|

by Tyler Durden

August 10,

2018

from

ZeroHedge Website

Lord Jacob Rothschild

Over the

past three years,

an unexpected

voice of caution

has emerged from

one of the

most legendary

families in finance:

Lord Jacob

Rothschild...

Readers may recall that as part of the

RIT Capital Partners 2014 annual

report commentary, the scion of

Rothschild family,

warned that,

"the geopolitical

situation is most dangerous since WWII."

One year later, Jacob

Rothschild

again warned about the outcome of,

"what is surely the

greatest experiment in monetary policy in the history of the

world".

And then again in August

2017 he

cautioned that,

"share prices have in

many cases risen to unprecedented levels at a time when economic

growth is by no means assured."

Little did he know that

they were only going to keep rising, but related to that, he also

made another warning which the market has so far blissfully ignored:

The period of

monetary accommodation may well be coming to an end.

Geopolitical problems remain widespread and are proving

increasingly difficult to resolve.

Fast forward to today

when in the

latest half-year commentary from

RIT Capital Partners, Jacob Rothschild has made his latest

warning to date, this time focusing on the global economic system

that was established after WWII, and which he believes is now in

jeopardy.

The billionaire banker pointed to the U.S.-China trade war

and the Eurozone crisis as the key problems putting economic

order at risk, and the lack of a "common approach" - a reference to

the gradual unwind of globalization in the wake of President

Trump - that has made

"co-operation today much more difficult":

"In

9/11 and in the

2008 financial crisis, the

powers of the world worked

together with a common approach. Co-operation today is proving

much more difficult.

This puts at risk the

post-war economic and security order."

It wasn't clear if he was

referring to,

-

the post-war

fiat standard that emerged once

FDR devalued the dollar

relative to gold, and then fixed a price for the yellow

metal, a tenuous link that was subsequently destroyed by

Nixon who finally

took the U.S. off the

gold standard

-

or the primacy of

the dollar which emerged as the world's reserve currency

after the end of WWII,

...but whenever one of

the people who profited handsomely from the "post war world order"

warns it may be on its last legs it may be time to worry.

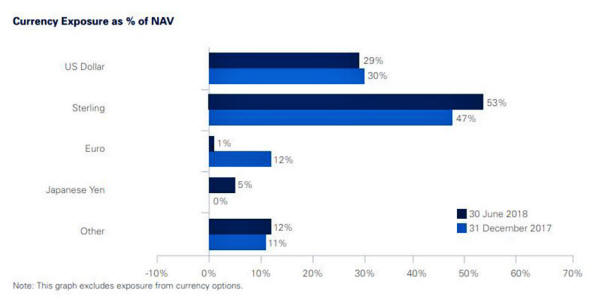

With global risks growing, how is Rothschild positioned?

He writes that,

"in the circumstances

our policy is to maintain our limited exposure to quoted

equities and to enter into new commitments with great caution",

...and indeed, in the

first half, RIT had a net quoted equity exposure of only 47%,

historically low.

The reason:

the iconic banking

family is concerned that the 10-year bullish cycle and market

rally could finally be ending.

The cycle is in its tenth

positive year, the longest on record. We are now seeing some areas

of weaker growth emerge; indeed

the IMF has recently predicted some

slowdown.

While Rothschild noted that,

"many of the world's

economies have enjoyed a broad-based acceleration not seen since

the aftermath of the financial crisis of 2008, with as many as

120 countries seeing stronger growth last year".

He also cautioned that,

"we continue to

believe that this is not an appropriate time to add to risk.

Current stock market

valuations remain high by historical standards, inflated by

years of low interest rates and the policy of quantitative

easing which is now coming to an end."

One potential risk

is Europe, where debt levels have

reached "potentially destructive levels":

The problems

confronting the Eurozone are of concern - both political and

economic - given the potentially destructive levels of debt in a

number of countries.

There is also the threat

that the global trade war escalates substantially from here,

as Chinese stocks have learned the hard way:

The likelihood of

trade wars has increased tension and the impact on equities has

been marked; for example by early July the Shanghai Composite

Index had dropped some 22% from its peak in January.

Rothschild also echoed

the recent warning from the head of the Indian Central Bank,

warning that the shrinking of global dollar liquidity is hurting

emerging markets:

Problems are likely

to continue in emerging markets, compounded by rising interest

rates and

the U.S. FED's monetary policy

which has drained global dollar liquidity.

We have already seen

the impact on the Turkish and Argentinean currencies.

Finally, Rothschild

remains understandably,

"concerned about

geo-political problems including Brexit, North Korea and the

Middle East, at a time when populism is spreading

globally..."

* * *

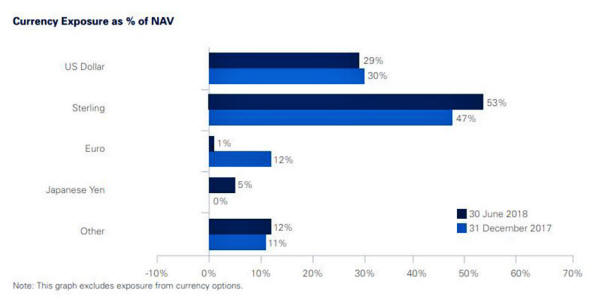

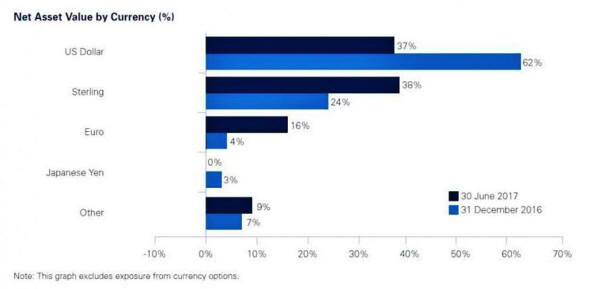

Rothschild continued the shift away from U.S. capital markets

exposure announced two years ago, noting that his,

"exposure to absolute

return and credit assets continued to generate steady returns

and on currencies, the net asset value benefited from the

strengthened U.S. Dollar."

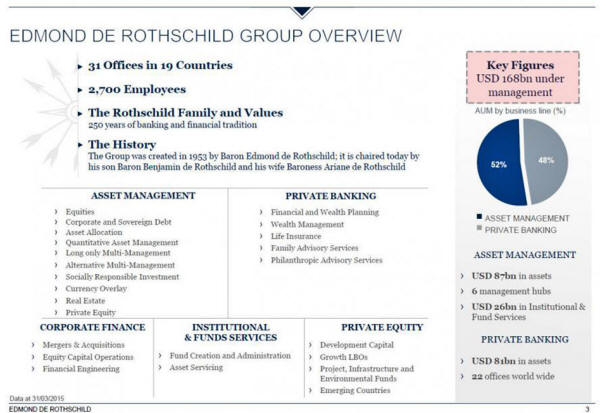

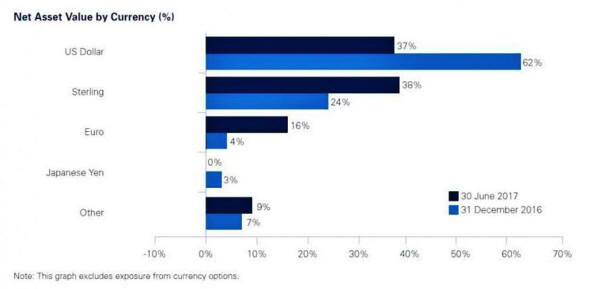

Compare the collapse in

the fund's USD exposure, which as of June 30 was only 29%, to the

62% as recently as December 31, 2016:

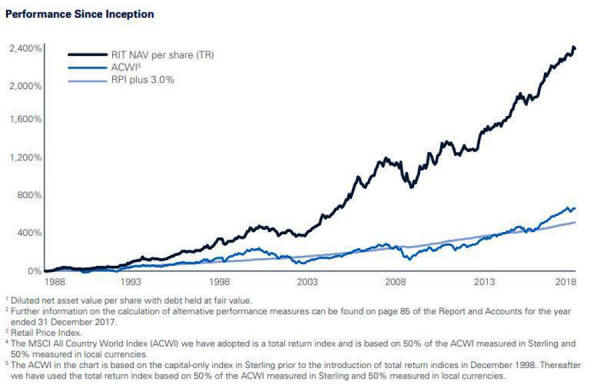

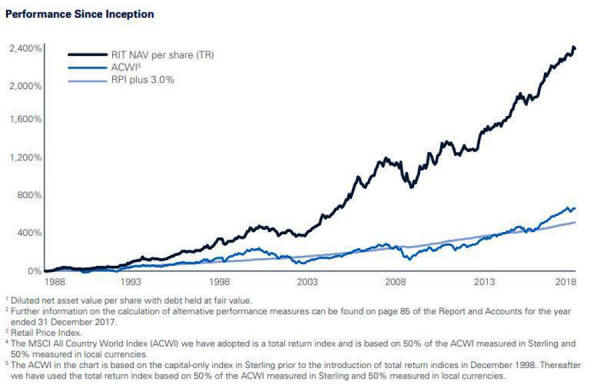

Not surprisingly, RIT's investment portfolio continues do quite

well, and has now returned over 2,400% since inception:

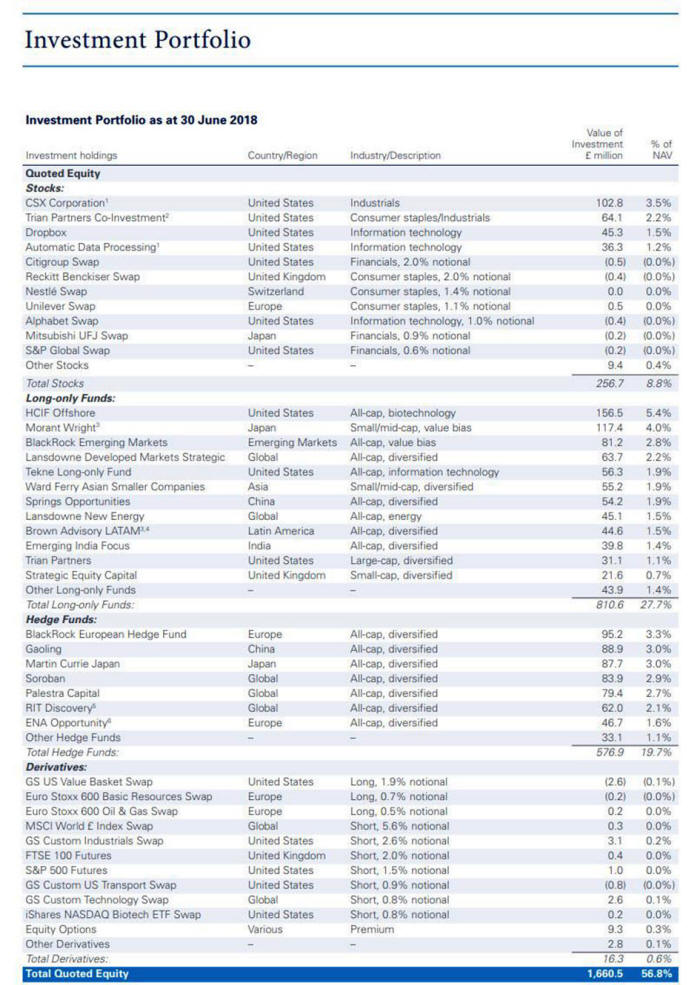

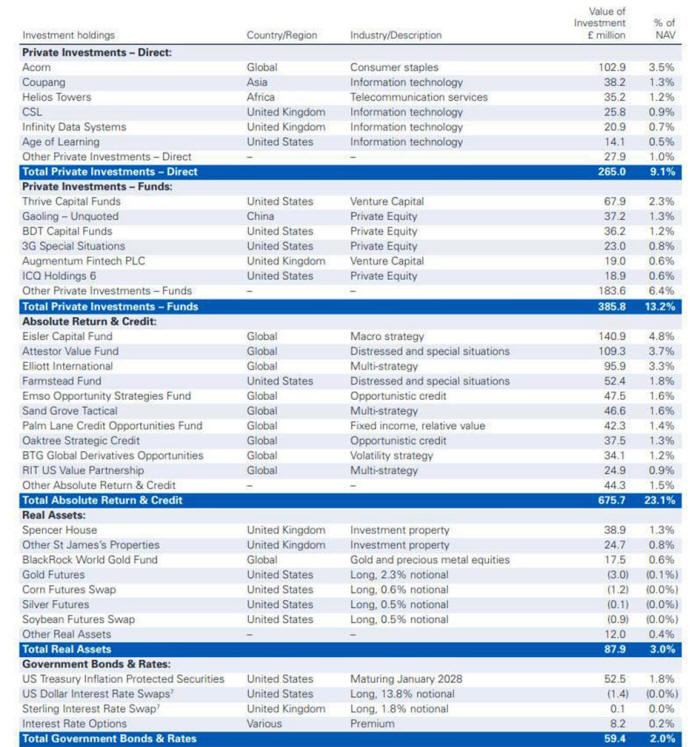

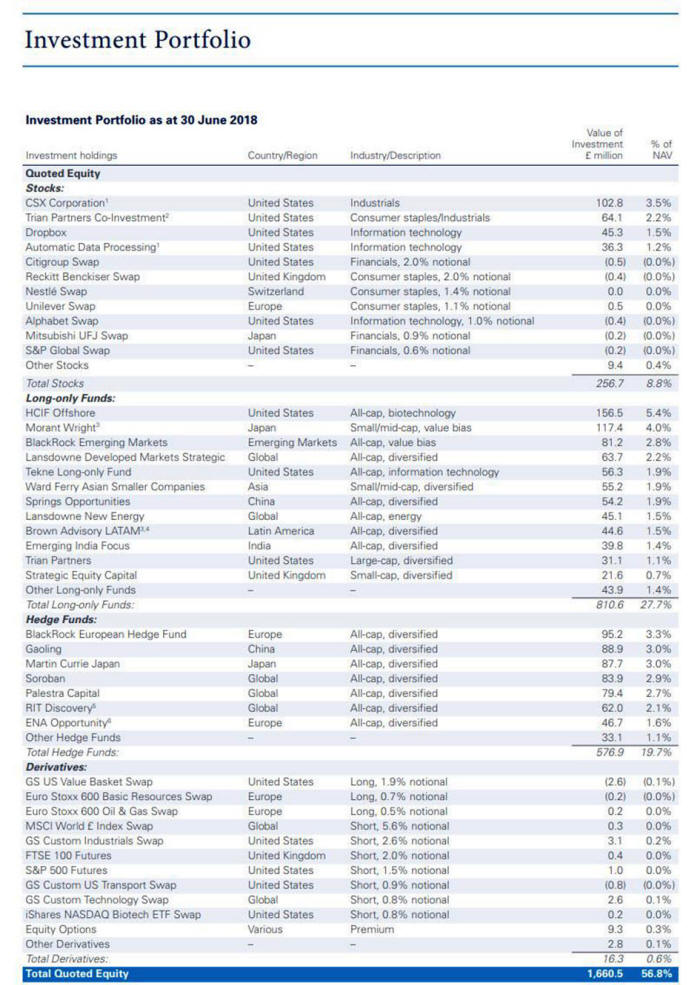

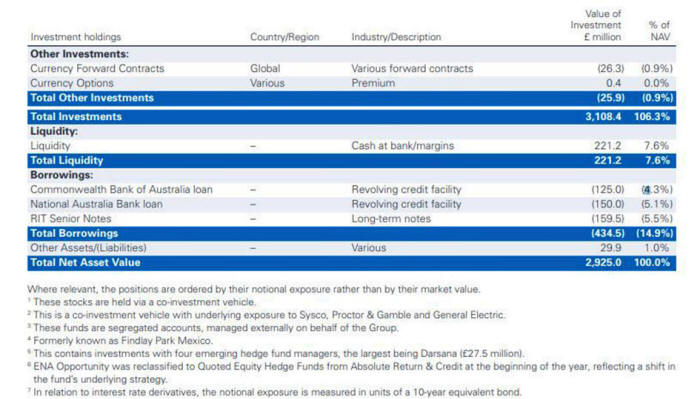

Below is a snapshot of where every hedge fund wants to end up:

the Rothschild

investment portfolio...

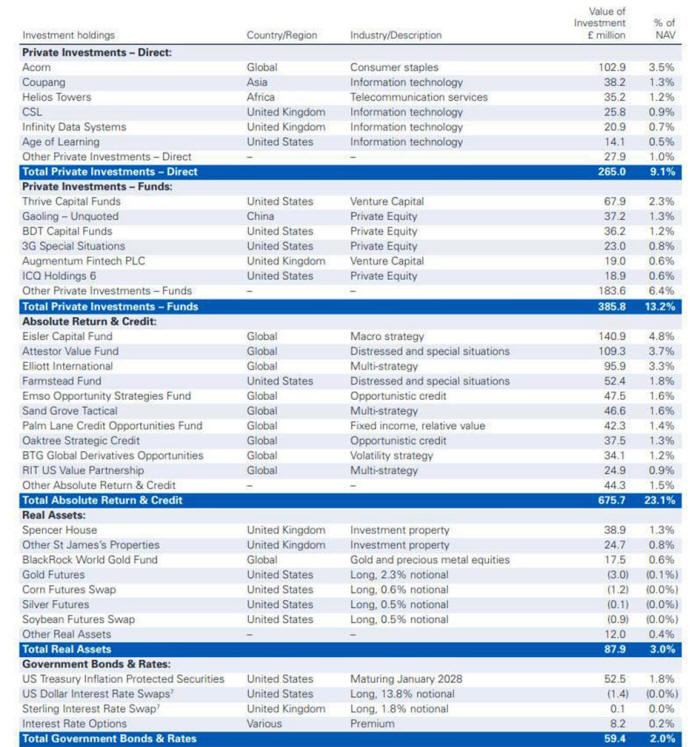

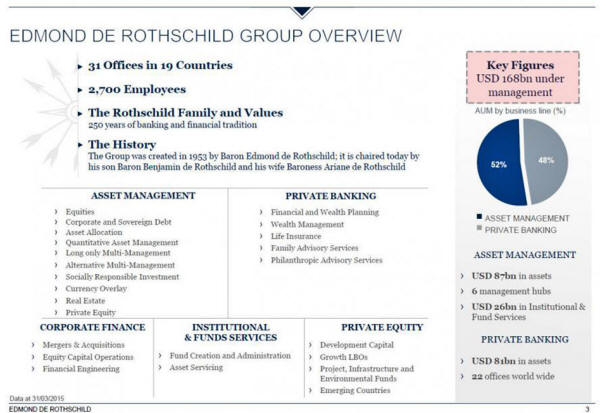

Finally, for all those wondering where the Rothschild family fortune

is hiding, here is the answer:

|