|

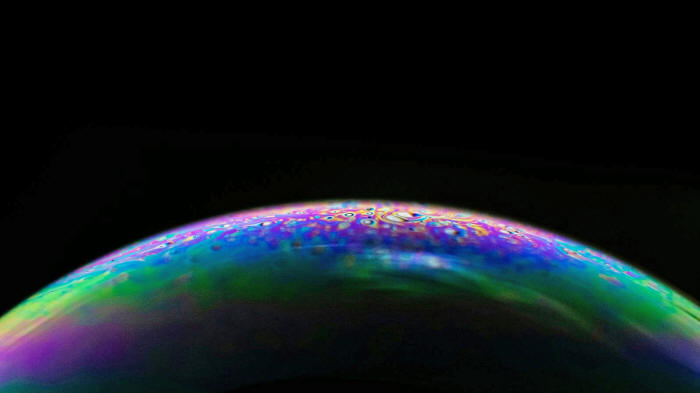

Photo by Ryan Braxton on Unsplash

Sadly, because no one has a crystal ball, we can never hope to figure out when shit will truly hit the fan.

But we have also struggled to pin down the size of this bubble, as the reality of AI economics has become muddied by Big Tech propaganda.

Likewise, these corporations have propagandized their finances to the point of unreality, making it nearly impossible to figure out who is actually connected to the bubble.

However, recent analysis has cut through this cloud of doubt, and reality is far more terrifying than we thought possible.

This isn't a bubble:

Let's start with the truly gut-flipping findings

of Julien Garran.

Needless to say, he understands his subject material.

But his recent analysis discovered that,

How did he arrive at that figure?

Like me, Garran pointed to the efficient compute frontier and the diminishing returns of AI, causing costs to skyrocket and progress to stagnate.

This is why,

...yet the improvement between these generations has been so slim it is almost unnoticeable.

This wouldn't be a problem if these AIs had reached a point of usefulness, but they haven't. Like me, Garran points to the plethora of studies that prove AI deployments offer practically no benefit, aren't profitable, and actually make companies less efficient.

But, unlike me, Garran used the economic analysis pioneered by economist Knut Wicksell to establish the size of this investing discrepancy, the 2008 bubble, and the dot-com bubble, and that is how he learned that the AI bubble is currently four times the size of the 2008 bubble at its peak...!

The housing market crash of 2008 caused,

Yet, somehow, the AI bubble is already four times as big and still growing...!

Just take a moment to let that sink in.

So, when the 2008 bubble burst, it first hit the financial institutions holding the debt that grew it, such as the Lehman Brothers bank...

The main question is,

It seems AI companies have been growing through equity financing (selling shares of the company) rather than debt financing (borrowing money).

Furthermore, investment seems to be incestuous to the tech industry:

As such, many believed that the AI bubble is actually relatively isolated from the rest of the economy and therefore might not have as significant an impact on the wider economy when it bursts.

While equity investment in AI has ballooned, it hasn't been enough to cover the industry's capital expense and operational losses.

Naturally,

Debt brings more scrutiny than equity, given that repayment is required, and, as I have covered before, no aspect of AI is profitable, and as such, it can't service debt.

Dario Perkins, managing director of global macro at TS Lombard, has found that many AI companies are increasingly using SPVs to raise significant amounts of debt financing off the books.

This covers their tracks and obfuscates the debt, making it "look" like the company is running on equity finance instead.

Due to this, it is incredibly difficult to get an accurate figure on how much of the AI industry's expenditure and growth comes from debt - but we know it is a lot...!

To give you an idea of how insane that is,

In other words,

We don't know how much of the capital expenditure comes from "off the books" debt raised through things like SPVs, but we still know it is frequent.

We know that Meta is looking to raise $26 billion in debt through an SPV by the end of the year.

This one deal equates to 5% of the total AI industry's capital expenditure for this year.

This means we don't know how much of that $500 billion capital annual expenditure actually came from debt,

Therefore, this bubble is four times bigger than the 2008 housing bubble and is deeply connected to the wider economy.

It isn't isolated at all. Indeed, if the AI bubble fails to pop soon, then its finances will be more connected to the wider economy than the internal tech industry economy.

They flew too close to the sun, but as their charred bodies crash down, they will land on others and destroy them too.

Unlike in 2008, we are already teetering on a global recession before this bubble bursts, so combining that with the fallout of the AI bubble bursting will create destruction on a scale we have never seen before.

The pain, trauma, brutalization and disenfranchisement of this experience have directly led to the rise of neo-fascism and the solidification of a super-wealthy ruling oligarchic class across the entire Western world.

Do not take financial advice from me. Go and do your own research...!

We need to make sure that after the dust

settles, our society, politics, democracy, economy and culture

actually serve us, the people, and not the uber wealthy who

created this mess in the first place...

|