|

by Claudio Grass

from

ClaudioGrass Website Source: ©pixabay.com Miguel Á. Padriñán, unsplash.com Dmitry Demidko

Part I

The corona crisis has already taken a very high toll and caused deep damage in our societies and our economies, the extent of which is yet to become apparent.

We have seen its impact on productivity, on unemployment, on social cohesion and on political division. However, there is another very worrying trend that has been accelerated under the veil of fear and confusion that the pandemic has spread.

The war on cash, that was

already underway for almost a decade, has been drastically

intensified over the last few months.

These talking points have been repeated over and over, in most western economies and by countless institutional figures. "Cash is used by terrorists, money launderers and criminals" is arguably the most oft-repeated one, as it's been widely employed in most debates about the digital transition.

Just a couple of years ago, it was also used by Mario Draghi, to support the decision to scrap the 500 euro note.

We didn't get any

specific information or data about how many terrorists were actually

using this high-denomination note, but we do know a lot of

law-abiding citizens were using it to save, as did small business

owners for their operational liquidity needs.

Even in the early stages of the pandemic, when essentially nothing was concretely known about the virus itself or its transmission, the seeds of new fears were already planted by sensational media reports and fear-mongering political and institutional figures...

The insidious idea that "you can catch Covid through cash" might have been prematurely spread, but it did stick in most people's minds.

Wanting to eliminate

potential threats was a natural instinct and so was the urge to take

back at least some control over our lives, after they'd been

suddenly thrown into utter chaos in the wake of the global economic

freeze.

Given the lockdown measures and the new "social distancing" directives that were enforced all over the world, it became difficult to use cash, even if you really wanted to, or had no other means of transaction, as is the case for billions of people.

With physical stores

being forced to shut down and with more and more online shops

offering contactless delivery (either as a choice or as a service

requirement), the need for cash very quickly gave way to digital

payments.

However, for many of our fellow citizens it was a serious impediment, which in some cases blocked their access to basic goods and essential supplies.

Contrary to the glowing promises of the digital economy, of financial inclusion and convenience, the fact remains that there are still millions of people who simply do not have access to this brave new world.

According to figures by the World Bank, globally there are 2.5 billion people with no bank account, with a high concentration in the developing world.

In the West too, however, there is a very large part of the population that is unbanked and/or has no access to digital solutions, while the elderly are also to a very large extent "locked out" of the digital economy.

For all these millions of

people, cash is the only way to save, to transact and to cover their

basic needs.

Both international

organizations and individual governments have actively participated

and encouraged this push, some through public guidance statements

and others through the blunt enforcement of direct rules and

measures that leave no real room for their citizens to make their

own choices.

The UAE Central Bank encouraged the use of online banking and digital payments,

In March, a report from

Reuters revealed that

the U.S. Federal Reserve was

quarantining dollars that it repatriated from Asia and so did South

Korea's central bank, while banks in China were forced by the

government to disinfect bills and keep them in a safe for up to 14

days, before putting them in circulation.

In it, the authors argue that,

They also applauded the efforts of China in digitalizing payments and appeared to hold the country and its measures as a model to be emulated:

Since a number of Western

governments may indeed be "eager to follow suit", let us take a

closer look at this bright example and examine what it really

entails.

The country's infamous "social rating system" has made headlines years ago and the government's eagerness to use technology, the internet and all sorts of digital systems to track its citizens' behaviors and affiliations has long attracted International criticism and widespread condemnation by human rights organizations, privacy advocates and free speech supporters.

Now, however, the state

has been given a reason to accelerate its efforts in the mass

adoption of digital payments and the abandonment of cash.

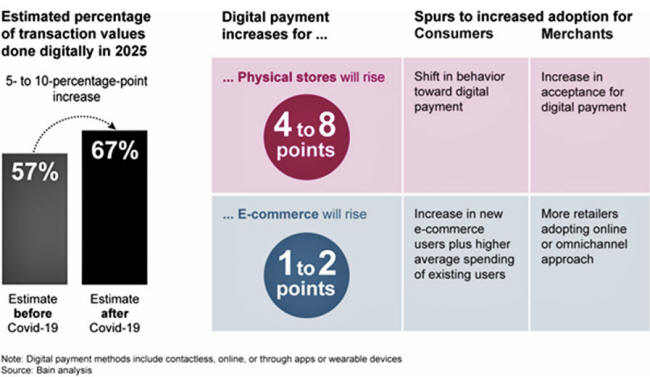

More than 80% of consumers already used mobile payments in 2019, according to management consultancy Bain, a sharp contrast with the US that had adoption rates of less than 10%.

So, as the population has already accepted a new way of payment, the new initiative sought to dominate the means of payment too.

Thus, a new "digital yuan" was introduced.

On the surface, it appears to work just like the old currency.

It is issued and backed by the PBOC, it's valued the same as the physical banknotes and, thanks to partnerships with Alipay and WeChat Pay, that control 80% of the country's payment market, it will be used to get paid by anyone and to pay for anything.

In fact, some public

servant salaries and state subsidies are already being paid out in

this new digital yuan, arriving in their intended recipients'

digital wallets.

The implication there is clear:

The strategy of spending of huge amounts of Chinese money abroad did provide some leverage over developing countries, but it didn't come anywhere near "dethroning" the Dollar and internationalizing the Renminbi.

The development and the rollout plan were significantly accelerated following Facebook's announcement of the Libra, as the Chinese state wouldn't have the private tech giant beat them to the punch.

In another

non-coincidence just a few years back, China's government banned

initial coin offerings and placed great burdens on cryptocurrencies

and crypto-investors making it very hard to operate in the country,

thereby dismantling the threat of potential competition from the

private sector and clearing the way for its own digital coin.

Part II

China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state.

Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian regime.

The ability to track citizens' transactions, access their financial data, control and freeze the account of anyone that presents a potential threat, it all opens the door to the ultimate oppression:

But we don't even have to wait for the first signs of abuse of the system.

As part of the government's covid relief spending packages, digital vouchers were loaded to Chinese citizens' smartphones to encourage them to spend in their local stores.

According to Dr. Shirley Yu, visiting fellow at the London School of Economics:

Of course, if the

government has access to data that allows them check if their

policies were well transmitted and if the money was spent as they

intended, they can also use that data to check and trace any

transactions for any other purpose.

Of course, this thought

is scary enough on its own, but it becomes infinitely more

terrifying when those that control the system have a very long track

record of abuse and blatant disregard for basic rights and

liberties.

By comparison, a digital fiat currency is not really that far-fetched.

In fact, about 20 central banks apart from the PBOC are already actively working on it.

As for the possibility of

digital currencies and payments systems being enforced, most central

bank officials and politicians in the West seem to be quite

confident.

During the corona relief debates in the US, Democratic Senator Sherrod Brown, advocated for the stimulus payments to be distributed thought a digital dollar wallet.

The so-called 'FedAccount'

program, with the Federal Reserve responsible for overseeing it,

would offer free bank accounts to receive money and make payments.

According to a recent European Parliament Briefing,

This is by all accounts the next step in the centralization and integration plan of the Union, and this couldn't be a better time for it to materialize.

Given the decline in

public trust after the EU's handling of the corona crisis, financial

"integration" could be a valuable tool to tie the members tighter

together and to force all citizens into a common digital economy,

centrally planned and managed.

We stand at a historic crossroads and the answer to these questions can determine the kind of future we'll wake up to.

It can be a very bleak one, if the power remains with governments and centralized institutions.

If we instead choose to break the state monopoly of money and allow private digital currencies to compete, a myriad of different solutions will emerge to serve a myriad of different needs.

Savings can be accommodated though physical gold-backed digital currencies, real assets can be tokenized to facilitate and secure physical property sales, specialized cryptocurrencies can offer privacy and untraceable transactions.

Far from a pipe dream, many solutions like these already exist, while others are in the making.

There is therefore a

choice about what kind of future we want and it is us,

as individuals, that must make it...

|