|

from

TheEconomicCollapseBlog Website

Boom Goes The Dynamite...!

If you were waiting for a "black swan event" to come along and devastate the global economy, you don't have to wait any longer.

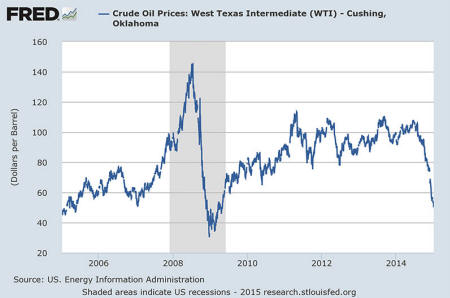

As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression.

But following the financial crisis of 2008, the price of oil rebounded fairly rapidly.

As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get.

At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before.

So let's hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

What amazes me is that there are still many economic "experts" in the mainstream media that are proclaiming that the collapse in the price of oil is going to be a good thing for the U.S. economy.

The only precedent that we can compare the current crash to is the oil price collapse of 2008.

You can see both crashes on the chart below…

If rapidly falling oil prices are good economic news, that collapse should have pushed the U.S. economy into overdrive.

But that didn't happen, did it?

Instead, we plunged into the deepest recession that we have seen since the Great Depression. And unless there is a miracle rebound in the price of oil now, we are going to experience something similar this time.

Already, we are seeing oil rigs shut down at a staggering pace.

The following is from Bloomberg…

But that was just the beginning of the carnage.

61 more oil rigs shut down last week alone, and hundreds more are being projected to shut down in the months ahead. For those that cannot connect the dots, that is going to translate into the loss of large numbers of good paying jobs.

Just check out what is happening in Texas…

Unfortunately, this crisis will not just be localized to states such as Texas. There are tens of thousands of small and mid-size firms that will be affected.

The following is from a recent CNBC report…

If the price of oil makes a major comeback, the carnage will ultimately not be that bad.

But if it stays at this level or keeps going down for an extended period of time, it is inevitable that a whole bunch of those firms will go bankrupt and their debt will go bad.

That would mean a junk bond crash unlike anything that Wall Street has ever experienced.

And as I have written about previously, a stock market crash almost always follows a junk bond crash. These are things that happened during the last financial crisis and that are repeating again right in front of our eyes.

Another thing that happened in 2008 that is happening again is a crash in industrial commodity prices.

At this point, industrial commodity prices have hit a 12 year low. I am talking about industrial commodities such as copper, iron ore, steel and aluminum. This is a huge sign that global economic activity is slowing down and that big trouble is on the way.

So what is driving this?

The following excerpt from a recent Zero Hedge article gives us a clue…

Once again, much of this could be avoided if the price of oil starts going back up substantially.

Unfortunately, that does not appear likely. In fact, many of the big banks are projecting that it could go even lower…

OPEC could stabilize global oil prices with a single announcement, but so far OPEC has refused to do this.

Many believe that the OPEC countries actually want the price of oil to fall for competitive reasons…

The oil producing countries in the Middle East seem to be settling in for the long haul.

In fact, one prominent Saudi prince made headlines all over the world this week when he said that,

Never is a very strong word.

Could there be such a massive worldwide oil glut going on right now that the price of oil will never get that high again? Well, without a doubt there is a huge amount of unsold oil floating around out there at the moment.

It has gotten so bad that some big trading companies are actually hiring supertankers to store large quantities of unsold crude oil at sea…

The fundamentals for the price of oil are so much worse than they were back in 2008.

We could potentially be looking at sub-$50 oil for an extended period of time. If that is indeed the case, there will be catastrophic damage to the global economy and to the global financial system.

So hold on to your hats, because it looks like we are going to be in for quite a bumpy ride in 2015.

|