|

by Brian Shilhavy

Editor, Health Impact News

June 13, 2024

from

VaccineImpact Website

This past Sunday (June 9, 2024) Saudi Arabia made the

historical move to not renew an 80-year-old agreement

with the United States that established the U.S. Dollar as the world

currency to purchase Saudi oil, in what should have been headline

news, but seems to have been blacklisted in U.S. financial news

publications, even in alternative financial news publications such

as ZeroHedge News.

Here is the coverage of this historic event from the The Business

Standard, a Bangladeshi daily newspaper.

Saudi Arabia's petro-dollar exit: A global

finance paradigm shift

The crucial decision to not renew the contract enables Saudi

Arabia to sell oil and other goods in multiple currencies,

including the,

...instead of exclusively in US dollars.

Significant financial upheaval is potentially ahead of the

financial world as Saudi Arabia has decided not to renew its

80-year petro-dollar deal with the United States.

The deal, which expired on Sunday 9 June, was a cornerstone of

the United States global economic dominance.

Originally signed on 8 June 1974, the deal established two joint

commissions, one based on economic cooperation and the other on

Saudi Arabia's military needs.

At the time, it was said that it heralded an era of close

cooperation between the two countries, says Katja Hamilton of

BizCommunity.

This latest development signifies a major shift away from the

petrodollar system established in 1972, when the US decoupled

its currency from gold, and is anticipated to hasten the global

shift away from the US dollar.

Source

While I could find no major U.S. English publication covering this

as headline news, there was plenty of discussion on Twitter/X.

One U.S. investor, Andrei Jikh, who has over 2 million subscribers

on YouTube, published a video on just what the end of the

petrodollar means, and that video has accumulated almost 1 million

views over the past couple of days.

The video is just over 15 minutes long, but the facts regarding the

end of the petrodollar is only covered in the first 12 minutes.

Everything after that is this investor's views, including his view

that people should continue investing in the U.S. Stock market and

also invest in Bitcoin, certainly a view that myself and many others

would not agree with.

But his summary of the history and significance of the Petrodollar

is excellent, and well worth the 12 minutes to watch.

The petrodollar agreement between Saudi Arabia and the United States

included more than just the agreement to require the purchase of oil

with U.S. dollars, as it also included a promise from the U.S. to

protect Saudi Arabia militarily, and also contained provisions for

establishing the State of Israel in 1948, something that President

Roosevelt actually opposed, but was adopted by his successor,

President Truman.

The Quincy Pact

Saudi Arabia reportedly did not renew "its 50-year petrodollar

agreement with the United States", an agreement that expired on

Sunday, June 9, 2024.

While it is permissible to doubt the existence of a

half-century-long agreement, it was indeed in 1974 that the

petrodollar emerged. Three short years after the end of the

Bretton Woods agreements.

From a historical perspective, the origins of the petrodollar

date back even to 1945.

On his way back from the Yalta conference, President Roosevelt

made a stop unbeknownst to the British along the Suez Canal. It

was aboard his cruiser USS Quincy that he met King Abdulaziz Al

Saud.

It will later be said that this meeting birthed the "Quincy

Pact."

This diplomatic anchorage went so well that Roosevelt offered

his wheelchair to the Saudi king, who was also disabled.

Despite this goodwill, the king refused to allow Jewish

settlement in Palestine.

However, the American president ensured the essential by

sidelining British Petroleum in favor of American oil companies.

This tacit agreement prevented the creation of a Jewish state,

but Roosevelt would die two months later. His successor, Harry

Truman, would be a strong supporter of the founding of Israel.

He would recognize the Hebrew state 11 minutes after the

Israelis declared themselves a nation, against the advice of his

Secretary of State.

Henry Kissinger's Masterstroke

It was in 1974 that the second historic meeting between the

Saudis and the American government took place. Henry Kissinger

had been Secretary of State for a year.

His mission?

To impose the dollar on the ingrates of

the old continent who dared to demand gold.

His strategy began with an intervention in

favor of Israel in the Yom Kippur War.

[For more context, note that Henry Kissinger is Jewish. He fled

Nazi Germany at the age of 15 and would return in uniform five

years later to fight in France and Germany.]

In retaliation, Arab countries ceased their oil exports,

primarily to European nations. The United States, for its part,

was self-sufficient. By 1974, the price of a barrel had

quadrupled, going from $3 to $12.

This oil embargo was all the easier to implement as the United

States had been pushing for years for the emancipation of Iraq,

Iran, Kuwait, the United Arab Emirates, Qatar, and Libya from

European companies (British Petroleum, Royal Dutch-Shell, and

the French Petroleum Company, ex-Total).

Kissinger wanted the price of the barrel to explode to weaken

the old continent. He knew well that the American army would

have the last word if things escalated, allowing him to impose

himself at the heart of international relations.

International discord would reach its peak when President Gerald

Ford recognized Jerusalem as the capital of the Hebrew state.

Petrodollar

In response, Saudi Arabia continued to raise the price of the

barrel, without knowing that it was playing into the hands of

Henry Kissinger, who would ultimately threaten to use force to

remedy what he called "the strangulation of the industrialized

world".

The London Sunday Times revealed in February

1975 the existence of the "Dhahran Option Four" plan, which

planned to invade Saudi Arabia to take possession of its oil

wells.

King Faisal would hear these drums of war very clearly.

At the end of 1974, he finally gave in to

Henry Kissinger's demands, who promised him the unlimited sale

of arms, a backpedal on the Jerusalem issue, and a return of

Israel to its 1948 borders (plus a myriad of technologies).

In exchange, Saudi Arabia had to:

1. Sell its oil exclusively in dollars.

2. Invest its dollar surpluses in American debt (It was

anyway impossible for a kingdom of 10 million inhabitants to

spend the thousands of billions of petrodollars).

All OPEC countries would agree in 1975 to

denominate their oil in dollars. Here are the broad lines of the

genesis of the petrodollar.

King Faisal would be assassinated on March

25, 1975, on the day of the Mawlid, the anniversary of the birth

of the prophet Muhammad.

Subsequently, Israel would never return to

its 1948 borders.

Source

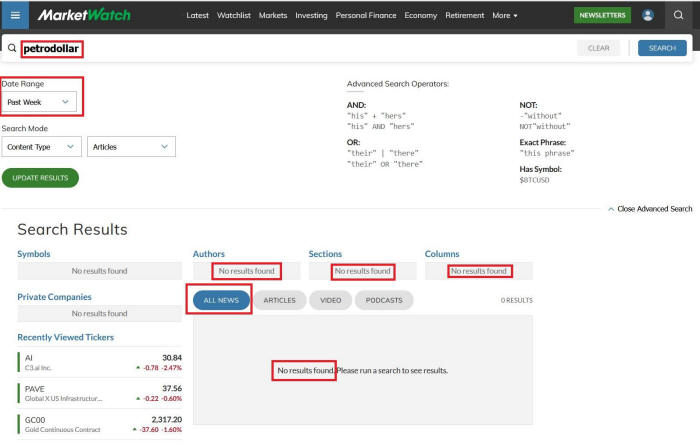

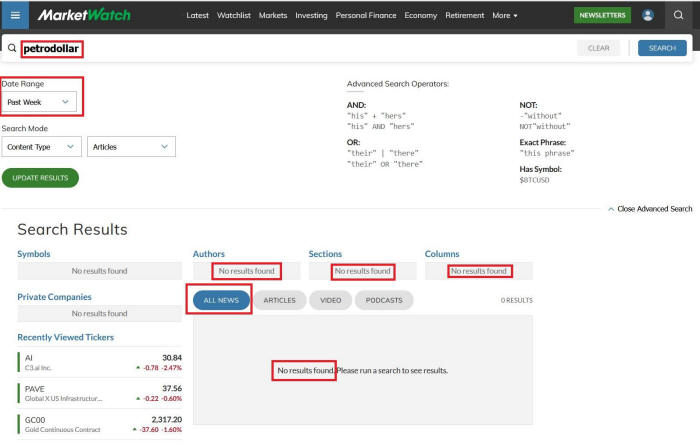

I was amazed that this news of the petrodollar agreement ending

Sunday was barely mentioned, if mentioned at all, in the corporate

news in the U.S.

I subscribe to

Market Watch, a Dow Jones company, and a search I did

yesterday for any news on this petrodollar agreement ending this

past Sunday returned ZERO results.

However, I did find several articles in the corporate media from

recent days reporting that a new deal was expected soon between the

U.S. and Saudi Arabia.

Here is one based on an article published in the Wall Street

Journal.

US, Saudi Arabia close to finalizing draft

security treaty, WSJ reports

The Biden administration is close to finalizing a treaty with

Saudi Arabia that would commit the U.S. to help defend the Gulf

nation as part of a deal aimed at encouraging diplomatic ties

between Riyadh and Israel, the Wall Street Journal reported on

Sunday, citing U.S. and Saudi officials.

The possible deal, widely telegraphed by U.S. and other

officials for weeks, is part of a wider package that would

include a U.S.-Saudi civil nuclear pact, steps toward the

establishment of a Palestinian state and an end to the war in

Gaza, where months of ceasefire efforts have failed to bring

peace.

Approval of the treaty, which the WSJ said would be known as the

Strategic Alliance Agreement, would require a two-thirds

majority vote in the U.S. Senate, a threshold that would be

difficult to achieve unless the treaty were tied to

Israeli-Saudi normalization.

The draft treaty is modeled loosely on Washington's mutual

security pact with Japan, the newspaper cited U.S. and Saudi

officials as saying.

In exchange for the U.S. commitment to help defend Saudi Arabia

if it were attacked, the draft treaty would grant Washington

access to Saudi territory and airspace to protect U.S. interests

and regional partners, the newspaper reported.

It is also intended to bind Riyadh closer to Washington by

prohibiting China from building bases in the kingdom or pursuing

security cooperation with Riyadh, the WSJ quoted officials as

saying.

The White House, the U.S. State Department and the Saudi embassy

in Washington did not immediately respond to requests for

comment.

Source

And here is a contradictory article about a new U.S. - Saudi deal

published in The Atlantic from someone who actually went to Saudi

Arabia and interviewed people there.

The Saudi Deal the U.S. Actually Needs

Along-rumored deal to form a strategic partnership between the

United States and Saudi Arabia looks doomed to fail because of

Israel's inability to accept a path toward Palestinian statehood

in exchange for normalized ties with Saudi Arabia.

As the deal collapses, though, it is worth asking: What kind of

relationship should the United States and Saudi Arabia aspire

to? What is reasonable for each side to ask of the other?

On a recent trip to the kingdom, I spent a week speaking with

Saudis from various backgrounds: wealthy businessmen from the

eastern province, young Saudi women starting out in careers

unimaginable to their mothers, senior government officials

responsible for topics including privatization and foreign

policy, and young Saudi men doing everything from starting their

own law firm to driving for Uber after their government job had

ended for the day.

Beyond their usual warm hospitality, and their patience with my

rusty Arabic, I was struck by two things in conversations with

Saudis: First, it is hard not get caught up in the infectious

confidence they have about the direction their country is headed

in. They feel like they are building something new - and judging

by the innumerable construction cranes on Riyadh's skyline, they

are.

Second, there is deep frustration and even disillusionment with

the United States.

As a former government official, I am used to the regular

complaints, such as the tiresome allegations that the United

States is "abandoning" the region (despite the tens of thousands

of troops that continue to garrison the Persian Gulf).

But I heard newer, more disturbing concerns.

At dinner with a dozen or so older Saudi men one night - almost

all of whom had a degree from a U.S. university - I heard real

reservations about sending their children and grandchildren to

the United States to study: Gun violence, societal divisions,

and populist politics in America were all cited as reasons to

send their children to the United Kingdom or Europe instead.

One Saudi who had gotten his Ph.D. in the United States worried

that "the America I love is tearing itself apart at the seams."

And for what it's worth, I heard something very similar from a

group of businessmen in Singapore two weeks later.

Full article

The first cross-border digital

dirham payment was completed

by Sheikh

Mansour Bin Zayed Al Nahyan,

Chairman of the

Board of the Central Bank of the UAE,

using the

Mbridge platform, a

central bank

digital currency (CBDC) liquidity and interconnection tool.

The settlement

involved sending 50 million dirhams ($13.6 million)

directly to

China.

Source

While U.S. Bitcoin enthusiasts believe that Bitcoin can replace the

petrodollar, all the evidence points in the opposite direction, as

it was announced last week that Saudi Arabia has joined the Bank for

International Settlements (BIS) Project mBridge, a China-dominated

central bank digital currency.

Saudi Arabia Joins BIS and China-Led Central Bank Digital

Currency Project

LONDON (Reuters)

Saudi Arabia has joined a China-dominated

central bank digital currency cross-border trial, in what could

be another step towards less of the world's oil trade being done

in U.S. dollars.

The move, announced by the Bank for International Settlements on

Wednesday, will see Saudi's central bank become a "full

participant" of Project mBridge, a collaboration launched in

2021 between the central banks of China, Hong Kong, Thailand and

the United Arab Emirates.

The BIS, a global central bank umbrella organisation which

oversees the project, also announced that mBridge had reached

"minimum viable product" stage, meaning it will move beyond the

pro type phase.

Roughly 135 countries and currency unions, representing 98% of

global GDP, are exploring central bank digital currencies, or

CBDCs. But the new technologies they use makes cross-border

movement both technically challenging and politically sensitive.

"The most advanced cross-border CBDC project just added a major

G20 economy and the largest oil exporter in the world," said

Josh Lipsky, who runs a global CBDC tracker at the U.S.-based

Atlantic Council.

"This means in the coming year you can expect to see a scaling

up of commodity settlement on the platform outside of dollars -

something that was already underway between China and Saudi

Arabia but now has new technology behind it."

The mBridge transactions can use the code China's e-yuan is

built on.

Source

The U.S. Central Bank is not currently a part of mBridge, but one of

its branches is, the New York Federal Reserve.

The U.S. has been trying to broker a deal with Saudi Arabia that

includes recognition of a Palestinian state since Trump's Abraham

Accords proposal in 2020.

But the ongoing massacre of Palestinians has put any motivation by

Saudi Arabia to enter into new agreements with the U.S. on hold.

All the evidence points to Saudi Arabia

aligning more closely with China and Russia as they are now full

members of BRICS, and more evidence was seen this week when

Saudi Arabia's Crown Prince Mohammed bin Salman decided to skip

the G7 Summit currently going on in Italy.

Source

UPDATE:

And at the G7, Biden announced that the U.S. is

going to send more aid to Ukraine by seizing Russia's assets in U.S.

dollars in the U.S., which could have more disastrous repercussions

on the U.S. dollar.

Here is a short video by Dimitry Simes,

Jr. who explains what might happen next:

Saudi Arabia is also exporting more oil to China now, which is the

second largest economy in the world, and is an economy with a

net-negative oil balance, as they do not produce enough oil to meet

the consumption needs of China, whereas the U.S. now produces more

oil than the U.S. population consumes and is an oil exporter.

In recent news, it was announced that China is investing over $1

BILLION in natural gas pipelines in Saudi Arabia.

China's Sinopec to Build Gas Pipelines for

Saudi Aramco in $1-Billion Deal

A subsidiary of China's energy giant Sinopec has signed a

$1.3-billion deal with Saudi Aramco to procure and build

pipelines for an expansion of the Kingdom's natural gas

distribution network, the Chinese firm said on Thursday.

Under the turn-key fixed-price contract worth $1.3 billion (5.17

billion Saudi riyals), Sinopec International Petroleum Services

Corporation, a wholly-owned subsidiary of Sinopec Oilfield

Service Corporation, will be responsible for the in-country

procurement and construction of Packages 6 and 7 of the Phase 3

Pipeline Project Clusters of the Master Gas System.

Source

The

New World Order is rapidly changing right before our eyes.

If you only get your news from U.S. sources, where the U.S. only

makes up about 5% of the world's population, you are only getting

the minority view right now, and probably not seeing world events

the way the rest of the world is seeing them today...

|