|

March 3, 2015

from

WashingtonsBlog

Website

The Guardian

reports that global debt has grown by $57 trillion dollars - to

$199 trillion dollars -

since the 2008 financial crisis.

How much is that? It's a big number... but what does it actually mean?

The Guardian notes that global debt is

now more than twice the size of the entire global

economy:

Total debt as a share of GDP stood

at 286% in the second

quarter of 2014 compared with 269% in the fourth quarter of

2007.

(That's more than 2.8 times the size of

the world economy).

And it will only keep getting worse:

Government debt-to-GDP ratios will

to continue to rise over the

next five years in a number of countries including

Japan, the US and most European countries...

While the mainstream press talks about

"deleveraging", the fact is that many households are going deeper

into debt:

Household debt is "reaching new peaks".

Only in Ireland,

Spain, the UK and the US have households deleveraged.

According to the study,

not only have household

debt-to-income ratios continued to rise, they now actually

exceed the peak

levels in the

crisis countries before 2008 in some cases,

including advanced economies such Australia, Canada and Denmark.

Why Should We Care?

It has been known for a very long time

that

debt grows exponentially, while economies only grow in an

s-curve.

As such, debt will always overtake

prosperity unless measures are taken to reduce it.

In 2008, the most prestigious financial

agency in the world - the Bank for International Settlements (BIS),

often described as the "central bank for central banks" -

said that failing to force

companies to write off bad debts "will only make things worse".

Moreover:

The recent edition of the Geneva

report - "an

annual assessment informed by a top drawer conference of

leading decision makers and economic thinkers" - finds that

the "poisonous combination"

of spiraling debts and low growth could trigger another crisis.

The report also notes:

Contrary to widely held beliefs, the world

has not yet begun to de-lever and the global debt to GDP

ratio is still growing,

breaking new highs.

And as the Telegraph

put it last year:

On a global level,

growth is

being steadily drowned under a rising tide of debt,

threatening renewed financial crisis, a continued squeeze to

living standards, and eventual mass default.

Top economists say that

Iceland did it right… and everyone else is doing it wrong.

Here's why:

Arni Pall Arnason, 44, Iceland's

minister of economic affairs, says

the decision to make debt

holders share the pain saved the country's future.

Even the IMF

points to

Iceland

as a model for debt write-offs as

a way out of its economic slump.

And - despite the fact that mainstream

"neoclassical" economists

don't believe that debt even "exists" as a force that acts on

the economy - many economists note that high levels of private

debt

cause depressions.

Indeed, an economics professor who bases

his analysis on computer models says

we'll have,

"a never-ending depression unless we

repudiate the debt, which never should have been extended in the

first place".

Well-known economist Michael Hudson

agrees (starting around 2:16 into below video):

If the problem that is grinding the

economy to a halt is too much debt, and

if no one in the

government - in either party - is looking at solving the debt

problem, then... we're going to go into a depression as far as

the eye can see.

The Secret of OZ

February 2011

This

version finally cuts several bogus quotes which

have festered in the monetary reform literature

for decades.

The world economy is doomed to spiral downwards

until we do 2 things: outlaw government

borrowing and outlaw fractional reserve lending.

Banks

should only be allowed to lend out money they

actually have and nations do not have to run up

a "National Debt".

Remember:

It's not what backs the money, it's who

controls its quantity.

And high levels of debt lead to war.

For example, Martin Armstrong argued that war plans

against Syria

are really about

debt and spending:

The Syrian mess seems to have people

lining up on Capital Hill when sources there say the phone calls

coming in are overwhelmingly against any action.

The politicians are ignoring the

people entirely.

This suggests there is indeed a

secret agenda to achieve a goal outside the discussion box. That

is most like the debt problem

and a war is necessary to relieve the pressure to curtail

spending.

Billionaire investor Jim Rogers

agrees:

"Add

debt, the

situation gets worse, and eventually it just collapses.

Then everybody is looking for

scapegoats. Politicians blame foreigners, and we're in World War

II or World War whatever."

So do

many other top economic advisers.

The Wrong Prescription

The central banks' central bank

warned in 2008 that bailouts of the big banks would create

sovereign debt crises. That is exactly what has happened.

Remember, it is not the people or Main

Street who are getting bailed out…

it is the giant banks.

A study of 124 banking crises by the

International Monetary Fund (IMF)

found that

propping up banks which are only pretending to be

solvent - instead of forcing them to write off their bad debt -

often leads to austerity:

Existing empirical research

has shown that providing assistance to banks and their borrowers

can be counterproductive, resulting in increased losses to

banks, which often abuse forbearance to take unproductive risks

at government expense.

The typical result of

forbearance

is a deeper hole in the net worth of banks,

crippling tax burdens to finance bank bailouts, and even more

severe credit supply contraction and economic decline than would

have occurred in the absence of forbearance.

Cross-country analysis to date also

shows that accommodative policy measures (such as substantial

liquidity support, explicit government guarantee on financial

institutions' liabilities and forbearance from prudential

regulations) tend to be fiscally costly and that these

particular policies do not necessarily accelerate the speed of

economic recovery.

***

All too often, central banks

privilege stability over cost in the heat of the containment

phase: if so, they may too liberally extend loans to an illiquid

bank which is almost certain to prove insolvent anyway.

Also, closure of a nonviable bank is

often delayed for too long, even when there are clear signs of

insolvency (Lindgren, 2003).

Since bank closures face many

obstacles,

there is a tendency to rely instead on blanket

government guarantees which, if the government's fiscal and

political position makes them credible, can work albeit at the

cost of placing the burden on the budget, typically squeezing

future provision of needed public services.

In other words, the "stimulus" to the

banks blows up the budget, "squeezing" public services through

austerity.

But instead of throwing trillions at the

big banks, we could provide stimulus to Main Street. It would

work much better at stimulating the economy by wiping out some

of the little guy's debt.

Instead of imposing

draconian austerity, we could

stop handouts to the big banks, stop getting into imperial military

adventures and stop incurring unnecessary interest costs (and

see

this).

And bondholders - rather than the little

guy -

must be forced to take a haircut.

The Solution Has Been Known For Over 4,000 Years

Periodic debt forgiveness - or debt

"jubilees" - were a

basic part of the original Jewish, Christian, Babylonian and

Sumerian cultures. Indeed, this tradition goes back over 4,000

years…

In fact, many of the major religions

were founded on the concept of debt forgiveness.

For example,

Matthew 6:12 says:

And forgive us our debts, as we

forgive our debtors.

Anthropologist David Graeber,

author of "Debt: The First 5,000 Years",

says:

If you look at the history of world

religions, of social movements what you find is for much of

world history what is sacred is

not debt, but the ability to make debt disappear to forgive it

and that's where concepts of redemption originally come from.

Freedom from debt is also the basis of

liberty…

After all, the first recorded word for

"freedom" in any human language is the word for

freedom from debt.

Both founding father Thomas Jefferson

and the father of free market economics Adam Smith warned that

every generation should pay off its own debts. And this a very

timely and current issue…

Respected economic writer Ambrose

Evans-Pritchard

wrote in 2009:

In the end, the only way out of all

this global debt may prove to be a Biblical debt Jubilee.

Well-known economist Nouriel Roubini

writes in the Financial Times:

Since this is a crisis of solvency

as well as liquidity, orderly debt restructuring must

begin. This means across the board reduction on the

mortgage debt for the roughly half of America's households that

are underwater ….

Martin Armstrong

notes:

"At the end of every seven years you shall grant

a remission of debts."

Deuteronomy 15:1, which is the manner of remission where every

creditor shall release what he has loaned to his neighbor.

***

Historically, society is destroyed by debt every

time.

***

Absolutely no nation has ever

survived a debt crisis.

***

So should we have a debt forgiveness

every 7 years? Perhaps that prevents the crash and burn in the

[business cycle]. Interesting correlation. Could this be an

ancient mechanism to lower the volatility of the… business

cycle?... Interesting wisdom indeed.

Sprott's Jeff Nielsen

writes:

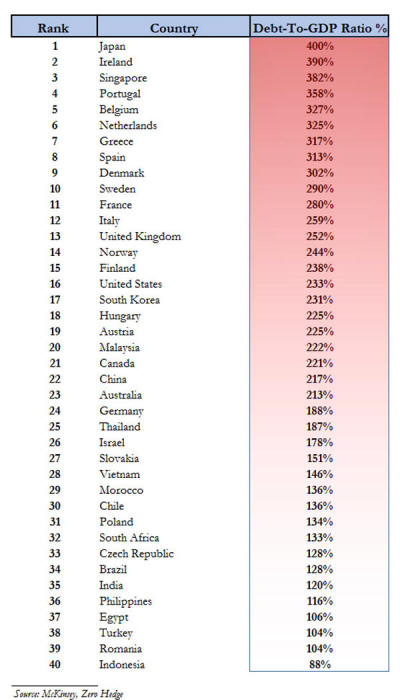

As indicated in the chart below

(originally produced at Zero Hedge)... Membership in the

international Bankruptcy Club has soared to roughly 40 nations.

Canada's previous "debt crisis"

would no longer even earn it a place in the world's "top-40" of

most-indebted nations today.

***

In collective terms, the unequivocal

proof that these regimes must (immediately) declare Debt Jubilee

comes in many forms.

We start with the fact that none of

the members of the Bankruptcy Club ever manage to

improve their fiscal standing (i.e. lessen their level of

obvious insolvency).

While there may be occasional,

annual "blips" in the economic self-destruction of these

nations; examine the balance sheet of any member of the

Bankruptcy Club over five-year increments, and their fiscal

position is always worse.

***

Debt Jubilee is a long-standing

economic "tradition" of our species, as financial mismanagement

(at the national level) is an endemic problem of our species,

irrespective of the historical era, or the system of government.

Arithmetic is arithmetic. Continuing

to (attempt to) "sustain" the unsustainable is at best economic

suicide, at worst economic treason.

Moreover, our own sovereign debts

are fraudulent, on several different levels. Wiping away these

gargantuan debts, and restoring solvency to the Western world is

not only economically necessary and morally imperative, it is

legally justifiable. The "legal remedy" for fraud is a very

simple one: the fraudulent transactions (i.e. our debts and

accumulated interest) are instantly rendered null-and-void.

For injured parties with "clean

hands"; they can seek restitution for any losses

through the branch of law known as Equity. Needless to say there

would not be any bankers standing in that line.

Clearly if Western governments were

'merely' drowning in debt-to-GDP ratios of roughly 100%, then

they could still argue that attempting to manage these

debt-loads was legitimate rather than treasonous.

However, Germany's government

(debt-to-GDP of 188%) can no longer make that claim.

Nor can:

|

|

(221%)

(225%)

(233%)

(238%)

(244%)

(252%)

(259%)

(280%)

(290%)

(302%)

(313%)

(325%)

(327%)

(358%)

(390%)

|

|

***

When Western debt-levels began

soaring past the point-of-no-return at the beginning of this

millennium; it suggested that the West (and thus the

whole global economy) was due for the latest Debt Jubilee.

When these already-excessive debt

levels exploded to a ludicrous level, following the so-called

"bail-outs" (to these same bankers) from the Crash of '08; this

required an immediate Debt Jubilee.

However, the insane/treasonous

numbers in the previous, current chart shout out an even simpler

message: we demand Debt Jubilee.

Indeed, there is a long-standing legal

principle that people

should not have to repay their government's debt to the extent that

it is incurred to launch aggressive wars or to oppress the people…

what is called "odious debt".

If a debt jubilee is not voluntarily

granted, people may

very well repudiate their debts… which would lead to chaos.

|