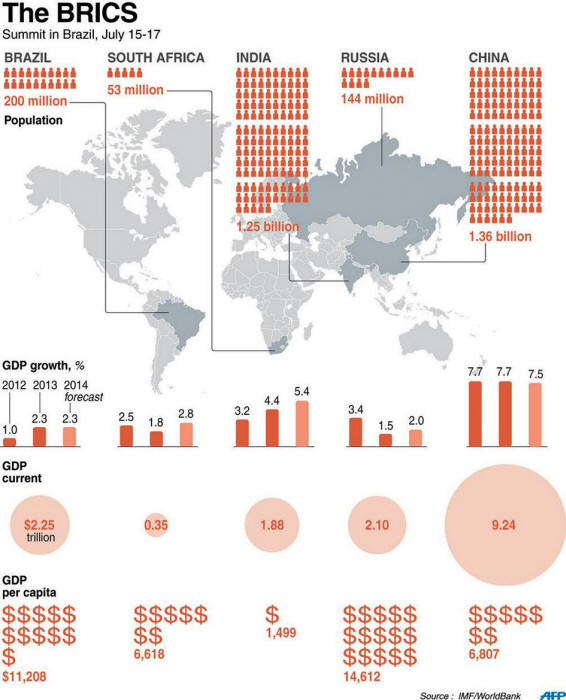

For those who have forgotten who

the BRICS are, aside from a droll acronym

by a former Goldman banker, here is a reminder of the countries that make up

3 billion in population.

Key excerpts from

the Full statement:

We remain disappointed and seriously concerned with the current

non-implementation of the 2010 International Monetary Fund (IMF) reforms,

which negatively impacts on the IMF’s legitimacy, credibility and

effectiveness.

The IMF reform process is based on high-level commitments,

which already strengthened the Fund's resources and must also lead to the

modernization of its governance structure so as to better reflect the

increasing weight of EMDCs in the world economy. The Fund must remain a

quota-based institution.

We call on the membership of the IMF to find ways

to implement the 14th General Review of Quotas without further delay. We

reiterate our call on the IMF to develop options to move ahead with its

reform process, with a view to ensuring increased voice and representation

of EMDCs, in case the 2010 reforms are not entered into force by the end of

the year.

We also call on the membership of the IMF to reach a final

agreement on a new quota formula together with the 15th General Review of

Quotas so as not to further jeopardize the postponed deadline of January

2015.

BRICS, as well as other EMDCs, continue to face significant financing

constraints to address infrastructure gaps and sustainable development

needs.

With this in mind, we are pleased to announce the signing of the

Agreement establishing the New Development Bank (NDB), with the purpose of

mobilizing resources for infrastructure and sustainable development projects

in BRICS and other emerging and developing economies.

We appreciate the work

undertaken by our Finance Ministers. Based on sound banking principles, the NDB will strengthen the cooperation among our countries and will supplement

the efforts of multilateral and regional financial institutions for global

development, thus contributing to our collective commitments for achieving

the goal of strong, sustainable and balanced growth.

The Bank shall have an initial authorized capital of US$ 100 billion.

The

initial subscribed capital shall be of US$ 50 billion, equally shared among

founding members. The first chair of the Board of Governors shall be from

Russia. The first chair of the Board of Directors shall be from Brazil. The

first President of the Bank shall be from India. The headquarters of the

Bank shall be located in Shanghai.

The New Development Bank Africa Regional

Center shall be established in South Africa concurrently with the

headquarters. We direct our Finance Ministers to work out the modalities for

its operationalization.

We are pleased to announce the signing of the Treaty for the establishment

of the BRICS Contingent Reserve Arrangement (CRA) with an initial size of

US$ 100 billion.

This arrangement will have a positive precautionary effect,

help countries forestall short-term liquidity pressures, promote further BRICS cooperation, strengthen the global financial safety net and complement

existing international arrangements. We appreciate the work undertaken by

our Finance Ministers and Central Bank Governors.

The Agreement is a

framework for the provision of liquidity through currency swaps in response

to actual or potential short-term balance of payments pressures.

Goodbye visions of an SDR-world currency.

As for the USD...

Video: