|

is a history of gold price intervention and manipulation"

This month in London marks the 100th anniversary of the first "London Gold Fixing", the infamous daily meeting of a secretive cartel of bullion banks which has met since 1919 to set benchmark gold prices used throughout the international gold market, a meeting which continues to this day through its thinly disguised successor, the LBMA Gold Price auction.

London gold price benchmarks are critically important to the global gold market because they are used as a valuation source for everything from ISDA gold interest rate swap contracts to gold-backed Exchange Traded Funds (ETFs), and everything from OTC gold contracts to transaction reference prices used by physical bullion dealers when purchasing gold bars and gold coins from refineries and suppliers.

Since 2015, the London Gold Fixing has been known as the LBMA Gold Price following a rush by the London Bullion Market Association (LBMA) bullion banks to patch over the then scandalized 'Fixing' in a smoke and mirrors and circle the wagons relaunch and renaming exercise.

The collusive Gold Fixing first formally came into existence on 12 September 1919 when the Bank of England tapped its favorite bankers N.M. Rothschild & Sons to be the daily Fixing's permanent chairman.

Rothschild and the Bank of England had been joined at the hip since the early 1800s and would continue to be so in the Gold Fixing throughout the next century.

The 1919 launch of the Gold Fixing by the Bank of England and Rothschild succeeded a more informal version of a gold fixing that had existed up to the outbreak of the First World War in 1914, which consisted of a meeting of four London gold brokers,

...who between them set a daily gold price at the offices of Sharps & Wilkins.

For the next 85 years from its inception in September 1919, the Gold Fixing occurred daily at Rothschild's headquarters in New Court, St. Swithins Lane, across the road from the Bank of England, with five men from five bullion banks religiously meeting at 10:30 am each morning.

After the collapse of the London Gold Pool in 1968, the Gold Fixing moved to a twice per day pricing with an extra 3:00 pm meeting added by the fixers to 'watch over' the US morning hours gold market.

Rothschild would remain as the Gold Fixing's permanent chairman until May 2004 at which point the fabled investment bank mysteriously departed the gold fixing and stepped back into the shadows after 200 years in the London Gold Market...

Until now that is, for in one of its rare re-appearances, the LBMA's seminar and cocktail reception to celebrate the Gold Fixing's centenary took place this week at, you guessed it, NM Rothschilds' headquarters in St Swithins Lane.

In the words of the LBMA, the 'momentous occasion' of the centenary celebrations is being:

N.M. Rothschild's London headquarters at New Court in St Swithin's Lane, City of London

So,

Let's take a look, drawing on some of the many articles on this website and elsewhere that have covered aspects of the infamous gold fixing over the course of its existence, including articles that have looked at more recent LBMA Gold Price.

After all, the LBMA Gold Price is just another name for the Gold Fixing, and was conceded as such by the LBMA press office this month when they threw pretense out of the window, saying that:

The very definition of the centenary as covering 1919-2019 underscores the continuity of the "London Gold Fixing - LBMA Gold Price" as one and the same thing, with the LBMA Gold Price just a disguised and more palatable version of the Gold Fixing, a classic case of same old wine in a new bottle, and a pricing process still controlled by the Bank of England and the bullion banks.

Permanent Fixtures - Rothschild and Bank of England

So,

To give a quick recap it was as follows.

The five former gold fixers in the offices of Rothschild in London where the fixings took place until 2004.

For Rothschild, acquainted with the number five in the form of the five houses of Rothschild and its five arrows symbolism, the fact that there were only ever five seats on the Gold Fixing, is, to say the least coincidental, and maybe even symbolic.

But as to which was the real puppet master in the London Gold Market, Rothschild or the Bank of England, that has always been the question...

The Bank of England's not so hidden hand

The one constant in the Gold Fixing from its inception, apart from NM Rothschild, is of course the Bank of England, the central bank which controls and has always controlled the London Gold Market.

For example,

But the the Bank of England had been regularly intervening into the Gold Fixing even before the London Gold Pool, to exercise what it aloofly called a 'moderating influence' on the gold price.

This is starkly illustrated in the following passage from a Bank of England's Quarterly Bulletin in 1964 in which it wrote (page 16):

After the London Gold Pool collapsed in March 1968, the gold market reopened after two weeks using a two tier approach of an official gold price pegged at $35 per ounce for central banks, and a supposedly 'free market' gold price for everyone else.

Notably, upon reopening, the daily Gold Fixing of Rothschild and friends switched to being priced in US dollars, and an afternoon fixing meeting was added 3:00 pm so as to allow the Bank of England and the five fixers to exert more control over morning trading hours in New York.

But if you think that the Bank of England bowed out of thinking about ways to manipulate the gold price in 1968, then you would be mistaken.

On the contrary, it continued to scheme behind closed doors and in secretive ways right up to the modern era, including discussions with other G10 central bank governors at the Bank of International Settlements (BIS) in Basel, Switzerland in 1979 and 1980 about forming a new interventionist gold pool to,

(See "New Gold Pool at the BIS Basle, Switzerland - Part 1" and "New Gold Pool at the BIS Basle - Part 2 - Pool vs. Gold for Oil").

The Bank of England also devised the London gold lending market, a top secretive and opaque market that emerged on the 1980s in which central banks lend out their gold via LBMA bullion banks, the lent gold positions of which are sold into the market and have a subduing effect on the price.

Ask the LBMA and Bank of England for data on outstanding gold loans or the size of the lending market and you will not get an answer.

The Bank of England also allowed the development unallocated gold position trading in London, a vast ponzi of paper gold positions (mere credit in the form of bullion bank promises) that have little or no backing of real gold, but whose trading still perversely is hugely influential in gold price discovery.

And the Bank of England's "moderating influence" on the Gold Fixings also continued.

This is illustrated by the astounding case of the head of the Bank of England's foreign exchange and gold Terry Smeeton intervening into the Gold Fixing during the 1980s:

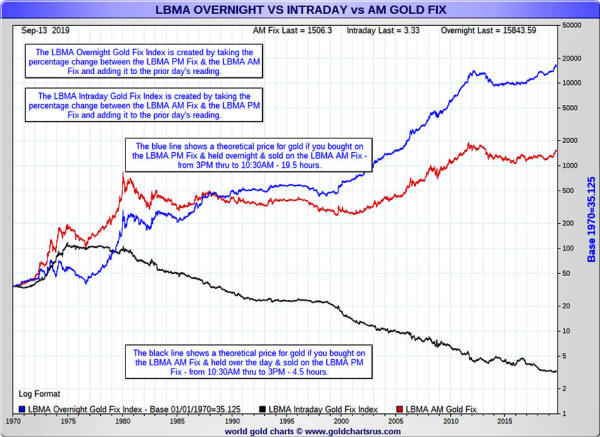

For anyone with doubts about how the London Gold Fixings have suppressed gold prices over time, take a look at the following chart from Nick Laird's www.goldchartsrus.com website which shows three price lines of gold prices from 1970 when the price was $35 per troy ounce to 2019.

In red is the actual US dollar gold price, in blue is the theoretical gold price if you bought at the afternoon London gold fix and held overnight and sold at the next day's morning gold fix, in black is a theoretical gold price if you bought at the morning gold fix and sold same day at the afternoon gold fix.

The Fix is In - Subduing effects of the London Gold Fixings on gold prices over nearly 50 years. Source: www.goldchartsrus.com

Starting in 1970 when the price of gold was $35 per ounce, if every day you bought at the price of the afternoon Gold Fixing and sold 19.5 hours later at the price of the next day's morning Gold Fixing price, your $35 would now be worth $15,843.

That's the cumulative value of the Overnight strategy.

On the other hand if every trading day since 1970 you bought at the morning Gold Fixing price and sold 4.5 hours later at the afternoon Gold Fixing price, your $35 would now be worth, wait for it, just $3.33.

That's the cumulative value of the Intraday strategy.

The key point is the London Gold Fixings suppress the gold price intraday and that the current gold price of around $1500 is far lower than it should be because of the prices in these Gold Fixes.

None of which is mentioned by the LBMA in its commentaries of the 100th anniversary of the Gold Fixing this month in London.

The London Gold Market Fixing Limited

Also not mentioned by the LBMA in its centenary celebrations this month is the fact that the incredibly named The London Gold Market Fixing Limited (LGMFL), a private company comprising the five member banks of the Gold Fixing,

...is still an active company on the UK Companies House register.

And it does exactly what it says on the tin. Incorporated in January 1994, the company's accounts are still prepared on a going concern basis because the company can't be wound up as it is currently being sued in New York courts by class actions suits accusing LGMFL of involvement in gold price manipulation.

For example, the latest activity on the company register, just filed on 4 September 2019, shows the recent appointment of SocGen's Francois Combes as a LGMFL director on 30 August 2019, the termination of SocGen's Vincent Domien, as a LGMFL director on the same date, and the termination of Scotia's Steven Lowe in August 2018.

In addition to SocGen's Francois Combes, other current directors of LGMFL are,

Deutsche Bank has successfully extracted itself from the LGMFL at this time.

Recent filings also show the latest annual accounts for The London Gold Market Fixing Limited to December 2018, with a critical commentary that:

The US class actions being referred to by the London Gold Market Fixing Limited above were covered in posts on the BullionStar website such as "Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks" and in the detailed and ground-breaking analysis of the class action court papers by Allan Flynn on his blog site here.

And its not only in New York where investors think they have been the victims of gold market fraud. Investor groups are also using Canadian courts to pursue class actions against The London Gold Market Fixing Limited and the five gold fixing banks using the Ontario Superior Court.

The above LGMFL accounts state that the Canadian class actions say that:

See here and here for more details.

Missing from the LBMA's momentous occasion centenary update on 12 September were any references to The London Gold Market Fixing Limited still being a very much live and active company, or the fact that London Gold Market Fixing Limited and four of the five fixers are currently defendants in class action suits in New York and Canada.

Its also interesting that a majority of the five gold price fixers of London Gold Market Fixing Limited have now exited the entire precious metals markets in London.

This includes Deutsche Bank, Barclays, and more recently SocGen.

Another member of the cartel, Scotia Mocatta, tried but failed to sell its precious metals business but did execute a reorganization of that business.

That just leaves HSBC still fully active in the London Gold Market...

As explained in "Curse of the London Gold Fix strikes again as SocGen abandons ship":

GoldFixing Website hurriedly 'pulled'

The LBMA also failed to mention in its speeches this week the real reasons why the entire Gold Fixing was 'pulled' in March 2015.

As background, the last ever Gold Fixing took place on the afternoon of Thursday 19 March 2015 at 3.00 pm.

Following that, the www.goldfixing.com website of The London Gold Market Fixing Limited was permanently switched off on 23 March 2015 and the server taken off line, a fact confirmed the previous week by the same Douglas Beadle, former Rothschild banker.

See "London

Gold Fixing website www.goldfixing.com taken offline" for

details, and for links to all the original documents which were on

the old www.goldfixing.com website before it was hurriedly taken

down.

'The best thing to do was to Pull it'

But what lead to the Gold Fixing being pulled in 2015 (while being replaced with practically the same thing under a new name)?

The unraveling of the London Gold Fixing arguably began in late 2013 in the wake of the LIBOR scandal when financial regulatory authorities such as the UK FCA and Germany's BaFin began investigating the Gold Fixing and scrutinizing the five gold fixing banks.

Germany's financial regulator BaFin appeared particularly efficient in its investigation into Deutsche Bank's gold fixing activities, and whatever was in the documents that Bafin demanded from Deutsche in late 2013 caused Deutsche Bank to run for the exits of the London gold and silver market in January 2014 and abandon both its Gold Fixing and Silver Fixing seats.

Unable to sell either its Gold Fixing or Silver Fixing seat, as no other banks would touch the fixings given the regulatory investigations, Deutsche Bank gave just two weeks notice and walked away on 13 May 2014, leaving four banks on the Gold Fixing (Barclays, Scotia, HSBC and SocGen), and only two banks on the Silver Fixing (Scotia and HSBC).

This then opened the flood gates for the rest of the fixers to abandon ship, but not before all 10 directors of the London Gold Market Fixing Company at that time were profiled on 15 May 2014 in ZeroHedge's excellent article "From Rothschild to Koch Industries - Meet the People who "Fix" the Price of Gold".

The names of these directors were,

Less than a week later on 20 May 2014, Baclays then announced that its Head Of Gold Trading Marc Booker was leaving the bank.

Then three days later on 23 May 2014, the Financial Conduct Authority (FCA), the UK's financial regulator, announced that Daniel Plunkett, a director on the Barclays precious metals desk in London and a colleague of Booker, Spall and Whitehead on the trading floor in Canary Wharf, had been charged with manipulating gold prices of the afternoon Gold Fixing, and was being levied with a financial penalty and prohibition from trading.

This is the same Daniel Plunkett who became infamous for his "I Am Hoping for a Mini Puke" statement, the mini puke being a lower gold price.

At the same time the FCA fined Barclays Bank Plc (Barclays) £26,033,500 for,

Yes, you have read that correctly.

The year 2004 is also interesting because from 2004 onwards the five fixers were no longer meeting face to face each day but meeting remotely using a web based application and electronic chat apps.

See the article "The pre-2015 London Gold Fixings - More technologically advanced than reported" for details.

These networked and chat apps would make collusion a lot easier but would also leave a trail of evidence.

It's all the Same - Only the Names will change

It is beyond the scope of this article to look at how the LBMA locked down and controlled the move from the London Gold Fixing to the LBMA Gold Price, and is still acting preventing real representative participation in the global gold price discovery process.

That will be left for future analysis.

For those interested in the background and modus operandi for choosing the 'new' version of the gold fixing, a selection of relevant articles includes, Suffice to say, a full two thirds of the fifteen participants in the LBMA Gold Price auction are bullion banks, including the likes of,

Bank of England, a moderating influence on the gold price

Conclusion

For those who happen to be in London later this month on 27 September and want to see the LBMA and Bank of England's take on the 100th anniversary of the Gold Fixing, there is a 'Gold Talk' being jointly presented by LBMA CEO Ruth Crowell, and LBMA Chairman Paul Fisher in an event at the Bank of England.

'Independent' LBMA Chairman Paul Fisher will be no stranger to the location as he was a career long executive at the very same Bank of England including Head of Foreign Exchange (which includes gold).

See "Blood Brothers - The Bank of England and the London Bullion Market Association (LBMA)" for details.

As Jim Rickards observed when Fisher was appointed LBMA chairman back in 2016:

https://twitter.com/JamesGRickards/status/753298548406390785

As the great and the good of the London Gold Market raise a toast to the centenary of the Gold Fixing this September, while lauding the 'new' LBMA Gold Price, it would be well to keep in mind the old phrase,

The LBMA recently asserted that it took 89 years for the gold price to break through the $1,000 barrier, reaching a new all-time high of $1,023.50 on 17 March 2008, to which we have the question:

|