STEVE MEYERS:

My name is Steve Meyers.

And I want to thank you for taking part in this exclusive Money

Morning interview with

Jim Rickards, the Financial Threat and

Asymmetric Warfare Advisor for both the Pentagon and

CIA.

Recently, all 16 branches of our Intelligence Community have

come together to release a shocking report.

These agencies, that include the,

...they've already begun to estimate the impact of the fall of the

dollar as the global reserve currency.

And our reign as the world's leading super power being

annihilated in a way equivalent to the end of the British

Empire, post-World War II.

And the end game could be a nightmarish scenario, where the

world falls into an extended period of global anarchy.

Jim Rickards fears he and his colleagues' warnings are being

ignored by our political leaders and

the Federal Reserve (FED), and

we're on the verge of entering the darkest economic period in

our nation's history.

One that will ignite a 25-year Great Depression.

Today, we're going to examine everything he's uncovered because

the bedlam could begin within the next six months.

Which is why every American should hear his warnings before it's

too late.

Jim Rickards, thank you for joining us.

JIM RICKARDS:

It's my pleasure, Steve. Glad to be with you.

STEVE MEYERS:

In the early '80s, you were a member of the team that helped

negotiate an end to the

Iran hostage crisis.

In the late '90s, when it was discovered that the Wall Street

firm Long-Term Capital Management was about to cause a total

collapse of the financial markets, the Federal Reserve had to

turn to you in order to stop this catastrophe from plunging

America into a recession.

And then,

after 9/11, you were tasked by the CIA with

investigating potential insider trading that took place prior to

the terrorist attacks.

JIM RICKARDS:

That's exactly right.

The problem was the CIA didn't have any capital markets

expertise.

And why should they?

Prior to the beginning of globalization, capital markets weren't

really part of the battle space.

So the CIA engaged in some outreach, they recruited certain

people, myself included, to bring the Wall Street expertise to

the agency.

This Led to Project Prophecy

So, what the CIA said was, well, if there's going to be another

spectacular attack…

Using price signals to determine the actions of participants in

the market, whether it be terrorists, or strategic rivals of the

United States…

Could you spot it?

Could you get the information, and actually break up the plot,

and save American lives?

STEVE MEYERS:

This system you built with Project Prophecy actually predicted a

terrorist attack that was thwarted in 2006.

JIM RICKARDS:

On August 7, 2006, I got an email from my partner.

She said,

"Jim, we've got a bright signal on American Airlines.

It looks like a possible terrorist attack."

We documented that.

I was up at 2:00 in the morning in my study, watching CNN, and

all of a sudden MI-5 and New Scotland Yard emerged to break up

this terrorist attack.

They were arresting suspects and removing files.

So this showed that the system worked.

However, it's not just good for predicting terrorist attacks,

but also strategic attacks by rivals and enemies of the United

States.

STEVE MEYERS:

For years now, you've been helping the Pentagon and CIA prepare

for a rise in asymmetric warfare and financial threats, because

today there are immense fears we'll be struck by - as you've

described it before - a financial Pearl Harbor.

JIM RICKARDS:

There's now concern in different branches of the U.S.

government…

Historically in Washington, the Treasury and the FED take care

of the dollar.

The Pentagon and the Intelligence Community take care of other

threats, but what happens when the dollar IS the threat?

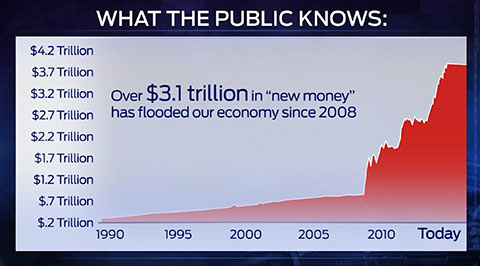

Americans generally know that:

-

The FED has increased the money supply by $3.1 trillion.

-

We have $17.5 trillion of debt.

-

We have $127 trillion of unfunded liabilities.

What are those?

-

Medicare

-

Medicaid

-

Social Security

-

student loans

-

Fannie Mae

-

Freddie Mac

-

FHA

You go through the whole list and it goes on and on and on.

There's no way to pay it.

Debt can no longer be used to artificially grow our economy.

During the boom years of the 1950s and 1960s, every dollar of

debt that was created, we got $2.41 worth of economic growth.

So that was pretty good bang for the buck.

But by the "stagflation" of the late 1970s that relationship had

actually collapsed.

So now for a dollar of debt in the late 1970s, we were only

getting $.41 in growth, so, obviously, that's a huge drop-off.

You know what that number is today? Today, we only get $.03 in

growth for every $1 of debt.

So we're piling on the debt, but we're getting less and less

growth.

As the trend goes from $2.41 to $.41 to $.03…

It's soon going to go negative.

This is a signal of a complex system about to collapse.

STEVE MEYERS:

This really speaks to what you wrote about in your new book,

The

Death of Money, the title strongly alludes to this, the

hourglass is now empty.

You warn we're about to fall into a 25-year Great Depression…

That the stock market could plunge overnight 70%.

JIM RICKARDS:

(Interrupts)

You know, when I use the phrase 25-year depression, it sounds a

little extreme, but historically it's not.

We had a 30-year depression in the United States from about 1870

to 1900. Economists actually call it the

Long Depression.

That was before the

Great Depression.

The Great Depression

lasted from 1929 to 1940, so that was quite long.

The U.S. is in a Depression Today

STEVE MEYERS:

A lot of folks might disagree with you that we're currently in a

depression.

That word brings to mind images of the 1930s and soup kitchens.

JIM RICKARDS:

Well, we have soup kitchens today…

They're just at Whole Foods and your local supermarket, because

50 million Americans are on food stamps.

It's not that we don't have distress.

We have enormous distress, but it's being hidden in different

ways.

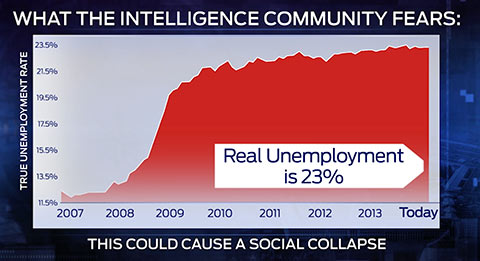

The unemployment rate today is actually 23% when you calculate

it the right way.

STEVE MEYERS:

And you point the finger right at the FED, Congress, and the

White House.

JIM RICKARDS:

(Interrupts)

I was in a meeting in the Treasury and I said:

"The FED and the Treasury are the greatest threats to national

security, not Al- Qaeda."

Right here in this building with this group…

You people are destroying the dollar and it's just a matter of

time before it collapses.

And I testified before the United States Senate about this.

I warned the Senate, maybe we can't stop earthquakes on the San

Andreas Fault…

But nobody thinks it's a good idea to send the Army Corps of

Engineers out there to make the San Andreas Fault bigger.

But by money printing, credit creation, and reckless monetary

policy by the FED, we're making the San Andreas Fault bigger

every day.

And when you make a complex system bigger - the risk doesn't go

up a little bit - it goes up exponentially. So the risk is

unimaginable at this time.

The collapse hasn't happened yet, but the forces are building up

and it's just about to snap.

STEVE MEYERS:

Jim, your take, and that of many in the Intelligence Community…

Is much different than what we're hearing out of Capitol Hill.

Which is why the allegations you make in this book are causing

quite a controversy in Washington.

JIM RICKARDS:

I was at a recent conclave in the Rocky Mountains with a couple

central bankers, one from the Federal Reserve and one from the

Bank of England.

They'll say things privately that they won't say publicly.

And I was handed a copy of Janet Yellen's playbook.

The FED is trying to kind of use propaganda…

Lie to us about economic prospects, talk about green shoots, use

happy talk to try to get us to spend our money.

The FED doesn't know what they're doing.

Don't ever think that they know what they're doing.

You can print all the money you want, but if people are not

borrowing it, if they're not spending it, then your economy is

collapsing, even with money printing.

So you can understand it this way…

Let's say I go out to dinner and I tip the waiter.

And the waiter takes my tip and he takes a taxicab home.

And the taxi driver takes the fare and puts some gas in her

taxicab.

Well, in that example, my dollar had the velocity of three.

$1 supported $3 of goods and services: the tip, the taxi ride,

and the gasoline.

But, what if I don't feel great? I stay home, and watch

television.

I don't spend any money.

Well, that money now has a velocity of zero.

I leave my money in the bank, but I don't spend it.

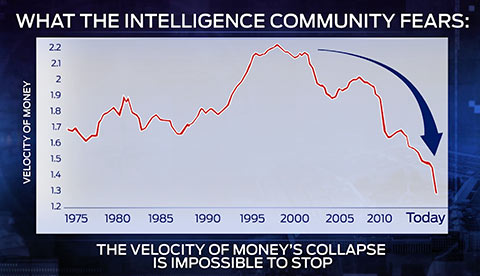

Let's look at what's actually happening with the velocity of

money.

It's plunging… It's going down very rapidly.

But compare this decline of velocity today to what we saw

leading up the Great Depression.

Now, in the depths of the Great Depression velocity was even

lower…

But…

If you compare what's going on today to what happened in the

late 1920s just prior to the Great Depression, there's a very

striking resemblance.

So, it doesn't matter how much money the FED prints.

Think of it as an airplane that's coming in for a nosedive.

It's crashing… crashing… getting closer to the ground.

The FED is trying to grab the joystick and pull the plane up out

of the nosedive and get it back in the air...

But, unfortunately, it's not working, we're heading for a crash.

STEVE MEYERS:

We've just covered a lot of these startling numbers, these

signals of this coming Great Depression.

Let me see if I can quickly put it all together.

Nobody denies that we have a debt crisis in this country, but

you're saying we can no longer grow our debt without causing our

economy to aggressively slow down.

We're barely above water now.

So that's signal number one.

Signal number two is this dangerous slowdown in our velocity of

money.

It's already plummeting to levels not witnessed since the Great

Depression in the 1930s.

Are there any other signals the Intelligence Community is

monitoring that suggest this collapse is right around the

corner?

JIM RICKARDS:

There are, Steve.

There are a lot of signals out there and they're very, very

troubling.

One of the ones I'm watching closely, and I know people in the

Intelligence Community focus on also, because it covers so much

ground, is called the Misery Index.

The Misery Index = Real Inflation Rate + Real Unemployment Rate

If you look at the Misery Index today compared to the period of

stagflation in the late 1970s and early '80s that Americans

remember so well…

It's actually worse.

This can lead to social instability…

Take this back to the Great Depression...

The Misery Index in

the Great Depression was 27.

Today it's 32.89.

Believe it or not, it's worse today than it was during the Great

Depression.

What happens as a depression worsens?

Businesses can't pay their debts. The bad losses fall on the

banks. The banks ultimately fail.

That's happened before.

The FED has had to bail out the banks.

But what happens when the FED, itself, is in jeopardy?

STEVE MEYERS:

Based on these signals you've been tracking, the Federal Reserve

is going to fail?

JIM RICKARDS:

The Federal Reserve actually, in some ways, already has failed.

I spoke to a member of the Board of Governors of the Federal

Reserve and I said,

"I think the FED is insolvent."

This Governor first resisted and said,

"No, we're not."

But, I pressed her a little bit harder and she said,

"Well,

maybe."

And, then, I just looked at her and she said,

"Well, we are, but

it doesn't matter."

In other words, here's a Governor of the Federal Reserve

(Chair of the Federal Reserve Board of Governors -

Janet Louise Yellen) admitting to me, privately, that the Federal Reserve is

insolvent, but said, it doesn't matter, because central banks

don't need capital.

Well, I'm going to suggest that central banks do need capital.

Look at this chart.

What it shows you is that the FED has increased its capital they

currently have about $56 billion.

That sounds good.

You say,

"gee, $56 billion is a lot of money, that's a pretty

good capital base."

But That's Not the Whole Story

You have to compare the capital to the balance sheet.

How much in the way of assets and liabilities is that amount of

capital supporting.

When you look at that it's a much scarier picture, because the

actual liabilities, or debt, if you will, on the FED's books is

$4.3 trillion.

So you've got $4.3 trillion sitting on this little skinny

capital base of $56 billion…

That's very unstable.

Prior to 2008, the FED's leverage was about 22 to 1.

Meaning they had $22 in debt on their books for every $1 of

capital.

Today, that leverage is 77 to 1.

So, yes, the capital has increased, but the debt and the

liability has increased much more.

STEVE MEYERS:

Your warnings haven't gone completely ignored.

In the budget he presented this year, Senator

Rand Paul cited

your work and how we've driven our economy to the edge of a

Roman Empire-like collapse.

In fact, we have footage of Senator Paul instructing Americans

to listen to your warnings.

SENATOR RAND PAUL:

Jim Rickards notes the

FED is insolvent on a mark-to-market

basis. The FED has wiped out its capital on a mark-to-market basis.

Of course, the FED carries these notes on its balance sheet at

cost and does not mark them down to market. But if they did, they would be broke.

JIM RICKARDS:

First of all, I give Senator Rand Paul credit.

He's one of the few people who understand the dangers here.

But, the problem is not limited to the FED.

It's infecting

the private banking system as well.

There's about $60 trillion of debt on the balance sheets of our

banking system.

For a long time, debt and the banks grew at about two times the

rate of growth in the economy.

But lately, this has exploded.

Today it's up to 30 to 1.

In other words, for every dollar of economic growth, there's $30

of credit being created by the banking system.

The Whole Thing is Unstable

I can give you a very good example of this and this actually

comes from physics.

If you had, let's say, a 35-pound block of uranium shaped like a

cube, it would actually be fairly harmless.

It's what we call sub-critical. It's radioactive, but it's kind

of tame.

But now imagine you engineer it.

You take that 35-pound block.

You take one piece and shape it into something about the size of

a grapefruit.

Take another piece, shape it into something like a bat.

Put the ball and the bat in a tube and fire them together with

high explosives.

That sets off a nuclear detonation.

That destroys a city.

The way it's been shaped and configured is what takes it from

what we call sub-critical to super-critical.

STEVE MEYERS:

Jim, are you seeing any signs that our stock market has reached

a super-critical state?

JIM RICKARDS:

Well, unfortunately, yes.

We're seeing a lot of signs of this.

One of the signs that's really fundamental, and really

important, is the ratio of stock market capitalization to GDP.

Because, remember, the value of all the stocks in the stock

market, that's supposed to represent the fundamental economy.

It's not supposed to be off in a world of its own.

But if you look at what's been happening to that ratio recently,

it's going sky-high.

It's 203%.

Just prior to the recession…

That number was 183%.

Go back to the famous tech bubble, the dot com implosion of

2000.

At that time, it was 204%.

And if you want the scariest news of all…

Just prior to the Great Depression that number was 87%.

In other words…

The stock market capitalization, as a percentage of GDP, is

twice as high as it was just prior to the Great Depression.

So, that's a really good metric for saying,

"Hey, is the stock

market heading for a crash?"

All the data says,

"Yes, we are."

But there's another metric, another warning sign, if you will,

that's even more frightening, which is the Gross Notional Value

of Derivatives.

There are a certain number of shares of IBM that are

outstanding, but we know what that number is.

But there's no limit on the derivatives.

I can write options and futures on IBM stock all day long and

all the other stocks on the stock market.

And that's what's been going on.

Now, the Gross Notional Value of Derivatives in the world today

is over $700 trillion. Not billion.

$700 trillion.

That's ten times the global GDP.

This collapse is unavoidable.

So, we ask ourselves, how bad can this be?

Well, what happened in

2007, 2008 when the markets collapsed…

We all remember the value of stocks going down…

Real estate going down, housing going down…

All that lost wealth was $60 trillion.

The problem is now the system is bigger, so I would expect the

lost wealth this time to be $100 Trillion - possibly a lot more.

We're in this critical state, getting close to the

super-critical state where the system implodes.

But it takes a catalyst, it takes a flashpoint.

There are a number of potential flashpoints I've investigated.

STEVE MEYERS:

Jim, in a few moments I want to discuss the steps Americans need

to take with their investments and personal finances to prepare

for everything you and your colleagues are predicting.

But now let's quickly focus on some of these major flashpoints.

JIM RICKARDS:

One of the key flashpoints we're looking at is foreign ownership

of U.S. government debt.

Now, this is a very important thing to understand.

We all know that the Treasury has issued over $17 trillion worth

of debt, the question is who buys it?

A lot of U.S. debt is owned by foreigners. Who owns it?

China, Russia, other countries…

Countries that are not necessarily 'our' friends.

But they can dump it when they want to.

Well, guess what, that's actually what's been going on.

Recently, foreign holdings of U.S. government debt have been

plummeting.

But it gets even more interesting than that.

We talked earlier about the project I did for the CIA…

Project Prophecy.

And we said, you can see not only market action, but rivals,

enemies, terrorists and others, operating in financial markets.

So, we all know that

Russia "invaded" Crimea in the spring of

2014.

Let's say you're Putin. You know you're going to invade Crimea.

You can expect U.S. financial sanctions.

So what do you do?

You basically mitigate the impact of the sanctions, start

dumping treasuries in advance so that when you make your move

and the Treasury tries to come against you, you've insulated

yourself.

So go back and look at October 2013, here's Russia dumping

Treasuries month after month.

That was a clear signal that they were getting ready to do

something…

To engage in financial warfare against the United States.

But guess what? It's worse than that.

We know the Russians and Chinese are working together.

So is it any surprise that when the Russians started dumping…

The Chinese started dumping also?

STEVE MEYERS:

Does the Intelligence Community have the ability to defend our

country in the event that this escalates even further?

JIM RICKARDS:

Believe it or not, there's an intelligence unit inside the

Treasury.

And they actually have a war room.

That tells you that financial warfare is here and it's real.

So if the Russians are dumping…

The Chinese are dumping…

Who is going to buy all this debt?

Well, a mystery buyer has shown up.

Recently, Belgium has bought enormous amounts…

In the hundreds of billions of dollars of U.S. government

securities.

STEVE MEYERS:

So Belgium started loading up on treasuries, coincidentally at

the exact same time Russia and China began dumping theirs?

JIM RICKARDS:

(Interrupts)

It's not the Belgians.

These amounts are bigger than the Belgian current account

surplus.

These are not Belgian dentists who are buying these things.

Belgium is a Front

You know, could it be the FED itself?

That's the point.

Maybe the public doesn't know who the mystery buyer is, but

the

national security community does.

Now, the Treasury, operating through this war room, and the FED

- the mystery buyer in Belgium…

For now, they have managed to prop up the treasury market.

It hasn't collapsed yet.

But they're not going to be able to keep pulling these rabbits

out of a hat, there's a limit.

This should be very scary, because if the FED is tapped out - we

talked earlier about how the FED is leveraged 77 to 1.

So the FED is at the limit of what they can do.

The foreigners are now dumping treasuries and if no one buys it,

guess what, interest rates go up.

That'll sink the stock market, that'll sink the housing market.

Higher interest rates mean the debt gets higher, so interest

rates go up some more.

So you start a death spiral and there's no way out of it.

STEVE MEYERS:

An attack on our treasury market is obviously a very serious

flashpoint that could ignite this Great Depression you predict

in your book.

Let's talk about another flashpoint.

JIM RICKARDS:

What I call flashpoint number two has to do with the

petrodollar.

STEVE MEYERS:

Can you explain what you mean by the petrodollar?

JIM RICKARDS:

It's basically a system whereby oil exports are priced in

dollars.

Oil doesn't have to be priced in dollars.

It could be priced in Euros, Japanese Yen, Swiss Francs, gold.

It could be priced in a lot of things.

But, in fact, the whole global oil market is priced in dollars.

I was actually very close to the birth of the petrodollar

system.

My first visit to the White House on official business was in

1974, with a small group, about five of us.

We met with

Helmut Sonnenfeldt, who was the

Deputy National

Security Advisor at the time.

He was the number two to

Henry Kissinger.

And, this was at a time you have to remember…

At the beginning of the '70s oil was $2 a barrel.

At the end of the '70s, oil was $12 a barrel.

This Was an Oil Shock

The price of oil was skyrocketing.

Inflation was getting out of control.

There were gas lines.

You know, a certain generation of Americans remembers this very

well.

We were in the White House talking about what to do about this.

One of the scenarios we discussed was the U.S. military would

invade Saudi Arabia.

We would secure the oil fields and create a military perimeter

around them.

We would pump the oil and set it at a price that was favorable

to us.

Now, we would give the money to the Saudis.

We didn't want to steal their money.

We didn't want to steal their oil.

We just wanted to set the price.

Now, fortunately, that plan was not carried out.

But it shows you how desperate things were at the time.

But what did happen?

Why did we not invade Saudi Arabia?

Well, the answer is Kissinger and the Saudis worked out a deal.

And the Saudis said,

"Okay, we'll price oil in dollars, so that

secures the role of the dollar as the global reserve currency."

But there was a

quid pro quo.

We agreed to guarantee the continuation of the House of Saud,

the royal family of Saudi Arabia.

And by extension, the national security of Saudi Arabia.

Because they're a relatively weak military power.

And it's a bad neighborhood - a lot of enemies in the region

starting with Iran and others.

So the question would be, obviously, did this petrodollar deal

work?

And it ABSOLUTELY did work.

Once it kicked in, the dollar roared.

This was the period - sometimes people call it the king dollar

period, the strong dollar period.

This was after Volcker and Reagan in the 1980s.

But this only continued up to a certain period of time…

Up

until around 2000...

And since then, the dollar has been in a decline.

STEVE MEYERS:

So what could cause the fall of the petrodollar?

JIM RICKARDS:

Well, we're seeing it in real time.

Think of the petrodollar, or the dollar as the global reserve

currency…

Think of it as a three-legged stool.

So, here's the stool and it's got three legs.

As long as the legs are standing, the foundation is firm and the

dollar will remain as a global reserve currency.

But, one by one, those legs are being pulled out.

What are the legs?

Well, the first one is Saudi Arabia.

That was where the petrodollar deal began.

Our side of the deal was we would guarantee the national

security of Saudi Arabia.

But lately - going back to December of 2013…

President

Obama stabbed the Saudis in the back by anointing Iran

as the regional-hegemonic power.

You know, the President has been withdrawing American power from

around the world and his view is, well, we'll leave a friendly

cop on the beat.

Every sort of bad neighborhood around the world will have a cop

on the beat.

The President has decided that Iran is going to be the cop on

the beat in the Middle East.

They're going to be the heavyweight regional power.

Where does that leave Saudi Arabia? Out in the cold.

So now Saudi Arabia is saying…

"Wait a second, you've undermined our national security, you've

reneged on your side of the petrodollar deal, why should we hold

up our end?

Maybe we'll start pricing oil in gold or Euros or maybe Chinese

Yuan."

Because now, increasingly, Saudi Arabia is selling more and more

oil to China.

So, the first leg of the stool has been pulled out.

The

Saudis are going to back away from the petrodollar, because

we are no longer guaranteeing their security - we're playing footsie with Iran.

The second leg of the stool is Russia.

Now, Russia is not a member of OPEC, but they are the world's

largest oil exporter, one of the world's largest energy

exporters, actually bigger than Saudi Arabia.

So even though they're not a member of OPEC, they also price oil

in dollars.

So, they've signed onto the petrodollar deal in their own way.

But, we're now engaged in financial warfare,

Russia is ready to

fight back.

And this is not classified information.

This is being said publicly.

Andrei Kostin, President and Chairman of Russia's

VTB Bank, it's

one of the largest banks in Russia, he recently said…

"It's time to change the entire international financial system

that considers the dollar the key reserve currency. The world

has changed."

A member of the Russian Parliament, he said…

"The dollar is evil.

We will sell rubles to consumers that rely on gas and later

we'll exchange the rubles for gold.

If they don't like this, let them not do it.

Let them freeze to death."

So, two of the legs of the stool, Saudi Arabia and Russia, have

already been pulled out.

The third leg is China.

And that is coming out too.

STEVE MEYERS:

As far as Russia and China's role in taking down the

petrodollar…

This recent $400 billion energy alliance they signed, is that

the purpose of it?

JIM RICKARDS:

Sure.

Russia is the world's largest energy exporter, China is the

fastest growing economy in the world, they need energy.

So this is a natural partnership between the two. But the dollar

is out in the cold.

And, China is actually putting these Yuan bilateral trade

agreements in place all over the world.

They're doing them one-by-one.

But once there's enough trade and enough volume in a certain

currency, it can become a reserve currency.

These are all straws in the wind, leading to the collapse of the

dollar as the global reserve currency.

STEVE MEYERS:

Jim, in your book, you investigate how nations are now using

gold as a financial weapon.

Is this one of the most dangerous flashpoints?

JIM RICKARDS:

It's absolutely one of the most dangerous flashpoints and,

here's why…

A lot of people look at the dollar and say,

"Look, you may not

like the dollar, you may worry about the dollar, but you've got

nowhere else to go."

But there is another place to go, which is gold.

You don't have to buy treasuries, you can

buy gold.

And countries are actually doing that.

So this is basically a global rebalancing of gold reserves.

This is one of the things that the Intelligence Community is

watching most closely.

And China is our number one case.

Here's why:

China has acquired more than 3,000 tons in the past

four years.

Now they lie about this. They officially say they have 1,054 tons.

The reason is, China is using their own military and their own

intelligence assets to acquire some of this gold in stealth.

I recently ran into a senior officer of one of the major secure

logistics firms in the world. Secure logistics that means these are people who operate vaults

and armored cars.

So they handle the physical metal.

They're not central banks.

They're not government agencies.

These are Brinks and G4S and ViaMat.

These are the big players in this field.

One of these officials said he recently brought gold into China

at the head of an armored column of the People's Liberation

Army.

In other words, he was in an armored car and they had Armored

personnel vehicles bringing gold into China.

I guarantee that did not show up in the official Hong Kong

import figures.

Now, why is China doing this?

A lot of people speculate that they want to launch their own

gold-backed reserve currency, to take the Chinese Yuan, back it

with gold, make it a global reserve currency.

That's extremely unlikely.

That's not what China is doing.

What they are trying to do is hedge against the collapse of the

dollar.

China can't prevent that from happening.

What they can do is build up the gold reserves.

This is known to the Intelligence Community.

This is NOT publicly revealed.

What if it were publicly revealed?

Here's what global gold reserves would look like if the amount

that China owns were actually suddenly revealed.

This is a dagger aimed at the heart of the dollar.

STEVE MEYERS:

Jim, so far all of these flashpoints have involved China.

Isn't this an economic suicide mission to attack America?

JIM RICKARDS:

There's something else here, another flashpoint that could

meltdown the global financial system.

What if the U.S. doesn't bring the entire pyramid crashing down,

what if it's China?

Well, it could very well be.

They have a highly leveraged banking system.

But the banking system is just the beginning.

There's also something called a

shadow banking system.

This is now a $7.5 trillion industry and it's up 4,067% since

2005.

STEVE MEYERS:

This term shadow banking, it's starting to get play in the

press.

How would you explain it?

JIM RICKARDS:

If you put your money in the bank in China, they - it's just

like the United States.

They pay you nothing, zero maybe, one quarter of one percent,

something pathetically small.

But, they're offering these wealth management products that pay

five, six, seven percent.

Well, what are they?

Well, they're actually - they take the money and they buy

mortgages on worthless assets, inflated assets and bubble assets

that are going to crash.

Before the crash in the United States, before 2008, new

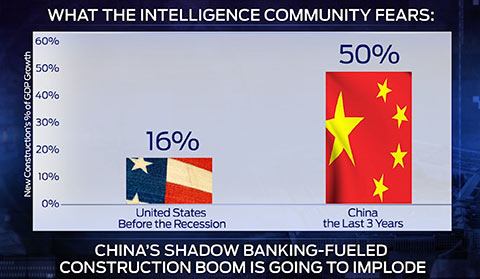

construction, as a percentage of GDP growth, that was about 16%.

16% is a pretty big slice.

But, look at China.

In each of the last three years, construction has been 50% of

GDP growth.

They're building white elephants, they're building trophy

projects, they're building ghost cities.

I've been to China - I was with the Communist Party officials

and provincial officials, they were trying to get me to bring

some businesses there.

I went to one place near Nanjing.

They weren't building seven buildings, they were building seven

cities.

Every city had a whole cluster of skyscrapers, luxury hotels,

athletic facilities, housing facilities, high-end shopping,

metro stops, highway access…

And an airport to service all seven of these cities.

This construction was going on as far as the eye can see.

It was all empty.

All of it.

Now, here's the point.

In the U.S. before the crash, it took about 4.3 years of income

to buy the typical house.

In China, it takes 18 years of income.

If they're building apartments, co-ops and condos, and people

can't afford them, you know their prices are going to collapse.

One of the senior banking officials in China said,

"This is a Ponzi scheme."

Those are his words, not my words.

I happen to agree.

But, we all know what happens to

Ponzi schemes, eventually you

run out of suckers and they collapse.

Once you have enough collapses, there's going to be a run on the

banks.

The bankers are going to say sorry, we can't pay you, it's not

our problem.

Well, that's not going to be good enough.

Riots are going to break out.

What does it mean when the world's second largest economy hits

the brakes?

That's going to be disastrous to global growth; it's going to

pull the rug out from under the sky-high valuations we're seeing

in the U.S. stock market.

This is a set-up for an entire collapse of the global economy.

STEVE MEYERS:

Jim, there's one more flashpoint I'd like to talk about.

It has to do with a premeditated plan you believe exists inside

the IMF, and it involves high-ranking U.S. officials…

To replace the dollar as the world's reserve currency.

JIM RICKARDS:

It's not just my belief.

This is actually documented.

It's a ten-year plan to replace the dollar as the global reserve

currency.

The IMF released a report this year, it was called - and get

this title - "The Dollar Reigns Supreme By Default."

And here's a direct quote…

"The aggressive use of unconventional monetary policies by the

Federal Reserve, the U.S. central bank, has increased the supply

of dollars and created rifts in the financial system. The dollar

status should be in peril."

Reserves are nothing more than a savings account for a country.

That's the amount of money they've saved.

But, the problem is, when you have it you have to decide what to

do with it.

You can't just stick it under a mattress, so to speak.

A lot of people think that the dollar will prevail because there

are no good

alternatives.

That's not true.

The dollar is declining sharply, as a percentage of total global

currency reserves.

Imagine if that continued.

The euro comes up.

Swiss franc comes up.

Some of the other currencies come up.

That's one outcome.

But, there's another outcome, that's probably coming a lot

sooner.

We have a financial panic in the world.

If a central bank has to re-liquefy the world, where is that

money going to come from?

It can't come from the FED, they're leveraged 77-to-1.

There's only one clean balance sheet left in the world… the

IMF's.

The IMF, believe it or not, is only leveraged 3-to-1.

When the next crisis comes, it's going to be bigger than the

FED.

The only source of liquidity in the world is going to be the

IMF.

Think of it this way.

The Federal Reserve has a printing press, they can print

dollars.

The European central bank has a printing press, they can print

Euros.

The IMF, the International Monetary Fund, has a printing press

too.

They can print something called the

Special Drawing Right, or

the SDR for short.

These SDRs can come along as a new reserve currency.

The reason they came up with the name Special Drawing Right is

because if they called it "world money" that would sound a

little spooky and scary.

But that's exactly what it is.

Here's the point.

This may be a ten-year plan.

We're not going to make it ten years.

This collapse will happen a lot sooner than that.

So they're going to have to dust off this playbook and run out

these SDRs and print trillions of them to prop up the system.

Now, if the FED

bailed out private credit in 2008…

And the IMF now bails out the FED in the next financial panic…

Who runs the IMF? Who's really in charge?

Well, it's a "nice" crowd.

We've got kings, dictators, communists…

They're unelected, unaccountable.

And this is the next flashpoint, really, the IMF taking over the

world monetary system and becoming the central bank of the

world…

Printing "world money" called the SDR.

STEVE MEYERS:

Jim, these flashpoints…

The attacks on our treasury market and petrodollar…

China's stealth gold run…

China's inevitable collapse…

Even this alarming inside job to take down our dollar that's

escalating at the IMF…

You've only scratched the surface of what you reveal in your

book.

However, the most important message I took away from

The Death

Of Money is:

Regardless of which flashpoint unleashes the 25-year Great

Depression, folks need to understand it's coming, and coming

quick.

JIM RICKARDS:

Steve, that's exactly right.

There is a mission in this book and it's urgent and it's

important.

We're talking about:

A prolonged depression…

This could all start within the next six months.

Look at it this way.

Americans right now are standing at the very bottom of a tall

mountain… Mt. Everest, Mt. Kilimanjaro.

About halfway up the mountain, there's a catastrophic avalanche

barreling down towards us.

Determining the one snowflake…

The one flashpoint that's going to speed this chaos up shouldn't

be our focus.

Recognizing the severity of the situation and moving to safety

should be.

So, mission one is helping people hold on to what they've got.

That's going to be more than half the battle ahead.

STEVE MEYERS:

Jim, as you know, Money Morning believes so much in your book…

As well as your mission to warn the public…

That we'd like to send free copies of

The Death of Money: The

Coming Collapse of the International Monetary System, to

everyone who is watching this interview.

Now, it's on bookshelves, it's being sold for about $xxx.

But, I want to point this out.

The version we're sending folks is different than the one being

sold in stores.

JIM RICKARDS:

(Interrupts)

And the reason why is simple.

What we're talking about today is not light reading material.

The book investigates everything thoroughly, except for one

part.

It's what our government calls - and to be clear, this is what

they call it - "the Day After Plan".

This describes what America and our government will be like when

our economy collapses.

Now, I have an unpublished chapter that does outline this

situation, it's called The Day After Plan Declassified.

I didn't put it in the book that was originally released,

because it is controversial.

The picture I paint is far from pretty.

But I am going to include this chapter here…

Because folks watching this interview are more prepared to see

this intelligence and these scenarios.

STEVE MEYERS:

You also took another step with this version of the book…

You created a six-part video series you're calling, The Death of

Money Digital Debriefing.

JIM RICKARDS:

Here's why I put that together.

It's impossible for anyone, me or anyone else in my line of

work, to give you an exact day and time this collapse will

begin.

We just know it's coming and coming soon.

However, there are crystal clear warning signs that will appear

in our economy and in our markets.

This is certain.

So, across this video series I walk folks through the seven

major signs.

I give you the exact signals to watch for.

I share the charts.

The announcements you'll hear from certain world governments and

the Federal Reserve.

I examine, even further, the flashpoints that could ignite this

nuclear meltdown in our economy.

I explore the secret bubbles nobody is talking about.

I share more findings from the Intelligence Community about

Russian, Chinese, and Iranian activities against America.

This is very important…

Across this video series I help folks analyze their investment

portfolios.

I show them how to adjust their allocations accordingly for

numerous scenarios that could unfold, because this is a fluid

situation - it's volatile.

So, I review how much of your portfolio should be in certain

sectors of the stock market, precious metals, income

opportunities…

Where folks should be looking overseas to invest. It's a

point-by-point examination of each of these areas.

STEVE MEYERS:

Jim, we'd like to rush copies of your book, the unpublished

chapter, and this six -art digital debriefing out to everyone

watching.

It's part of a bold initiative you're taking on, what you're

calling:

You helped lead a CIA mission called "Project Prophecy."

The goal was to identify the signals in the financial markets

and economy that threatened our country.

With this re-launch of Project Prophecy here, you're applying

this same methodology to helping everyday folks build this

unbreakable wall around their wealth.

Let's talk about what you've created.

JIM RICKARDS:

Steve, I realize much of what I've revealed today is a shock to

the system.

America is facing one of its darkest periods.

There's no escaping that.

And some of the measures folks are going to need to take to

protect themselves may be outside of their comfort zones.

So, I'm going to take a hands-on approach here.

My book, the unpublished chapter, and digital debriefing will

give them the big picture.

But, folks also need to know the exact investments to target and

the ones to avoid.

They need to rethink how they handle their personal finances.

To help them I've prepared a set of intelligence briefings.

The first is called, The Project Prophecy Wealth Defense

Blueprint: The Four Directives.

And, with each directive, I have specific investments targeted.

STEVE MEYERS:

Let's examine each of them.

JIM RICKARDS:

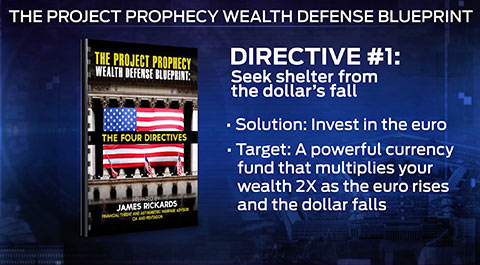

Directive #1

Seek Shelter From the Dollar's Fall

The next time the dollar falls - it won't be the first time.

The dollar almost collapsed completely in the late 1970s.

Between 1977 and 1981, a five-year period, cumulative inflation

was 50%.

If you had insurance, annuities, any kind of fixed income,

retirement income, savings in the bank, you lost half your

wealth in a very short period of time.

What we're talking about now could be a 70 or 80% collapse,

maybe even more.

The best way to handle the dollar's fall - and this is what I

focus on in the briefing - is to invest in the euro.

What people have to understand is the euro is not an economic

project.

It's a political project.

And if the political will is there, directed from Germany, the

euro is going to hang together.

We have a chart actually showing the euro's rise against the

dollar.

So just imagine all the talk about the collapse of the euro and

yet the euro is actually getting stronger.

And, by the way, everyone knows that the United States has 8,000

tons of gold.

Well, Europe has 10,000 tons of gold.

Europe is the largest gold holder in the world.

So, they actually have the gold to back up the euro.

Now, you don't have to open a foreign bank account to invest in

the euro.

In this Project Prophecy Wealth Defense Blueprint, I'm

recommending a specific fund that rises twofold as the dollar

falls against the euro.

This is a very strong defense play because you are getting twice

the return from both the dollar's fall and the euro's rise.

STEVE MEYERS:

So walk us through this second directive in this briefing.

JIM RICKARDS:

Directive #2

Always Have an Insurance Plan For a Market Collapse

The stock market is going to fall 70%.

Now, does that mean you shouldn't hold stocks?

Folks should make that decision for themselves.

But, there are ways to use the market itself as a safety net.

I'm recommending we target the sector that will experience the

most severe consequences of this collapse, the financial sector.

The companies that are holding all these stock derivatives.

These are going to fall harder and faster than anything else.

So, I examine a specific fund in this briefing that is heavily

weighted against the financial sector.

It rises 3% for every 1% the financial sector pulls back.

So, a 25% pull back, that's a 75% return from this fund.

If it falls 70%, now you're looking at a 210% return.

What this fund allows you to do is use a small amount of capital

to multiply your protection against a market crash.

It's excellent insurance.

STEVE MEYERS:

So, take us through the third directive.

JIM RICKARDS:

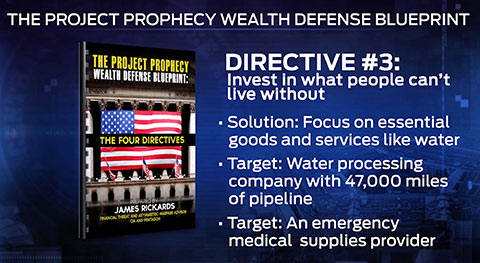

Directive #3

Invest in What People Can't Live Without

When America experiences this worst case scenario we are

predicting in the Intelligence Community, people won't stop

needing food.

They won't stop using energy.

They won't stop using essential goods and services.

This is where folks should be looking now.

So in the briefing I'm recommending water investments, because

you can't live without water.

And we're already seeing water investments begin to take off.

This sector has been surging since 2009. It's up about 200%.

I'm targeting a water processing company that operates 47,000

miles of water pipelines across 16 states and 1500 communities.

Now, this is a sleeping giant income play.

This water processor's dividend has grown every year.

It's up 55% already.

And, income is something we can't live without either.

And, besides water, the briefing also focuses on a company that

provides emergency medical supplies, because that's also a

necessity.

STEVE MEYERS:

Jim, you have one more directive in this briefing.

JIM RICKARDS:

Yes, Warren Buffet's secret weapon.

Directive #4

Target Companies Who Control Hard Assets

You know Warren Buffet has this reputation as the

avuncular

oracle of Omaha, the stock market investor's best friend.

But, I say when it comes to billionaires, don't listen to what

they say, watch what they do.

Warren Buffet's recent acquisitions have been very revealing.

A few years ago he bought the

Burlington Northern Santa Fe

Railroad.

He bought the whole railroad.

He actually took it private.

But what is a railroad?

A railroad is nothing but hard assets.

They have right-of-ways, mining rights adjacent to the

right-of-ways, rail rolling stock, yards, switches, signals;

it's all hard assets.

How does a railroad make money?

It moves hard assets in the form of freight, coal, wheat, corn,

steel, cattle, etc.

So a railroad is the ultimate hard asset play. It's hard assets

making money moving hard assets.

What was Warren Buffet's next big acquisition? He bought oil and

natural gas resources, another hard asset.

And by the way, he can move his oil on his own railroad.

He doesn't need the Keystone Pipeline.

When you line up 100 tanker cars on a railroad, that's a

pipeline on wheels.

So Warren Buffet is a guy who's dumping paper money, getting

hard assets in the form of railroads, oil, natural gas.

If it's good enough for Warren Buffet, it's good enough for

everyday Americans.

This is the most important of the directives, so I have the top

six companies who have built these hard asset escape plans into

their business models.

STEVE MEYERS:

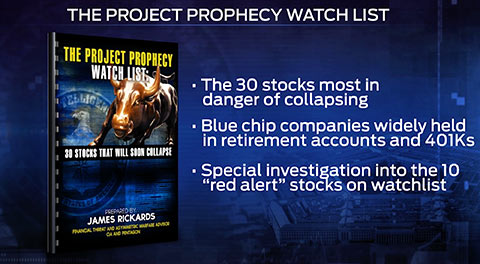

The second intelligence briefing you've created is called:

The

Project Prophecy Watch List: 30 Stocks That Will Soon Collapse.

Take us through this.

JIM RICKARDS:

Steve, during the original Project Prophecy for the CIA we built

a tracking system, a watch list of the 400 stocks most likely to

signal a coming attack on America.

But, in the years that followed, we kept modifying its

capabilities so it could identify the companies that were in

danger of collapsing.

This intelligence briefing reveals the 30 stocks that are now at

the top of that list.

Now, when folks see these stocks, it may shock them.

These aren't micro caps or small caps, because they don't have

the capability to do widespread damage.

These are 30 of the most widely held stocks in the retirement

accounts and 401ks of everyday Americans.

Most are large blue chip.

That means everybody watching today is probably holding one,

two, or more of them.

And they are vulnerable to complete annihilation.

Now, inside this list of 30 I've singled out the 10 that are

currently at a red alert status.

This means if you were holding them today you need to not be

holding them tomorrow, because the clock is running out on them.

They're already at risk of failure before the worst of what's

coming appears.

STEVE MEYERS:

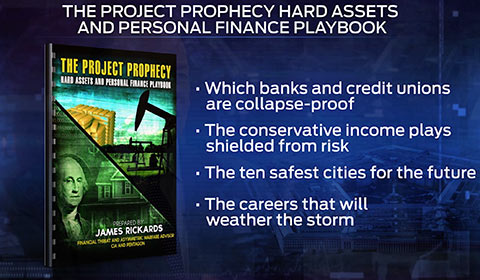

Now, let's talk about the final intelligence you've created:

The

Project Prophecy Hard Assets and Personal Finance Playbook.

JIM RICKARDS:

I'm advocating people - if they aren't already and they have the

means to do so - to start exploring adding hard assets to their

overall portfolio.

This intelligence briefing covers them all, from land, including

farmland, to certain antiquities and art that holds value, as

well as physical currencies and precious metals.

STEVE MEYERS:

I'd like to focus on one precious metal in particular, gold.

Now, in the book, you reveal how China has successfully

manipulated gold's price to keep it low, while they stockpile it

in their reserves.

But you're bullish on it moving forward.

However, you do write that people may be taking a dangerous

approach to gold investing.

JIM RICKARDS:

It has become fashionable in recent years to invest in gold

ETFs.

The GLD ticker is the headliner.

The logic on the surface makes sense, you can secure gold

without having to acquire it physically and store it.

You can even, theoretically - at least, they tell you - you can

cash in your ETF shares for physical gold if you so choose in

the future.

This is the problem - that's not true.

The everyday American does not have that ability.

Here's how to think about the gold market.

Imagine it's a pyramid, but it's inverted.

The point is down at the bottom and wide base is at the top.

There's a little tiny bit of physical gold at the bottom.

On top you have all these forms of paper gold.

What are they?

These are all what I call paper gold. They give you contractual

rights but there's no assurance you'll ever get your hands on

physical gold.

Now, what's happening is this whole pyramid is getting larger

and larger, but the amount of physical gold, the floating

supply, is disappearing.

When gold moves from the GLD warehouse to the Chinese warehouses

in Shanghai, which it is…

It's been moving from west to east in very large quantities…

Once it goes to Shanghai it's no longer a part of the floating

supply. That gold is never going to see the light of day, at

least not for several hundred years.

So, the total supply may be unchanged, but the floating supply

is dropping.

That means this little brick at the bottom of the pyramid is

getting smaller and smaller.

One of two things has to happen:

So, if you have GLD, you only have shares and you will only ever

have shares.

You cannot get your hands on the gold.

So, with this intelligence briefing, I tell folks to

stay away

from gold ETFs.

Instead, I talk about three specific precious metal coins

they'll want to look into immediately.

STEVE MEYERS:

Now, let's examine how folks can fortify their personal finances

from these dangerous times that are fast approaching.

JIM RICKARDS:

This is very important, because if you protect yourself with

your investments, yet don't take the same measures with your

personal finances, you'll experience the same outcome and it

won't be a good one.

The bank you choose to keep your money in is now a critical

decision, because that bank may not be around next year or the

year after, as everything escalates.

So, I talk about the safest banks and credit unions, these will

not collapse.

You should make sure your money is in one of them.

I show folks which CDs and conservative income opportunities are

most shielded from risk.

I talk about the ten safest cities for the future.

These are the ones with the strongest local economies.

They have industries that will continue providing jobs, their

crime rates are low now, and they have the best chance of

staying that way, even in the darkest times.

Retirees should be looking near these areas.

Plus, I also examine which careers will be the safest, because

real unemployment and underemployment is already an epidemic,

but it's going to get much worse.

STEVE MEYERS:

Jim Rickards, what you revealed today in this interview is

nothing short of a wake-up call. Thank you for joining us.

JIM RICKARDS:

It's my pleasure, Steve.