|

from

IainDavis

Website

March 02, 2023

Central bank digital currency (CBDC) will end human freedom.

Central Bank Digital Currency is the most comprehensive, far-reaching, authoritarian social control mechanism ever devised.

Its "interoperability" will enable the CBDCs issued by various national central banks to be networked to form one, centralized global CBDC surveillance and control system.

We will explore the technical aspects of CBDC that will form the walls of our prison in more detail in Part 2 far below.

First, we need to explore the broader context.

Should we allow it to prevail, CBDC will deliver the global governance of humanity into the hands of the bankers.

CBDC is unlike any kind of "money" with which we are familiar. It is programmable and "smart contracts" can be written into its code to control the terms and conditions of the transaction.

Policy decisions and broader policy agendas, restricting our lives as desired, can be enforced using CBDC without any need of legislation. Democratic accountability, already a farcical concept, will become literally meaningless.

CBDC will enable genuinely unprecedented levels of surveillance, as every transaction we make will be monitored and controlled.

Not just the products, goods and services we buy, even the transactions we make with each other will be overseen by the central bankers of the global governance state.

Data gathering will expand to encompass every aspect of our lives.

This will allow central planners to engineer society precisely as the bankers wish. CBDC can and will be linked to our Digital IDs and, through our CBDC "wallets," tied to our individual carbon credit accounts and jab certificates.

CBDC will limit our freedom to roam and enable our programmers to adjust our behavior if we stray from our designated Technate function.

The purpose of CBDC is to establish the tyranny of a dictatorship. If we allow CBDC to become our only means of monetary exchange, it will be used enslave us.

Be under no illusions: CBDC is the endgame.

What Is Money?Defining "money" isn't difficult, although economists and bankers like to give the impression that it is.

Money can simply be defined as:

Money is a "medium" - a paper note, a coin, a casino chip, a gold nugget or a digital token, etc. - that we agree to use in exchange transactions.

It is worth whatever value we ascribe to it and it is the agreed value which makes it possible for us to use it to trade with one-another. If its value is socially accepted "by general consent" we can use it to buy goods and services in the wider economy.

We could use anything we like as money and we are perfectly capable of managing a monetary system voluntarily.

The famous example of US prisoners using tins of mackerel as money illustrates both how money functions and how it can be manipulated by the "authorities" if they control the issuance of it.

Tins of mackerel are small and robust and can serve as perfect exchange tokens (currency) that are easy to carry and store. When smoking was banned within the US penal system, the prisoners preferred currency, the cigarette, was instantly taken out of circulation.

As there was a steady, controlled supply of mackerel cans, with each prisoners allotted a maximum of 14 per week, the prisoners agreed to use the tinned fish as a "medium of economic exchange" instead.

The prisoners called in-date tins the EMAK (edible mackerel) as this had "intrinsic" utility value as food.

Out-of-date fish didn't, but was still valued solely as a medium of exchange. The inmates created an exchange rate of 4 inedible MMAKs (money mackerel) to three EMAKs.

You could buy goods and services in the Inmate Run Market (IRM) that were not available on the Administration Run Market (ARM).

Other prison populations adopted the same monetary system, thus enabling inmates to store value in the form of MAKs. They could use their saved MAKs in other prisons if they were transferred.

Prisoners would accept payment in MAKs for cooking pizza, mending clothes, cleaning cells, etc. These inmate service providers were effectively operating IRM businesses.

Their main problem was that they were reliant upon a monetary policy authority - the US prison administration - who issued their currency (MAKs).

This was done at a constant inflationary rate (14 tins per prisoner per week) meaning that the inflationary devaluation of the MAKs was initially constant and therefore stable.

It isn't clear if it was deliberate, but the prison authorities eventually left large quantities of EMAKs and MMAKs in communal areas, thereby vastly increasing the money supply. This destabilized the MAK, causing hyperinflation that destroyed its value.

With a glut of MAKs available, its purchasing power collapsed.

Massive quantities were needed to buy a haircut, for example, thus rendering the IRM economy physically and economically impractical. If only temporarily.

Perfectly usable "money"

The Bankers' Nightmare

In June 2022, as part of its annual report, the BIS published The future monetary system.

The central banks (BIS members) effectively highlighted their concerns about the potential for the decentralized finance (DeFi), common to the "crypto universe," to undermine their authority as the issuers of "money":

The BIS defined DeFi as:

The key issue for the central bankers was "permissionless."

A blockchain is one type of DLT that can either be permissionless or permissioned.

Many of the most well known cryptocurrencies are based upon "permissionless" blockchains. The permissionless blockchain has no access control.

Both the users and the "nodes" that validate the transactions on the permissionless blockchain network are anonymous.

The network distributed nodes perform cryptographic check-sums to validate transactions, each seeking to enter the next block in the chain in return for an issuance of cryptocurrency (mining).

This means that the anonymous - if they wish - users of the cryptocurrency can be confident that transactions have been recorded and validated without any need of a bank.

Regardless of what you think about cryptocurrency, it is not the innumerable coins and models of "money" in the "crypto universe" that concerns the BIS or its central bank member.

It is the underpinning "permissionless" DLT, threatening their ability to maintain financial and economic control, that preoccupies them.

The BIS more-or-less admits this:

Many will argue that Bitcoin was a creation of the deep state.

Perhaps to lay the foundation for CBDC, or at least provide the claimed justification for it. Although the fact that this is one "conspiracy theory" that the mainstream media is willing to entertain might give us pause for thought.

Interesting though this debate may be, it is an aside because it is not Bitcoin, nor any other cryptoasset constructed upon any permissionless DLT, that threatens human freedom.

The proposed models of CBDC most certainly do.

CBDC & The End of the Split Circuit IMFS

Central banks are private corporations just as commercial banks are.

As we bank with commercial banks so commercial banks bank with central banks. We are told that central banks have something to do with government, but that is a myth...

Today, we use "fiat currency" as money.

Commercial banks create this "money" out of thin air when they make a loan (exposed here). In exchange for a loan agreement the commercial bank creates a corresponding "bank deposit" - from nothing - that the customer can then access as new money.

This money (fiat currency) exists as commercial bank deposit and can be called "broad money."

Commercial banks hold reserve accounts with the central banks. These operate using a different type of fiat currency called "central bank reserves" or "base money."

We cannot exchange "base money," nor can "nonbank" businesses. Only commercial and central banks have access to base money. This creates, what John Titus describes - on his excellent Best Evidence Channel - as the split-monetary circuit.

Prior to the pseudopandemic, in theory, base money did not "leak" into the broad money circuit.

Instead, increasing commercial banks' "reserves" supposedly encouraged them to lend more and thereby allegedly increase economic activity through some vague mechanism called "stimulus".

Following the global financial crash in 2008, which was caused by the commercial banks profligate speculation on worthless financial derivatives, the central banks "bailed-out" the bankrupt commercial banks by buying their worthless assets (securities) with base money.

This all changed, thanks to a plan presented to central banks by the global investment firm BlackRock. In late 2019, the G7 central bankers endorsed BlackRock's suggested "going-direct" monetary strategy.

BlackRock said that the monetary conditions that prevailed as a result of the bank bail-outs had left the International Monetary and Financial System (IMFS) "tapped out."

Therefore, BlackRock suggested that a new approach would be needed in the next downturn if "unusual circumstances" arose.

These circumstances would warrant,

BlackRock opined:

Coincidentally, just a couple of months later, the precise "unusual circumstances," specified by BlackRock, came about as an alleged consequence of the pseudo-pandemic.

The "going direct" plan was implemented.

Instead of using "base money" to buy worthless assets solely from commercial banks, the central banks used the base money to create "broad money" deposits in commercial banks.

The commercial banks acted as passive intermediaries, effectively enabling the central banks to buy assets from nonbanks.

These nonbank private corporations and financial institutions would have otherwise been unable sell their bonds and other securities directly to the central banks because they can't trade using central bank base money.

The US Federal Reserve (FED) explain how they deployed BlackRock's 'going direct' plan:

This process of central banks issuing "currency" that then finds its way directly into private hands will find its ultimate expression through CBDC.

The transformation of the IMFS, suggested by BlackRock's "going direct" plan, effectively served as a forerunner for the proposed CBDC based IMFS.

The "Essential" CBDC Public-Private Partnerships

CBDC will only be "issued" by the central banks. All CBDC is "base money."

It will end the traditional split circuit monetary system, although proponents of CBDC like to pretend that it won't, claiming the "two-tier banking system" will continue.

This is nonsense. The new "two-tier" CBDC system is nothing like its more distant predecessor and much more like "going direct.".

CBDC potentially cuts commercial banks out of the "creating money from nothing" scam.

The need for some quid pro quo between the central and the commercial banks was highlighted in a recent report by McKinsey & Company:

McKinsey also noted, for CBDC to be successful, it would need to be widely adopted:

According to McKinsey, a thriving CBDC would need to replace existing "instruments of payment."

To achieve this, the private "payment solution providers" will have to be on-board. So, if they are going to countenance displacement of their "material share of deposits," commercial banks need an incentive.

Whatever model CBDC ultimately takes, if the central bankers want to minimize commercial resistance from "existing alternatives," so-called public-private partnership with the commercial banks is essential.

Though, seeing as central banks are also private corporations, perhaps "corporate-private partnership" would be more appropriate.

McKinsey state:

Accenture, the global IT consultancy that is a founding member of the ID2020 Alliance global digital identity partnership, agrees with McKinsey.

What Model of CBDC?

By creating the new concept of "wholesale CBDC," the two-tier fallacy can be maintained by those who think this matters.

Nonetheless, it is true that a wholesale CBDC wouldn't necessarily supplant broad money.

The Bank for International Settlements (BIS) - the central bank for central banks - offers a definition of the wholesale CBDC variant:

Wholesale CBDC has some tenuous similarities to the current central bank reserve system but, depending upon the added functionality of the CBDC design, increases central bank ability to control all investment and subsequent business activity.

This alone could have an immense social impact.

The BIS continues:

It is "retail CBDC" that extends central bank oversight and enables it to govern every aspect of our lives.

Retail CBDC is the ultimate nightmare scenario for us as individual "citizens."

While the BIS outlines the basic concept of retail CBDC, it has thoroughly misled the public. Suggesting that retail CBDC is the users "claim on the central bank" sounds much better than acknowledging that CBDC is a liability of the central bank.

That is,

At the moment, spending cash in a retail setting - without biometric surveillance such as facial recognition cameras - is automatically anonymous.

While "token-based access" retail CBDC could theoretically maintain our anonymity, this is irrelevant because we are all being herded into a retail CBDC design that is "rooted in a digital identity scheme."

The UK central bank - the Bank of England (BoE) - has recently published its envisaged technical specification for its CBDC which it deceptively calls the Digital Pound.

The BoE categorically states:

Again, it is imperative to appreciate that CBDC is nothing like cash.

The Digital Pound will end that possibility for British people. Just as CBDCs in every other country will end it for their populations.

The BoE model assumes no possible escape route. Even for those unable to present state approved "papers" on demand, "varying levels of identification" will be enforced to ensure that the CBDC control grid is "for all."

The BoE, the executive branch of government and the judiciary form a partnership that will determine the acceptable "parameters" of the BoE's, not the users, "privacy preferences."

The more personal identification data you share with the BoE and its state partners, the sweeter your permitted use of CBDC will be. It all depends upon your willingness to comply.

Failure to comply will result in you being unable to function as a citizen and ensure that you are effectively barred from mainstream society.

If we simply concede to the rollout of the CBDC, the concept of the free human being will be distant memory.

This may sound like hyperbole but, regrettably, it isn't.

It is the dictatorial nightmare of retail CBDC that we will explore in part 2 below, as we note the simple steps we can all take to ensure the CBDC nightmare never becomes a reality.

Part 2

In Part 1 above, we noted that "money" is no more than a medium of exchange.

If we cooperate in sufficient numbers, we could create an economy based upon an entirely voluntary monetary system.

We don't need banks to control our exchange transactions and modern Distributed Ledger Technology (DLT) has made voluntary exchange on a global scale entirely feasible.

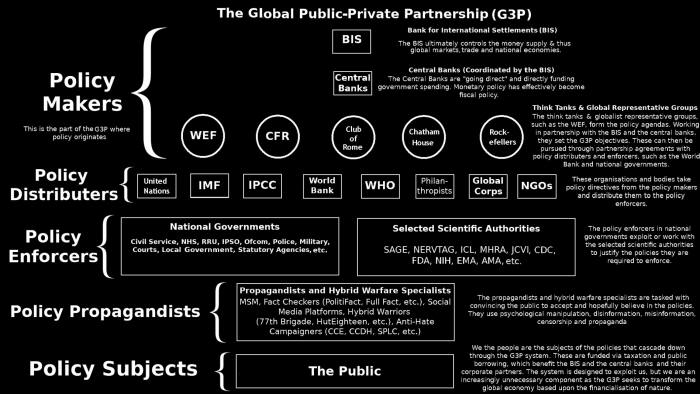

We contrasted the true nature of "money" with the proposed Central Bank Digital Currencies. CBDC is being rolled out across the world by a global public-private partnership.

What we call money is actually fiat currency conjured out of thin air by central and commercial banks. Even so, CBDC is nothing like "money" as we currently understand it.

In late 2019, the global financial institution BlackRock introduced a monetary plan that advocated "going direct" in order "to get central bank money directly in the hands of public and private sector spenders."

We discussed how the idea of putting "central bank money" directly into the hands of "private sector spenders" is precisely what that new CBDC based International Monetary and Financial System (IMFS) is designed to achieve.

But CBDC will accomplish far more for the global parasite class than merely revamp its failing "debt" based IMFS.

If it is universally adopted, CBDC will afford the bankers complete control over the our daily lives. The surveillance grid will be omnipresent and every aspect of our lives will be engineered.

CBDC is the endgame and, in this article, we will explore how that game will play out.

If we allow it.

The Interoperable CBDC Empire

Contrary to the stories we are told, central banks are private corporations.

These private corporations operate a global monetary and financial empire that is overseen and coordinated by the Bank for International Settlements (BIS).

The BIS does not come under the jurisdiction of any nation state nor intergovernmental organization. It is exempt from all "law" and is arguably sovereign over the entire planet.

As its current monetary system power-base declines, it is rolling out CBDC to protect and enhance its own authority.

While a "most likely" CBDC "platform" model has emerged, there is, as yet, no agreed single technical specification for CBDC. But, for the reasons we discussed previously, it is safe to say that no national model will be based upon a permissionless DLT - blockchain or otherwise - and all of them will be "interoperable."

In 2021 the BIS published its Central bank digital currencies for cross-border payments report.

The BIS defined "interoperability" as:

The BIS' global debt based monetary system is "tapped out" and CBDC is the central bankers' solution.

Their intended technocratic empire is global. Consequently, all national CBDCs will be "interoperable." Alleged geopolitical tensions are irrelevant.

The CBDC Tracker from the NATO think tank, the Atlantic Council, currently reports that 114 countries, representing 95% of global GDP, are actively developing their CBDC.

Just as the pseudo-pandemic initiated the process of getting "central bank money" directly into private hands so, according to the Atlantic Council, the sanction response to the war in Ukraine has added further impetus to the development of CBDC:

That this evidences the global coordination of a worldwide CBDC project, and that the BIS innovation hubs have been established to coordinate it, is apparently some sort of secret.

China's PBC, for example, is a shining beacon of CBDC light as far as the BIS are concerned:

The People's Bank of China (PBC) has been coordinating development of its CBDC cross-border payment system in partnership with the BIS via the m-Bridge CBDC project which is overseen by the BIS' Hong Kong innovation hub.

Supposedly, the Central Bank of the Russian Federation (CBR - Bank of Russia) was suspended by the BIS.

Apparently, it was also ousted from the SWIFT telecommunications system. We were told that this was a "punishment" for the Russian government's escalation of the war in Ukraine.

In reality, it is doubtful that the BIS suspension ever occurred, and the SWIFT sanction was a meaningless gesture. Developing interoperable CBDC's takes precedence over anything else.

All we have to substantiate the BIS suspension claim is some Western media reports, citing anonymous BIS sources, and an ambiguous footnote on a couple of BIS documents.

Meanwhile, the CBR is currently listed as an active BIS member with full voting rights and no one, either from the BIS or the CBR, has made any official statement in regard to the supposed suspension.

The CBR's cross-border CBDC development uses two of the three BIS m-Bridge CBDC models and it is testing its interoperable "digital ruble" with the PBC.

Seeing as the PBC is BIS m-Bridge development "partner," alleged suspension or not, there is no chance that the "digital ruble" won't be interoperable with the BIS' new global financial system.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) provides the world's most pervasive encoded inter-bank messaging system.

There are a number of SWIFT alternatives.

As a result of SWIFT's "sanction" of the CBR, the PBC and the CBR then started collaborating in earnest on a potential CIPS based SWIFT replacement.

If the stories we are told are true, SWIFT's action appears to have been an empty act of self-defeating folly.

None of the various communication layer technologies are financial systems in and of themselves, but they enable banks, trading platforms, clearing houses, payment processing systems and all the other elements of the global financial system to communicate with each other.

For CBDCs to be successful they need to be interoperable both with these systems and with each other.

Interoperability also extends to existing fiat currencies and other financial assets, such as mortgage backed securities and exchange traded funds (ETFs).

These assets, funds, currencies and securities, etc. can be "tokenized." As can practically any physical or virtual asset or commodity.

Hidera, a distributed ledger technology company that uses the hashgraph based DLT - a blockchain alternative - is backed by a number of wealthy global corporations.

The company explains the asset tokenisation (or tokenization) process:

The ability to trade tokenized assets internationally in any market, using CBDC, will facilitate the creation of a new CBDC based IMFS.

Furthermore, digital "tokenization" means anything can be converted into a financial asset and then traded on the new, CBDC based, digital IMFS.

For example, the BIS' Project Genesis tokenized "government green bonds."

The World Bank explains "green bonds":

Using CBDC's added "smart contract" functionality, Project Genesis appended "mitigation outcome interests" smart contracts (MOIs) to their green bond purchase agreements.

When the bond matured, in addition to any premium or coupon payments from the bond itself, the investor received verified carbon credits. The carbon credits are also tradable assets and they too can be tokenized.

Tokenized assets, traded using the CBDCs that central banks create from nothing, will generate almost limitless permutations for the formation of new markets. Subsequent profits will soar.

This "financialisation of everything" will further remove an already distant financial system to from the real, productive economy the rest of us live in.

Needless to say, "interoperability" is a key desired "feature" of CBDC.

The BIS published its Project Helvetia report in December 2020 which demonstrated proof of concept for the settlement payment for "tokenized assets" using CBDC.

SWIFT subsequently published the findings from its Connecting Digital Islands: CBDCs modeling experiment in October 2022.

SWIFT's stated objective was to link various national CBDCs to existing payment systems and thereby achieve "global interoperability."

SWIFT was delighted to report:

In its associated press release, SWIFT announced:

Whatever CBDC design national central banks adopt, no matter which inter-bank payment system they access - be it SWIFT, CIPS or some new communication layer - global interoperability is assured.

Thus many different CBDCs can form one, centrally controlled IMFS that will transact in near instantaneous real time.

Control of this CBDC system will also mean,

The CBDC Flimflam

Jon Cunliffe, Bank of England (BoE) Deputy Governor for Financial Stability, launching the UK's proposal for a "digital pound," said:

In its 2021 document on the Digital Ruble Concept, the CBR said that it had developed its Russian CBDC in response to:

The claimed advantages of cost saving, efficiency, speed, convenience, financial inclusion, improved resilience, financial security and so on, are trotted out time and time again.

All of it is part of a dangerous and completely disingenuous sales pitch deceiving you into accepting your own monetary slavery.

Further on, the CBR reveals what has really spurred its development of the "digital ruble:"

The digital ruble might initially seem more "convenient" but it is also designed to enable the the Russian central bankers to identify exactly who is buying what, anywhere in the country at any time.

It will also empower them to set the "contract" conditions which will determine what Russians can buy, when and from whom. The central bankers will decide what "choices" Russian CBDC users are allowed to make.

We should not be duped by the faux rationales offered by the proponents of CBDC.

Despite all the cosy rhetoric from the likes of the CBR and the BoE, the real objective is to enhance the global power and authority of bankers. As far as they are concerned, this power will know no bounds.

For instance, the BoE's Jon Cunliffe added:

Don't be surprised that the central bankers consider geopolitics to be within their remit.

Their stated intention to "actively" work on geopolitical "issues" has no "democratic" mandate whatsoever,

Most of us are too busy worrying about feeding ourselves and paying our energy bills.

The fact that bankers have long been able exert inordinate influence over geopolitics, economics and society has always been to our detriment.

If we continue to neglect our duty to defend each other and ourselves, and if we blindly accept CBDC, the bankers' power and authority will be immeasurable.

In 2020, the Russian Federation government amended its legal code with the "Law on Digital Financial Assets" (DFAs).

The amendment regulated "non-cash ruble" DFAs. The CBR soon added its commercial bank partner Sberbank to the list of financial institutions authorized by the CBR to issue DFAs. In December 2022 Sberbank launched its "gold backed " DFA offering "tokenized" gold.

Since 1971, when central banks finally abandoned any semblance of gold standard, many have lamented the supposed loss of fiat currency's "intrinsic value."

The possibility of adding "intrinsic value" to CBDC through smart contracts is apparently enticing some to now welcome CBDC and, thereby, their own enslavement.

The Russian and Iranian governments have already proposed a possible gold-backed CBDC "stablecoin" for interoperable cross border payments.

If this sounds suspiciously like a shell game that's because it is. Nonetheless, some are convinced and have extolled the alleged virtues of this "gold backed" CBDC.

It makes no difference if CBDC is backed by gold, oil, nuclear weapons or unicorn horns. All claims of its advantages are nothing but CBDC flimflam.

No matter how it is spun, the brutal fact is that,

From our perspective, unless we have completely taken leave of our senses, nothing warrants taking that risk.

It is all so shiny and marvelous, isn't it?

The Programmable CBDC NightmareThe BoE is among the central banks to reassure the public that it won't,

Elsewhere, it also claims that is a public institution, which isn't true.

So we have little reason to believe anything the BoE says.

Not that it matters much, because the BoE assurances given in its CBDC technical specification don't provide reason for optimism:

Perhaps "not currently" but enforcing programmable CBDC may well become "relevant," don't you think?

Especially given that the BoE adds:

As if this mealy-mouthed squeamishness wasn't bad enough, the BoE then goes on to suggest we should welcome their dream of a stakeholder-capitalism CBDC Wild West:

If the BoE don't "currently" feel the need to program your "money,"

They will program your CBDC to,

Undoubtedly adding some lucrative "contract logic" of their own along the way. What could possibly go wrong?

Let's say EDF Energy is your energy provider.

You could let BlackRock, working in partnership with the manufacturers it invests in, exploit the IoT to program your washing machine to automatically pay for your energy use by deducting your "money" from your CBDC "wallet", subject to whatever "contract logic" BlackRock has agreed with EDF Energy.

If you run a small UK business you could let your bank automatically deduct income tax from your earnings and pay it directly to the Treasury. No need for the inconvenience of self-assessment. CBDC will be so much more "convenient."

Of course, this will be entirely "optional," although it may be a condition of opening a business account with your bank. In which case your CBDC "option" will be to work in a central bank managed CBDC run business or don't engage in any business at all.

How does that all sound to you?

Because that is exactly the "model" of retail CBDC that the BoE are proposing. So are nearly all other central banks because CBDC is being rolled out, for all intents and purposes, simultaneously on a global scale.

The Retail CBDC NightmareAs noted in Part 1, the real nightmare CBDC scenario for us is programmable retail CBDC. In its proposed technological design of the disingenuously named "digital pound," the BoE revealed that "retail CBDC" is exactly what we are going to get.

The BoE claims that retail CBDC is essential to maintain access to central bank money. This is only "essential" for bankers, not us.

It also alleges that its digital pound model has been offered to the public merely for "consultation" purposes. Yet it has only offered one, very specific CBDC design for our consideration and the "consultation" deploys the Delphi technique to ensure that responses are limited to expressing levels of agreement with the imposed, underlying premise.

The only question appears to be when we will adopt CBDC, not if.

Speaking about the design of the digital pound, Jon Cunliffe said:

If working people are "paid" in CBDC they won't actually have any "choice" at all.

The low paid and those reliant upon benefits payments will have no option but to use CBDC. The independently wealthy, for whom £20,000 is neither here nor there, won't.

Cunliffe's comments highlight the possibility that savings can also be limited in the brave new CBDC world. He clearly suggests that those on low incomes won't be able to hold more than CBDC-£20,000 and will perhaps be limited to as little as CBDC-£10,000.

Unsurprisingly, the UK's CBDC won't be based upon a permissionless DLT that could potentially grant anonymity, but rather upon, what the BoE calls, its "platform model."

The BoE will "host" the "core ledger" and the application layer (API) will allow the BoE's carefully selected private sector partners - called Payment Interface Providers (PIPs) and External Service Interface Providers (ESIPs) - to act as the payment gateways.

The PIPs and the ESIPs will be "regulated," and will thus be empowered on a preferential basis by the central bank.

If CBDC becomes the dominant monetary system, as is clearly the intention, by controlling "access to the ledger," all user transactions - our everyday activity - will be under the thumb of a public private-partnership led, in the UK, by the BoE.

While the majority of British people don't have anywhere near £10,000 in savings, the ability to control the amount we can save, and the rate at which we spend, is a tantalising prospect for the central bankers.

Add in the ability to specify what we can spend it on and it's their dream ticket.

The CBR's "Model D" CBDC is also a,

The CBR states:

Every Russian business and private citizen will each have one CBDC wallet allocated to them by the CBR.

Russian commercial banks will enable the "client onboarding" to speed up adoption of CBDC. The commercial banks and other "financial institutions" will then process CBDC payments and act as payment intermediaries on the CBR's Model D "platform."

The People's Bank of China (PBoC) and the Reserve Bank of India (RBI) are among those considering programming expiration dates into their CBDC's.

This will ensure that Chinese and Indian CBDC users can't save and have to spend their issued "money" before it expires and ceases to function.

Thereby "stimulating" economic activity in the most "going direct" way imaginable.

Instead, it has devolved this power to its commercial banks "partners" which the BoE will then control through regulation:

The BoE public-private partnership could, for example, program its CBDC with an expiry date.

The PIPs or the ESIPs could then modify the program adding "more complex" conditions through their own "contract logic" infrastructure. For example, the BoE could specify that the CBDC your "wallet" will expire by next Wednesday.

A PIP or ESIP could add some contract logic to ensure you can only buy Italian coffee - before next Wednesday. This could be enforced at the point of sale in any retail setting (off ledger).

This is a silly example, but don't be fooled into believing such an excruciating degree of oppressive control isn't possible.

Programmable CBDC, probably programmed by AI algorithms, is capable of enforcing an intricate web of strictures over our everyday lives.

Just as you can send an encrypted message to anyone else on the same message app, so CBDC "smart contracts" can be tailored to the precisely prescribe what you can or cannot do with your "money."

Bo-Li

They Wouldn't Do That Though Would They?The infamous quote, from a salivating BIS general manager Agustín Carstens, reveals why central bankers are so excited about CBDC:

We can look to other influential central bankers to appreciate what kind of "rules" central banks might choose to "enforce" by exercising their "absolute control."

Bo Li, the former Deputy Governor of the Bank of China and the current Deputy Managing Director of the International Monetary Fund (IMF), speaking at the Central Bank Digital Currencies for Financial Inclusion: Risks and Rewards symposium, offered further clarification:

Nigeria has already launched its eNaira retail CBDC.

The Nigerian central bank and the BIS have immediately used it as a tool to roll out Digital ID:

The French central bank - the Banque de France - hosted a conference in September 2022 where US and EU central bankers decided that their retail CBDC would also force Digital ID upon users.

Indeed, all central banks have effectively "ruled out" any possibility of "anonymous use" of their programmable money.

The Reserve Bank of India states:

Once we have no option but to use CBDC nor will we have any but to accept Digital ID.

We will be fully visible on the grid at all times.

Currently if the state wishes to lockdown its citizens or limit their movement within 15 minutes of their homes they need some form of legislation or enforceable regulation.

Once we start using CBDC that is linked to our Digital ID, complete with biometric, address and other details, they won't need legislation or regulation.

It is no use imagining that "they wouldn't do that"...

We have already seen the use of monetary punishment and control in our so-called liberal democracies. Numerous private payment providers removed access from those who, in their view, expressed to wrong opinion.

When Canadians exercised their legitimate right to peaceful protest and their fellow Canadians chose to offer their financial support to the protesters, the commercial banks worked in partnership with the Canadian state to freeze protesters accounts and shut down their funding streams.

CBDC will make this a matter of routine, as targeted individuals are punished for their dissent or disobedience. It stretches naivety to wilful ignorance to believe that it won't.

The whole point of CBDC is to control the herd and enhance the power and authority of the parasite class. CBDC is a social engineering tool designed to establish a prison planet. Unless you want to be a slave, there is no possible justification for using CBDC.

Submitting to CBDC enslavement truly is a "choice."

Please share these articles. It is absolutely vital that as many people as possible understand the true nature of CBDC. We cannot rely upon the state or the mainstream media for anything approaching transparency or honesty on the subject.

With regard to our potentially calamitous adoption of CBDC, they are the enemy.

People are already resisting. The Swiss have gathered enough signatures to force a referendum that, if successful, will enshrine cash in Swiss law and stop the government from moving towards a "cashless society."

The Nigerian e-Naira is not popular and there have been significant protests against the removal of cash.

US Congressman Tom Emmer has introduced the CBDC Anti-Surveillance State Act (bill) to stop the Fed rolling out its CBDC. Whether it will go beyond the bill stage remains to be seen.

This is why the retail CBDC "platform" models, as proposed in the UK, Russian and other central banks, add further reason for concern.

By welcoming the commercial banks and the private payment providers into CBDC interoperability, the central banks are not only attempting to overcome resistance from the private sector but seeking to seed CBDC into every form of payment we currently have available to us, other than cash.

It is easy to envisage how a global financial collapse could usher in the "solution" of CBDC. The European Central Bank (ECB), for example, has already "modelled" how the so-called "climate crisis" could precipitate just such a collapse.

If, as Cunliffe proposes, peoples' only means of payment is CBDC then, using the existing financial system, we really won't have much choice.

While we need to use every peaceable means at our disposal, such as referenda, lobbying and protest, to oppose CBDC, ultimately these approaches are appeals to those who wish to impose the CBDC tyranny upon us. It would be prudent for us also to consider potential counter-economic solutions and step away from compliance with centralised authority.

Fortunately, if we decide to resist there is no reason why we have to succumb to using CBDC. In order to construct better systems of exchange that will render CBDC superfluous, we have to come together in our communities.

It won't be easy, there are no simple solutions nor one "perfect" strategic response.

But the fact is, we simply cannot afford CBDC.

|